Georgia Checklist — Sale of a Business When engaging in the process of selling a business in Georgia, it is crucial to follow a comprehensive checklist to ensure a smooth and successful transaction. This checklist outlines the essential steps and considerations that both buyers and sellers need to take into account. Here is a detailed description of the Georgia Checklist for the Sale of a Business, including different types of checklists available depending on specific circumstances: 1. Initial Preparation: — Identify the objectives and motivations behind the sale. — Evaluate the business's financials and gather all relevant documents, including tax returns, financial statements, leases, licenses, contracts, and patents. — Secure confidentiality agreements to protect the sensitive information related to the business. — Evaluate the current market conditions and consult with professionals, such as business brokers or attorneys, as necessary. 2. Valuation and Pricing: — Establish a realistic and accurate value of the business. — Conduct a thorough valuation analysis, taking into account various factors such as financials, market trends, industry comparable, and goodwill. — Consult with business appraisers and financial experts to ensure an accurate valuation. 3. Legal Considerations: — Seek legal advice from an attorney specialized in business transactions. — Confirm the legal structure of the business and ensure compliance with all regulatory requirements. — Assess any potential legal risks, liabilities, or pending litigation that could affect the sale. — Prepare or review existing contracts and agreements related to the business, such as lease agreements, customer contracts, and employee contracts. 4. Marketing and Advertising: — Develop a comprehensive marketing strategy to attract potential buyers. — Prepare marketing materials, including a business prospectus or executive summary, highlighting the key features and financial performance of the business. — Advertise the sale through various channels, such as online listings, industry publications, and networking with other business professionals. 5. Confidentiality and Due Diligence: — Implement strict confidentiality measures to maintain the privacy of the business during the sales process. — Conduct thorough due diligence on potential buyers to verify their financial capabilities, intentions, and compatibility with the business. — Allow interested buyers to review relevant documents and perform their due diligence on the business. 6. Negotiation and Offer Acceptance: — Assess and negotiate offers received from potential buyers. — Evaluate the terms and conditions of each offer, including the purchase price, financing options, contingencies, and transition period. — Work with the buyer to draft and negotiate a purchase agreement that outlines all the terms and conditions agreed upon. 7. Closing and Transition: — Coordinate with legal professionals to ensure all necessary documentation is completed for the closing. — Transfer ownership of assets, contracts, licenses, and permits to the buyer. — Settle any outstanding debts, taxes, or liabilities related to the business. — Develop a transition plan to facilitate a smooth handover of the business operations and responsibilities to the new owner. Different types of Georgia Checklist — Sale of a Business may exist depending on specific circumstances, such as: 1. Checklist for Selling a Small Business: Specifically tailored for owners of small businesses, this checklist addresses the unique challenges and requirements relevant to smaller-scale transactions. 2. Checklist for Selling a Franchise Business: Franchise business sales often involve additional considerations, such as obtaining franchisor approval, transferring franchise agreements, and complying with franchise disclosure regulations. This checklist provides specific guidelines for selling a franchise. 3. Checklist for Selling an Online Business: With the increasing number of online businesses, this checklist focuses on the specific aspects of selling an internet-based business, including domain name transfers, customer databases, and digital assets. By following a comprehensive Georgia Checklist — Sale of a Business, sellers can ensure they cover all necessary steps, minimize risks, and optimize the outcome of the business sale transaction.

Georgia Checklist - Sale of a Business

Description

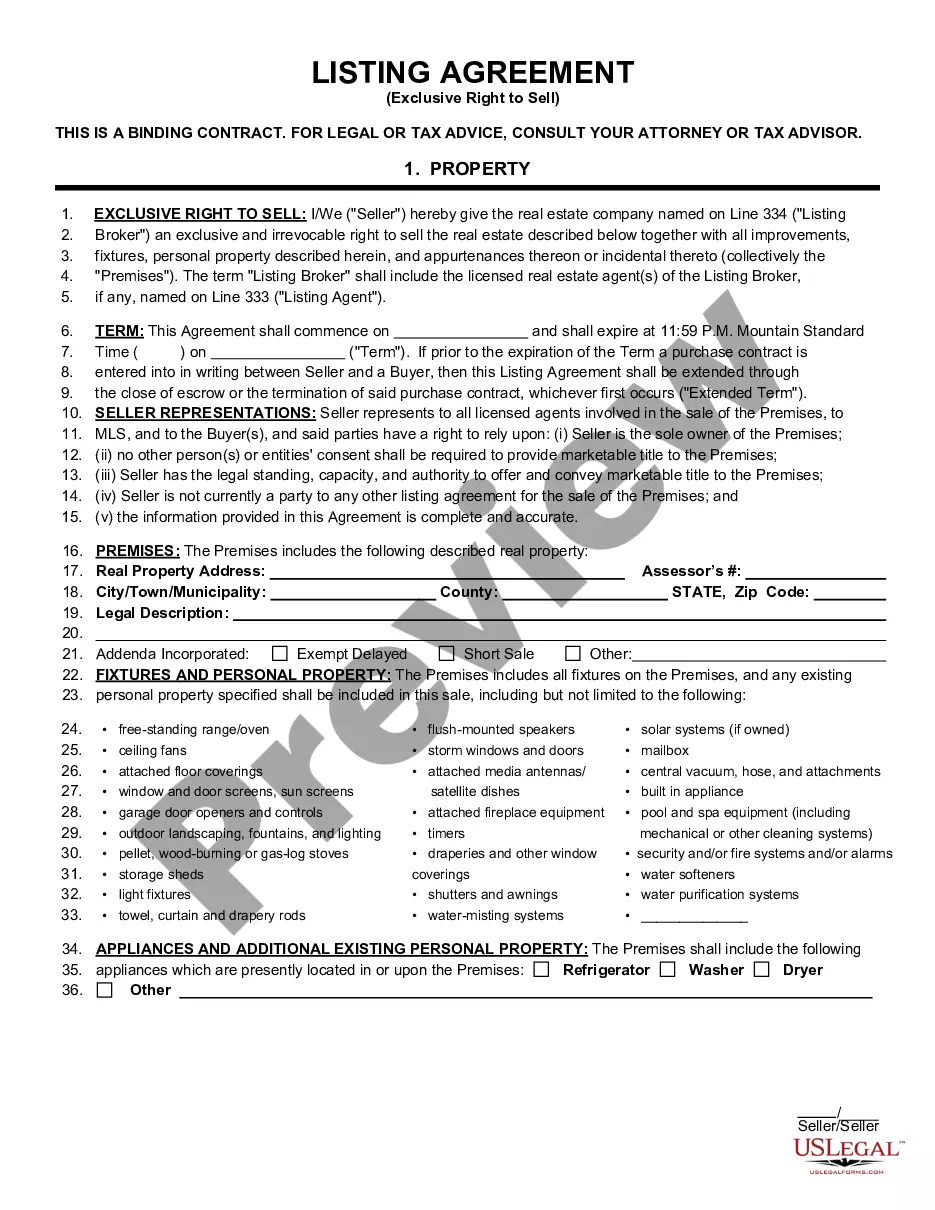

How to fill out Georgia Checklist - Sale Of A Business?

If you need to comprehensive, down load, or produce legal document web templates, use US Legal Forms, the largest variety of legal varieties, which can be found on-line. Take advantage of the site`s simple and easy handy research to discover the paperwork you will need. Different web templates for enterprise and specific functions are sorted by types and says, or key phrases. Use US Legal Forms to discover the Georgia Checklist - Sale of a Business in just a couple of click throughs.

When you are currently a US Legal Forms buyer, log in to the accounts and click on the Down load button to have the Georgia Checklist - Sale of a Business. Also you can access varieties you formerly delivered electronically from the My Forms tab of your accounts.

Should you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the form for that proper city/land.

- Step 2. Utilize the Review solution to check out the form`s content. Don`t forget about to read the explanation.

- Step 3. When you are unhappy using the form, utilize the Look for field on top of the display screen to find other models from the legal form design.

- Step 4. When you have discovered the form you will need, select the Acquire now button. Select the rates plan you like and put your credentials to sign up for the accounts.

- Step 5. Method the transaction. You can use your charge card or PayPal accounts to finish the transaction.

- Step 6. Select the formatting from the legal form and down load it on your own gadget.

- Step 7. Full, change and produce or signal the Georgia Checklist - Sale of a Business.

Every legal document design you get is yours forever. You possess acces to every form you delivered electronically with your acccount. Go through the My Forms section and choose a form to produce or down load again.

Contend and down load, and produce the Georgia Checklist - Sale of a Business with US Legal Forms. There are thousands of expert and state-particular varieties you can use for your enterprise or specific needs.