[Your Name] [Your Title] [Company/Organization Name] [Company/Organization Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Title] [Company/Organization Name] [Company/Organization Address] [City, State, Zip Code] Subject: Georgia Sample Letter for Policy on Vehicle Expense Reimbursement Dear [Recipient's Name], I hope this letter finds you well. As we navigate our operations in Georgia, it has become necessary for us to establish a comprehensive Vehicle Expense Reimbursement policy to ensure our employees are properly compensated for their travel-related expenses. This policy aims to establish guidelines and procedures to facilitate efficient and fair vehicle expense reimbursement while adhering to the regulations and laws of Georgia. Our organization acknowledges the importance of reimbursing employees for the expenses they incur while conducting business-related travel using personal vehicles. By implementing this policy, we aim to promote transparency, accountability, and equity in the expense reimbursement process, ensuring that all eligible expenses are reimbursed promptly and correctly. Types of Georgia Sample Letters for Policy on Vehicle Expense Reimbursement: 1. General Vehicle Expense Reimbursement Policy: This policy outlines the principles, procedures, eligibility criteria, and reimbursement guidelines for all employees who utilize personal vehicles for business-related travel within Georgia. 2. Mileage Reimbursement Policy: This specific policy focuses on providing reimbursement based on mileage traveled. Employees are required to maintain accurate records of their mileage, destinations, and purpose of travel. The policy specifies the reimbursement rate per mile, which is compliant with the current Internal Revenue Service (IRS) guidelines and Georgia legislation. 3. Allowable Vehicle Expenses Policy: This policy establishes a detailed list of allowable vehicle expenses eligible for reimbursement, such as fuel, parking fees, tolls, insurance, registration, maintenance, and repairs. It provides clarity on what expenses can be reimbursed, subject to any specific limitations or restrictions outlined within the policy. 4. Reporting and Documentation Policy: This policy ensures that employees follow proper reporting and documentation procedures for vehicle-related expenses. It includes information on forms that need to be completed, required supporting documents, submission deadlines, and the process for approval and reimbursement. Our organization values transparency and consistency; therefore, we emphasize the importance of compliance with this policy. Employees must familiarize themselves with the policy contents, adhere to its guidelines, and promptly submit accurate reimbursement requests to minimize delays and rejections. Please take the time to review the attached Georgia Sample Letter(s) for Policy on Vehicle Expense Reimbursement, specifically designed to meet our organization's requirements while aligning with applicable Georgia laws and regulations. These samples include comprehensive information on eligibility, reimbursement rates, reporting, and documentation procedures. Should you have any questions or concerns regarding these policies, please do not hesitate to reach out to the Human Resources department for clarification and guidance. Thank you for your attention to this matter. We believe that the implementation of these policies will streamline our expense reimbursement process while ensuring fairness and compliance with Georgia-specific regulations. Best regards, [Your Name] [Your Title] [Company/Organization Name]

Georgia Sample Letter for Policy on Vehicle Expense Reimbursement

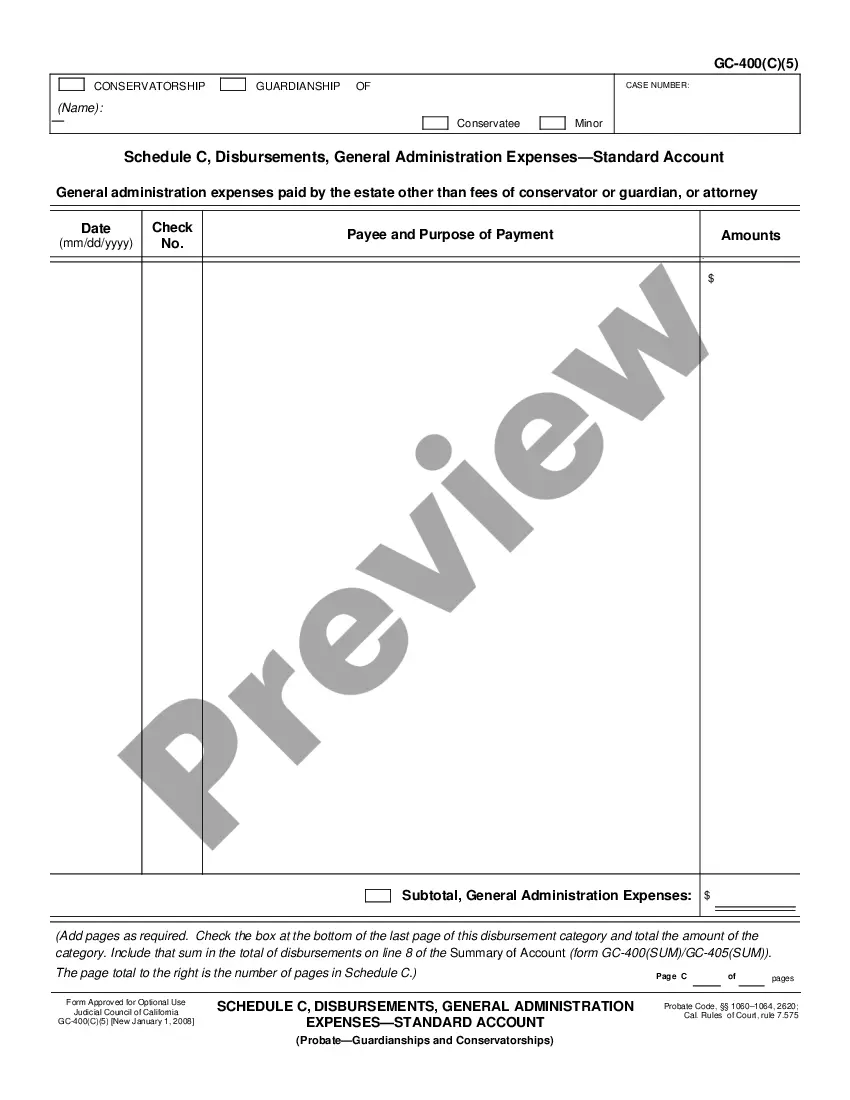

Description

How to fill out Georgia Sample Letter For Policy On Vehicle Expense Reimbursement?

If you wish to comprehensive, down load, or printing legal file layouts, use US Legal Forms, the largest variety of legal kinds, which can be found on the Internet. Use the site`s simple and hassle-free lookup to get the files you require. Different layouts for business and person functions are sorted by classes and states, or key phrases. Use US Legal Forms to get the Georgia Sample Letter for Policy on Vehicle Expense Reimbursement in just a few click throughs.

In case you are previously a US Legal Forms client, log in to your accounts and click the Down load option to get the Georgia Sample Letter for Policy on Vehicle Expense Reimbursement. You may also accessibility kinds you formerly saved from the My Forms tab of the accounts.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Make sure you have selected the form for that correct city/region.

- Step 2. Make use of the Preview option to look over the form`s content material. Do not neglect to learn the description.

- Step 3. In case you are not happy using the develop, make use of the Look for industry towards the top of the display to discover other models from the legal develop design.

- Step 4. After you have discovered the form you require, click on the Acquire now option. Opt for the pricing program you like and put your credentials to register for the accounts.

- Step 5. Process the deal. You can use your credit card or PayPal accounts to accomplish the deal.

- Step 6. Choose the format from the legal develop and down load it in your system.

- Step 7. Comprehensive, change and printing or indicator the Georgia Sample Letter for Policy on Vehicle Expense Reimbursement.

Each and every legal file design you get is the one you have permanently. You might have acces to every develop you saved inside your acccount. Go through the My Forms segment and decide on a develop to printing or down load yet again.

Compete and down load, and printing the Georgia Sample Letter for Policy on Vehicle Expense Reimbursement with US Legal Forms. There are thousands of specialist and state-certain kinds you may use for the business or person requirements.