US Legal Forms - among the most significant libraries of lawful varieties in America - offers a wide array of lawful document templates you are able to download or print. Using the website, you can find 1000s of varieties for enterprise and person reasons, sorted by types, says, or keywords.You will discover the most recent variations of varieties just like the Georgia Objection to Allowed Claim in Accounting in seconds.

If you already have a membership, log in and download Georgia Objection to Allowed Claim in Accounting from the US Legal Forms library. The Obtain key can look on every single develop you view. You have access to all in the past saved varieties within the My Forms tab of your own accounts.

In order to use US Legal Forms the first time, here are simple guidelines to get you started:

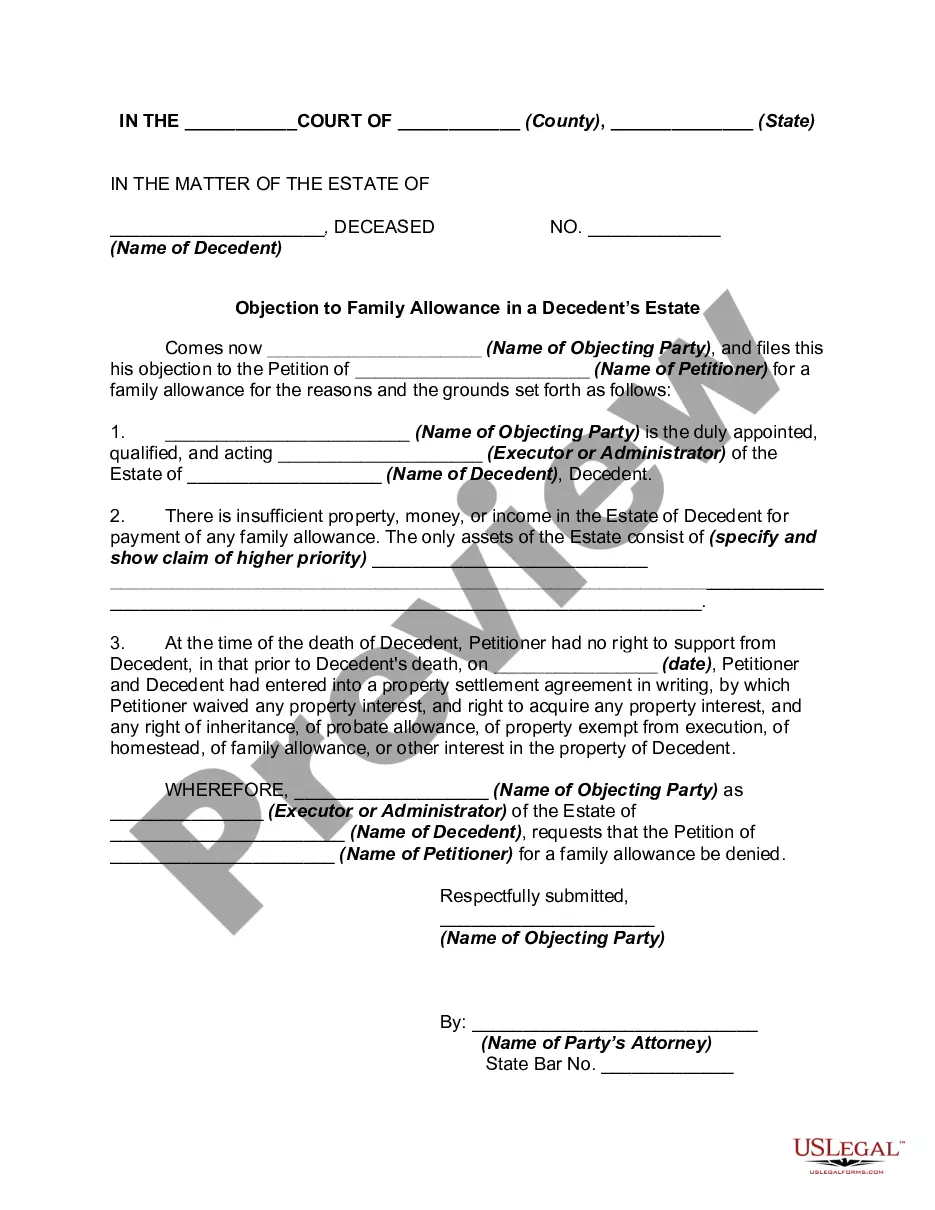

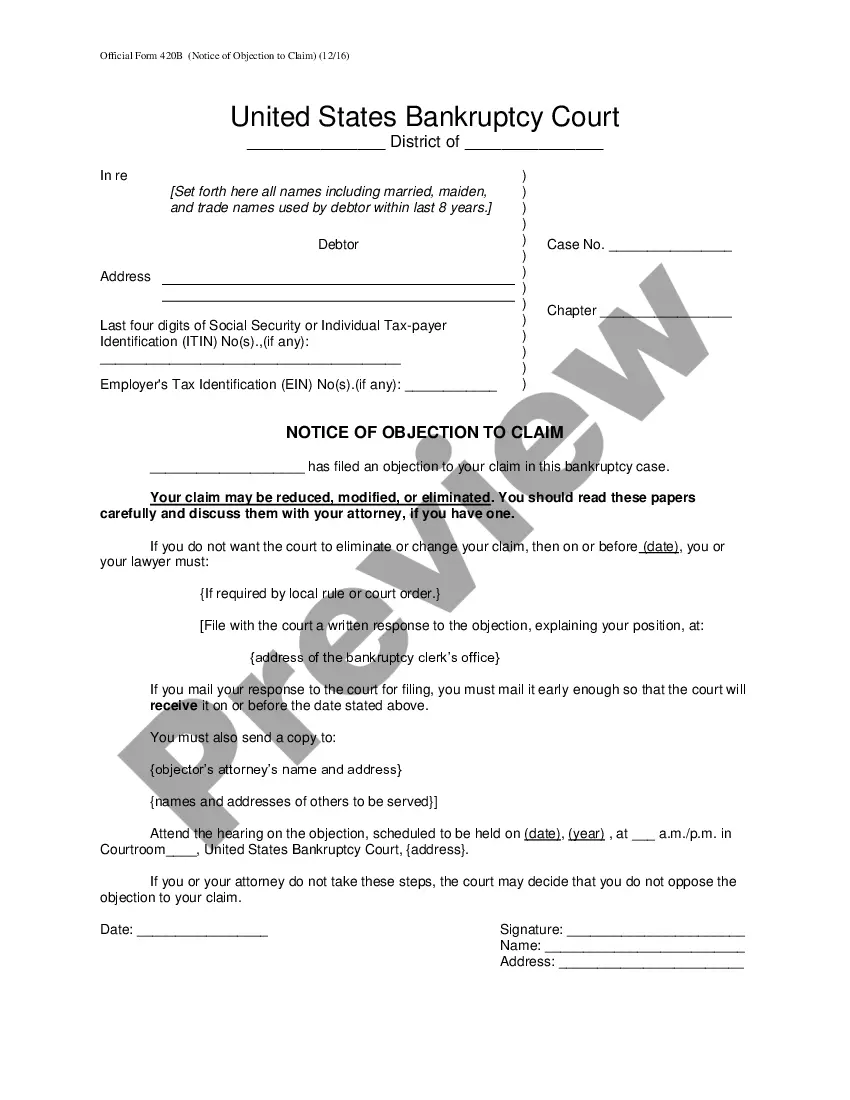

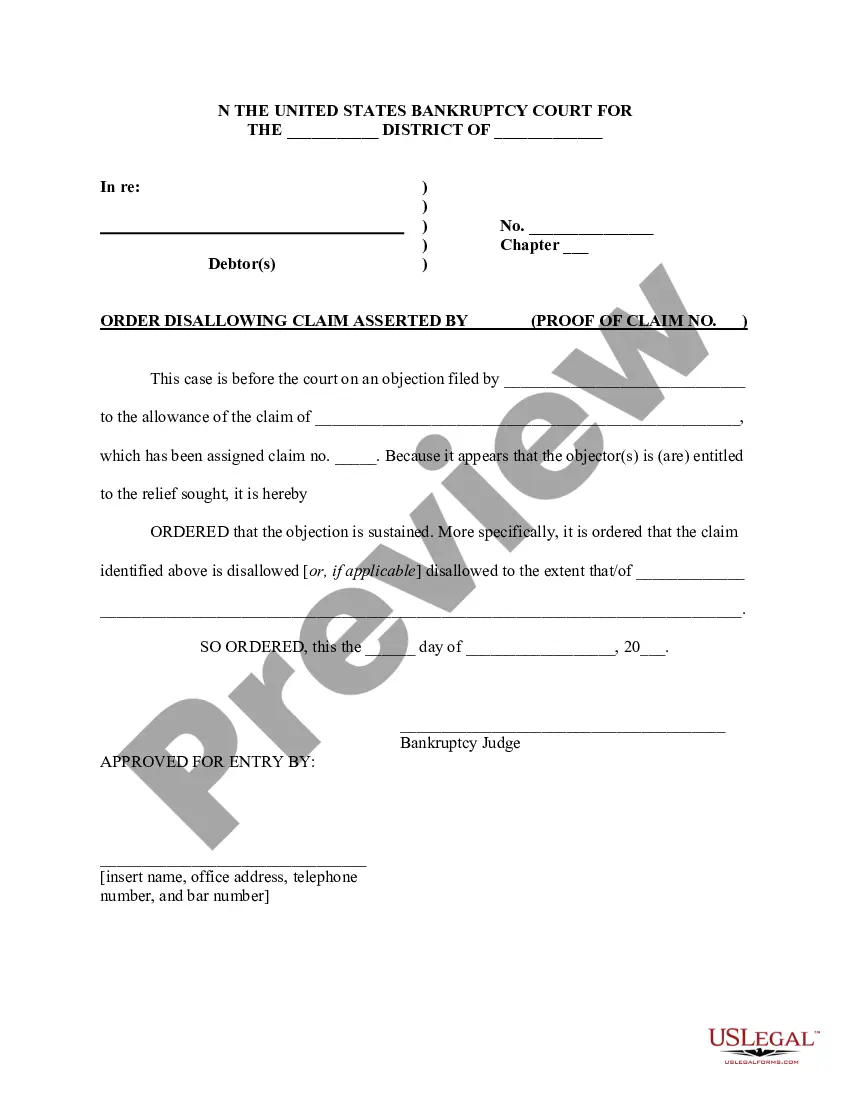

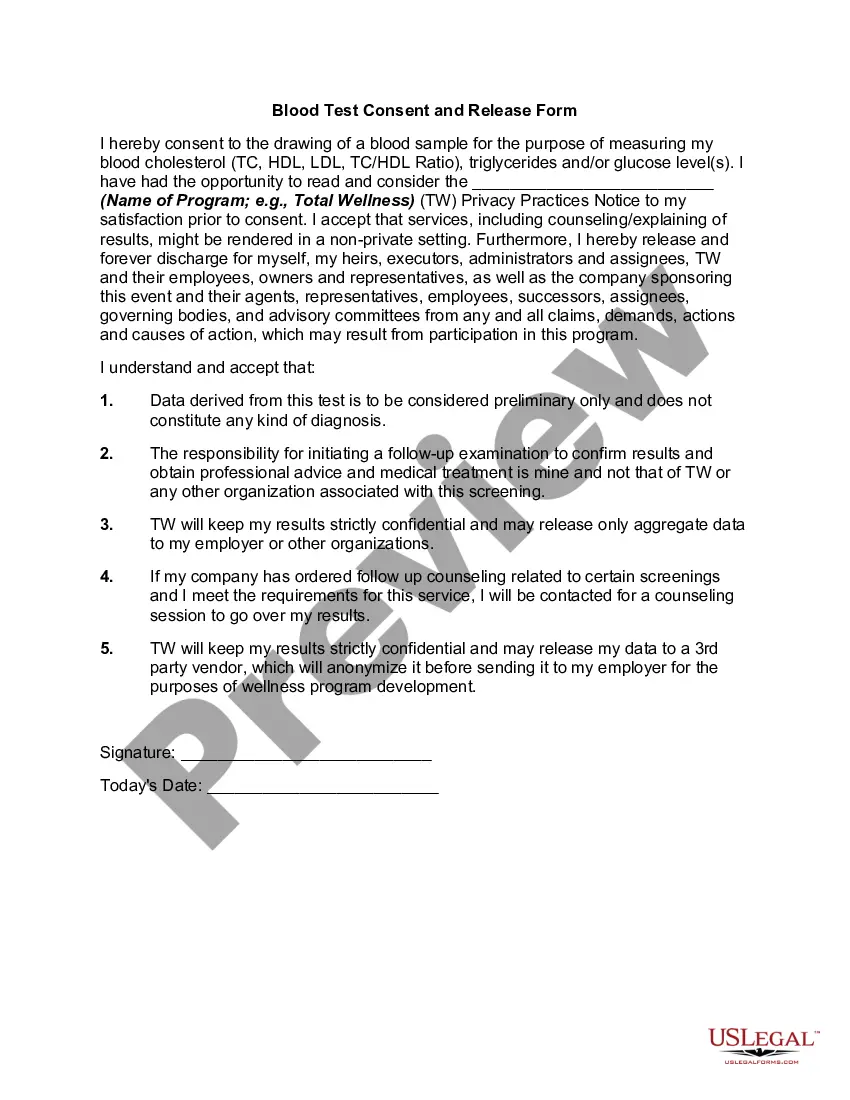

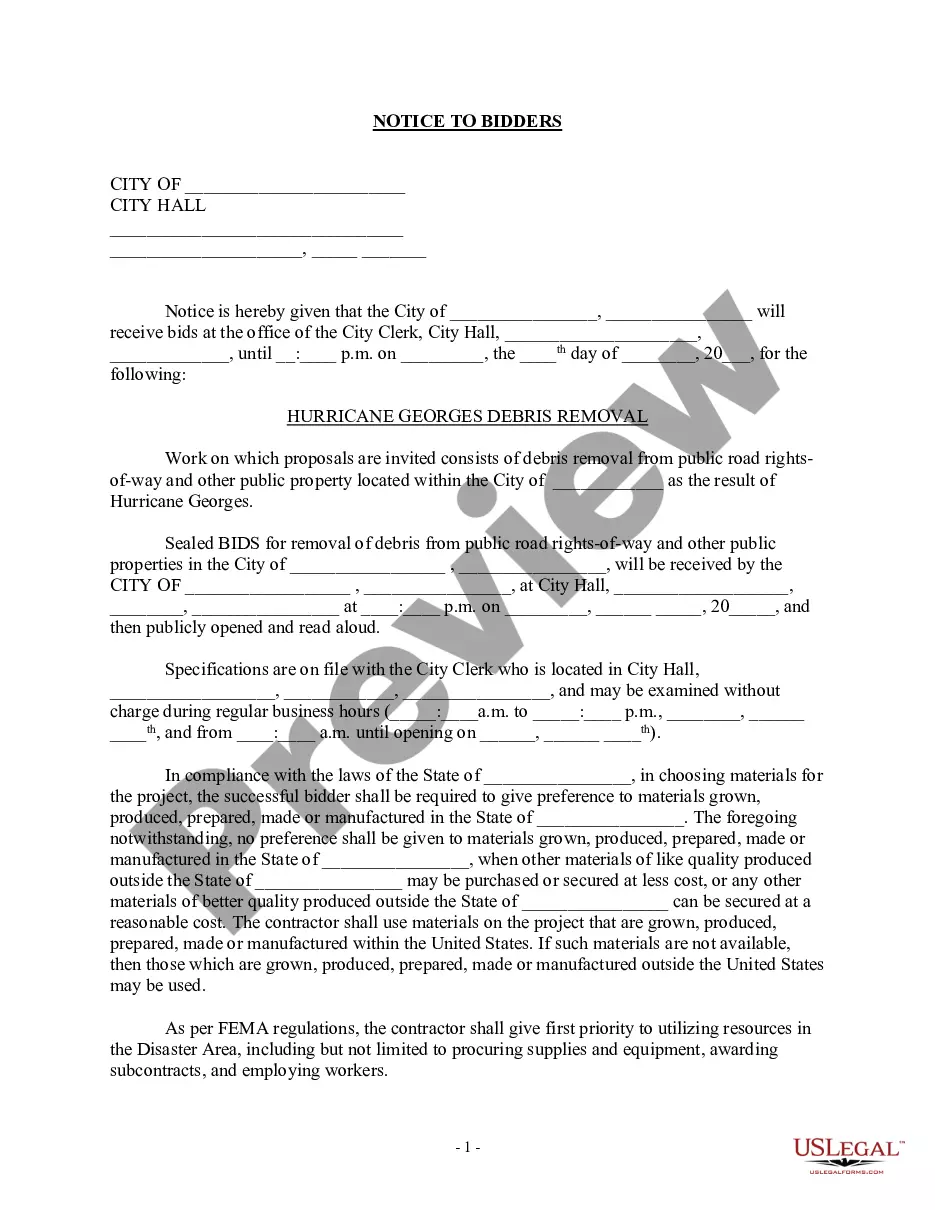

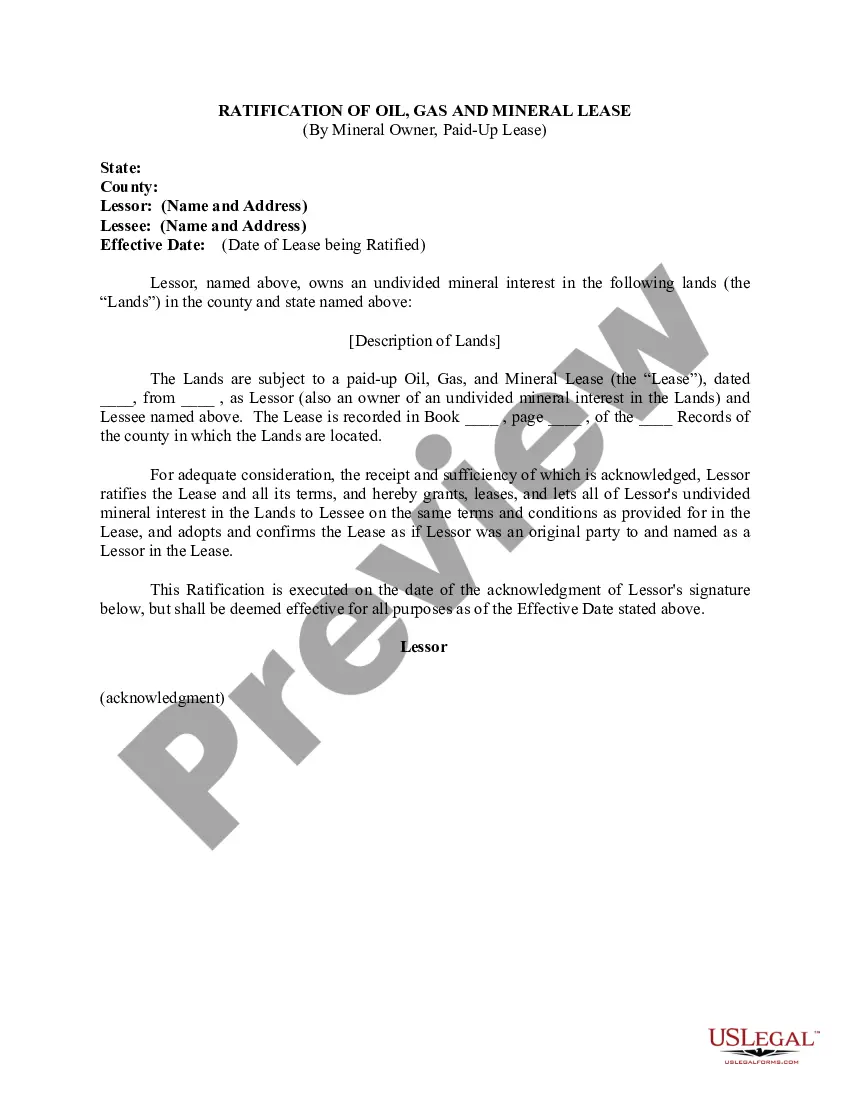

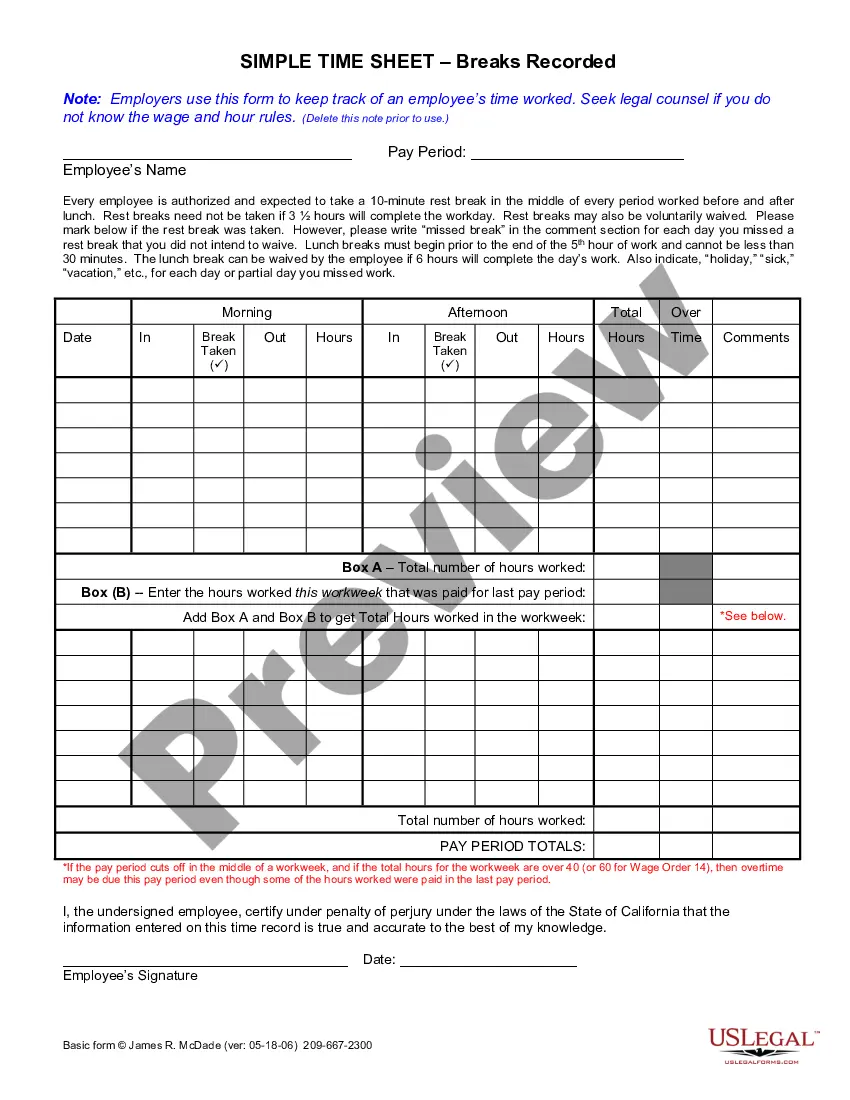

- Be sure you have picked out the best develop to your city/state. Click the Review key to review the form`s articles. Look at the develop explanation to actually have chosen the appropriate develop.

- In case the develop doesn`t satisfy your demands, utilize the Research discipline near the top of the screen to get the one that does.

- If you are pleased with the form, verify your decision by visiting the Buy now key. Then, choose the rates plan you like and give your references to register for an accounts.

- Procedure the purchase. Make use of charge card or PayPal accounts to complete the purchase.

- Pick the format and download the form on your device.

- Make alterations. Complete, modify and print and indicator the saved Georgia Objection to Allowed Claim in Accounting.

Each web template you included in your bank account does not have an expiration particular date and it is your own for a long time. So, if you wish to download or print yet another duplicate, just check out the My Forms portion and click around the develop you require.

Obtain access to the Georgia Objection to Allowed Claim in Accounting with US Legal Forms, probably the most considerable library of lawful document templates. Use 1000s of expert and state-distinct templates that fulfill your organization or person needs and demands.