Georgia Bylaws of a Nonprofit Organization — Multistate are legal documents that provide a comprehensive framework for the internal affairs, governance, and operations of nonprofit organizations operating in the state of Georgia and in multiple states. These bylaws are essential in establishing clear guidelines, procedures, and protocols for the organization's members, board of directors, officers, and other stakeholders. The Georgia Bylaws of a Nonprofit Organization — Multistate typically cover various aspects, including: 1. Purpose and Mission: These bylaws outline the organization's overarching purpose, mission, and its specific goals and objectives. It defines the intended activities the organization undertakes to fulfill its purpose and the key target beneficiaries. 2. Membership: The bylaws lay out the criteria, rights, and responsibilities of the organization's members, including eligibility, voting rights, membership meetings, and other relevant provisions. It may differentiate between different types of members such as individuals, corporations, or other organizations. 3. Board of Directors: This section defines the composition, roles, powers, and responsibilities of the organization's board of directors. It covers matters related to the election, terms, removal, and replacement of directors, as well as the frequency and conduct of board meetings. 4. Officers: The bylaws specify the roles, duties, and responsibilities of the organization's officers, such as the President, Treasurer, and Secretary. It may further outline the selection process, terms of office, and authority granted to officers, including their reporting obligations to the board of directors. 5. Meetings: This section provides guidelines for conducting meetings of both the board of directors and the organization's membership. It typically covers issues like notice requirements, quorum, voting procedures, and record-keeping for both physical and virtual meetings. 6. Committees: The bylaws may address the establishment, composition, responsibilities, and authority of various committees, such as executive committees, finance committees, or fundraising committees. This section outlines their roles in supporting the organization's goals and operations. 7. Financial Matters: This segment outlines financial policies, accounting procedures, and other financial matters unique to the organization. It may include provisions on budgeting, fiscal year, audits, financial reporting, and the management of the organization's assets. 8. Amendment and Dissolution: This clause explains the process of amending the bylaws, including the required majority or voting procedures. Additionally, it may outline the necessary steps and legal obligations if the organization decides to dissolve or wind up its operations. Different types of Georgia Bylaws of a Nonprofit Organization — Multistate may include specific variations or customizations based on the nature of the nonprofit organization. These variations depend on factors like the organization's size, purpose, tax-exempt status, and the specific requirements of operating in multiple states. Bylaws may also differ between charitable organizations, social welfare organizations, trade associations, or professional associations, tailoring the provisions to suit their specific goals and objectives.

Georgia Bylaws of a Nonprofit Organization - Multistate

Description

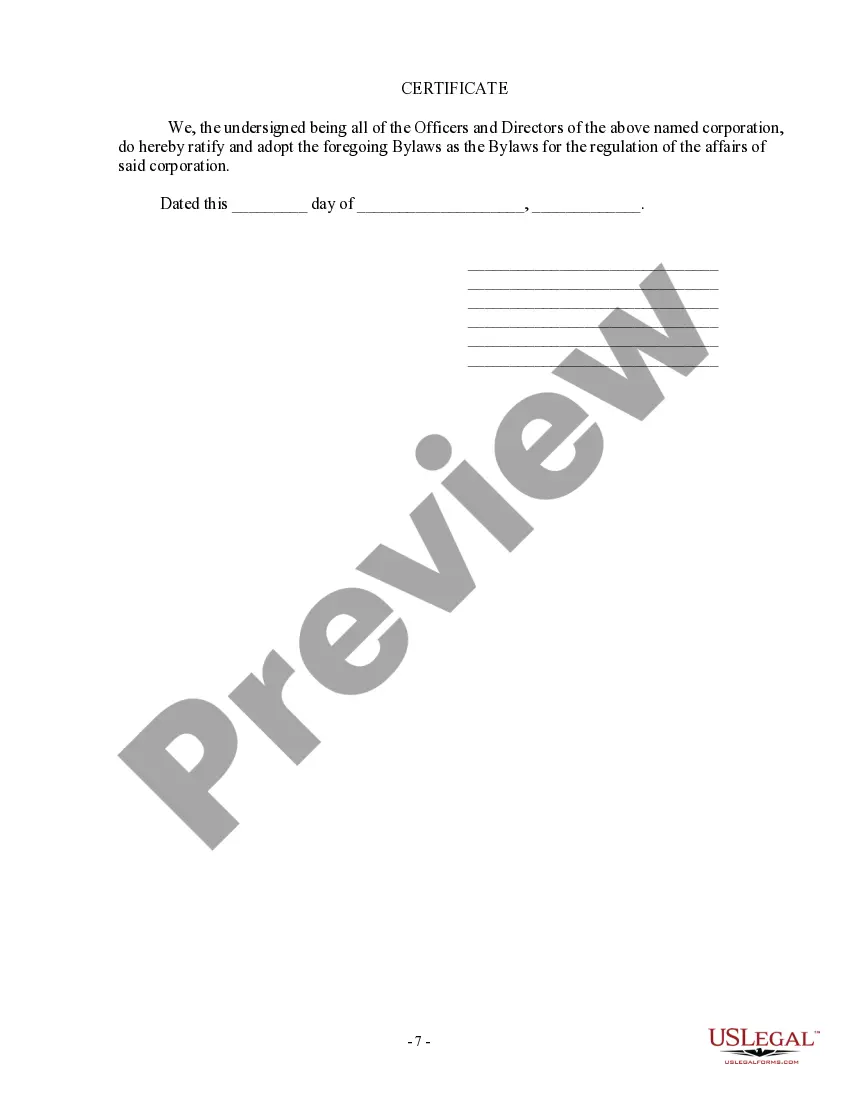

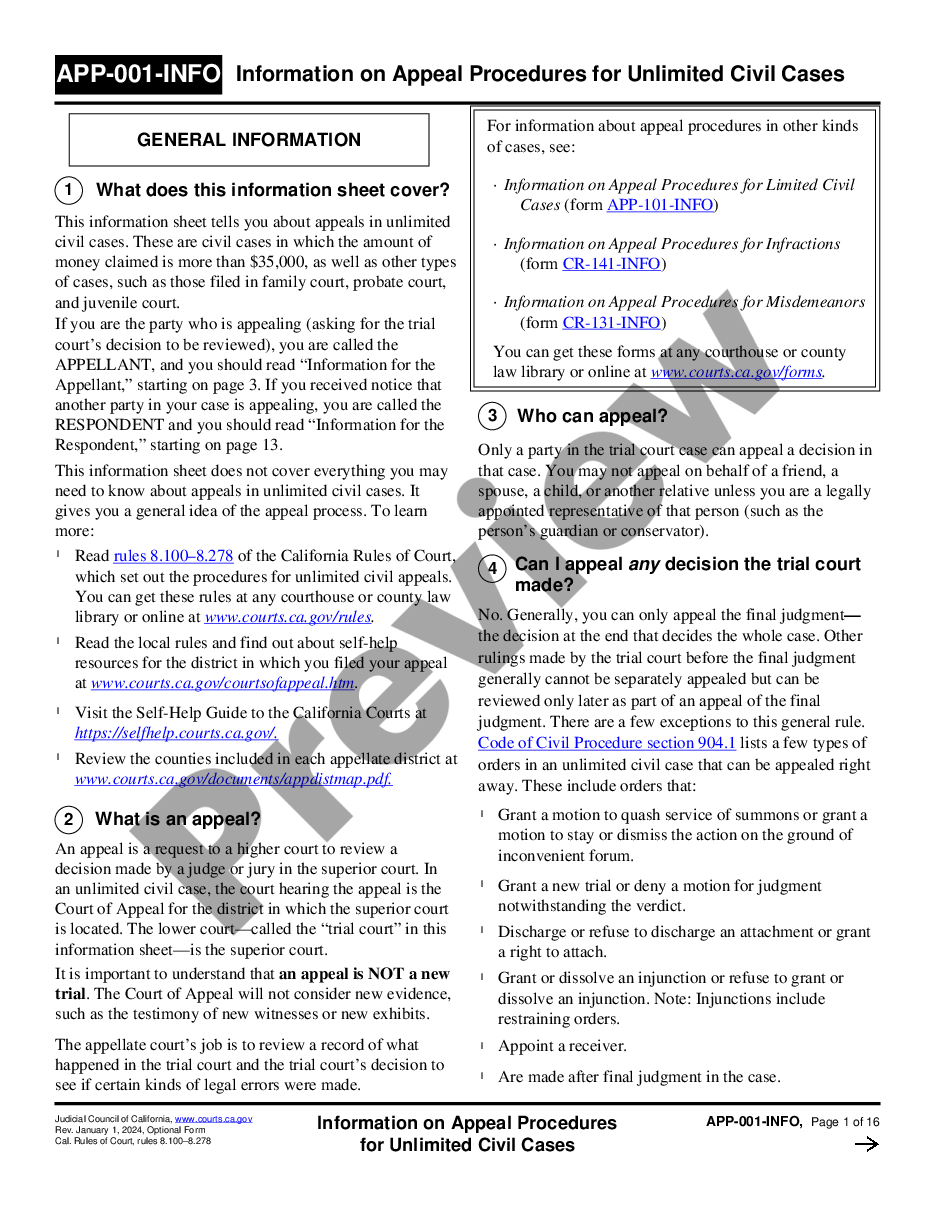

How to fill out Georgia Bylaws Of A Nonprofit Organization - Multistate?

You can commit several hours online trying to find the legal file web template which fits the federal and state needs you need. US Legal Forms offers thousands of legal varieties that are reviewed by pros. It is simple to obtain or printing the Georgia Bylaws of a Nonprofit Organization - Multistate from the assistance.

If you already possess a US Legal Forms profile, you may log in and then click the Obtain button. Afterward, you may total, change, printing, or sign the Georgia Bylaws of a Nonprofit Organization - Multistate. Each legal file web template you get is the one you have eternally. To obtain yet another backup of the acquired develop, visit the My Forms tab and then click the related button.

If you use the US Legal Forms website initially, follow the straightforward guidelines below:

- Initially, make sure that you have selected the proper file web template for your region/city of your choosing. See the develop outline to make sure you have picked the proper develop. If accessible, take advantage of the Preview button to check through the file web template as well.

- If you wish to discover yet another edition of the develop, take advantage of the Research industry to obtain the web template that suits you and needs.

- Once you have discovered the web template you would like, just click Buy now to carry on.

- Pick the costs plan you would like, enter your references, and sign up for an account on US Legal Forms.

- Full the deal. You should use your charge card or PayPal profile to purchase the legal develop.

- Pick the structure of the file and obtain it to the device.

- Make changes to the file if possible. You can total, change and sign and printing Georgia Bylaws of a Nonprofit Organization - Multistate.

Obtain and printing thousands of file layouts while using US Legal Forms web site, that provides the greatest variety of legal varieties. Use specialist and condition-certain layouts to take on your organization or specific needs.

Form popularity

FAQ

The state of Georgia only requires nonprofit organizations to have one board member, but the IRS rarely provides tax-exempt status with less than three unrelated board members. It is recommended for nonprofits to have three to twenty-five board members depending on the size and purpose of the organization.

5 Best States to Start a Nonprofit#1: Delaware. The state of Delaware is home to more than 5,500 nonprofit organizations, including more than 3,000 501(c)(3) public charities.#2: Arizona.#3: Nevada.#4: Wisconsin.#5: Texas.#1: New York.#2: California.

An advisory board may contribute to the organization in many different waysand the same nonprofit may have multiple advisory boards. One advisory board, for example, could be established to involve prospective donors, offering them a forum to give advice as well as donate and fundraise.

In order to qualify as a tax-exempt, 501(c)(3) organization, a nonprofit must exist for one or more exclusively charitable purposes.

By incorporating in Delaware, a nonprofit can retain the flexibility to tailor its governance to meet its unique needs. A nonprofit incorporated in Delaware (or any other state) is still subject to oversight by state charity officials in the states where the nonprofit operates.

Federated Nonprofit Organizations can be structured as a Single Corporation operating in multiple locations; as Separate Subsidiary Corporations; or as separate corporations with affiliation agreements.

In order to qualify as a tax-exempt, 501(c)(3) organization, a nonprofit must exist for one or more exclusively charitable purposes.

Bylaws are the rules used by the officers and directors to govern the organization. Georgia does not require a copy of the bylaws to be filed with the state. Regardless of filing requirement, their creation is a part of the formation process and is required by state law.

Nonprofit organizations can operate nationwide, even though they are legally registered in one specific state as a domestic entity. Generally, charities incorporate in the state either where their headquarters are located in or where the majority of their activities take place.