Georgia Partnership Dissolution Agreement is a legal document executed when partners decide to dissolve their partnership in the state of Georgia. This agreement outlines the terms and conditions under which the partnership will be terminated, including the distribution of assets and liabilities, the winding up of business affairs, and the termination of any ongoing obligations or contracts. It is crucial for partners to have a clear and comprehensive dissolution agreement to avoid any misunderstandings or disputes during the dissolution process. Key elements typically covered in a Georgia Partnership Dissolution Agreement include the effective date of dissolution, the names and addresses of all partners involved, the purpose and scope of the partnership, and a detailed explanation of how assets and liabilities will be divided among the partners. Additionally, the agreement may address the payment of any remaining partnership debts or obligations, the allocation of profits and losses, and the treatment of any ongoing contracts or leases. There are different types of Georgia Partnership Dissolution Agreements, depending on the circumstances and goals of the partners. Some common types include: 1. General Partnership Dissolution Agreement: This type of agreement is used when partners decide to dissolve a general partnership, where all partners equally share profits, losses, and management responsibilities. 2. Limited Partnership Dissolution Agreement: Limited partnerships involve both general partners, who manage the business, and limited partners, who contribute capital but have limited involvement in management. The dissolution agreement for limited partnerships may differ in terms of how assets, liabilities, and profits are allocated between the two types of partners. 3. Limited Liability Partnership (LLP) Dissolution Agreement: An LLP is a partnership where partners enjoy limited personal liability for the partnership’s debts and obligations. A dissolution agreement for an LLP may include provisions specific to the protections afforded by this type of partnership structure. In conclusion, a Georgia Partnership Dissolution Agreement is a critical legal document that outlines the terms and procedures for terminating a partnership in Georgia. It is essential for partners to carefully draft and execute this agreement to ensure a smooth and fair dissolution process. Different types of dissolution agreements exist based on the specific partnership structure, such as general partnerships, limited partnerships, and limited liability partnerships.

Georgia Partnership Dissolution Agreement

Description

How to fill out Georgia Partnership Dissolution Agreement?

If you need to total, obtain, or produce lawful file themes, use US Legal Forms, the biggest collection of lawful varieties, that can be found on the web. Take advantage of the site`s basic and handy look for to obtain the papers you require. Different themes for enterprise and personal purposes are sorted by categories and suggests, or search phrases. Use US Legal Forms to obtain the Georgia Partnership Dissolution Agreement with a number of clicks.

If you are presently a US Legal Forms consumer, log in to your account and then click the Obtain button to get the Georgia Partnership Dissolution Agreement. You may also entry varieties you previously downloaded in the My Forms tab of your respective account.

If you work with US Legal Forms the first time, refer to the instructions listed below:

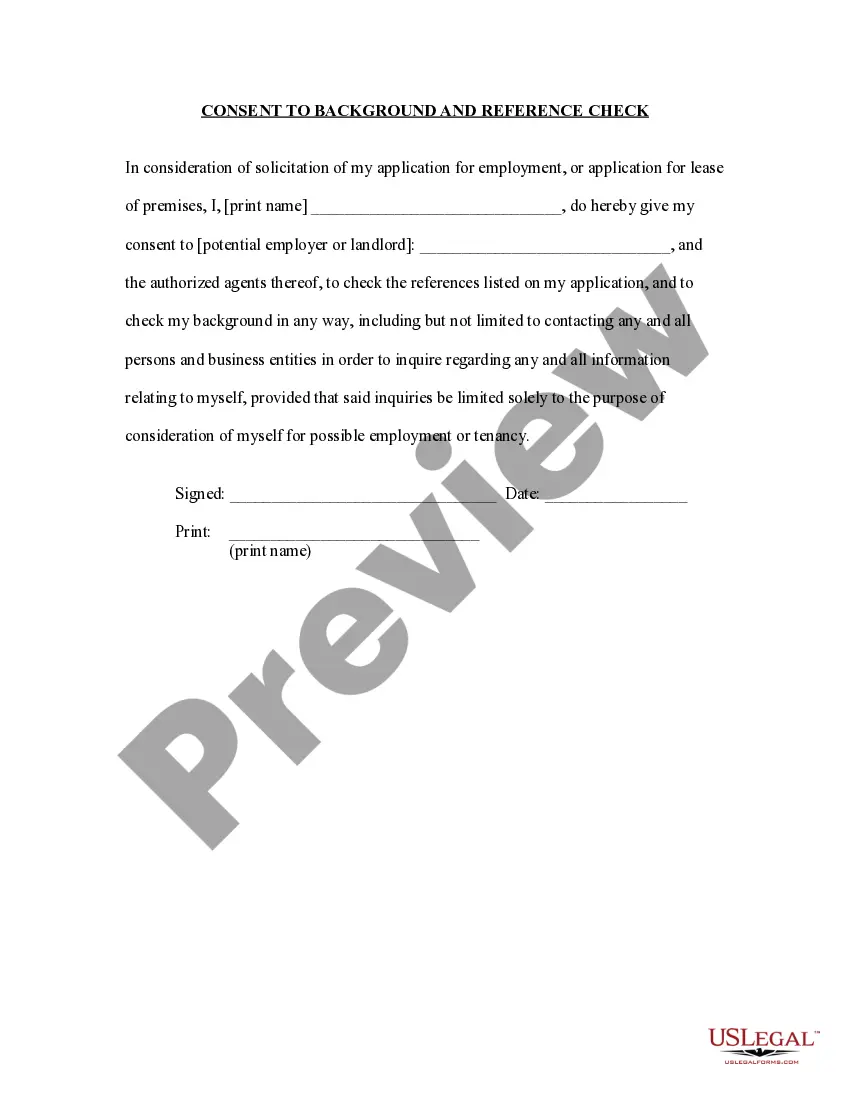

- Step 1. Be sure you have selected the form for the right area/region.

- Step 2. Take advantage of the Review solution to examine the form`s content material. Never forget about to see the outline.

- Step 3. If you are unsatisfied using the develop, make use of the Research field on top of the screen to find other models in the lawful develop web template.

- Step 4. When you have discovered the form you require, click on the Purchase now button. Choose the costs strategy you choose and add your accreditations to sign up for an account.

- Step 5. Process the purchase. You may use your charge card or PayPal account to finish the purchase.

- Step 6. Select the formatting in the lawful develop and obtain it on your system.

- Step 7. Comprehensive, change and produce or indicator the Georgia Partnership Dissolution Agreement.

Every single lawful file web template you buy is the one you have permanently. You have acces to each and every develop you downloaded in your acccount. Click the My Forms portion and choose a develop to produce or obtain once again.

Contend and obtain, and produce the Georgia Partnership Dissolution Agreement with US Legal Forms. There are thousands of specialist and state-specific varieties you can utilize for your personal enterprise or personal requirements.

Form popularity

FAQ

Can one partner force the dissolution of an LLC partnership? The short answer is yes. If there are two partners, each holding a 50% stake in the business, one partner can force the LLC to dissolve.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

The partnership can be dissolved if the partner has breached the agreements that are related to the management of business affairs. The dissolution of partnership also can be done when a partner indulges in any other illegal or unethical business activities.

In the dissolution process, any partner may dissolve the partnership at any time by providing a notice of dissolution. The partnership is then required to wind up its business activities and distribute its assets.

There is no filing fee. Under California law, other people generally are considered to have notice of the partnership's dissolution ninety (90) days after filing the Statement of Dissolution.

Take a Vote or Action to Dissolve In most cases, dissolution provisions in a partnership agreement will state that all or a majority of partners must consent before the partnership can dissolve. In such cases, you should have all partners vote on a resolution to dissolve the partnership.

Separation Agreement to Prevent Partnership DissolutionWhen one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves.

If the partners have very few assets and agree to separate, they may file their petition through the county clerk's office or Secretary of State. If a couple has major assets or one partner contests the separation, however, they may need to file a petition in court.

Under the law, partners may generally dissolve a partnership by: the term of the agreement expiring; or. one partner giving notice to the other of their intention to dissolve the partnership if no term is defined.

Removing a partner from a general partnership is the act of removing someone from your business that operates as a partnership. It can happen in several different ways, but the most common option is through a clause in the partnership agreement itself.