Georgia Checklist for Business Loans Secured by Real Estate: Securing a business loan with real estate in Georgia requires careful consideration and adherence to a checklist to ensure a smooth application process. Here are the key factors to include in your Georgia checklist for business loans secured by real estate: 1. Loan Application: Start by preparing a well-documented loan application, including detailed information about your business, its financial statements, and projections. Highlight the purpose of the loan and how it will be used to benefit your business. 2. Real Estate Details: Provide comprehensive information about the property you intend to use as collateral, such as its location, size, and current market value. 3. Legal Documentation: Gather all legal documents related to the real estate, such as property deeds, mortgages, leases, and insurance policies. Ensure these documents are up-to-date and readily available for review by the lender. 4. Title Search: Conduct a thorough title search to confirm ownership and verify that there are no liens or legal issues associated with the property. Clear title ownership is crucial for securing a loan. 5. Property Appraisal: Arrange for a professional real estate appraiser to determine the current market value of the property. This valuation will play a pivotal role in the loan approval process. 6. Environmental Assessments: Depending on your property's location and type of business, you may be required to undergo environmental assessments to ensure compliance with environmental regulations. 7. Financial Records: Prepare detailed financial records, including tax returns, profit and loss statements, balance sheets, and cash flow statements for your business. Lenders will scrutinize these records to assess your ability to repay the loan. 8. Business Plan: Craft a comprehensive business plan that outlines your long-term goals, strategies for growth, and how the loan will contribute to your overall success. Presenting a well-thought-out plan will enhance your chances of loan approval. 9. Personal Financial Statements: Most lenders will require personal financial statements from business owners and significant stakeholders. These statements provide insight into your personal financial stability and help determine your creditworthiness. 10. Credit History: Maintain a strong credit history and ensure your personal and business credit scores are in good standing. Lenders will assess your creditworthiness when considering your loan application. 11. Insurance Coverage: Secure adequate insurance coverage for the property, including general liability and property insurance. The lender may require proof of insurance before granting the loan. Types of Georgia Checklist for Business Loans Secured by Real Estate: 1. Small Business Administration (SBA) Loans: These loans are backed by the Small Business Administration, offering attractive terms and longer repayment periods. SBA loans typically require a thorough checklist to evaluate your eligibility and the property's suitability as collateral. 2. Commercial Real Estate Loans: Tailored for business owners looking to finance the purchase, construction, or renovation of commercial properties. These loans often require a more extensive checklist, considering factors such as property development plans, revenue projections, and property management expertise. 3. Mortgage Loans: Business owners looking to refinance their existing mortgage or purchase investment properties can apply for mortgage loans. The checklist for these loans emphasizes property details, such as appraisals, inspections, and lease agreements if the property is being leased. By diligently following the Georgia Checklist for Business Loans Secured by Real Estate, you can streamline the loan application process, improve your chances of approval, and secure the financing needed to take your business to new heights in Georgia.

Georgia Checklist for Business Loans Secured by Real Estate

Description

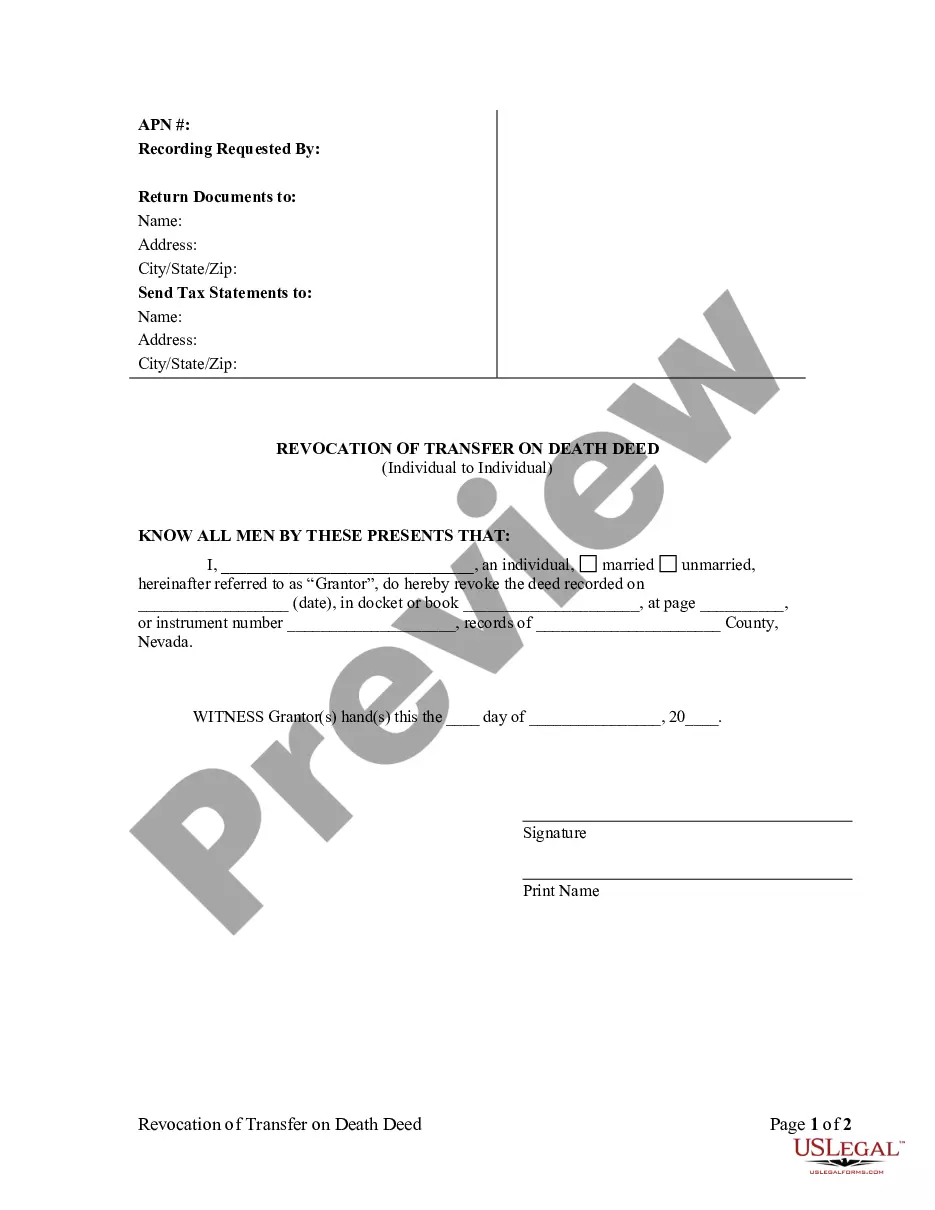

How to fill out Georgia Checklist For Business Loans Secured By Real Estate?

Finding the right lawful document format might be a battle. Of course, there are a variety of templates available online, but how do you find the lawful form you require? Make use of the US Legal Forms web site. The support provides a large number of templates, like the Georgia Checklist for Business Loans Secured by Real Estate, that you can use for enterprise and private requirements. All the varieties are inspected by pros and fulfill state and federal specifications.

Should you be currently authorized, log in in your accounts and then click the Acquire key to find the Georgia Checklist for Business Loans Secured by Real Estate. Use your accounts to check with the lawful varieties you possess bought in the past. Proceed to the My Forms tab of your own accounts and get an additional duplicate of the document you require.

Should you be a new end user of US Legal Forms, here are basic guidelines that you should adhere to:

- First, be sure you have chosen the proper form for your area/area. You can examine the shape while using Preview key and study the shape outline to ensure this is the best for you.

- If the form fails to fulfill your expectations, make use of the Seach area to discover the correct form.

- Once you are positive that the shape would work, select the Get now key to find the form.

- Pick the rates program you desire and type in the essential details. Make your accounts and pay for the order making use of your PayPal accounts or credit card.

- Select the data file file format and acquire the lawful document format in your gadget.

- Total, modify and printing and indicator the attained Georgia Checklist for Business Loans Secured by Real Estate.

US Legal Forms is the largest library of lawful varieties in which you can see various document templates. Make use of the company to acquire skillfully-made documents that adhere to condition specifications.