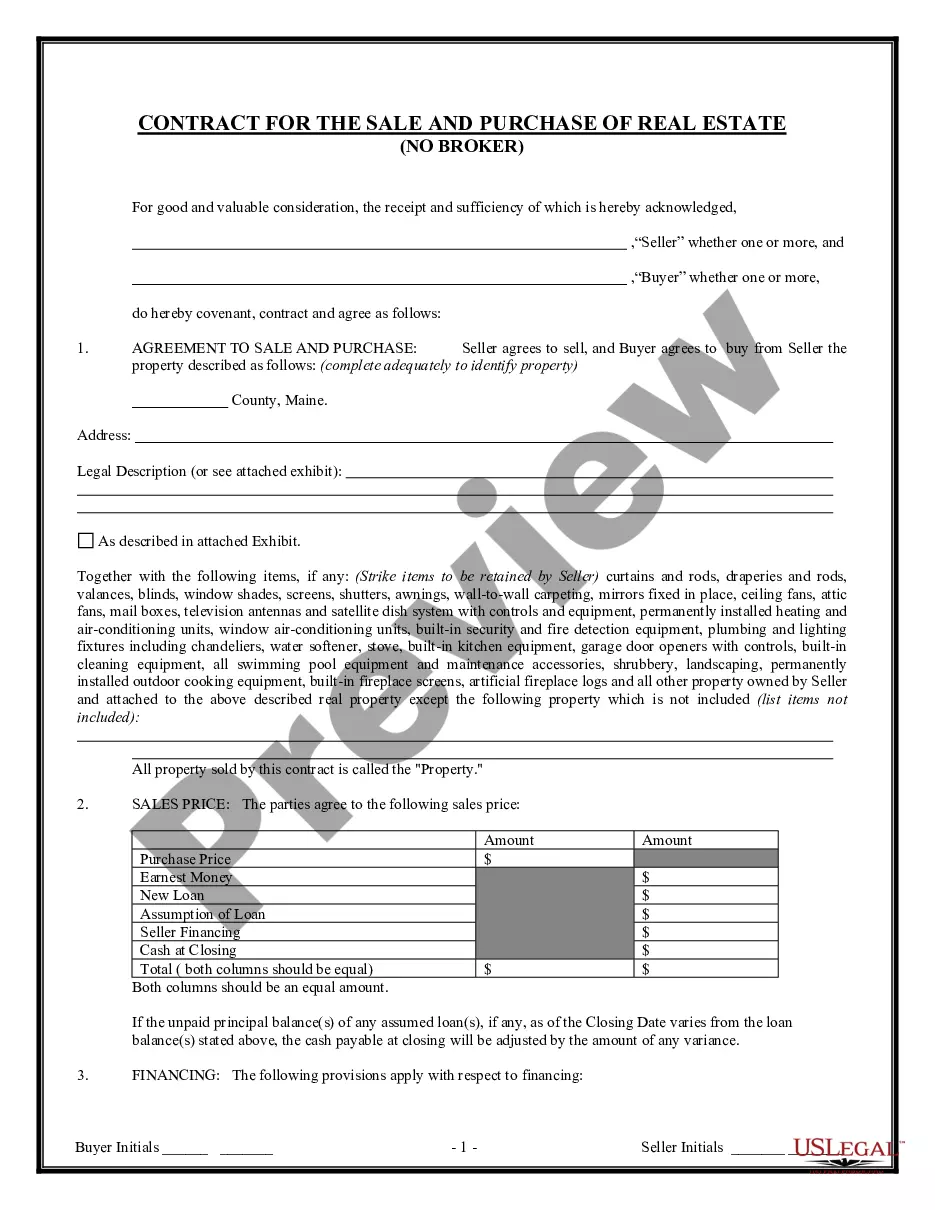

This form is a sample of an agreement to extend the time of a loan commitment in order to consummate a purchase of real property which will be security for the loan. In effect the loan applicant is asking for an extension of the date of closing set forth in the loan commitment or application.

Title: Georgia Extension of Loan Closing Date: A Comprehensive Overview Description: The Georgia Extension of Loan Closing Date refers to a provision within the state's loan industry, allowing borrowers to delay the finalized closing date for their loans under specified circumstances. This detailed description will provide you with valuable insights into the various types of Georgia Extension of Loan Closing Date and explain the concept using relevant keywords. 1. Georgia's COVID-19 Extension: Amid the ongoing COVID-19 pandemic, Georgia has implemented a specific extension framework to address the financial hardships faced by borrowers. This extension allows borrowers who have been affected by the pandemic to request an extended loan closing date, allowing them more time to gather necessary documentation or secure appropriate funding. 2. Georgia Natural Disaster Extension: In instances where there is a declared natural disaster, such as hurricanes, floods, or wildfires, Georgia offers an extension of the loan closing date to affected individuals. This provision helps borrowers cope with the unforeseen challenges posed by such calamities, allowing them extra time to recover, reconstruct, or relocate. 3. Georgia Mandatory Legal Review Extension: Sometimes, certain legal complications or intricacies may arise during the loan closing procedure. In such cases, the Georgia Extension of Loan Closing Date allows borrowers to secure an extension, ensuring sufficient time for legal professionals to review and resolve any outstanding legal concerns. This extension ensures compliance, safeguards the borrowers, lenders, and the overall integrity of the loan system. 4. Georgia Loan Renegotiation Extension: In situations where borrowers face unexpected financial difficulties that hinder their ability to meet the original loan closing date, Georgia provides an extension mechanism for loan renegotiation. This extension grants borrowers the opportunity to restructure loan terms, adjust interest rates, or modify repayment schedules in order to facilitate a successful loan closing and prevent default. 5. Georgia Incremental Extension: Occasionally, borrowers may require additional time to fulfill specific requirements or complete necessary steps related to the loan closing process. The Georgia Incremental Extension enables borrowers to request multiple, small-scale extensions, allowing them to address outstanding issues step by step rather than a single lengthy postponement. In summary, the Georgia Extension of Loan Closing Date encompasses various provisions designed to accommodate borrowers facing unique challenges. Whether it's due to extenuate circumstances like a pandemic or natural disasters, the need for legal review, renegotiation, or incremental changes, these extensions provide flexibility and support to borrowers, ensuring a smooth and successful loan closing experience while prioritizing their financial well-being.