A Georgia Revocable Trust for a Married Couple is a legal instrument that allows a couple to establish a trust for themselves while maintaining control over their assets during their lifetimes. This type of trust offers various benefits, such as avoiding probate, providing for the management of assets in case of incapacity, and ensuring an efficient transfer of assets upon death. A Georgia Revocable Trust for a Married Couple can be customized to suit the specific needs and goals of the couple. There are different types of Georgia Revocable Trusts for a Married Couple that can be considered, based on the couple's preferences and circumstances. Some of these types are: 1. Joint Revocable Trust: In this type of trust, both spouses are named as co-trustees, allowing them to manage and control the trust assets together. They also have the flexibility to modify or revoke the trust at any time. Upon the death of one spouse, the surviving spouse becomes the sole trustee and continues to manage the trust assets. 2. Separate Revocable Trusts: Instead of having a joint trust, each spouse can establish their own revocable trust. This option may be preferable if the couple has separate assets, wishes to maintain separate control over their assets, or if there are blended family issues or concerns surrounding the handling of assets. 3. Pour-over Will and Revocable Trust: A pour-over will is designed to work in conjunction with a revocable trust. It states that any assets not already held in the trust will "pour over" into the trust upon the individual's death. This ensures that any assets inadvertently left out of the trust will still be included and distributed according to the trust provisions. 4. Revocable Trust with Marital Deduction: This type of trust is specifically structured to take advantage of the marital deduction for estate tax purposes. It allows a couple to minimize estate taxes by placing assets in the trust while still providing income or benefits to the surviving spouse. In conclusion, a Georgia Revocable Trust for a Married Couple is a versatile legal tool that offers flexibility and control over assets for a couple during their lifetime, as well as efficient estate planning options. Depending on the specific needs and objectives of the couple, various types of trusts can be considered to tailor the arrangement accordingly. Seeking the advice of an experienced estate planning attorney is crucial to ensure that the trust is properly structured and meets the couple's individual goals.

Georgia Revocable Trust for Married Couple

Description

How to fill out Georgia Revocable Trust For Married Couple?

Are you currently situated in the location where you need documents for either business or personal needs almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not straightforward.

US Legal Forms offers thousands of form templates, including the Georgia Revocable Trust for Married Couples, which can be tailored to meet federal and state requirements.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors.

The service offers professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Georgia Revocable Trust for Married Couples template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you need and ensure it is for the correct city/state.

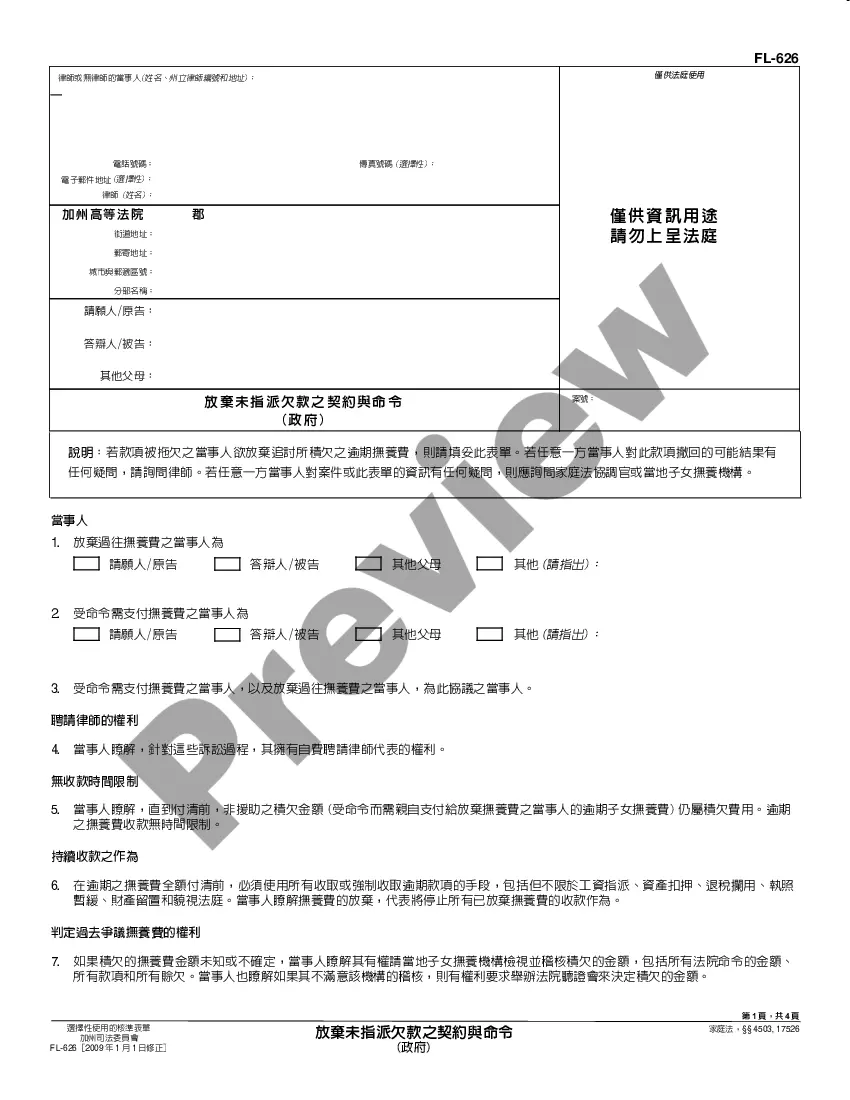

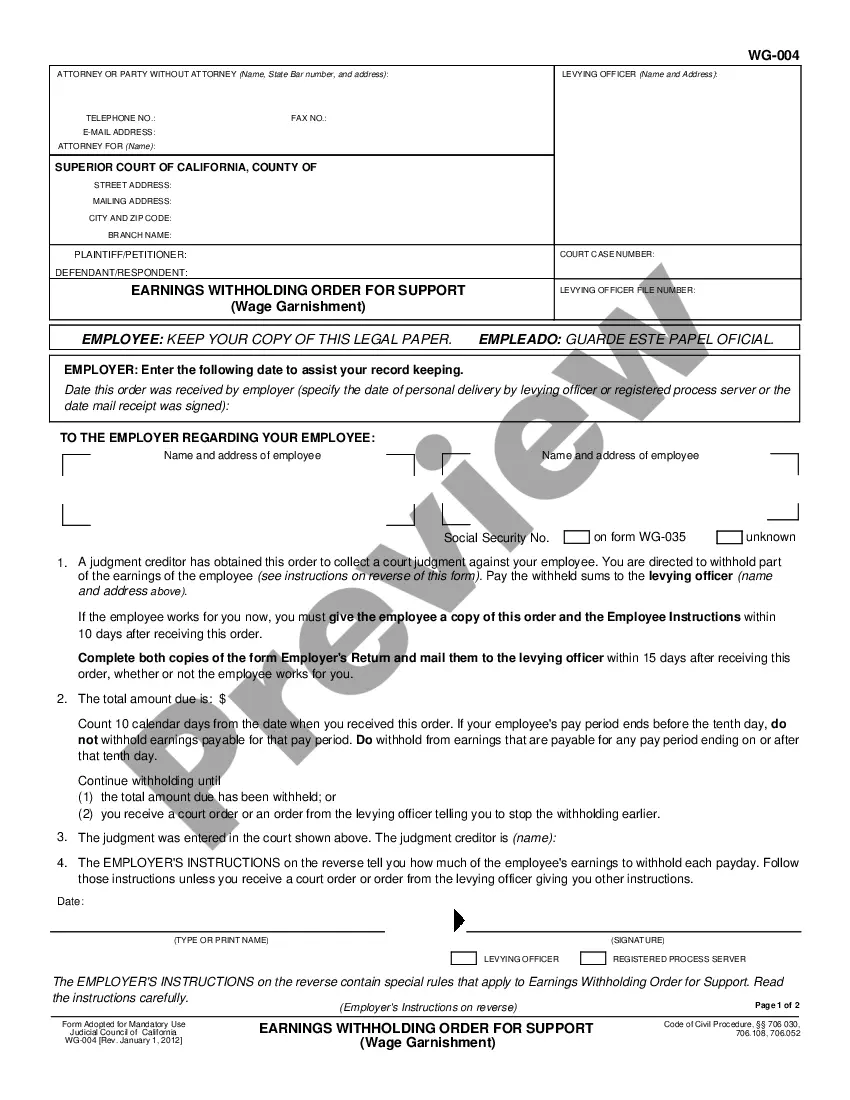

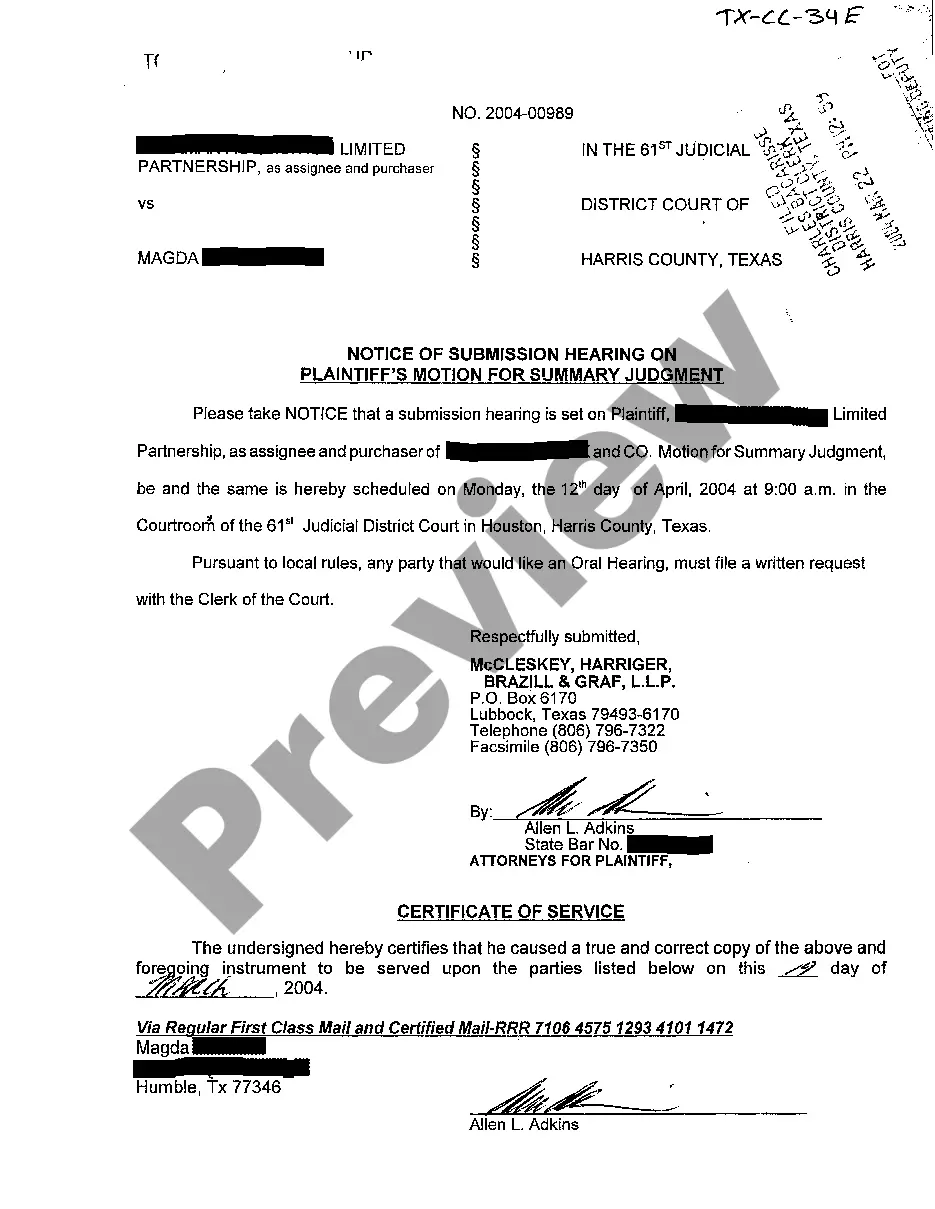

- Use the Preview button to review the form.

- Read the description to ensure you have selected the right document.

- If the document is not what you're searching for, utilize the Search function to find a form that meets your needs.

- Once you find the appropriate document, click on Get now.

- Choose the pricing plan you wish to select, fill in the required information to create your account, and complete the payment using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Get all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Georgia Revocable Trust for Married Couples at any time if necessary. Simply click on the needed document to download or print it.

Form popularity

FAQ

The negative side of a trust often involves the ongoing administrative duties required to maintain it, such as tax filings and compliance with legal requirements. These responsibilities can become burdensome, especially without proper organization. This is where a Georgia Revocable Trust for Married Couple can simplify the process by providing a clear directive for asset management, helping you navigate complexities efficiently.

One disadvantage of a family trust is the potential for misunderstandings about control and access to trust assets. Family dynamics can complicate matters if beneficiaries have differing opinions on how the trust should be managed or accessed. It is crucial to communicate the terms clearly. A Georgia Revocable Trust for Married Couple can clarify expectations and reduce family disputes by clearly outlining asset management.

Common pitfalls of setting up a trust include failing to fund the trust properly and not communicating the existence of the trust to family members. If assets are not transferred into the trust, its intended purpose is defeated. Moreover, lack of communication can create confusion among heirs. Establishing a Georgia Revocable Trust for Married Couple helps avoid these pitfalls and provides a clear asset management plan.

While it is possible to set up a trust without an attorney in Georgia, it is advisable to have professional guidance to navigate the complexities of trust law. Doing it yourself may lead to errors in documentation or non-compliance with laws, potentially causing issues down the line. Using a Georgia Revocable Trust for Married Couple allows for flexibility, but having an experienced attorney can ensure that all legal requirements are met.

Many parents underestimate the importance of clearly defining the terms of the trust when setting it up. Ambiguities in language or expectations can create confusion and lead to disputes among beneficiaries. Clarity is key to preventing misunderstandings. A well-structured Georgia Revocable Trust for Married Couple provides a clear framework for asset distribution and supports harmonious family relationships.

One common mistake parents make when setting up a trust fund is failing to regularly review and update the trust to reflect their current circumstances. For example, they might overlook changes in assets or family dynamics, which could misalign their estate planning goals. This oversight can lead to unintended consequences for heirs. A Georgia Revocable Trust for Married Couple can help streamline your estate planning and ensure your intentions are clear.

The best trust for a married couple is commonly a Georgia Revocable Trust for Married Couple. This trust provides flexibility and control, allowing couples to change the terms as their relationship evolves. It effectively protects assets, simplifies the management process, and can help avoid probate. To set up this trust, consider using a reliable platform like uslegalforms, which offers valuable resources to streamline your estate planning journey.

One of the disadvantages of a joint trust is that it may complicate asset division in the event of a divorce. Additionally, joint trusts may limit flexibility, as both partners must agree on changes or distributions. Some couples may also overlook the importance of updating their beneficiaries or trustees over time. However, the benefits of a Georgia Revocable Trust for Married Couple often outweigh these concerns, especially when properly managed.

Remarried couples often find a Georgia Revocable Trust for Married Couple to be a suitable option. This type of trust allows for customization, enabling couples to address the needs of their individual families and children from prior marriages. By clearly specifying asset distribution and beneficiary designations, remarried couples can avoid potential conflicts and protect all heirs. Consulting with an estate planning attorney can help you determine the best path forward.

The most popular form of marital trust is the QTIP trust, which stands for Qualified Terminable Interest Property. This trust allows the surviving spouse to receive income from the trust during their lifetime while ensuring that the remaining assets pass to specified beneficiaries upon their death. This structure provides both financial support and control over the asset distribution. Couples often find that a Georgia Revocable Trust for Married Couple can also include features of QTIP trusts to meet their unique needs.

Interesting Questions

More info

We'll discuss them as they relate to your personal situation. IRA with a Roth Conversion IRA with a standard deduction The first way to create a traditional IRA account is to open a new 401(k) account. If you want an IRA with a Roth conversion, you should get a statement that shows your Roth IRA balance before and after the conversion. To do this, log into your 401(k) account, click on the IRA tab and click on the IRA button at the bottom of the page. You'll see a report of the current status of your IRA. You can see that you have a balance currently. If you're converting an existing IRA to an IRA with a Roth Conversion, you also need to make sure that if you're making a rollover of money to the Roth IRA, you put the exact value of the money converted to the IRA before you roll it over. To do this, simply go to the “Rollovers” section of the IRA and click the arrow to the right of the “To Be Rolled Over” section.