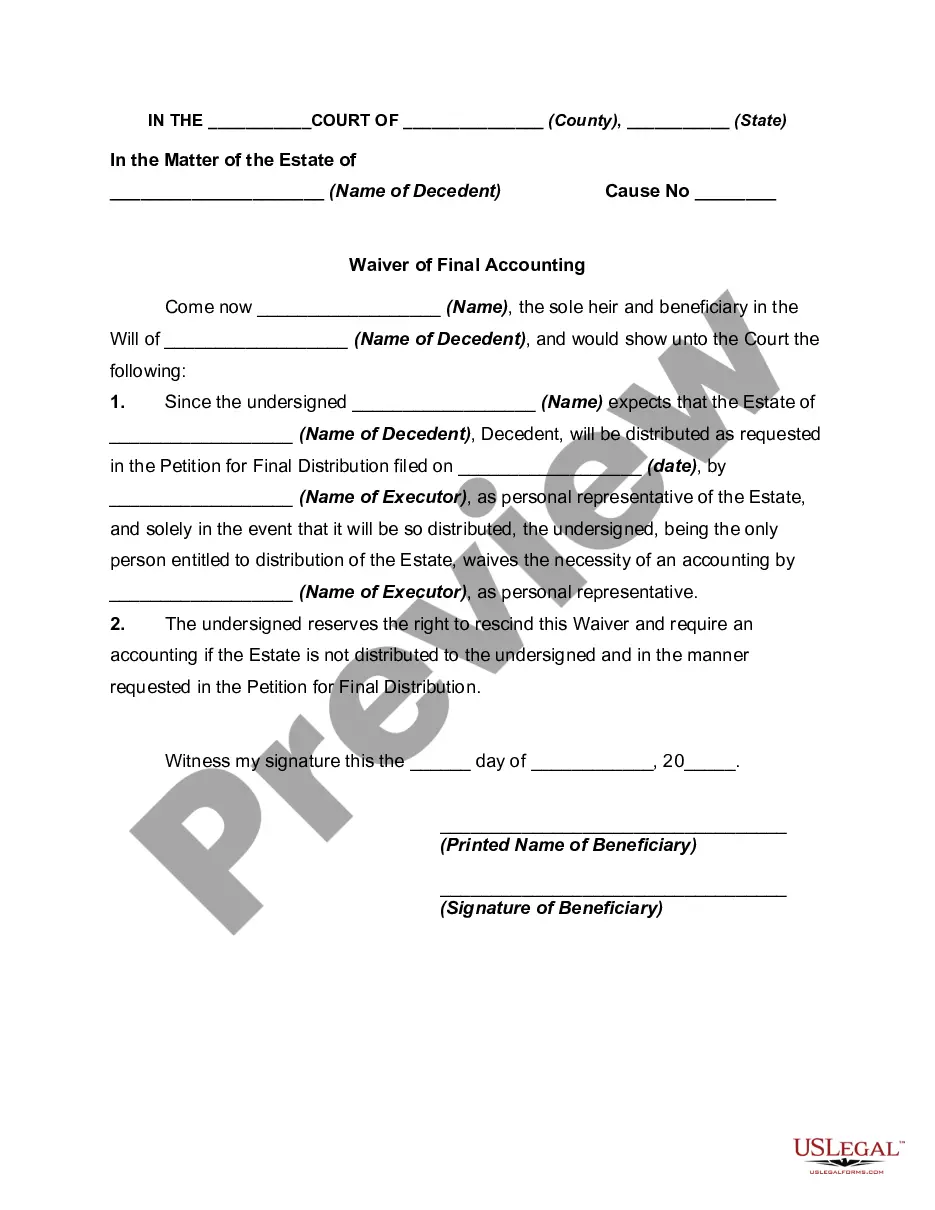

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

A Georgia Waiver of Final Accounting by Sole Beneficiary is a legal document that allows a sole beneficiary of a decedent's estate to waive their right to receive a final accounting of the estate's assets and distributions. This waiver is often used in situations where the beneficiary has complete trust and confidence in the executor's handling of the estate and wishes to expedite the probate process. By signing the Georgia Waiver of Final Accounting, the sole beneficiary acknowledges that they have received all necessary information regarding the estate's assets, debts, and distributions. They understand that they are relinquishing their right to receive a detailed report of the executor's actions throughout the probate process. This type of waiver can save time and money by avoiding the need for the executor to prepare and submit a final accounting to the beneficiary. It provides a streamlined approach to probate administration, particularly in cases where the estate is straightforward and the beneficiary has a good understanding of the overall estate's affairs. While the primary focus of this description is on the "Georgia Waiver of Final Accounting by Sole Beneficiary," it is important to note that variations of this waiver may exist, such as: 1. Partial Waiver of Final Accounting: This type of waiver allows the beneficiary to waive their right to a full accounting but retains the ability to request specific information or documentation if needed. It offers a level of flexibility while still reducing the administrative burden. 2. Conditional Waiver of Final Accounting: This waiver is contingent upon certain conditions being met. For example, the beneficiary may choose to waive the final accounting if a specific amount of the estate's assets is distributed, or if certain debts are paid off. It provides additional control to the beneficiary while still streamlining the probate process. 3. Limited Waiver of Final Accounting: Unlike a complete waiver, a limited waiver allows the beneficiary to receive some but not all aspects of the final accounting. They can specify which information or documents they would like to receive, tailoring the waiver to their specific needs. In conclusion, a Georgia Waiver of Final Accounting by Sole Beneficiary is a legal tool that allows the sole beneficiary of an estate in Georgia to skip receiving a detailed report of the executor's actions during probate. It expedites the probate process and is particularly useful in cases where the beneficiary has complete trust in the executor. Different variations of the waiver may exist, including partial, conditional, and limited waivers, providing beneficiaries with options for tailoring the waiver to their needs.