Georgia Settlement Agreement Regarding Property Damages due to an Automobile Accident

Description

How to fill out Settlement Agreement Regarding Property Damages Due To An Automobile Accident?

Selecting the correct legal document format may be challenging. Naturally, there are numerous templates available online, but how can you find the legal form you need? Utilize the US Legal Forms website. The service offers countless templates, including the Georgia Settlement Agreement Concerning Property Damages from an Automobile Accident, suitable for business and personal needs. All forms are reviewed by professionals and comply with state and federal regulations.

If you are already a member, Log In to your account and press the Download button to access the Georgia Settlement Agreement Concerning Property Damages from an Automobile Accident. Use your account to browse the legal forms you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you need.

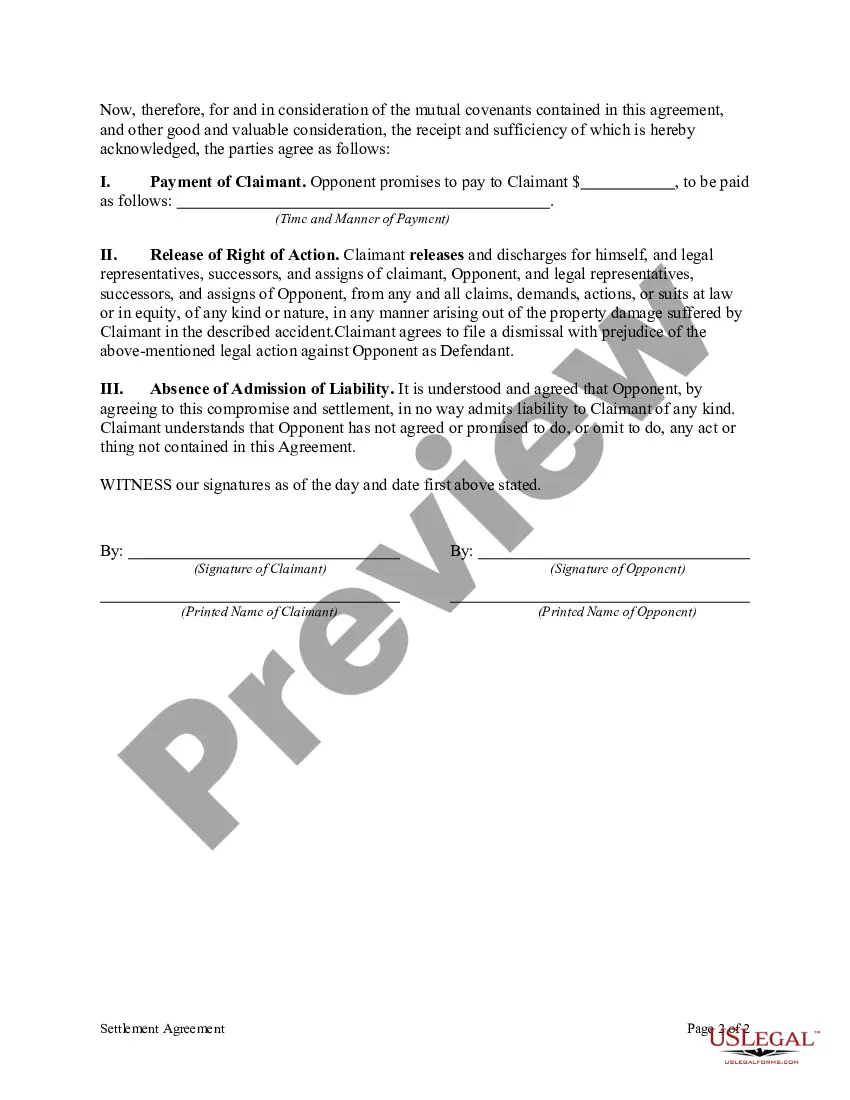

If you are a new user of US Legal Forms, here are simple steps to follow: First, ensure you have selected the correct form for your locality. You can examine the form using the Preview button and review the form details to confirm it is the right one for you. If the form does not meet your needs, use the Search field to locate the correct form. Once you are confident that the form is suitable, click the Purchase now button to obtain the form. Select your preferred pricing plan and enter the necessary information. Create your account and pay for the transaction using your PayPal account or Visa or Mastercard. Choose the file format and download the legal document format to your device. Complete, edit, and print out and sign the acquired Georgia Settlement Agreement Concerning Property Damages from an Automobile Accident.

US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain professionally crafted paperwork that aligns with state requirements.

- Utilize the US Legal Forms site for numerous templates.

- Forms are verified by experts to meet regulations.

- Log in to download forms you've previously ordered.

- Preview forms before selection.

- Search for appropriate forms if needed.

- Pay using available payment methods.

Form popularity

FAQ

Property damage typically involves physical damage to tangible property. Tangible property is something that can be touched or felt like a building or computer monitor. Most property damage claims involve physical injury to tangible property owned by the person making the claim (the claimant).

Insurance companies in Georgia have 40 days to settle a claim after it is filed. Georgia insurance companies also have specific timeframes in which they must acknowledge the claim and then decide whether or not to accept it, before paying out the final settlement.

What is the difference between property damage liability coverage and collision? Property damage liability coverage pays for the cost to repair damage you cause to property owned by someone else. Collision coverage pays to repair your own vehicle less your deductible.

Property damage is injury to real or personal property. An example could be a chemical leak on a piece of real estate, or damage to a car from an accident. Property owners can obtain property insurance to protect against the risk of property damage.

A signed settlement agreement is a powerful document that requires the demonstration of an extreme condition in order to render it null and void. If a party wishes to back out of the settlement, then they must prove the existence of fraud, duress, coercion, or unconscionability.

You can overturn a settlement agreement by demonstrating that the settlement is defective. A settlement agreement may be invalid if it's made under fraud or duress. A mutual mistake or a misrepresentation by the other party can also be grounds to overturn a settlement agreement.

If you feel you've been treated badly, you could still bring a claim after turning down a settlement, but you might not be awarded as much money as you were offered initially. You might also incur legal costs in bringing a claim and time and the stress of litigation also need to be considered.

What is Property Damage Coverage? If you're responsible for an accident, Property Damage Coverage will take care of the cost of repairing or replacing another person's property. This typically means damage to someone else's car, but it could apply to any other type of property you damage in an accident.

According to the Insurance Information Institute, the average personal injury car accident claim in 2019 settled for $18,417. The average property damage car accident settlement came in at $4,525 that same year.

Anything that is damaged in a car wreck is considered property damage. While the damage to your vehicle is the main component of property damage, you should also look to see whether there was any personal property that was damaged in the wreck. This might include a GPS system, a phone, a GoPro camera, or even CDs.