Georgia Invoice Template for Sales Executive is a professional and customizable document used by sales executives in Georgia to streamline their invoicing process. It is a crucial tool for ensuring accurate and organized financial transactions between a sales executive and their clients. With a Georgia Invoice Template, sales executives can efficiently create and manage invoices, saving time and enhancing professionalism in their business transactions. This invoice template can be easily customized to fit the specific needs of a sales executive. It typically includes all the essential elements required for a legally compliant invoice, such as the sales executive's name, address, contact details, and the client's information. Key features and sections of a Georgia Invoice Template for Sales Executive might include: 1. Header: A professional header with the sales executive's name, logo, and contact details, such as address, phone number, and email. 2. Invoice Number: A unique identification number assigned to each invoice, helping in easy tracking and reference. 3. Date: The date of issuing the invoice, which is important for record-keeping and tracking payment deadlines. 4. Client Information: The client's name, address, and contact details, ensuring accurate billing and smooth communication. 5. Description of Goods or Services: A detailed breakdown of the goods or services provided by the sales executive. It may include item names, descriptions, quantities, rates, and applicable taxes or discounts. 6. Subtotal: The total amount for the goods or services provided before adding any taxes or discounts. 7. Taxes: Any applicable sales taxes, VAT, or other taxes that need to be charged on the invoice. 8. Discounts: Any applicable discounts, promotions, or special offers provided to the client. 9. Total Amount Due: The final amount payable by the client after applying taxes and discounts. 10. Payment Terms: Clear and concise information about the acceptable payment methods, due dates, and late payment penalties, if any. 11. Terms and Conditions: Any additional terms or conditions relevant to the business transaction, such as return policies, payment deadlines, or cancellation policies. Types of Georgia Invoice Templates for Sales Executives: 1. Basic Georgia Invoice Template: A simple invoice template suitable for entry-level sales executives or small-scale businesses, containing essential fields like client information, goods or services provided, and the total amount due. 2. Customized Georgia Invoice Template: This type allows sales executives to incorporate business-specific details, branding, and additional fields as required. It offers more flexibility in addressing the unique needs of the business. 3. Georgia Invoice Template with Tax Calculation: Specifically designed for sales executives in Georgia, this template includes built-in tax calculations based on local tax regulations, ensuring accurate tax invoicing and compliance. 4. Automated Georgia Invoice Template: This advanced template utilizes automation tools, such as formulas and pre-populated fields, to automatically calculate totals, taxes, and generate subtotals. It saves time and reduces the chances of errors during invoicing. In conclusion, a Georgia Invoice Template for Sales Executive is a versatile and customizable document that helps streamline the invoicing process for sales executives in Georgia. It ensures professional communication, accurate record-keeping, and compliance with local tax regulations. Explore different types of templates available to find the one that best meets your business requirements.

Georgia Invoice Template for Sales Executive

Description

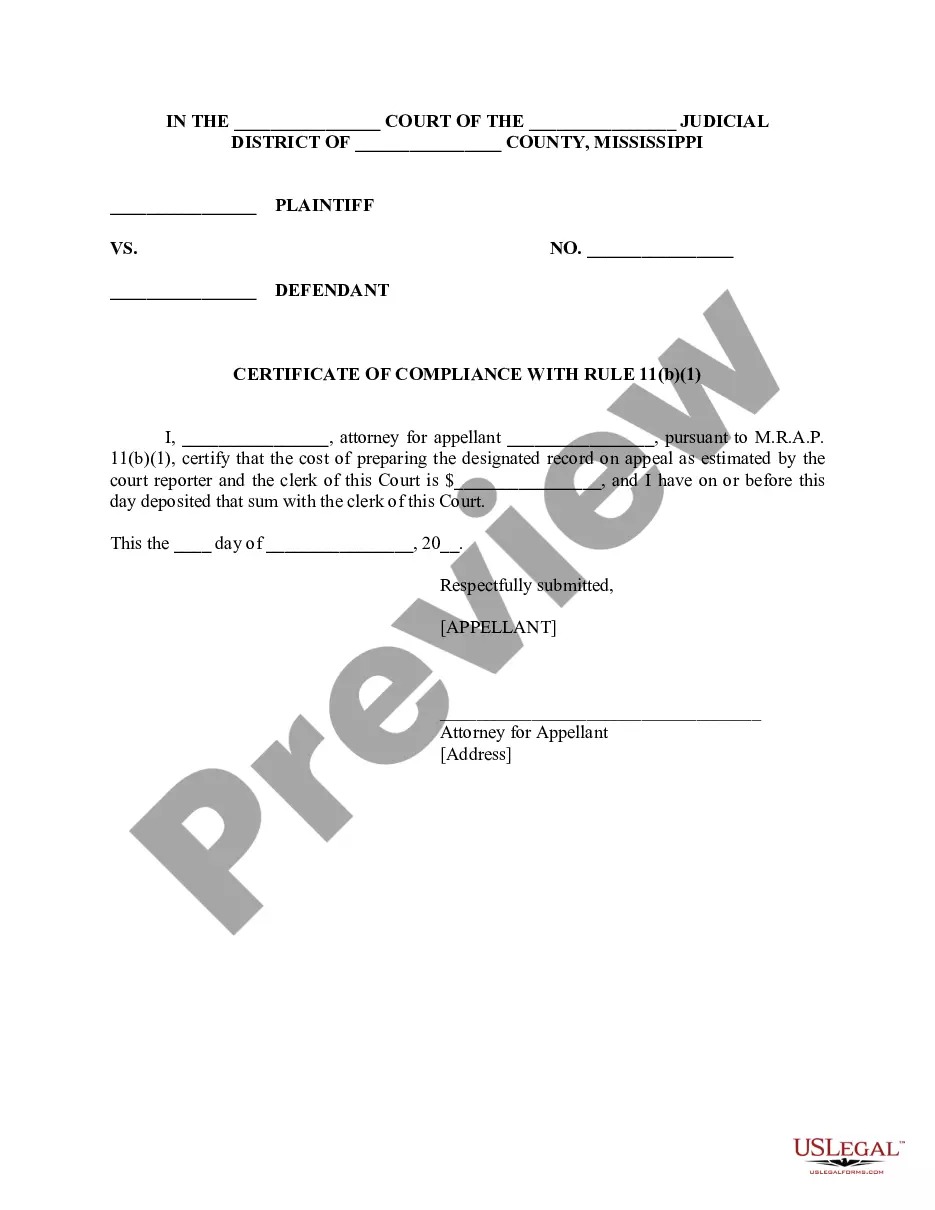

How to fill out Invoice Template For Sales Executive?

US Legal Forms - among the largest collections of legal documents in the USA - offers a range of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can quickly find the latest versions of forms such as the Georgia Invoice Template for Sales Executives.

If you already have a monthly subscription, Log In and download the Georgia Invoice Template for Sales Executives from your US Legal Forms account. The Download button will appear on every form you view. You can access all previously acquired forms from the My documents section of your profile.

Once you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your information to register for an account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment. Select the format and download the form to your device. Edit the form as needed. Fill it out, modify it, print, and sign the downloaded Georgia Invoice Template for Sales Executives.

Every template you add to your account has no expiration date and remains your property indefinitely. Therefore, if you want to download or print another version, simply go to the My documents section and click on the form you wish.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the contents of the form.

- Read the form description to confirm that you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the page to find the one that does.

Form popularity

FAQ

Invoicing for a beginner can feel daunting, but using a Georgia Invoice Template for Sales Executive makes it accessible. Start by entering your company information at the top of the template. Fill in your client’s details, followed by a comprehensive list of services or products, along with their respective prices. Finally, provide a total due and set clear payment deadlines to encourage timely transactions.

To fill up a sales invoice, start with a Georgia Invoice Template for Sales Executive for a structured approach. Input your company’s details prominently at the top, then fill in the customer's information. After that, detail the items sold, including quantities and prices, followed by the total amount due. Be sure to highlight payment terms to avoid any confusion.

Writing a simple invoice template begins with a Georgia Invoice Template for Sales Executive. Include your company name and contact information at the top. List the services or products provided, along with costs. Finally, sum it all up with a total amount and clear payment instructions to ensure prompt payment.

Creating a sales invoice template is easy with a Georgia Invoice Template for Sales Executive. Simply choose a template that suits your needs, enter your business particulars, and set up sections for item descriptions, prices, and totals. This template will serve as a reusable document, making your invoicing process more efficient.

To fill in an invoice template, use a Georgia Invoice Template for Sales Executive to guide you through the process. Start by entering your business name and contact details at the top. Then, fill in the customer’s information, followed by a detailed list of the goods or services provided, and their respective prices. Lastly, ensure you add the total amount due and any payment terms.

The correct format for an invoice typically includes the business name, contact information, invoice number, date, customer details, itemized list of services or products, prices, and total amount due. Using a Georgia Invoice Template for Sales Executive can simplify this process by providing a structured layout. Ensure you include payment terms to clarify when the payment is expected.

Filling out an invoice template is straightforward with a Georgia Invoice Template for Sales Executive. Begin by entering your company's name and contact information. Next, input the recipient's details, followed by a clear itemization of goods or services rendered, their costs, and the total due. Remember to review the invoice for accuracy before sending it.

To fill out a sales order invoice using a Georgia Invoice Template for Sales Executive, start by entering your business details at the top. Include the customer's information, such as their name and address. Then, list the products or services you provided, along with their quantities and prices. Finally, add any necessary payment terms and the total amount due.

An invoice should be laid out in a clean and professional manner to ensure clarity. Start with your company's name and contact information, followed by the client's details, an itemized list of products or services, and a total amount due. Utilizing the Georgia Invoice Template for Sales Executive can give you an effective structure that enhances comprehension and maintains professionalism in your invoicing.

The best way to file invoices is through a systematic approach that combines both digital and physical records. You can keep digital copies on cloud storage and physical copies in labeled folders. Using the Georgia Invoice Template for Sales Executive enhances your filing system, allowing you to access invoices quickly, saving you time and effort in managing your finances.

More info

IP: To have our software help you create your first sales invoice, register as a customer today. This will give you free unlimited access to our service for the life of your account. Then simply click “Next,” we will guide you step by step through this process of sending a free sales document to someone you have never been acquainted with. And, it's fast and easy! Get Started Now! Click one of the links below to get started or sign up to the PRO Version to get more features: FREE PRO VERSION Download Sales Invoice Templates Type Retail Private Sale that Involves Property Transfer from Seller Buyer Payment Transactional Email Form Invoice Send TIP: To have our software help you create your first sales invoice, register as a customer today. This will give you free unlimited access to our service for the life of your account.