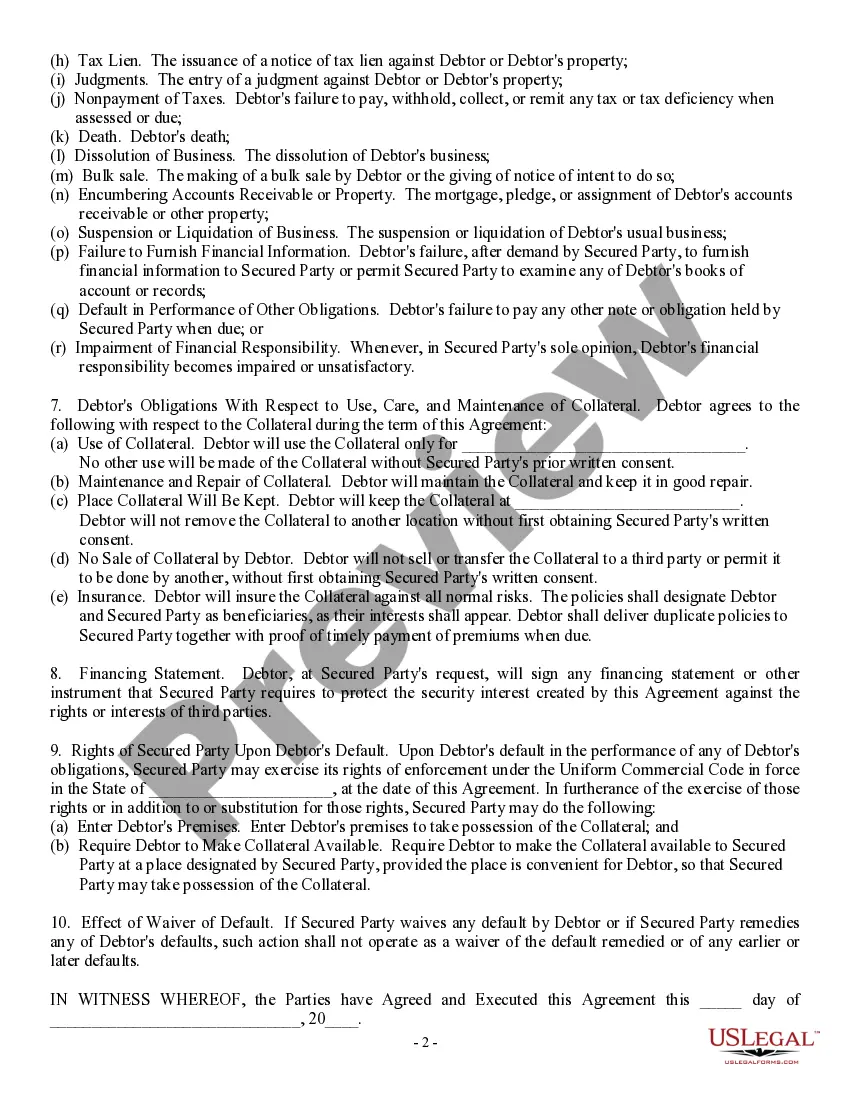

Georgia Security Agreement involving Sale of Collateral by Debtor is a legal document that outlines the terms and conditions regarding the sale of collateral by a debtor in the state of Georgia. This agreement serves to protect the creditor's interests in case the debtor defaults on the loan or fails to repay the debt. Keywords: Georgia Security Agreement, collateral, debtor, sale, creditor, terms and conditions, default, loan, repayment, legal document. There are different types of Georgia Security Agreements involving the sale of collateral by a debtor. Some common ones include: 1. Traditional Security Agreement: This type of agreement is the standard form used for securing a loan or credit by both individuals and businesses. It outlines the terms and conditions of the loan, including the rights and responsibilities of both the debtor and the creditor in the event of default or non-payment. 2. Chattel Mortgage Agreement: This type of security agreement involves the sale of movable property, also known as chattel, to secure a loan. The debtor pledges the personal property as collateral, and in case of default, the creditor has the right to seize and sell the pledged chattel to recover the outstanding debt. 3. Conditional Sales Agreement: This agreement involves the sale of goods or equipment in which the creditor retains ownership until the debtor completes the payment in full. The sale is conditioned upon the debtor's timely payments, and if the debtor defaults, the creditor can repossess the goods and sell them to recover the debt. 4. Pledge Agreement: In this type of security agreement, the debtor pledges a specific asset, such as stocks, bonds, or real estate, as collateral for a loan. The debtor retains ownership of the asset but gives the creditor a security interest in it. If the debtor defaults, the creditor has the right to sell the pledged asset to satisfy the debt. 5. Consignment Agreement: This agreement involves the sale of goods by a consignor to a consignee, who acts as a dealer or seller. The consignee holds the goods on behalf of the consignor and agrees to sell them on consignment. In case of default or non-payment, the consignee may sell the goods to recover the debt owed to the consignor. It is crucial for both debtors and creditors to understand the specifics of the Georgia Security Agreement involving the sale of collateral. Additionally, consulting with a legal professional is highly recommended ensuring compliance with Georgia laws and to protect the rights and obligations of both parties involved in the agreement.

Georgia Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Georgia Security Agreement Involving Sale Of Collateral By Debtor?

Have you been inside a place in which you need to have paperwork for sometimes enterprise or specific purposes nearly every working day? There are a lot of legal document themes available online, but locating versions you can rely on isn`t easy. US Legal Forms offers a large number of kind themes, just like the Georgia Security Agreement involving Sale of Collateral by Debtor, that are composed to fulfill state and federal specifications.

Should you be previously familiar with US Legal Forms internet site and get a free account, basically log in. After that, you may download the Georgia Security Agreement involving Sale of Collateral by Debtor template.

Should you not have an profile and need to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you need and make sure it is to the appropriate area/state.

- Take advantage of the Preview switch to examine the shape.

- Read the information to ensure that you have selected the appropriate kind.

- In the event the kind isn`t what you`re looking for, take advantage of the Research industry to discover the kind that meets your needs and specifications.

- Whenever you get the appropriate kind, simply click Purchase now.

- Opt for the prices strategy you would like, fill out the required information and facts to generate your account, and purchase the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a handy document structure and download your version.

Get every one of the document themes you have purchased in the My Forms menu. You can obtain a additional version of Georgia Security Agreement involving Sale of Collateral by Debtor anytime, if needed. Just click on the needed kind to download or print the document template.

Use US Legal Forms, one of the most comprehensive variety of legal types, to conserve some time and prevent errors. The service offers skillfully created legal document themes that can be used for a variety of purposes. Generate a free account on US Legal Forms and start creating your life a little easier.