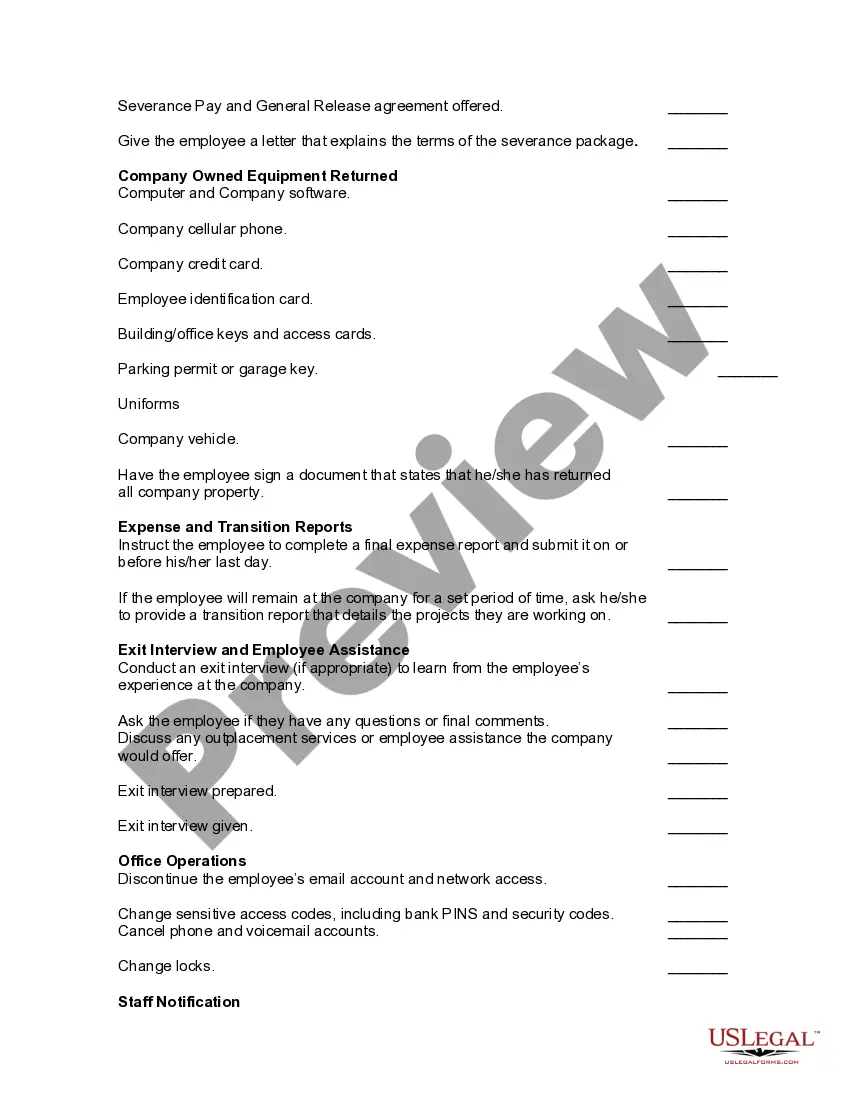

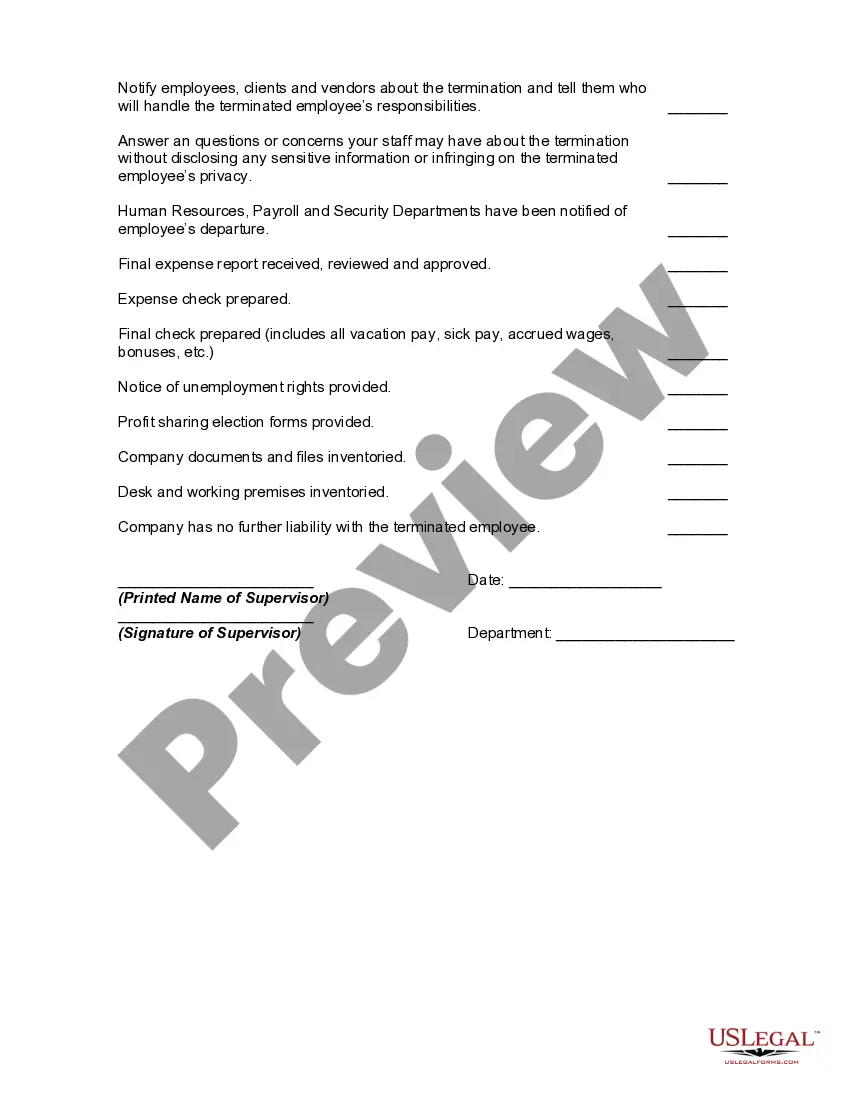

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

The Georgia Worksheet — Termination of Employment is a document specifically designed to assist employers and HR professionals in the state of Georgia in effectively handling employee terminations. This worksheet guides employers through a systematic process to ensure compliance with state laws and regulations while terminating an employee. Key elements covered in the Georgia Worksheet — Termination of Employment include: 1. Georgia Employment Laws: This section provides an overview of the relevant state laws and regulations governing employee terminations in Georgia. It highlights the legal requirements that employers must follow during the termination process. 2. Preparation: The worksheet includes a comprehensive checklist to help employers prepare for a termination. It covers essential steps such as gathering necessary paperwork, preparing final pay and benefits calculations, and reviewing the employment agreement or contract. 3. Reasons for Termination: Employers are guided through the process of documenting the reasons for terminating an employee. The worksheet emphasizes the importance of clearly articulating the justifiable cause or valid reasons for the termination, whether it is due to poor performance, misconduct, downsizing, or any other legally acceptable grounds. 4. Compliance with Notice Periods: In Georgia, employers are required to provide specific notice periods to terminating employees based on their tenure and certain other factors. The worksheet outlines these requirements, ensuring employers are aware of their obligations and avoid potential legal issues. 5. Severance and Final Pay: Employers must understand the legal obligations related to severance pay, unused vacation or sick leave, and other benefits that terminated employees may be entitled to receive. The worksheet outlines the guidelines for determining the amount and method of payment. 6. Post-Termination Obligations: This section focuses on the employer's responsibilities after termination, such as providing relevant COBRA (Consolidated Omnibus Budget Reconciliation Act) information, returning company property, and ensuring compliance with unemployment benefits procedures. Different types or variations of the Georgia Worksheet — Termination of Employment may exist to cater to specific industries or organizational structures. Some employers may develop customized worksheets tailored to their specific needs, incorporating additional sections or guidelines relevant to their particular circumstances. In conclusion, the Georgia Worksheet — Termination of Employment serves as a comprehensive tool for employers in Georgia to navigate the termination process while abiding by state laws and regulations. By utilizing this worksheet, employers can ensure compliance, mitigate legal risks, and handle employee terminations more efficiently.