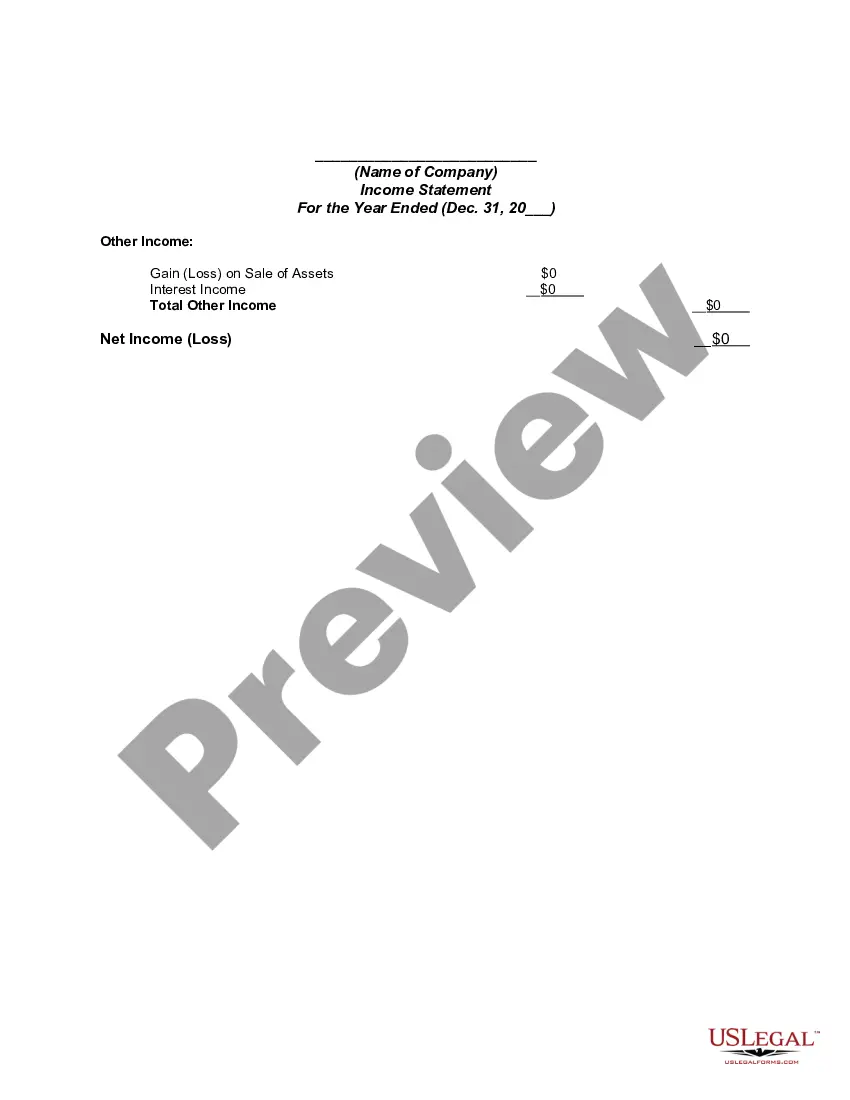

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

Georgia Income Statement

Description

How to fill out Income Statement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide variety of legal document templates that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, organized by type, state, or keywords. You can find the latest versions of forms like the Georgia Income Statement in just minutes.

If you have a monthly subscription, Log In and download the Georgia Income Statement from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Georgia Income Statement. Every template you added to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, just go to the My documents section and click on the form you want. Access the Georgia Income Statement with US Legal Forms, one of the most extensive collections of legal document templates. Use a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- To use US Legal Forms for the first time, here are some simple instructions to help you get started.

- Ensure you have selected the appropriate form for the city/county.

- Click the Preview button to review the content of the form.

- Read the form description to confirm you have chosen the correct form.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- Once you're satisfied with the form, validate your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Calculating a Georgia Income Statement involves summarizing your revenues and deducting expenses to determine net income. Start by tracking all income sources and listing them under revenue. Next, document all expenses related to operations. Finally, subtract total expenses from your total revenue to find your net income. Tools available on uslegalforms can help you structure this calculation effectively.

An income statement is a financial document that summarizes revenues and expenses over a period. For instance, a Georgia Income Statement might show your business earning $100,000 in revenue while incurring $60,000 in expenses, resulting in a net income of $40,000. This example helps illustrate how operational efficiency impacts profitability. You can access templates and detailed examples on uslegalforms.

To calculate Georgia state income tax, begin by determining your total taxable income after deductions. Then, apply the appropriate tax rate based on Georgia's tax brackets to that income. It's essential to factor in any available credits that may reduce your total tax liability. Using online calculators or resources from uslegalforms can streamline this calculation for your Georgia Income Statement.

Preparing a Georgia Income Statement involves four main steps. First, gather all relevant financial data such as revenue and expenses. Next, organize this data into a structured format. Third, calculate your net income by subtracting total expenses from total revenue. Finally, review and finalize the statement for accuracy, ensuring it clearly represents your financial position.

The number of allowances you should claim in Georgia depends on your financial situation, including your income and number of dependents. Generally, more allowances mean lower withholding, but you may owe taxes later. It’s wise to review your tax situation annually, as changes can affect your allowances. Consult the resources on uslegalforms to better understand how allowances work within your Georgia Income Statement.

The format of a Georgia Income Statement typically includes sections for revenue, expenses, and net income. You will usually start with total revenue, deduct operating expenses, and account for taxes to arrive at net income. This format helps present your financial status clearly and concisely. You can find various templates to suit your needs on uslegalforms.

Filling out a Georgia Income Statement involves listing your revenues and expenses in a structured format. Start by recording your total revenues, then subtract your expenses to calculate net income. Ensure accuracy by double-checking your figures and using a specific template designed for Georgia income statements. You can also explore resources on uslegalforms for templates that simplify this process.

When reporting income from another state on your Georgia income statement, ensure you include all relevant income sources. Report your total income on your Georgia return and use tax credits to offset any taxes owed to Georgia for income subject to tax in both states. This will help you accurately reflect your tax situation and avoid issues with the Georgia Department of Revenue.

If you choose to mail your Georgia income tax return, you should send it to the address provided by the Georgia Department of Revenue. Typically, the mailing address depends on whether you are getting a refund or making a payment. For the most accurate information, refer to the Georgia income statement instructions provided by the state.

To file a Georgia income statement, start by gathering all necessary documents such as your W-2s and 1099 forms. You can file your Georgia income tax return online through the Georgia Department of Revenue website or use platforms like US Legal Forms for convenience. After completing your return, follow the instructions to submit it electronically or by mail.