If you want to complete, acquire, or produce lawful document layouts, use US Legal Forms, the largest collection of lawful types, which can be found online. Make use of the site`s basic and convenient lookup to get the files you will need. Various layouts for enterprise and person purposes are categorized by classes and claims, or key phrases. Use US Legal Forms to get the Georgia Contest of Final Account and Proposed Distributions in a Probate Estate within a handful of clicks.

Should you be previously a US Legal Forms client, log in for your profile and then click the Acquire key to have the Georgia Contest of Final Account and Proposed Distributions in a Probate Estate. You can also gain access to types you previously downloaded inside the My Forms tab of your own profile.

If you work with US Legal Forms the very first time, refer to the instructions under:

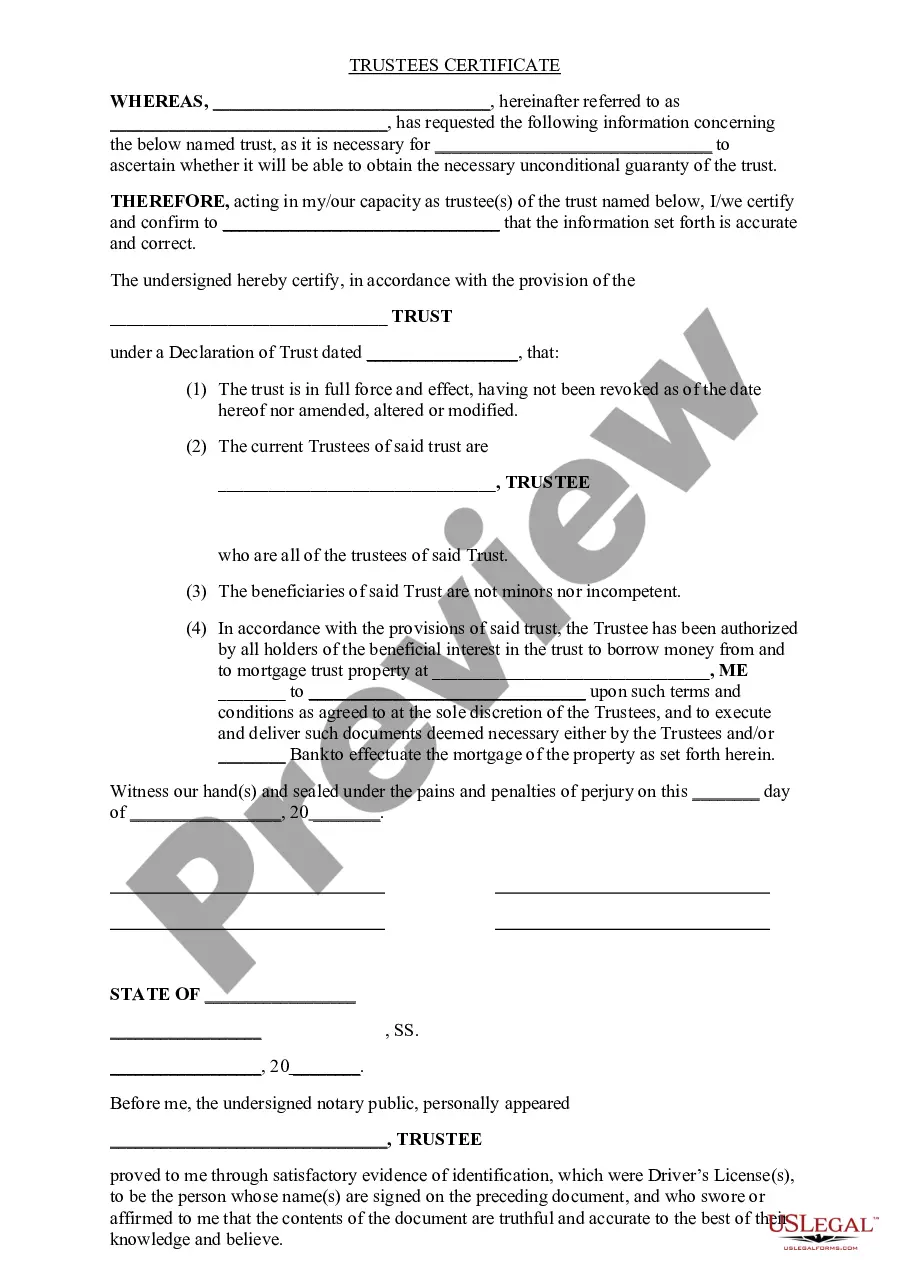

- Step 1. Be sure you have chosen the form for the correct metropolis/nation.

- Step 2. Take advantage of the Review choice to check out the form`s content material. Don`t forget to read the outline.

- Step 3. Should you be unhappy together with the type, make use of the Lookup field towards the top of the screen to locate other versions from the lawful type format.

- Step 4. After you have discovered the form you will need, select the Get now key. Choose the prices prepare you prefer and add your qualifications to register for the profile.

- Step 5. Process the financial transaction. You should use your credit card or PayPal profile to accomplish the financial transaction.

- Step 6. Pick the format from the lawful type and acquire it on your gadget.

- Step 7. Total, modify and produce or indicator the Georgia Contest of Final Account and Proposed Distributions in a Probate Estate.

Every lawful document format you purchase is yours permanently. You may have acces to every type you downloaded in your acccount. Click the My Forms segment and decide on a type to produce or acquire again.

Be competitive and acquire, and produce the Georgia Contest of Final Account and Proposed Distributions in a Probate Estate with US Legal Forms. There are millions of professional and state-distinct types you can use for your enterprise or person needs.