A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose

Description

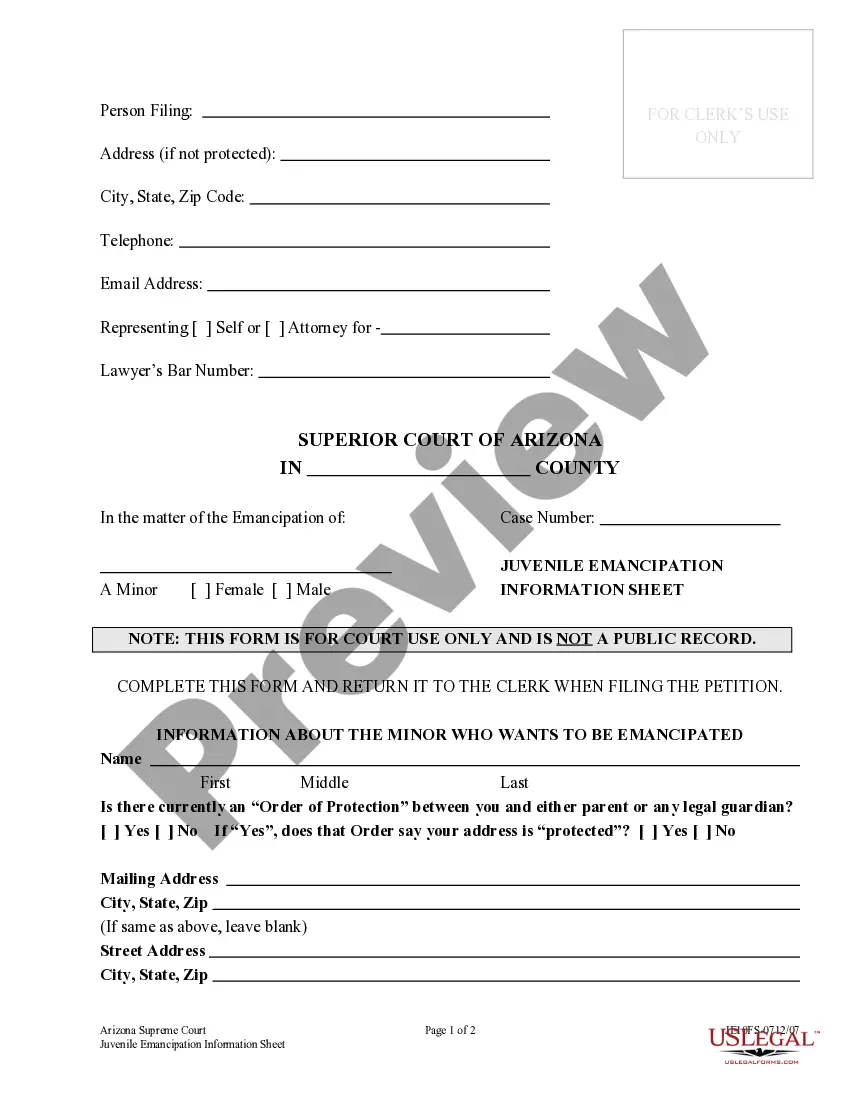

How to fill out Notice And Demand To Mortgagor Regarding Intent To Foreclose?

You can spend hours online looking for the valid document template that satisfies the state and federal requirements you need.

US Legal Forms offers a vast array of valid forms that are reviewed by professionals.

You can actually download or print the Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose from my help.

If available, utilize the Review button to browse through the document template as well.

- If you have a US Legal Forms account, you may Log In and click on the Obtain button.

- After that, you may complete, modify, print, or sign the Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose.

- Each valid document template you purchase is yours forever.

- To get another copy of any purchased form, go to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/city that you choose.

- Check the form description to ensure you have selected the right form.

Form popularity

FAQ

The foreclosure process in Georgia usually takes around 90 days, although it can vary based on specific circumstances. After the lender files the Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose, they must wait a minimum of 30 days before proceeding with the auction. Homeowners should remain informed and proactive during this period to explore possible options for avoiding foreclosure.

In Georgia, once a property is foreclosed, the timeline for tenants can vary. Typically, tenants may have to vacate the property after a foreclosure auction, but they might remain for up to 60 days if they have a lease agreement. However, it is vital for tenants to understand their rights, as receiving a Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose may impact their lease and occupancy status.

A notice of intent to foreclose, often referred to as a Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose, serves as a formal communication from the lender to the borrower. This document informs the borrower that they are in default and that the lender intends to begin foreclosure proceedings. It is crucial for homeowners to understand this process, as it outlines the next steps and provides an opportunity for the borrower to remedy the situation before foreclosure occurs.

To write a foreclosure hardship letter, start by clearly stating your name and property details. Explain your financial difficulties, such as job loss or medical expenses, and detail why you cannot continue making mortgage payments. It's crucial to express your willingness to work towards a solution, as this can positively influence the lender's response. Additionally, consider referencing the Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose to highlight the urgency of your situation.

The number of missed payments before foreclosure can vary depending on the lender and the terms of your mortgage. Generally, after you miss three payments, the lender may initiate a Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose. It is crucial to stay informed about your mortgage terms and communicate with your lender to address any payment issues before they escalate. Understanding your situation can help you take proactive measures to avoid foreclosure.

Receiving a foreclosure letter can be stressful, but it is important to act quickly. Start by reviewing the Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose to understand your specific situation. After that, consider reaching out to your lender to discuss possible solutions, such as repayment plans or modification options. Additionally, you may want to consult legal resources or platforms like uslegalforms to explore your options and rights.

While a notice of default and a demand letter both serve to inform the borrower of issues, they are not identical. The Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose is more specific and indicates a lender's intent to foreclose, while a notice of default generally informs the borrower of overdue payments. It is essential to recognize the differences, as each letter signals varying levels of urgency in addressing defaulted payments.

A demand letter serves as a formal request for payment or action. In the context of a Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose, it notifies the borrower of their default and potential foreclosure. This letter aims to encourage the mortgagor to address their missed payments promptly to avoid more serious consequences. By understanding its role, you can take the necessary steps to protect your property.

The notice of intention to foreclose is a legal notification indicating that a lender plans to initiate foreclosure proceedings on a property. This document is meant to inform the borrower about the lack of payment and the subsequent actions being taken. Understanding this notice in the context of the Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose will prepare homeowners to respond appropriately.

A letter of intent for foreclosure outlines the lender's plan to begin foreclosure proceedings against a borrower. This letter aims to inform the borrower of the pending action and may provide a timeline for response. Understanding this letter's significance can be crucial in navigating a Georgia Notice and Demand to Mortgagor regarding Intent to Foreclose.