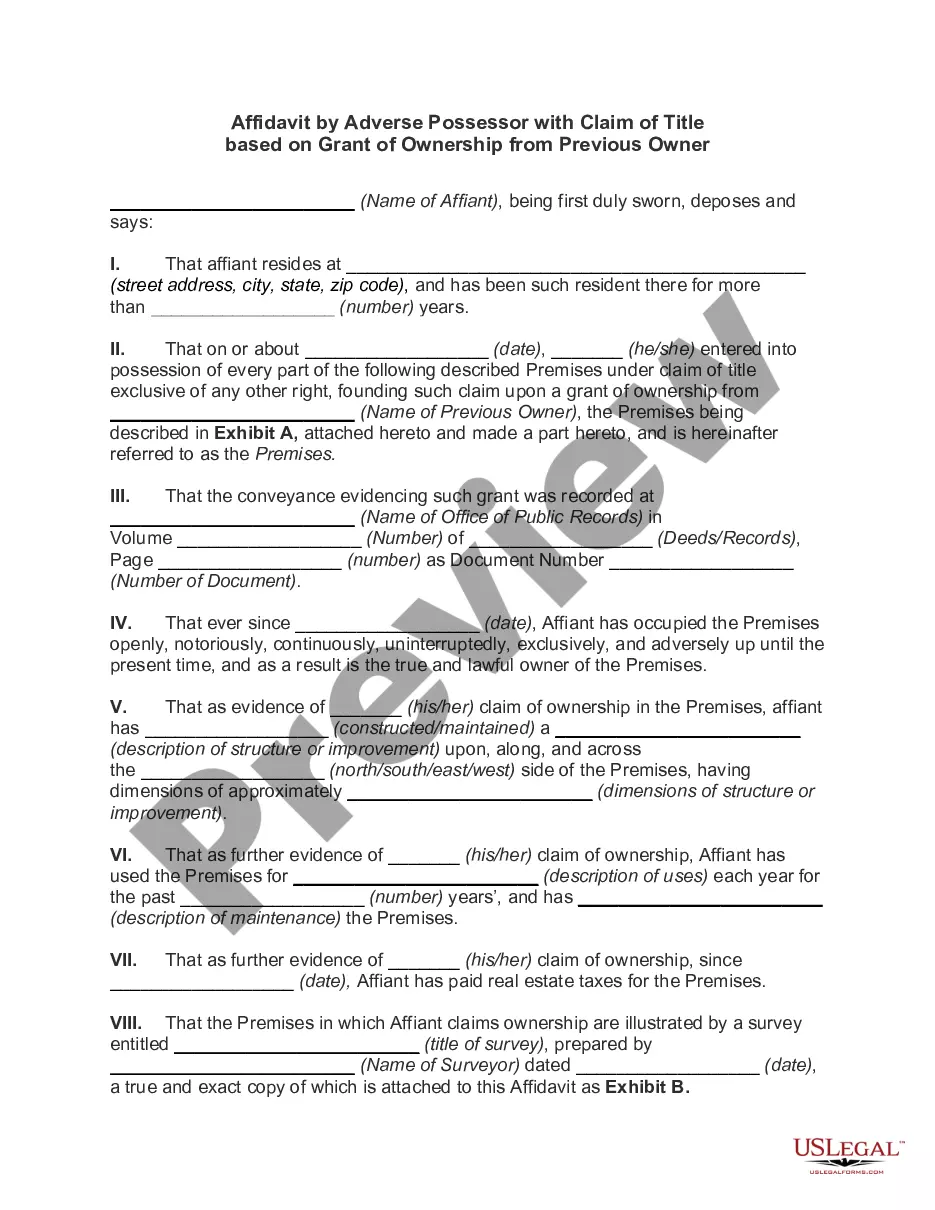

Georgia Cash Flow Statement is a financial document that provides an overview of the cash inflows and outflows within an organization operating in the state of Georgia. It showcases how money is generated, spent, and invested throughout a specific period, enabling stakeholders to gain insights into the company's financial health and liquidity position. This statement is crucial as it helps investors, creditors, and other interested parties evaluate the cash flow patterns and determine the sustainability of the business operations. By analyzing the Georgia Cash Flow Statement, stakeholders can accurately measure the company's ability to generate cash, identify potential cash flow issues, and assess the overall financial performance. The Georgia Cash Flow Statement typically consists of three main sections: operating activities, investing activities, and financing activities. Each section provides detailed information on the cash inflows and outflows related to different areas of an organization's operations. 1. Operating activities: This section reflects the cash flows generated from day-to-day operational activities, such as sales, revenue from services, and payment of expenses. It includes items such as cash receipts from customers, cash paid to suppliers, cash paid for salaries, and taxes. 2. Investing activities: This section focuses on cash flows related to long-term investments and capital assets. It includes cash inflows from the sale of property, plant, and equipment, as well as cash outflows for the purchase of new assets or investment in securities. 3. Financing activities: This section highlights cash flows related to the company's financial structure, including equity and debt. It entails activities such as issuing and repurchasing company stock, payment of dividends, and repayment of loans. By categorizing cash flows into these three sections, the Georgia Cash Flow Statement provides a comprehensive overview of how the company operates financially. It allows stakeholders to assess the company's ability to generate cash from its primary operations, invest in growth opportunities, and obtain financing for its overall goals. Moreover, the Georgia Cash Flow Statement assists in calculating the net change in cash during a specific period. This change accounts for any increase or decrease in cash balance, enabling stakeholders to evaluate the liquidity position and understand the capacity to meet short-term obligations. Overall, the Georgia Cash Flow Statement plays a vital role in providing insights into the financial performance, sustainability, and cash management of an organization operating in the state of Georgia. It helps stakeholders make informed decisions, identify areas for improvement, and develop strategies to enhance cash flow efficiency.

Georgia Cash Flow Statement

Description

How to fill out Georgia Cash Flow Statement?

You may devote hours on the Internet looking for the lawful record template which fits the state and federal demands you need. US Legal Forms supplies thousands of lawful kinds which are reviewed by professionals. You can actually download or printing the Georgia Cash Flow Statement from your assistance.

If you have a US Legal Forms profile, you may log in and click on the Down load button. Next, you may full, modify, printing, or indicator the Georgia Cash Flow Statement. Every single lawful record template you get is your own property permanently. To get one more copy associated with a acquired develop, check out the My Forms tab and click on the related button.

If you use the US Legal Forms website the first time, follow the basic recommendations beneath:

- Very first, make certain you have chosen the right record template for the area/town of your choice. See the develop explanation to ensure you have selected the proper develop. If offered, utilize the Preview button to search through the record template at the same time.

- If you would like discover one more version of your develop, utilize the Search area to obtain the template that fits your needs and demands.

- After you have found the template you desire, click Get now to move forward.

- Select the costs prepare you desire, type your accreditations, and register for your account on US Legal Forms.

- Comprehensive the financial transaction. You can use your Visa or Mastercard or PayPal profile to fund the lawful develop.

- Select the file format of your record and download it to the system.

- Make modifications to the record if needed. You may full, modify and indicator and printing Georgia Cash Flow Statement.

Down load and printing thousands of record web templates utilizing the US Legal Forms site, which provides the largest variety of lawful kinds. Use specialist and state-distinct web templates to take on your business or person needs.