Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

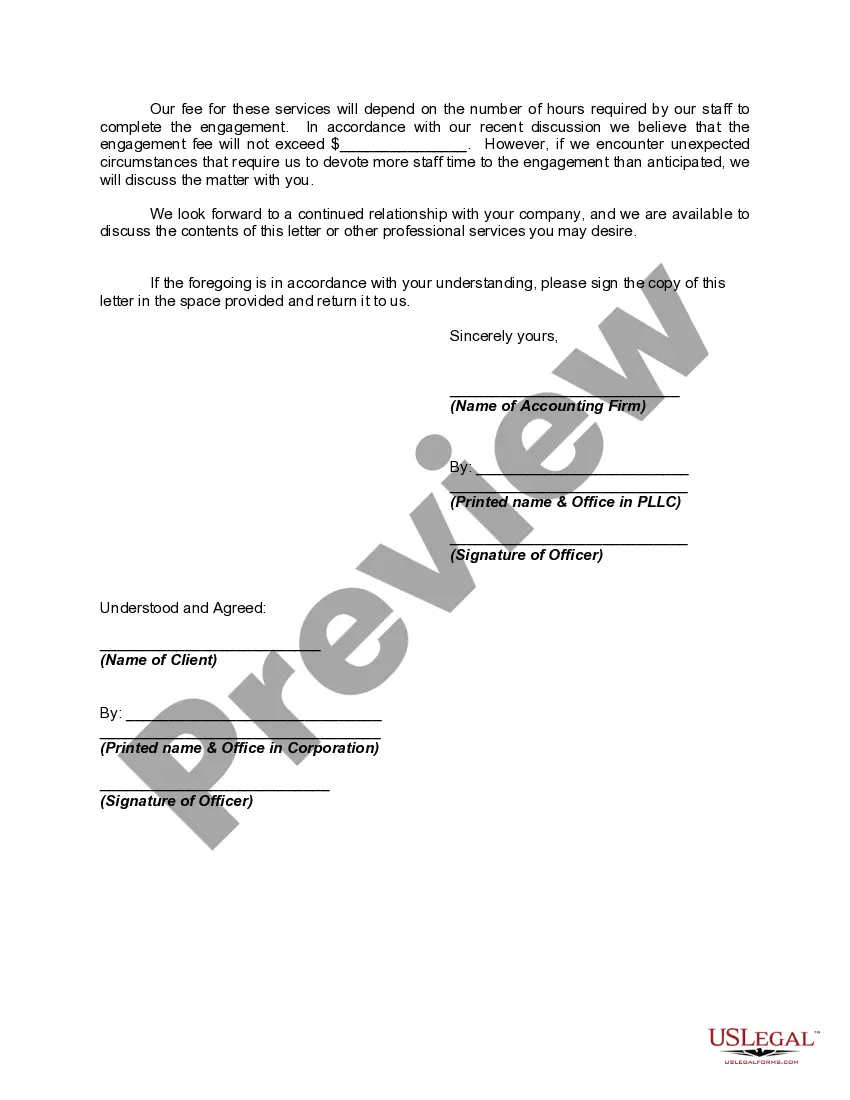

Georgia Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm Introduction: An engagement letter is a legal contract between an accounting firm and its client that outlines the terms and conditions for providing professional services. In the state of Georgia, an engagement letter for the review of financial statements and compilation is crucial for maintaining transparency and establishing clear expectations between the accounting firm and its client. This detailed description will shed light on the purpose, contents, and importance of the Georgia engagement letter for review of financial statements and compilation. Purpose: The purpose of the Georgia engagement letter for review of financial statements and compilation is to define the scope of services provided by the accounting firm. It sets out specific requirements, procedures, and limitations associated with the review and compilation process. The letter also serves as a legal agreement between the accounting firm and the client, safeguarding both parties' rights and responsibilities. Contents: 1. Engagement Objective: The engagement letter outlines the specific objective of the engagement, which is to review and compile the client's financial statements in accordance with the applicable accounting standards and procedures. 2. Scope of Services: This section describes the specific tasks and procedures the accounting firm will undertake during the review and compilation process. It may include a detailed description of the areas to be examined, such as the client's balance sheet, income statement, cash flow statement, notes to financial statements, and related documents. 3. Timelines and Deadlines: The engagement letter specifies the timeframes for completing the review and compilation services. It includes the duration of the engagement, key milestones, submission deadlines for required information, and the expected delivery date of the final review or compilation report. 4. Responsibilities of the Accounting Firm: This section outlines the responsibilities of the accounting firm, including adherence to professional standards, maintaining independence, conducting the review and compilation procedures with due care, and providing accurate and objective reports to the client. 5. Responsibilities of the Client: The engagement letter also delineates the client's responsibilities, such as providing accurate and complete financial records, disclosing any significant changes in the business, identifying potential risks or errors, and cooperating with the accounting firm during the engagement. 6. Limitations: This essential section highlights any limitations in regard to the review and compilation engagement. It specifically clarifies that the procedures performed are less detailed and extensive compared to an audit, and therefore, the accounting firm does not express an opinion on the financial statements' accuracy or conformity with accounting principles. Types of Georgia Engagement Letter for Review of Financial Statements and Compilation: 1. Unmodified Engagement Letter: This type of engagement letter is used when the accounting firm is engaged to review and compile the client's financial statements without any significant modifications or exceptions. 2. Modified Engagement Letter: In certain cases, the accounting firm may need to include modifications or additional procedures in the engagement letter if there are specific matters that require attention or if the standard review and compilation procedures are insufficient. 3. Engagement Letter for Specialized Industries: Some engagement letters may be tailored specifically for clients in specialized industries such as healthcare, manufacturing, or non-profit organizations. These engagement letters address industry-specific regulations, reporting requirements, or unique accounting practices. Importance: The Georgia engagement letter for review of financial statements and compilation is crucial for several reasons. It establishes a clear understanding of the services to be provided, ensures compliance with professional standards and ethical guidelines, defines the scope of the engagement, protects both parties' rights, and minimizes misunderstandings or disputes. Additionally, it helps the accounting firm manage its risk exposure and maintain a professional relationship with the client. In conclusion, the Georgia engagement letter for review of financial statements and compilation is a vital document that facilitates a clear understanding and agreement between the accounting firm and its client. It outlines the purpose, scope, responsibilities, and limitations associated with the engagement, thereby ensuring a transparent and efficient review and compilation process.