Georgia Sample Letter for Bank Account Funds

Description

How to fill out Sample Letter For Bank Account Funds?

US Legal Forms - among the biggest libraries of legal types in the USA - delivers a variety of legal papers layouts you can download or produce. While using internet site, you can get a huge number of types for business and personal reasons, sorted by classes, suggests, or keywords and phrases.You will find the latest types of types just like the Georgia Sample Letter for Bank Account Funds in seconds.

If you already have a subscription, log in and download Georgia Sample Letter for Bank Account Funds in the US Legal Forms local library. The Obtain option can look on each type you view. You have accessibility to all formerly downloaded types in the My Forms tab of your own account.

If you wish to use US Legal Forms initially, allow me to share straightforward recommendations to obtain began:

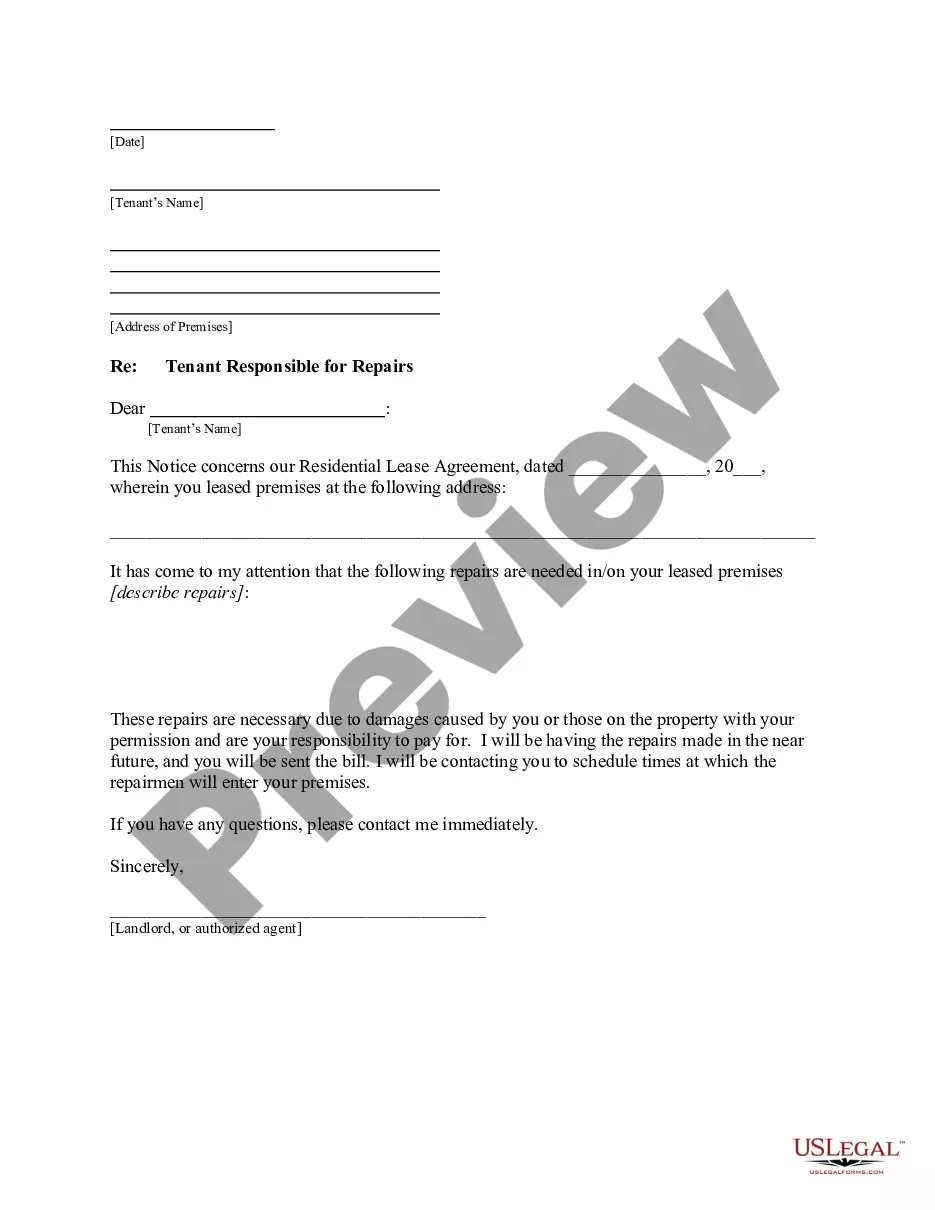

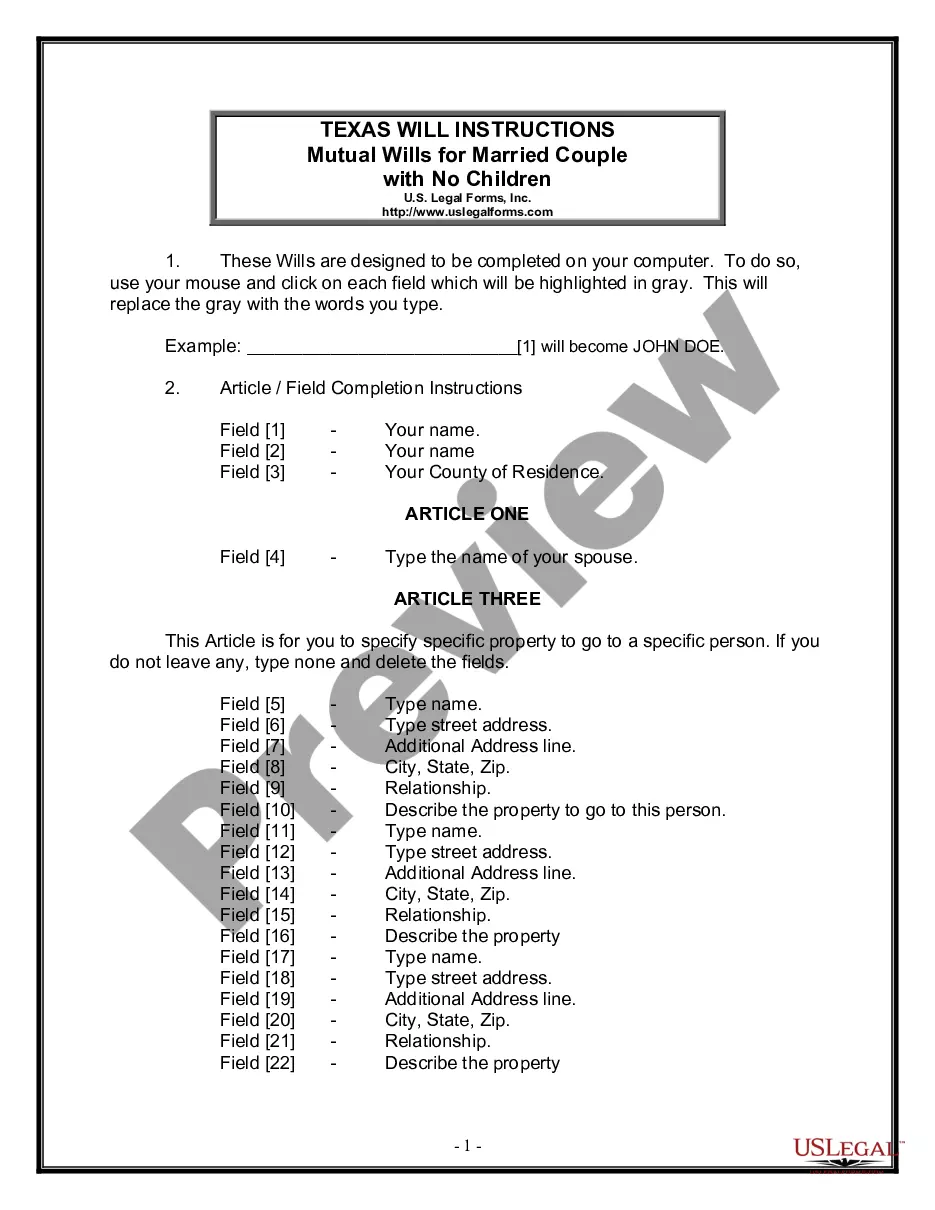

- Ensure you have chosen the right type for your personal metropolis/state. Select the Review option to examine the form`s articles. See the type explanation to ensure that you have chosen the appropriate type.

- When the type doesn`t satisfy your specifications, use the Search area near the top of the screen to get the one who does.

- When you are pleased with the shape, confirm your option by clicking on the Buy now option. Then, pick the prices program you like and give your qualifications to sign up to have an account.

- Approach the transaction. Use your credit card or PayPal account to accomplish the transaction.

- Find the formatting and download the shape on your own device.

- Make modifications. Fill up, edit and produce and indication the downloaded Georgia Sample Letter for Bank Account Funds.

Every design you included with your money lacks an expiration day which is yours forever. So, if you want to download or produce another version, just proceed to the My Forms section and click on in the type you require.

Gain access to the Georgia Sample Letter for Bank Account Funds with US Legal Forms, the most substantial local library of legal papers layouts. Use a huge number of professional and express-specific layouts that meet your company or personal requires and specifications.

Form popularity

FAQ

Requirements for an official POF letter include: Printed on the financial institution's official letterhead. Contact information of the bank. The individual's name. List of all debts, obligations, credit card balances, and loans. Account numbers. Date each account was opened. Current balance of each account.

A proof of funds (POF) is a document proving that a person or a company has the financial ability to perform a transaction. The POF can be issued by a bank, a financial institution or a trade finance.

Key Takeaways A receipt or bank statement is the most common way to provide proof of payment. Receipt copies can be obtained from the seller either online or in person. If you need to use a bank statement, access it through your online bank account.

A preapproval letter is a document stating that a lender will provide a buyer with a loan. In contrast, a POF letter states that a buyer has funds available to pay for the costs associated with the purchase of a home.

If proof of funds is presented as a letter, contact the author of the letter and ask them to verify the information they provided and ask any questions you may have. If proof of funds is presented via a bank statement, ask the buyer who you can contact at their bank to verify the statement is authentic.

Proof of funds refers to a document that demonstrates the ability of an individual or entity to pay for a specific transaction. A bank statement, security statement, or custody statement usually qualify as proof of funds. Proof of funds is typically required for a large transaction, such as the purchase of a house.

A proof of funds letter is a document providing evidence you have enough liquid assets, or cash, to buy a home with a mortgage. You'll need this paperwork to demonstrate to the lender and seller you can afford to purchase their home, including paying for the down payment and closing costs.

Proof of funds usually comes in the form of a bank security or custody statement. These can be procured from your bank or the financial institution that holds your money. Bank statements are the most common document to use as POF and can typically be found online or at a bank branch.