Georgia Agreement to Form Partnership in Future to Conduct Business

Description

How to fill out Agreement To Form Partnership In Future To Conduct Business?

Finding the appropriate legitimate document template can be challenging.

Of course, there is a wide selection of templates accessible online, but how can you find the authentic one you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Georgia Agreement to Form Partnership in Future to Conduct Business, that you can utilize for business and personal purposes.

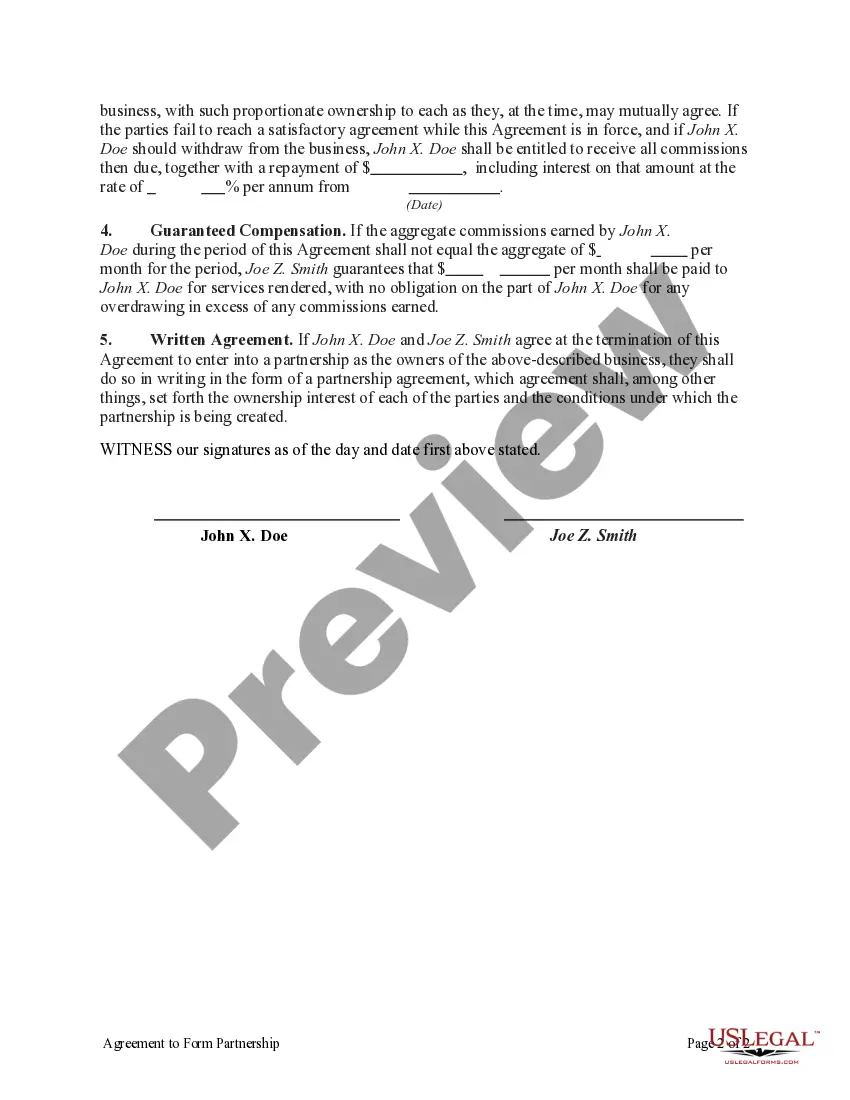

You can review the form using the Preview button and read the form description to confirm it is the correct one for you.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Acquire button to obtain the Georgia Agreement to Form Partnership in Future to Conduct Business.

- Use your account to check the legal documents you may have previously purchased.

- Visit the My documents tab in your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your jurisdiction.

Form popularity

FAQ

To form a partnership, you need at least two individuals who share a common goal for conducting business. It's essential to create a comprehensive Georgia Agreement to Form Partnership in Future to Conduct Business, which should outline profit-sharing, decision-making authority, and partner obligations. Additionally, partners must ensure they comply with local registration and licensing requirements, making this agreement a necessary foundation for your business venture.

To create a domestic partnership in Georgia, both parties must agree to the partnership terms and designate their contributions, whether financial or otherwise. A well-drafted Georgia Agreement to Form Partnership in Future to Conduct Business will specify the rights and obligations of each partner, ensuring compliance with Georgia law. Keep in mind that while Georgia does not officially recognize domestic partnerships, partners can still create agreements to formalize their business relationship.

To start a partnership in Georgia, first, you should choose a name for your business that complies with state regulations. Next, you should draft a Georgia Agreement to Form Partnership in Future to Conduct Business, outlining terms such as profit distribution, partner responsibilities, and other essential details. Finally, you may need to register your partnership name and obtain any required permits to operate legally in your industry.

In Georgia, partnerships are not taxed at the entity level; instead, the income passes through to the partners who report it on their personal tax returns. This means that, while partnerships enjoy a pass-through taxation structure, partners may be subject to individual income tax rates. Additionally, the Georgia Agreement to Form Partnership in Future to Conduct Business can help you align financial expectations and tax responsibilities among partners.

To make a general partnership agreement, start by discussing key components with your partner, including each person’s contributions, profit sharing, and dispute resolution methods. Then, draft the agreement, ensuring it covers all vital aspects of your partnership. A Georgia Agreement to Form Partnership in Future to Conduct Business template can guide you in structuring this document effectively. Finally, review it thoroughly together and sign to solidify your commitment to the partnership.

Forming a general partnership in Georgia is relatively straightforward. You simply need to agree with your partner on the business venture, and you can informally establish your partnership without filing formal paperwork. However, it's wise to create a Georgia Agreement to Form Partnership in Future to Conduct Business to clarify roles and responsibilities. This agreement can serve as a protective measure and provide a roadmap for your partnership's operations.

A general partnership can expose you to significant risks, as each partner shares unlimited personal liability for the business's debts. Additionally, disagreements among partners can lead to conflicts that hamper decision-making and productivity. When drafting a Georgia Agreement to Form Partnership in Future to Conduct Business, it's crucial to address these potential issues to safeguard your interests. Understanding these disadvantages can help you make informed choices about the partnership structure.

Setting up a business partnership agreement involves multiple steps, starting with discussing your goals and contributions with your partner. Next, draft an agreement that outlines roles, profit sharing, and procedures for resolving disputes. Utilizing a Georgia Agreement to Form Partnership in Future to Conduct Business template can streamline this process, ensuring you cover all essential elements. Finally, have both partners review and sign the agreement to establish a clear foundation for your partnership.

In the business realm, you can encounter four primary types of partnerships: general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type offers different levels of liability and involvement in management. A proper Georgia Agreement to Form Partnership in Future to Conduct Business can help delineate the roles and responsibilities of each partner. Understanding these types can guide you in selecting the one that aligns with your business goals.

In Georgia, you typically do not need to register a partnership unless it is a limited partnership or a limited liability partnership. However, registering can provide legal protections and credibility, especially if you have established a Georgia Agreement to Form Partnership in Future to Conduct Business. Consider your partnership structure and business goals to determine if registration is beneficial. Consulting with a legal expert can also provide tailored advice.