Georgia Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another is a legal document used when selling a vehicle in Georgia in installments. This agreement outlines the terms and conditions of the sale, including payment schedule, interest rates, and ownership transfer. It serves as a protection for both the seller and buyer and ensures that the transaction is fair and transparent. There are different types of Georgia Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another, including: 1. Simple Installment Sale Agreement: This agreement defines the terms of the sale, payment amounts, interest rates, and duration of the installment plan. It also includes provisions regarding late payments, default, and repossession rights. 2. Balloon Payment Installment Sale Agreement: In this type of agreement, the buyer makes regular installment payments for a certain period, but the final payment is significantly larger (balloon payment). This option allows buyers to have lower monthly payments and is ideal for those expecting a lump sum payment in the future. 3. Lease Purchase Agreement: This type of agreement combines elements of a lease and an installment sale. The buyer leases the vehicle for a defined period with an option to purchase it at the end of the lease term. It includes provisions for monthly lease payments, maintenance responsibilities, and purchase option terms. 4. Subordination Agreement: Sometimes, a buyer may already have an existing loan or debt secured by another asset. A subordination agreement is used in such cases, where the buyer's existing debt is subordinated to the new auto loan, ensuring the seller's security interest in the vehicle. When drafting a Georgia Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another, it is crucial to include specific details such as the vehicle's make, model, identification number (VIN), sale price, down payment amount, interest rate, and the total amount to be financed. Both parties should thoroughly read and understand the agreement before signing, and it is recommended to consult with a legal professional to ensure compliance with Georgia laws and to address any concerns or questions. This agreement protects the rights and interests of both the buyer and seller, providing a clear framework for the installment sale of an automobile in Georgia.

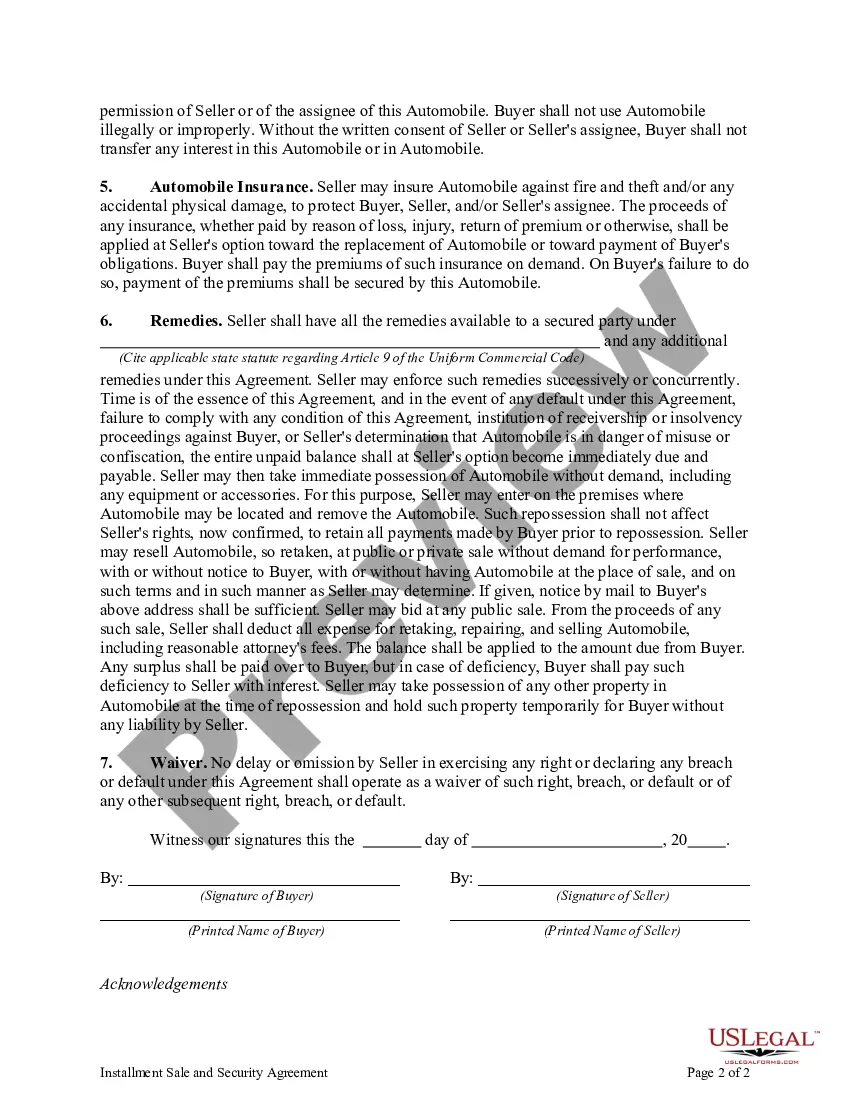

Georgia Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another

Description

How to fill out Georgia Installment Sale And Security Agreement Regarding Sale Of Automobile From One Individual To Another?

US Legal Forms - one of several greatest libraries of legal kinds in the United States - delivers a wide array of legal document layouts you are able to obtain or printing. Utilizing the internet site, you may get 1000s of kinds for organization and individual uses, sorted by groups, claims, or keywords.You will discover the latest versions of kinds much like the Georgia Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another within minutes.

If you have a monthly subscription, log in and obtain Georgia Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another from your US Legal Forms local library. The Download switch will show up on each develop you view. You get access to all earlier delivered electronically kinds from the My Forms tab of the account.

If you would like use US Legal Forms initially, listed below are basic guidelines to help you get started off:

- Be sure to have chosen the right develop to your metropolis/area. Select the Review switch to review the form`s content material. Browse the develop description to actually have selected the correct develop.

- If the develop doesn`t match your specifications, utilize the Research field towards the top of the display to get the the one that does.

- Should you be pleased with the shape, verify your selection by simply clicking the Purchase now switch. Then, pick the pricing program you like and supply your credentials to register for an account.

- Approach the transaction. Make use of Visa or Mastercard or PayPal account to finish the transaction.

- Find the file format and obtain the shape on your own system.

- Make changes. Fill up, change and printing and sign the delivered electronically Georgia Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another.

Each template you included in your account lacks an expiration time and is your own permanently. So, in order to obtain or printing one more copy, just visit the My Forms portion and click on on the develop you will need.

Get access to the Georgia Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another with US Legal Forms, by far the most considerable local library of legal document layouts. Use 1000s of specialist and state-specific layouts that fulfill your small business or individual needs and specifications.