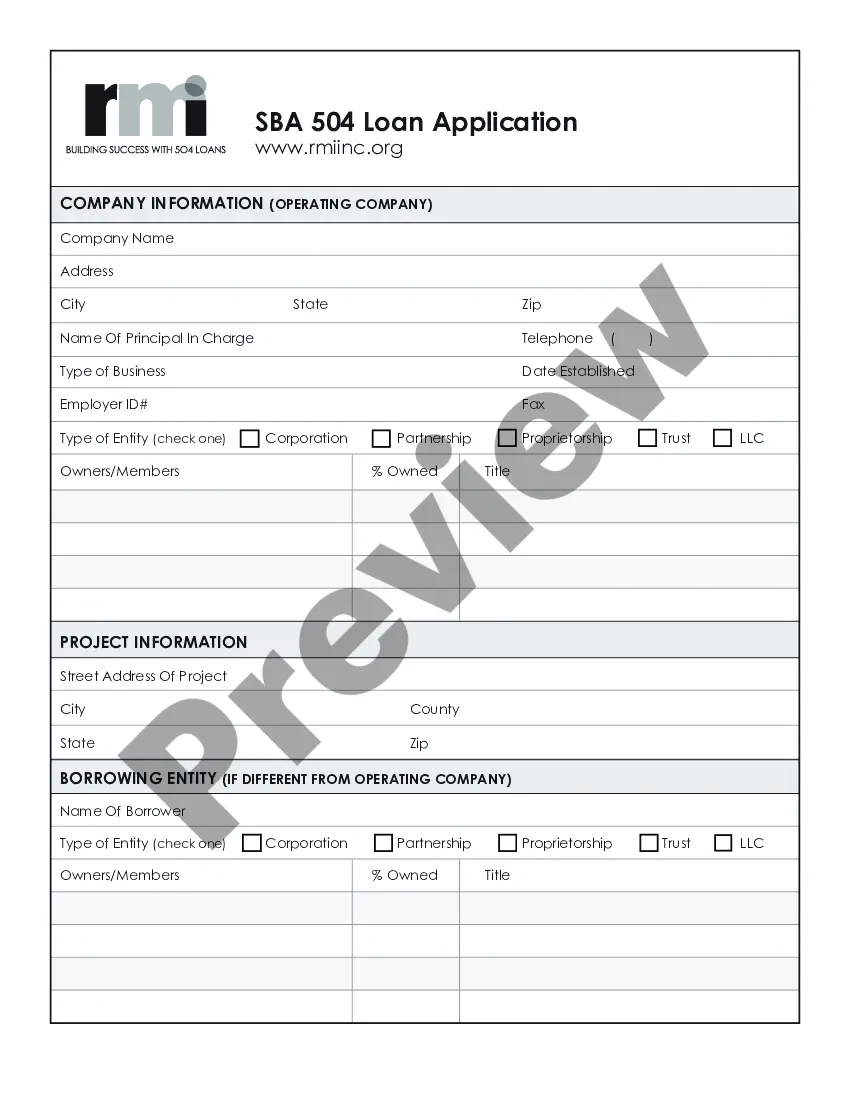

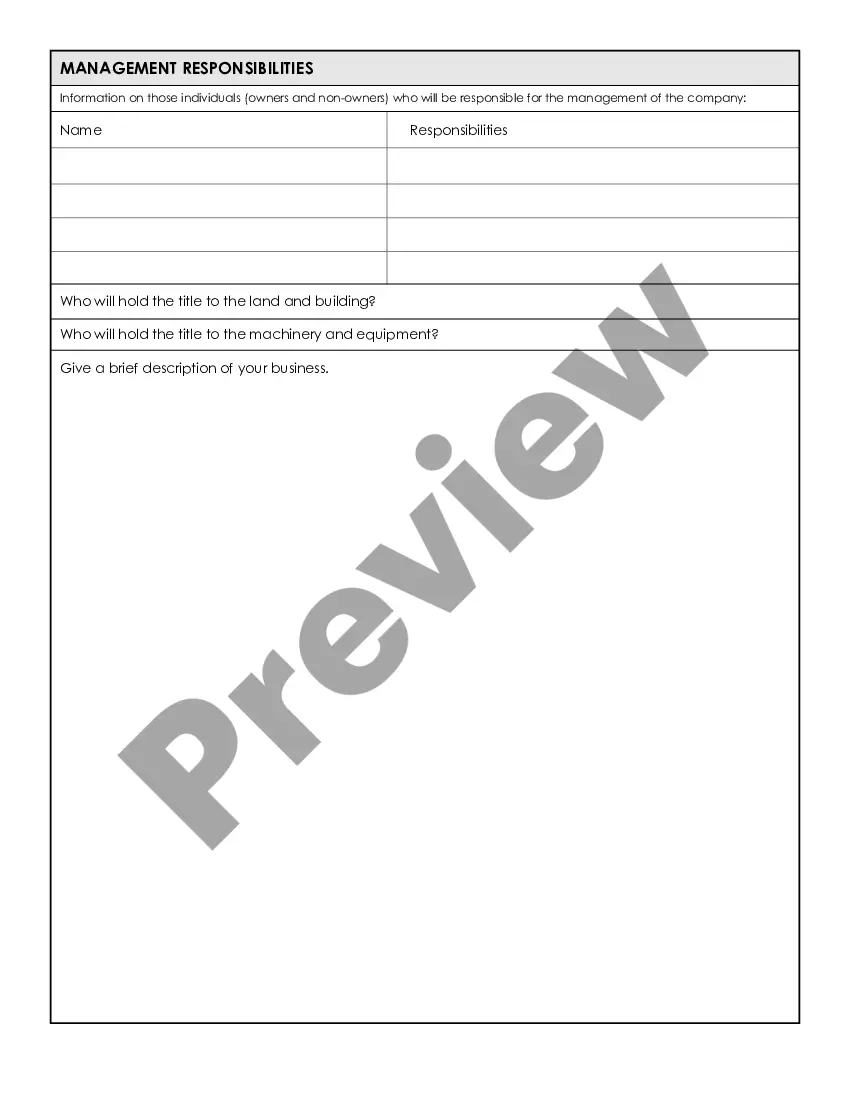

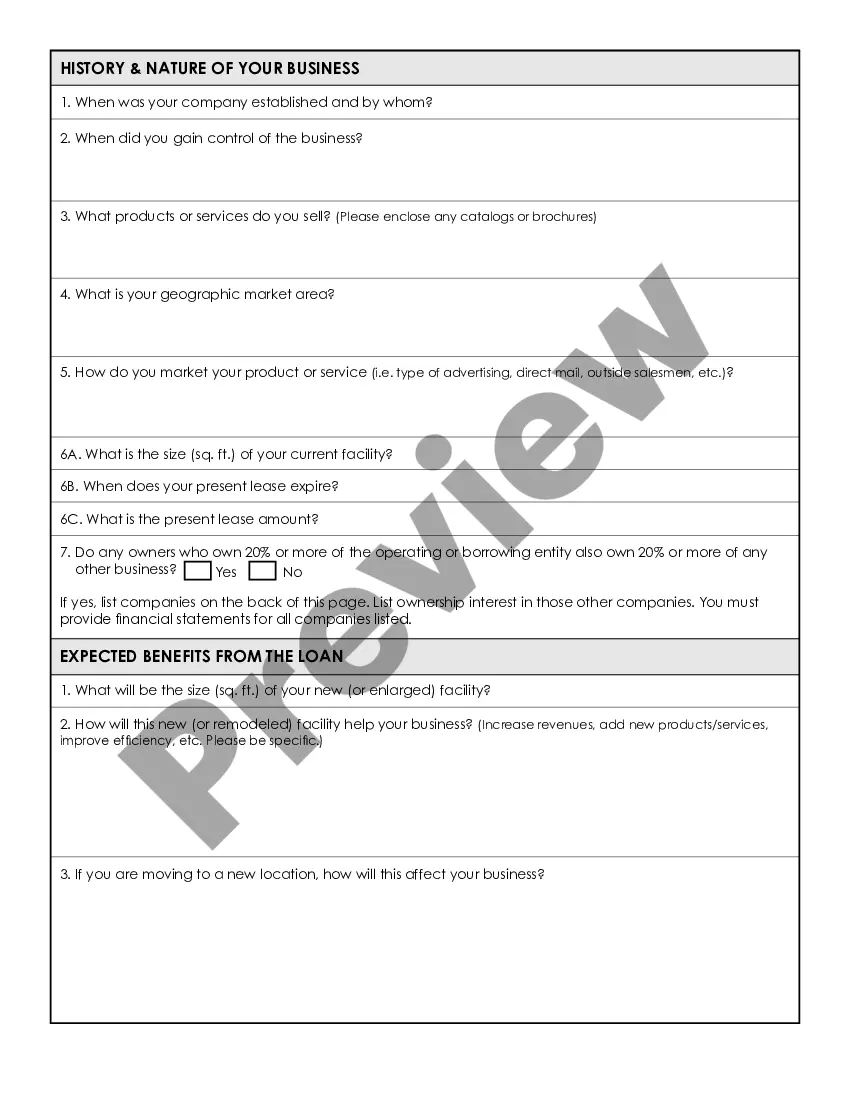

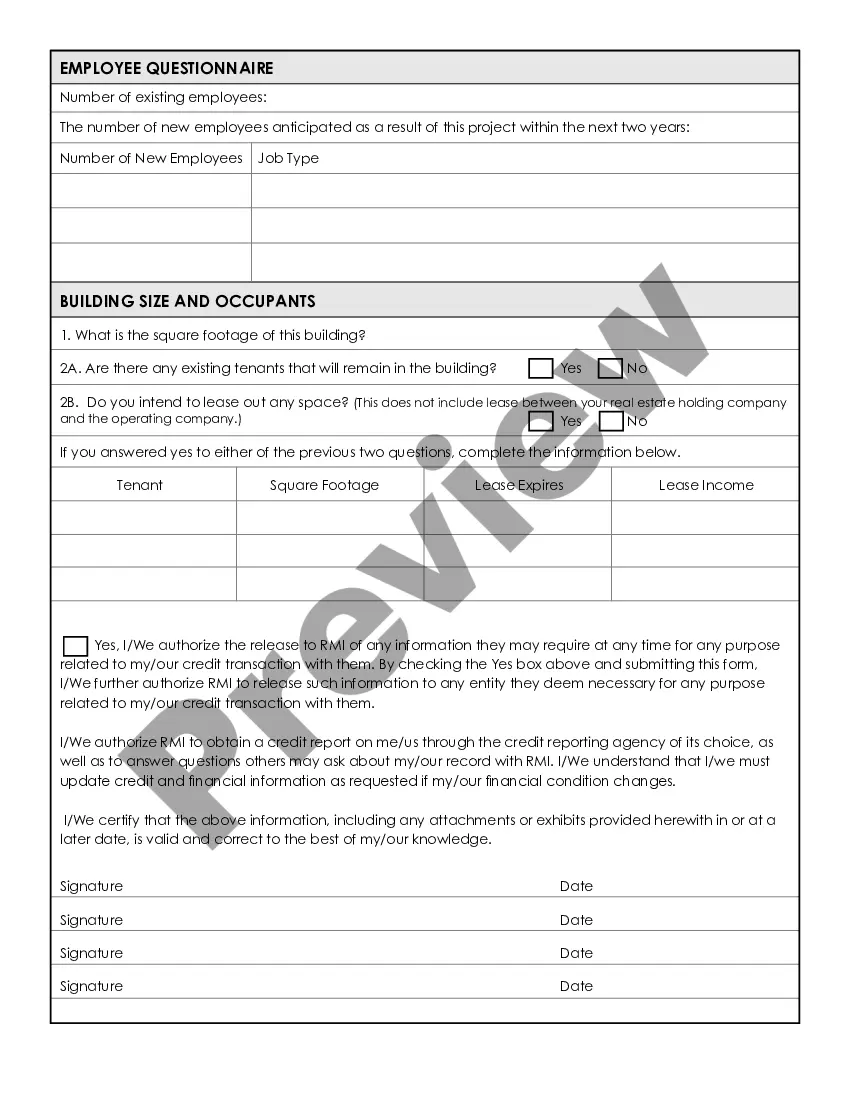

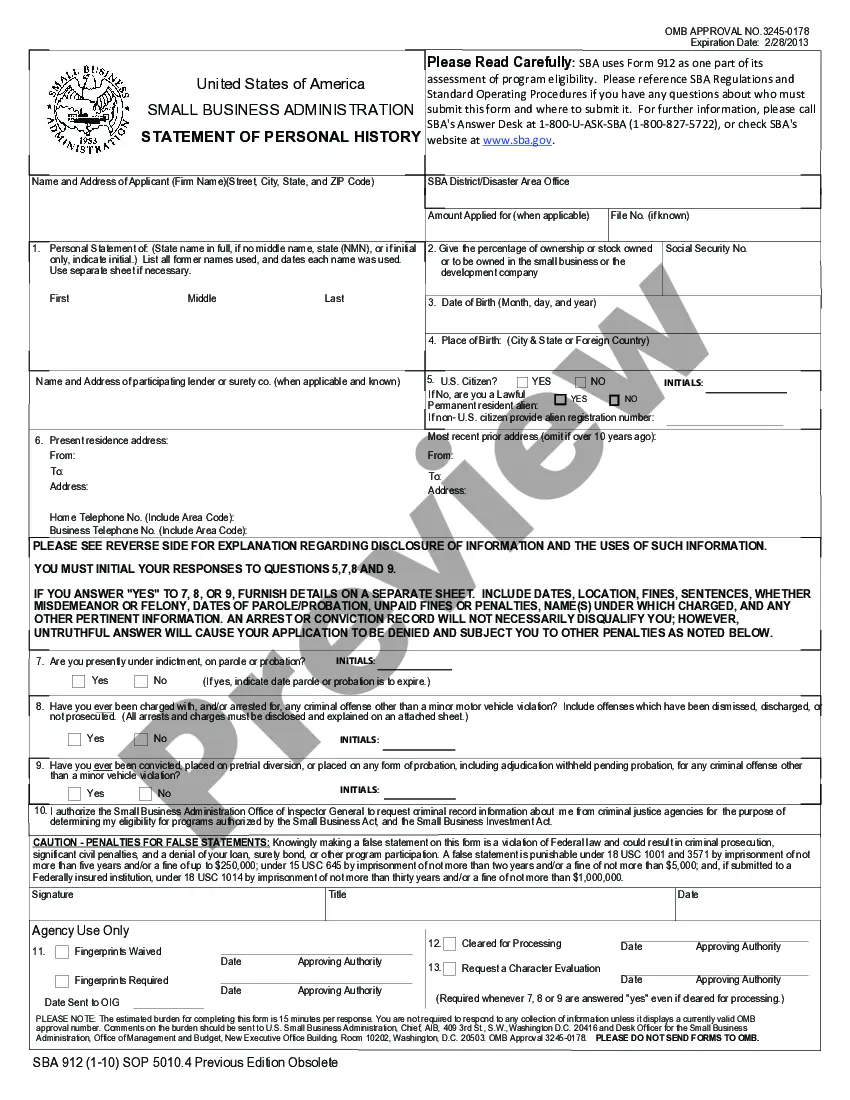

Georgia Small Business Administration Loan Application Form and Checklist are critical documents required to apply for loans through the Small Business Administration (SBA) in the state of Georgia. These forms help businesses in Georgia to secure loans by providing the necessary information and supporting documents to the SBA. The Georgia Small Business Administration Loan Application Form is a standardized document that outlines the business's details, financial information, loan request amount, and various other key aspects needed by the SBA to evaluate the loan application. It is a comprehensive form that requires accurate and detailed information to ensure a smooth application process. The form typically includes sections such as business information, ownership details, loan request details, financial statements, collateral details, and declaration and consent sections. In addition to the loan application form, there are several types of loan applications available for small businesses in Georgia. Some of these loan types specific to Georgia include: 1. SBA 7(a) Loan Application: This is the most common and versatile loan program provided by SBA, assisting small businesses in various purposes such as working capital, purchasing equipment, refinancing debts, and more. The application form and checklist associated with the SBA 7(a) loan focus on business details, personal background, financial statements, loan eligibility, and other information necessary to evaluate the loan request. 2. SBA 504 Loan Application: This loan program is designed to aid small businesses in acquiring fixed assets like land, buildings, or machinery. The application form and checklist for an SBA 504 loan include elements such as business information, loan purpose, personal financial statements, business projections, and collateral details. 3. SBA Microloan Program Application: The SBA Microloan program focuses on providing small businesses with modest funding requirements. The loan application form and checklist for the Microloan program involve essential details like business description, financial statements, credit history, collateral, and personal background information. The checklist associated with Georgia Small Business Administration Loan Application Forms helps businesses ensure that they have included all the necessary documentation along with their loan application. The checklist usually includes documents like business plans, financial statements (profit and loss statements, balance sheets, cash flow statements), personal and business tax returns, credit history reports, legal documents (licenses, registrations), and other supporting materials. It is vital for businesses to carefully review and complete the Georgia Small Business Administration Loan Application Form and Checklist to ensure accuracy and increase the chances of loan approval. Providing thorough and precise information, along with the required supporting documents, will help streamline the loan application process and enhance the potential for securing financial assistance from the SBA in Georgia.

Georgia Small Business Administration Loan Application Form and Checklist

Description

How to fill out Georgia Small Business Administration Loan Application Form And Checklist?

If you want to total, acquire, or print authorized file templates, use US Legal Forms, the most important assortment of authorized kinds, which can be found on-line. Make use of the site`s easy and practical look for to get the paperwork you require. Numerous templates for business and person uses are sorted by classes and claims, or key phrases. Use US Legal Forms to get the Georgia Small Business Administration Loan Application Form and Checklist within a couple of clicks.

If you are presently a US Legal Forms client, log in to the account and click the Down load button to find the Georgia Small Business Administration Loan Application Form and Checklist. You can also access kinds you formerly saved from the My Forms tab of your account.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for your right metropolis/land.

- Step 2. Take advantage of the Review method to check out the form`s content material. Never overlook to see the description.

- Step 3. If you are unsatisfied together with the develop, take advantage of the Search area near the top of the monitor to get other models of the authorized develop design.

- Step 4. After you have discovered the shape you require, click on the Acquire now button. Choose the prices strategy you prefer and include your references to register to have an account.

- Step 5. Procedure the deal. You can utilize your charge card or PayPal account to finish the deal.

- Step 6. Choose the file format of the authorized develop and acquire it on the gadget.

- Step 7. Total, revise and print or indication the Georgia Small Business Administration Loan Application Form and Checklist.

Every authorized file design you get is yours eternally. You may have acces to every develop you saved within your acccount. Click the My Forms segment and decide on a develop to print or acquire yet again.

Compete and acquire, and print the Georgia Small Business Administration Loan Application Form and Checklist with US Legal Forms. There are many specialist and express-certain kinds you may use for the business or person requires.

Form popularity

FAQ

In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose. Even those with bad credit may qualify for startup funding.

The SBA Checklist Borrower Information Form. Personal Background and Financial Statement. Business Financial Statements. Business Certificate/License. Loan Application History. Income Tax Returns. Resumes. Business Overview and History.

Some of the documents you'll be asked to provide include, copies of your state- or government-issued ID, copies of paystubs, tax returns or bank statements. Having these documents on hand will not only make the application process smoother but will increase your chances of getting approved in a timely manner.

These documents are used by the lenders to evaluate whether or not they will provide you with a loan. Loan documents are necessary to initiate a loan approval process by a lender. Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income.

In general, SBA loans are not as difficult to get as business bank loans. Because they're backed by the U.S. government, they're less risky for banks than issuing their own loans.

Get your financials in order. To this end, you should generally try to have three years' worth of business and personal tax returns on hand as well as year-to-date profit and loss figures, balance sheets, accounts receivable aging reports, and inventory breakdowns, if possible.

Creditagreement_300ps. jpg Loan Application Form. Forms vary by program and lending institution, but they all ask for the same information. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

SBA only makes direct loans in the case of businesses and homeowners recovering from a declared disaster. SBA partners with lenders to help increase small business access to loans.