Georgia Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions

Description

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

How to fill out Shareholders' Agreement Between Two Shareholders Of Closely Held Corporation With Buy Sell Provisions?

Have you ever been in a scenario where you require documents for potential business or particular activities almost every day.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of template options, including the Georgia Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions, designed to meet state and federal requirements.

Once you find the correct form, click Purchase now.

Select the payment plan you desire, provide the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Georgia Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

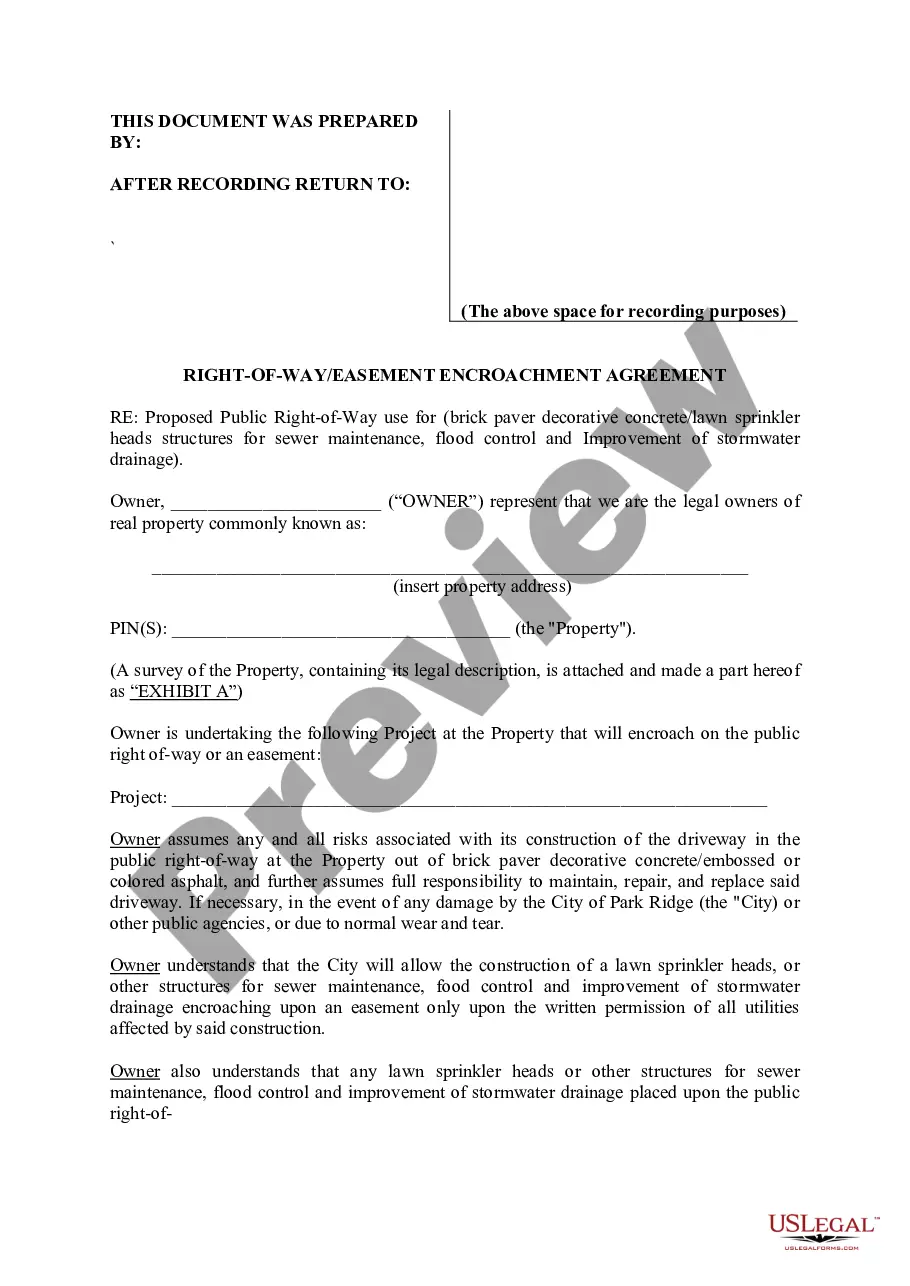

- Utilize the Review button to examine the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you are searching for, use the Lookup section to find the form that fits your needs and specifications.

Form popularity

FAQ

The two most-common buy and sell agreements are cross-purchase, and redemption; some agreements will combine the two. Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.

As a real estate buyer, a purchase contract is one of the first steps toward closing the sale. In layman's terms, a purchase contract is simply the written contract between the buyer and seller outlining the terms of the sale, Hardy explains.

Advantages of a Cross Purchase Plan When the owner(s) purchase the business interest of their departed or deceased owner, their basis increases by what they pay to the exiting owner or estate of the deceased owner. This then improves the tax consequences of their exit if it occurs during their lifetime.

A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations. It can be most helpful when a corporation has a small number of active shareholders.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires. The mechanism often relies on a life insurance policy in the event of a death to facilitate that exchange of value.

A crossing agreement is a form of Joint Use Agreement used for the common usage of intersecting utilities. Introduction. The following are examples of crossing and encroachment agreements, correspondence and other related documents provided by Operators.

Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

If you don't have a binding buy-sell agreement in place, your business is at risk. Without a clear succession plan, disputes can arise among partnersor their surviving spousesthat lead to loss of valuable time, increased expenses, and costly litigation.