28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

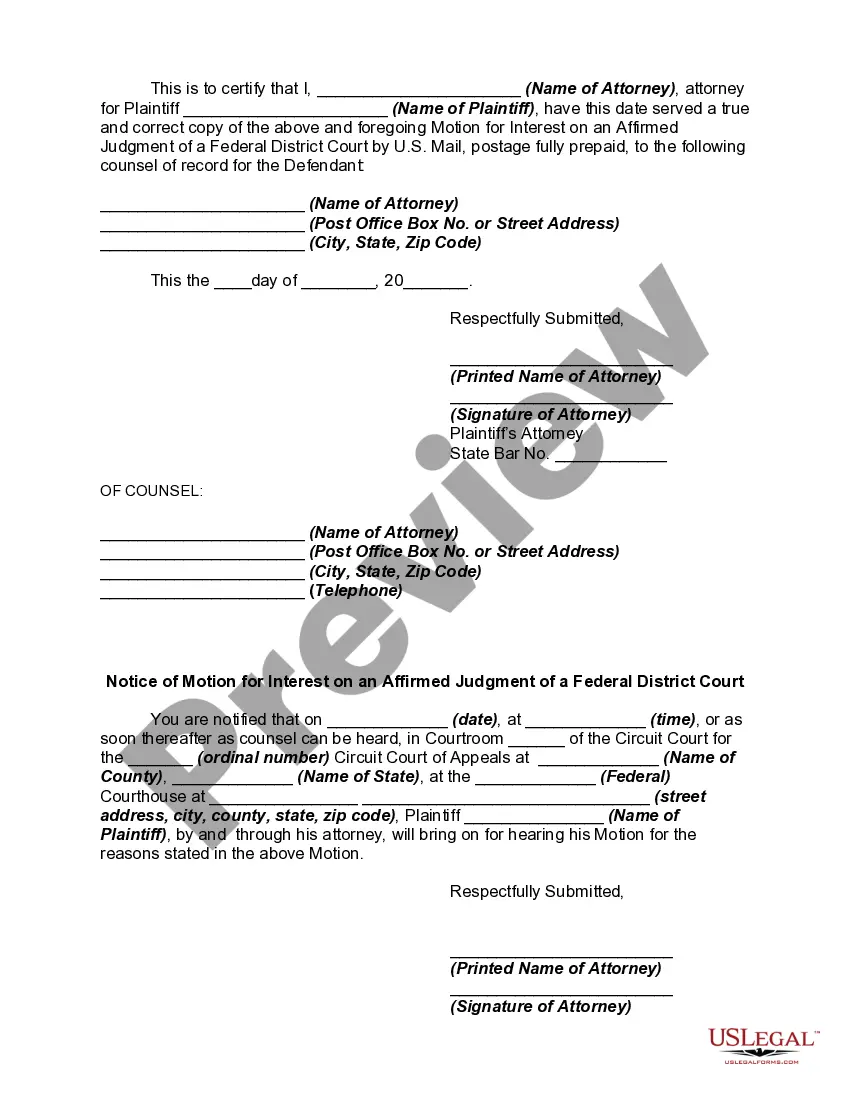

Title: Explaining the Georgia Motion for Interest on an Affirmed Judgment of a Federal District Court Keywords: Georgia, Motion for Interest, Affirmed Judgment, Federal District Court, types Introduction: The Georgia Motion for Interest on an Affirmed Judgment of a Federal District Court is a legal mechanism available to parties seeking to recover the accrued interest following the affirmation of a judgment by a federal district court in the state of Georgia. This motion serves to compensate the successful party for the delay in receiving the funds owed, taking into account the time between the original judgment and its affirmation. Types of Georgia Motions for Interest on an Affirmed Judgment of a Federal District Court: 1. Prejudgment Interest Motion: In some cases, a successful party may request prejudgment interest, which refers to the interest accrued on damages from the date they were incurred until the date of the judgment. This motion aims to compensate for the lost opportunity to invest or use the funds during the lawsuit. 2. Postjudgment Interest Motion: Postjudgment interest refers to the interest that accrues on the principal amount awarded in a judgment from its entry until payment is made. The successful party may file a motion to obtain postjudgment interest to compensate for the delay in receiving the judgment amount due to the appellate process. 3. Interest on Attorney's Fees Motion: Apart from the judgment amount, a prevailing party may also pursue the recovery of attorney's fees incurred during the legal proceedings. The motion for interest on attorney's fees seeks to include compensatory interest on the awarded attorney's fees, covering the period from the initial judgment until its affirmation. 4. Calculating Interest Motion: The motion to calculate interest aims to determine the exact amount of interest owed on a judgment by considering relevant factors such as the statutory rate, the principal amount, the duration of the appeal, and any specific terms set by the court. 5. Non-compounded Interest Motion: A party may file a motion for non-compounded interest, which seeks to have the interest awarded on an affirmed judgment calculated on a simple interest basis. Non-compounded interest is calculated solely on the initial principal amount, without additional interest being added to the unpaid interest over time. Conclusion: The Georgia Motion for Interest on an Affirmed Judgment of a Federal District Court provides a means for parties to recover accrued interest when a judgment is affirmed following an appeal. Various types of motions, including those for prejudgment interest, postjudgment interest, interest on attorney's fees, calculating interest, and non-compounded interest, cater to the specific needs and circumstances of the prevailing party. These motions play a crucial role in ensuring fair compensation and encouraging prompt fulfillment of court-ordered obligations.Title: Explaining the Georgia Motion for Interest on an Affirmed Judgment of a Federal District Court Keywords: Georgia, Motion for Interest, Affirmed Judgment, Federal District Court, types Introduction: The Georgia Motion for Interest on an Affirmed Judgment of a Federal District Court is a legal mechanism available to parties seeking to recover the accrued interest following the affirmation of a judgment by a federal district court in the state of Georgia. This motion serves to compensate the successful party for the delay in receiving the funds owed, taking into account the time between the original judgment and its affirmation. Types of Georgia Motions for Interest on an Affirmed Judgment of a Federal District Court: 1. Prejudgment Interest Motion: In some cases, a successful party may request prejudgment interest, which refers to the interest accrued on damages from the date they were incurred until the date of the judgment. This motion aims to compensate for the lost opportunity to invest or use the funds during the lawsuit. 2. Postjudgment Interest Motion: Postjudgment interest refers to the interest that accrues on the principal amount awarded in a judgment from its entry until payment is made. The successful party may file a motion to obtain postjudgment interest to compensate for the delay in receiving the judgment amount due to the appellate process. 3. Interest on Attorney's Fees Motion: Apart from the judgment amount, a prevailing party may also pursue the recovery of attorney's fees incurred during the legal proceedings. The motion for interest on attorney's fees seeks to include compensatory interest on the awarded attorney's fees, covering the period from the initial judgment until its affirmation. 4. Calculating Interest Motion: The motion to calculate interest aims to determine the exact amount of interest owed on a judgment by considering relevant factors such as the statutory rate, the principal amount, the duration of the appeal, and any specific terms set by the court. 5. Non-compounded Interest Motion: A party may file a motion for non-compounded interest, which seeks to have the interest awarded on an affirmed judgment calculated on a simple interest basis. Non-compounded interest is calculated solely on the initial principal amount, without additional interest being added to the unpaid interest over time. Conclusion: The Georgia Motion for Interest on an Affirmed Judgment of a Federal District Court provides a means for parties to recover accrued interest when a judgment is affirmed following an appeal. Various types of motions, including those for prejudgment interest, postjudgment interest, interest on attorney's fees, calculating interest, and non-compounded interest, cater to the specific needs and circumstances of the prevailing party. These motions play a crucial role in ensuring fair compensation and encouraging prompt fulfillment of court-ordered obligations.