A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

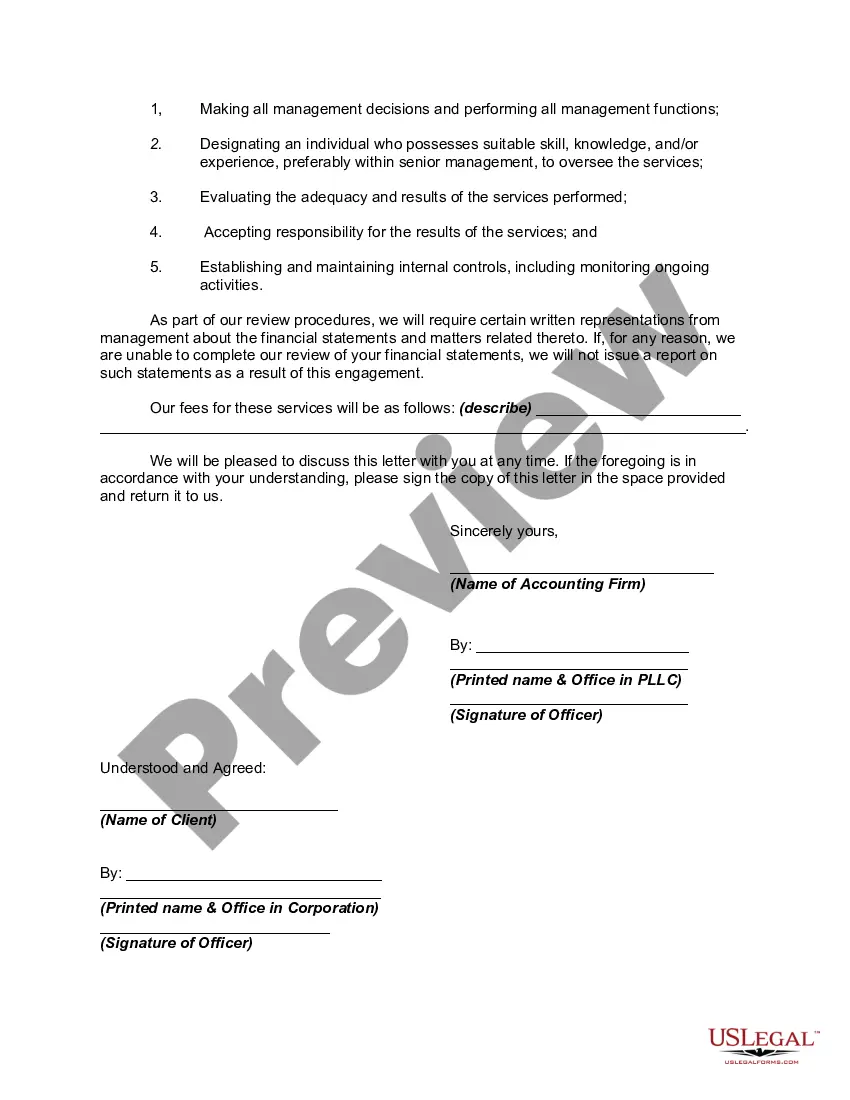

A Georgia Engagement Letter for Review of Financial Statements by an Accounting Firm is a formal agreement between an accounting firm and a client, specifically in the state of Georgia, outlining the terms and conditions for conducting a review. This letter signifies the beginning of an engagement and defines the scope, objectives, and responsibilities of both parties involved. The primary purpose of the engagement letter is to establish a clear understanding of the scope of work to be performed during the review. It sets forth the professional services to be provided by the accounting firm and the expected outcomes for the client. The engagement letter also serves as a legal protection for both parties, ensuring that both the accounting firm and the client are aware of their respective rights and obligations. The Georgia Engagement Letter for Review of Financial Statements typically includes key components such as: 1. Identification of Parties: The letter begins by identifying the accounting firm and the client, providing their official names, addresses, and contact details. 2. Objective and Scope: This section outlines the purpose of the engagement, which is to review the financial statements prepared by the client. It specifies the period to be reviewed and any limitations in scope. The letter also highlights the accounting standards and guidelines to be followed during the review. 3. Responsibilities: The engagement letter clearly defines the responsibilities of both the accounting firm and the client. The client is generally responsible for providing accurate and complete financial records, preparing financial statements, and ensuring compliance with relevant laws and regulations. The accounting firm, on the other hand, is responsible for conducting the review in accordance with professional standards and issuing a report highlighting any material findings. 4. Timelines and Deliverables: The engagement letter includes the expected timeline for completion of the review and submission of the final report. It also outlines the format in which the financial statements will be presented and any additional reports or schedules that will be included. 5. Fees and Billing: This section specifies the fee structure for the engagement, including the basis for billing (hourly rates, fixed fee, etc.), payment terms, and any other expenses that may be reimbursable by the client. 6. Confidentiality and Non-Disclosure: The engagement letter addresses the confidentiality of client information and prohibits the accounting firm from disclosing any confidential or proprietary information without prior written consent. Different types of Georgia Engagement Letters for Review of Financial Statements by an Accounting Firm may vary based on specific considerations. For example, additional engagement letters may be created for reviews of specific industries, such as healthcare, manufacturing, or non-profit organizations. These industry-specific engagement letters may include additional language and procedures tailored to the unique characteristics of the particular industry. In summary, a Georgia Engagement Letter for Review of Financial Statements by an Accounting Firm is a crucial document that lays out the terms and conditions of the engagement, ensuring a mutual understanding between the accounting firm and the client. It provides a clear framework for conducting the review and protects the rights and responsibilities of both parties involved.A Georgia Engagement Letter for Review of Financial Statements by an Accounting Firm is a formal agreement between an accounting firm and a client, specifically in the state of Georgia, outlining the terms and conditions for conducting a review. This letter signifies the beginning of an engagement and defines the scope, objectives, and responsibilities of both parties involved. The primary purpose of the engagement letter is to establish a clear understanding of the scope of work to be performed during the review. It sets forth the professional services to be provided by the accounting firm and the expected outcomes for the client. The engagement letter also serves as a legal protection for both parties, ensuring that both the accounting firm and the client are aware of their respective rights and obligations. The Georgia Engagement Letter for Review of Financial Statements typically includes key components such as: 1. Identification of Parties: The letter begins by identifying the accounting firm and the client, providing their official names, addresses, and contact details. 2. Objective and Scope: This section outlines the purpose of the engagement, which is to review the financial statements prepared by the client. It specifies the period to be reviewed and any limitations in scope. The letter also highlights the accounting standards and guidelines to be followed during the review. 3. Responsibilities: The engagement letter clearly defines the responsibilities of both the accounting firm and the client. The client is generally responsible for providing accurate and complete financial records, preparing financial statements, and ensuring compliance with relevant laws and regulations. The accounting firm, on the other hand, is responsible for conducting the review in accordance with professional standards and issuing a report highlighting any material findings. 4. Timelines and Deliverables: The engagement letter includes the expected timeline for completion of the review and submission of the final report. It also outlines the format in which the financial statements will be presented and any additional reports or schedules that will be included. 5. Fees and Billing: This section specifies the fee structure for the engagement, including the basis for billing (hourly rates, fixed fee, etc.), payment terms, and any other expenses that may be reimbursable by the client. 6. Confidentiality and Non-Disclosure: The engagement letter addresses the confidentiality of client information and prohibits the accounting firm from disclosing any confidential or proprietary information without prior written consent. Different types of Georgia Engagement Letters for Review of Financial Statements by an Accounting Firm may vary based on specific considerations. For example, additional engagement letters may be created for reviews of specific industries, such as healthcare, manufacturing, or non-profit organizations. These industry-specific engagement letters may include additional language and procedures tailored to the unique characteristics of the particular industry. In summary, a Georgia Engagement Letter for Review of Financial Statements by an Accounting Firm is a crucial document that lays out the terms and conditions of the engagement, ensuring a mutual understanding between the accounting firm and the client. It provides a clear framework for conducting the review and protects the rights and responsibilities of both parties involved.