A Georgia General Power of Attorney for Bank Account Operations is a legal document that grants an appointed individual, referred to as an agent or attorney-in-fact, the authority to manage, access, and make decisions regarding someone else's bank accounts and financial affairs within the state of Georgia. This authorization can be comprehensive, covering various account types and transactions, or limited, specifying certain restrictions and limitations. In Georgia, there are two main types of General Power of Attorney for Bank Account Operations: 1. Durable Power of Attorney: This type remains in effect even if the principal becomes mentally incapacitated or incapable of handling their financial affairs. It empowers the agent to continue managing the principal's bank accounts and other financial assets, ensuring uninterrupted operation and safeguarding the principal's interests. 2. Springing Power of Attorney: Also known as conditional power of attorney, this type only becomes effective under specific circumstances defined by the principal. Typically, these conditions are related to the principal's incapacity or inability to handle their bank account operations. Once the triggering event occurs, the agent assumes control over the bank accounts and financial matters. When creating a Georgia General Power of Attorney for Bank Account Operations, several essential details need to be included. These may involve the principal's identifying information, such as their full name and address, as well as the agent's details, including their name, address, and contact information. The document should clearly outline the extent of the agent's powers, describing the specific bank accounts, financial institutions, and transactions the agent can undertake. Additionally, it is crucial to outline any restrictions, limitations, or conditions placed on the agent's authority. Aside from these fundamental elements, it is crucial to sign and notarize the General Power of Attorney for Bank Account Operations in compliance with Georgia state laws. This ensures its legality and enforceability when presented to financial institutions or other third parties involved. In conclusion, a Georgia General Power of Attorney for Bank Account Operations is a legal instrument that delegates authority to an agent to handle all aspects of someone's bank accounts and related financial matters. It can be durable or springing, depending on the principal's preferences and goals. Careful consideration should be given to all relevant keywords to ensure a comprehensive and accurate description of this important legal document.

Georgia General Power of Attorney for Bank Account Operations

Description

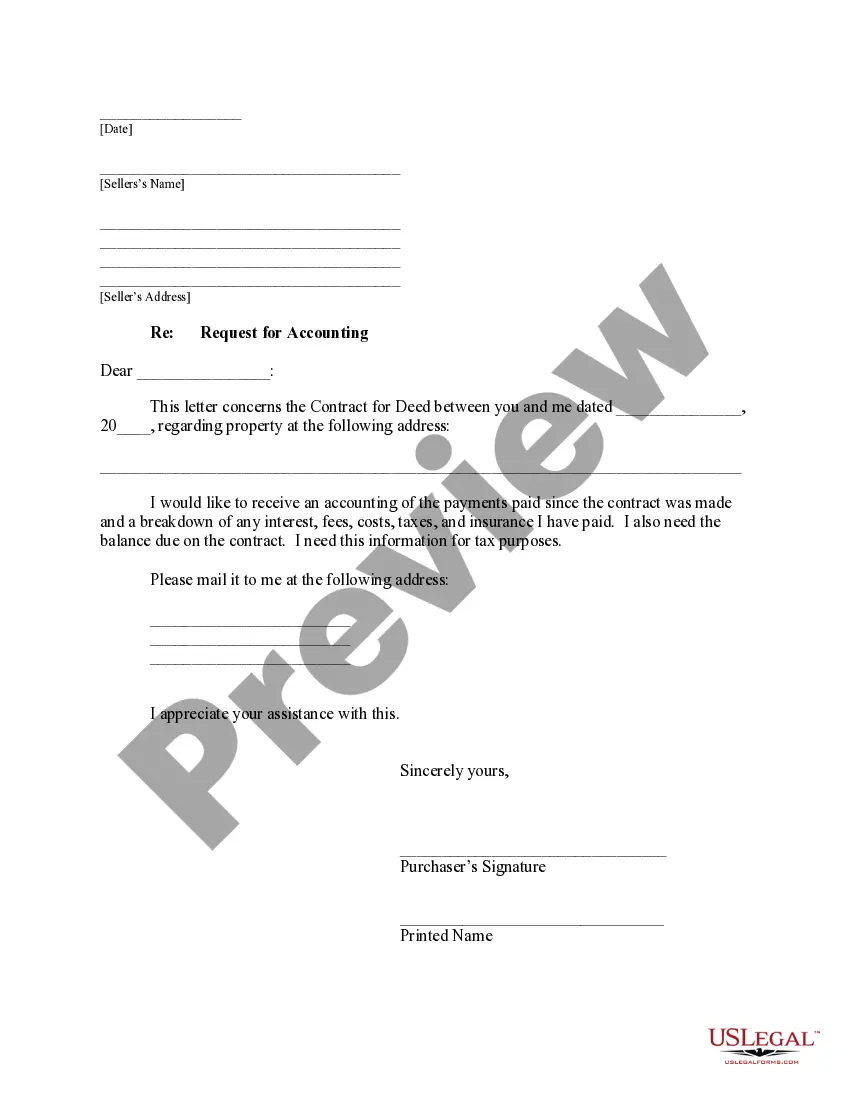

How to fill out Georgia General Power Of Attorney For Bank Account Operations?

Choosing the right lawful papers design can be quite a struggle. Needless to say, there are a variety of templates accessible on the Internet, but how can you obtain the lawful kind you want? Take advantage of the US Legal Forms site. The services provides a huge number of templates, including the Georgia General Power of Attorney for Bank Account Operations, which you can use for company and private demands. All of the types are checked out by pros and satisfy state and federal specifications.

In case you are currently signed up, log in for your accounts and click on the Download switch to get the Georgia General Power of Attorney for Bank Account Operations. Use your accounts to search through the lawful types you possess ordered in the past. Go to the My Forms tab of your respective accounts and acquire an additional copy of your papers you want.

In case you are a whole new user of US Legal Forms, here are simple recommendations that you should follow:

- Initial, make certain you have selected the proper kind for your personal city/region. You are able to look over the form utilizing the Review switch and browse the form information to guarantee this is the best for you.

- In case the kind does not satisfy your preferences, take advantage of the Seach discipline to obtain the proper kind.

- Once you are sure that the form is acceptable, go through the Acquire now switch to get the kind.

- Pick the pricing plan you would like and enter the necessary info. Build your accounts and pay for the order utilizing your PayPal accounts or Visa or Mastercard.

- Select the file structure and download the lawful papers design for your system.

- Complete, change and produce and signal the received Georgia General Power of Attorney for Bank Account Operations.

US Legal Forms is the greatest local library of lawful types in which you can see different papers templates. Take advantage of the company to download skillfully-manufactured documents that follow express specifications.

Form popularity

FAQ

Does a Power of Attorney Need to be Recorded in Georgia? A POA should be notarized and witnessed by two adults, and the principal should keep the form in a safe place unless the authority needs to be used immediately. However, there is no need to record it in public records.

Effective July 1st of this year, Georgia's new Uniform Power of Attorney Act (UPOAA) applies to most written, general, financial powers of attorney.

The individual granted decision-making authority must adhere to wishes outlined in a living will. Georgia durable power of attorney laws require the document to be in writing, signed by the principal, and witnessed by two competent adults.

If a person wants to authorise someone to act as a power of attorney on his behalf, it must be signed and notarised by a certified notary advocate, who is able to declare that you are competent at the time of signing the document to issue the said power of attorney.

Power of Attorney is created simply by composing and signing a document that grants this authority. In the State of Georgia, two adult witnesses are required to authenticate Power of Attorney. While it is not required, getting the document notarized is also a good idea.

A general power of attorney allows the agent to act on behalf of the principal in any matters, as allowed by state laws. The agent under such an agreement may be authorized to handle bank accounts, sign checks, sell property, manage assets, and file taxes for the principal.

To be valid under the UPOAA, a Georgia POA must be signed by the principal (or by another individual in the principal's presence at the principal's direct direction), and attested and signed by one or more witnesses and a notary public.

How to Write1 Download The Statutory Form Power Of Attorney To Appoint An Agent In Georgia.2 The First Page Requires Attention.3 Prepare This Document With The Agent's Information.4 The Principal Must Personally Approve The Granted Powers.More items...?

Power of Attorney is created simply by composing and signing a document that grants this authority. In the State of Georgia, two adult witnesses are required to authenticate Power of Attorney. While it is not required, getting the document notarized is also a good idea.

A Georgia general power of attorney (GPOA) allows a person to grant legal authority to another to handle their financial and business affairs. A GPOA is only valid for use while the principal is coherent and able to think for themselves.