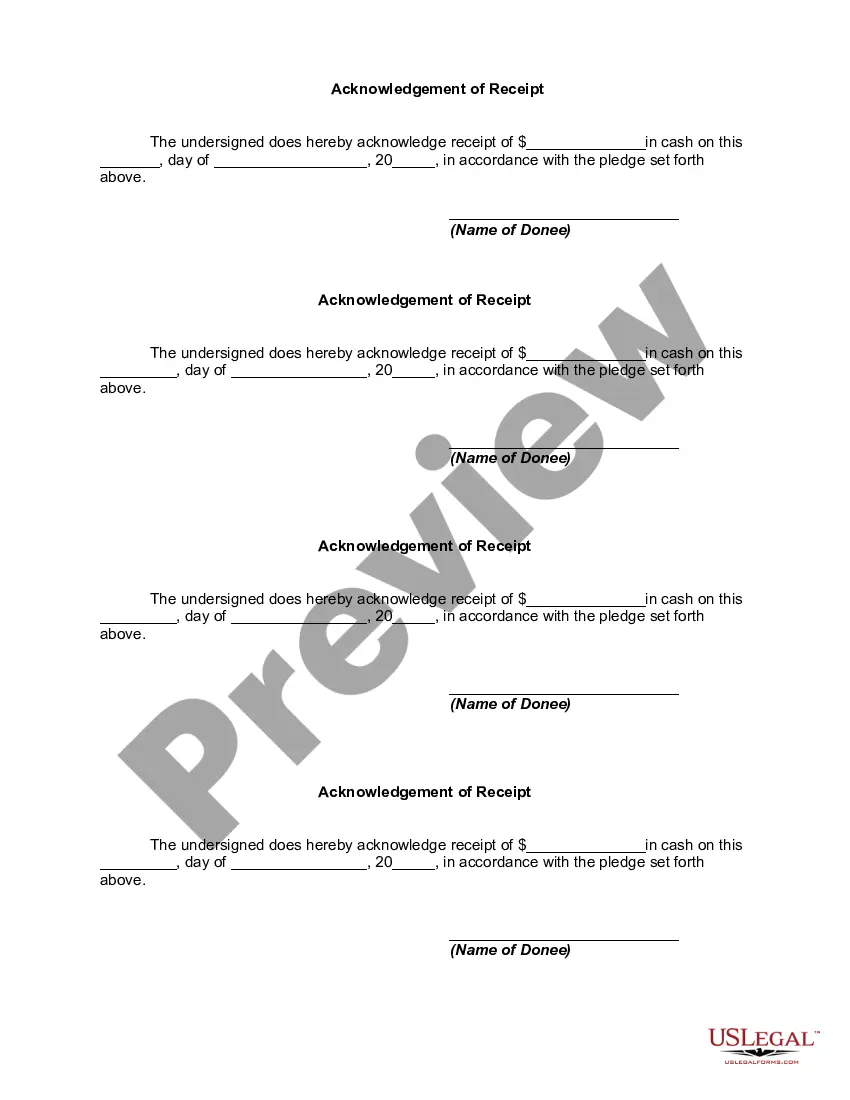

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Georgia Declaration of Gift Over Several Year Period

Description

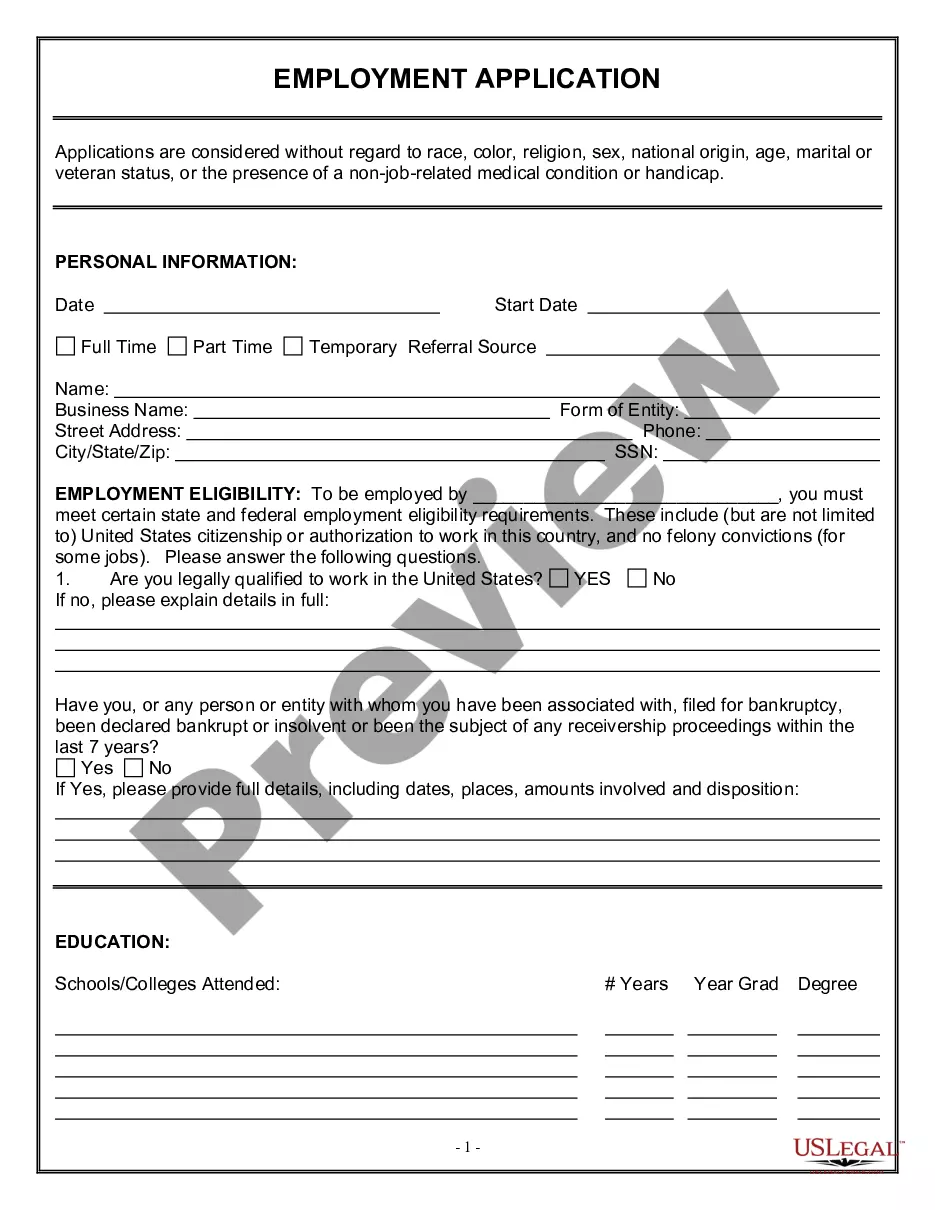

How to fill out Declaration Of Gift Over Several Year Period?

US Legal Forms - one of the largest collections of legal templates in the USA - provides a variety of legal document designs you can download or create.

Utilizing the site, you will access countless templates for business and personal purposes, categorized by types, states, or keywords. You can find the most recent versions of documents like the Georgia Declaration of Gift Over Several Year Period in moments.

If you already have a monthly subscription, Log In and retrieve the Georgia Declaration of Gift Over Several Year Period from your US Legal Forms library. The Download button will display on every form you view. You can access all previously downloaded templates in the My documents section of your account.

If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you prefer and provide your details to create an account.

Process the payment. Use your credit card or PayPal account to finalize the transaction. Retrieve the format and download the form to your device.

Make modifications. Fill out, edit, print, and sign the obtained Georgia Declaration of Gift Over Several Year Period.

Every template you add to your account does not expire and is yours permanently. Therefore, if you need to download or print another copy, just go to the My documents area and click on the form you require.

Access the Georgia Declaration of Gift Over Several Year Period with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started:

- Ensure you have selected the correct form for your city/state.

- Review the Preview option to assess the form’s content.

- Check the description of the form to make sure you've picked the right one.

- If the form does not meet your requirements, use the Search box at the top of the page to find the one that does.

Form popularity

FAQ

Yes, your parents can gift you $30,000, but they will need to be mindful of the annual gift exclusion. Since each parent can exclude $16,000 in a year, together they can gift you a total of $32,000 without incurring any gift taxes. This strategy aligns perfectly with the benefits of a Georgia Declaration of Gift Over Several Year Period, allowing them to plan their gifts effectively.

No, Georgia does not impose a state gift tax, making it easier for residents to give gifts without worrying about additional taxes. However, federal gift tax laws still apply, so it’s important to follow those guidelines. Utilizing a Georgia Declaration of Gift Over Several Year Period can help maximize your gifts while remaining compliant with the law.

Deciding whether to gift or sell a car in Georgia depends on several factors, including tax implications and personal circumstances. Gifting a vehicle may avoid sales tax, but it also raises considerations about gifting limits. Understanding these options is crucial, especially when planning to use a Georgia Declaration of Gift Over Several Year Period.

In the context of the Georgia Declaration of Gift Over Several Year Period, understanding the statute of limitations on gift tax is crucial. Generally, the IRS allows three years from the date of filing your gift tax return to assess any additional tax owed. However, if you do not file a return, there is no statute of limitations. It is essential to consult with a tax professional to navigate these complexities, especially when dealing with multi-year gifts.

To report a lifetime gift tax exemption, you will typically use Form 709 at the time of the gift that exceeds the annual exclusion. Properly leveraging the Georgia Declaration of Gift Over Several Year Period can streamline your reporting process. It’s important to be meticulous in your reporting to take full advantage of your lifetime exemption.

The IRS becomes aware of gifts primarily through required reporting on Form 709, should your gifts exceed the annual limit. It's crucial to understand the implications of the Georgia Declaration of Gift Over Several Year Period which helps maintain transparent records of your gifts. Accurate records can prevent misunderstandings with tax authorities.

Gifting someone over the annual gift tax exclusion amount means you will need to report the gift to the IRS. The Georgia Declaration of Gift Over Several Year Period can assist you in avoiding tax surprises down the line. Remember, excess gifts may apply against your lifetime exemption, so planning is essential.

When you gift more than the annual exclusion amount, you must file a gift tax return (Form 709) to declare the excess amount. Of course, the Georgia Declaration of Gift Over Several Year Period can be pivotal in managing your total gifting strategy. It can help you navigate the financial implications and exemptions effectively.

To document a gift for tax purposes, you should keep comprehensive records, including a description of the gift, its value, and the recipient's details. Utilizing the Georgia Declaration of Gift Over Several Year Period can simplify this process. Proper documentation ensures you comply with IRS regulations and provides evidence in case of an audit.

If you gift more than $15,000 in a year, you are required to report the excess amount to the IRS. The Georgia Declaration of Gift Over Several Year Period can help you structure your gifts efficiently. It's important to understand that anything over the annual exclusion may count against your lifetime gift tax exemption, which is currently set at $11.7 million.