Dear [Recipient], I am writing to bring to your attention the State Tax Commission Notice that was recently issued to you by the Georgia State Tax Commission. This notice pertains to your state tax obligations and requires immediate attention and action. In order to assist you in understanding and responding to this notice, enclosed with this letter, you will find a Georgia Sample Letter concerning State Tax Commission Notice that can serve as a guiding template. The Georgia Sample Letter concerning State Tax Commission Notice provides a detailed description of the notice, including the specific tax issue identified, the amount owed, and the deadline for payment or response. It also outlines the possible consequences of non-compliance, such as additional penalties and interest charges. The sample letter includes a step-by-step guide on how to address the notice effectively, ensuring that you fulfill your obligations and prevent any further complications. Additionally, there are various types of Georgia Sample Letters concerning State Tax Commission Notice that may be relevant depending on the specific circumstances: 1. State Tax Lien Notice Response Letter: If you have received a notice regarding the imposition of a state tax lien on your property, this sample letter can guide you in preparing a response to contest the lien or request a payment arrangement. 2. Tax Assessment Dispute Letter: In the event of a disagreement with the tax assessment provided by the Georgia State Tax Commission, this sample letter can help you communicate your concerns and provide supporting documentation to challenge the assessment. 3. Late Payment Penalty Waiver Request Letter: If you have been charged with late payment penalties due to extenuating circumstances, such as a medical emergency or natural disaster, this sample letter can assist you in requesting a waiver of these penalties. 4. Installment Agreement Proposal Letter: For taxpayers unable to pay their tax liability in full, this sample letter can serve as a guide for proposing an installment agreement, outlining a feasible repayment plan and requesting consideration from the Georgia State Tax Commission. It is important to note that these sample letters are provided as general templates and should be customized to fit your particular situation. Should you require further clarification or professional advice, I recommend consulting with a qualified tax professional or contacting the Georgia State Tax Commission directly. Please do not disregard this notice, as failure to take appropriate action may result in further penalties, interest, or even legal action. If you have any questions or need assistance, do not hesitate to contact our office. We are here to help you navigate through this process and find the best possible resolution. Sincerely, [Your Name] [Your Title] [Your Contact Information]

Georgia Sample Letter concerning State Tax Commission Notice

Description

How to fill out Georgia Sample Letter Concerning State Tax Commission Notice?

Discovering the right authorized papers format might be a have a problem. Of course, there are tons of web templates available online, but how do you find the authorized form you require? Make use of the US Legal Forms internet site. The service provides 1000s of web templates, for example the Georgia Sample Letter concerning State Tax Commission Notice, which you can use for enterprise and private needs. Each of the varieties are inspected by professionals and fulfill state and federal requirements.

When you are previously registered, log in to the profile and then click the Down load button to get the Georgia Sample Letter concerning State Tax Commission Notice. Use your profile to check throughout the authorized varieties you possess ordered in the past. Check out the My Forms tab of your own profile and get one more version of the papers you require.

When you are a whole new consumer of US Legal Forms, listed below are simple instructions for you to follow:

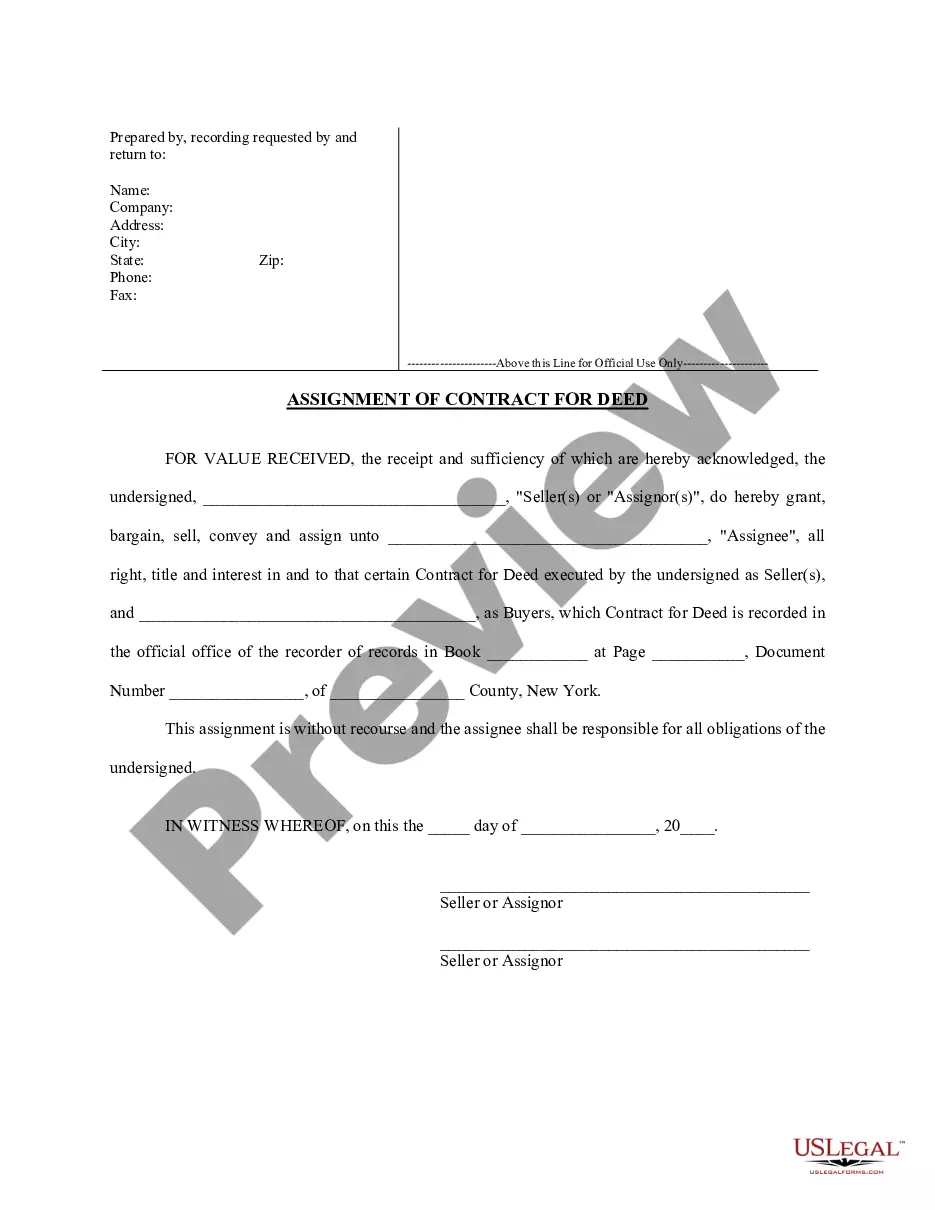

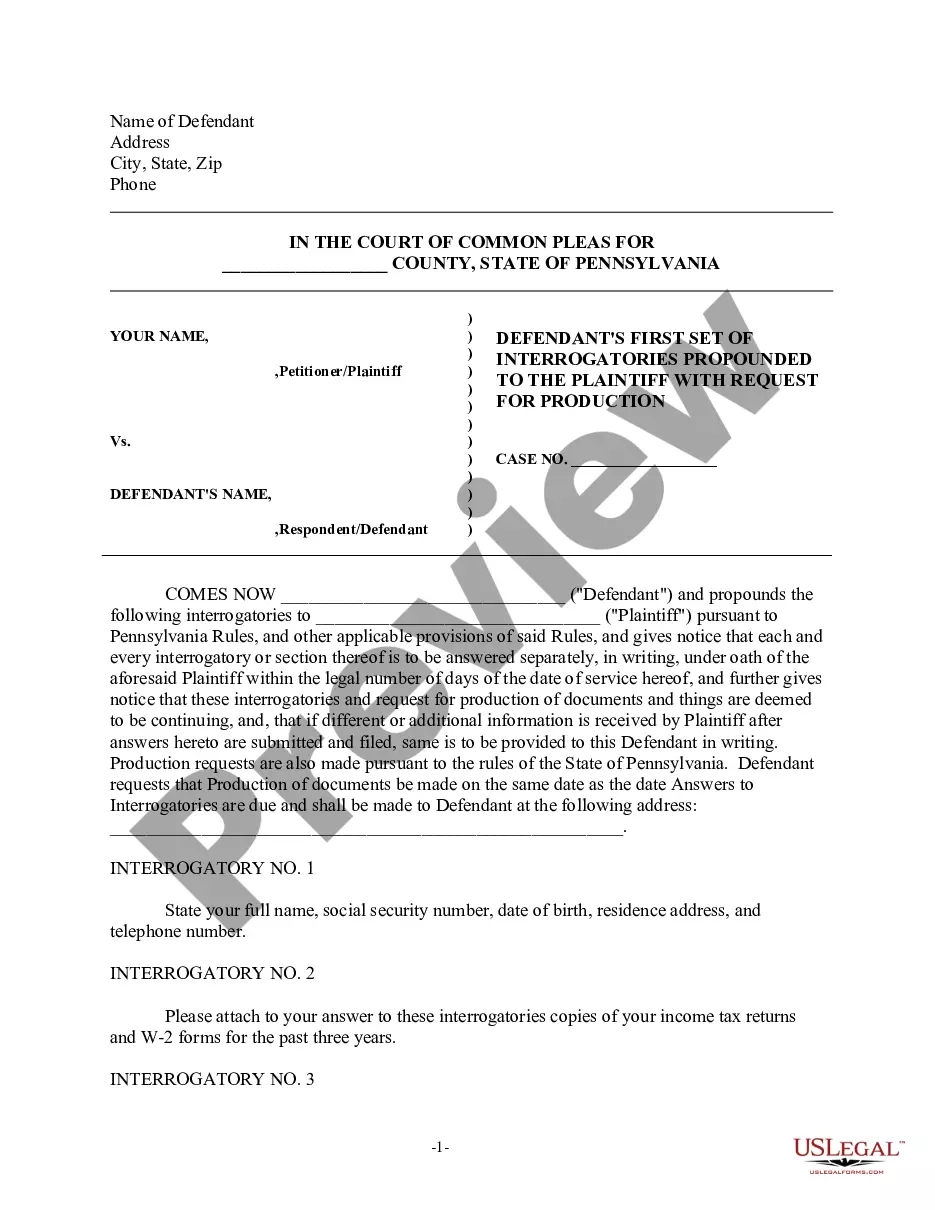

- Very first, be sure you have chosen the appropriate form for your town/state. You may check out the form making use of the Review button and look at the form description to make sure it is the best for you.

- When the form will not fulfill your needs, make use of the Seach industry to find the correct form.

- When you are positive that the form is proper, click the Get now button to get the form.

- Choose the rates plan you want and type in the needed info. Build your profile and purchase an order using your PayPal profile or bank card.

- Select the document formatting and acquire the authorized papers format to the device.

- Full, revise and print and indication the acquired Georgia Sample Letter concerning State Tax Commission Notice.

US Legal Forms is the greatest library of authorized varieties where you will find various papers web templates. Make use of the company to acquire appropriately-made files that follow condition requirements.

Form popularity

FAQ

Tax Clearance Certificates in Judicial Proceedings For Revenue forms, visit .revenue.state.pa.us or call (717) 783-6052. For information from the Department of State, visit .dos.state.pa.us/corp.htm or call (717) 787-1057.

A tax clearance letter is a document issued by a state government branch, which certifies that certain tax obligations of the seller have been met or are current, and that no amount of tax is outstanding to the state.

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

The Department of Revenue issues two types of notice of assessment letters when the following events occur. A taxpayer has not filed a return when due and the Department of Revenue has generated an estimated return. A taxpayer files a tax return but has not paid the full balance due on that return.

How do I get a Tax Clearance Letter? Login to the Georgia Tax Center (GTC) Under "I Want To...", click on "See more links ..." Click on Request Tax Clearance Letter. Click "Submit"

A tax clearance certificate is a document issued by a state government agency, usually the department of revenue. It certifies that a business or individual has met their tax obligations as of a certain date.

Most of our letters provide specific instructions of what you need to do, for example: Log in to the Georgia Tax Center and follow the directions provided, or. Let you know that your vehicle registration is suspended or will be suspended soon. The letter will tell you what you need to do to legally drive your vehicle.