Georgia Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Sample Of A Collection Letter To Small Business In Advance?

Locating the appropriate legal document template can be a challenge.

Of course, there are numerous templates accessible on the web, but how can you obtain the legal document you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Georgia Sample of a Collection Letter to Small Business in Advance, suitable for both business and personal use.

If the form does not meet your needs, utilize the Search field to find the appropriate one. Once you are confident that the form is correct, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the legal document template to your system. Finally, modify, print, and sign the acquired Georgia Sample of a Collection Letter to Small Business in Advance. US Legal Forms is the premier collection of legal forms where you can find a variety of document templates. Utilize the service to download professionally crafted documents that comply with state requirements.

- All templates are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Download button to obtain the Georgia Sample of a Collection Letter to Small Business in Advance.

- Use your account to browse through the legal documents you have previously purchased.

- Navigate to the My documents section of your account to download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/state. You may review the form using the Review button and read the form details to confirm it is the right one for you.

Form popularity

FAQ

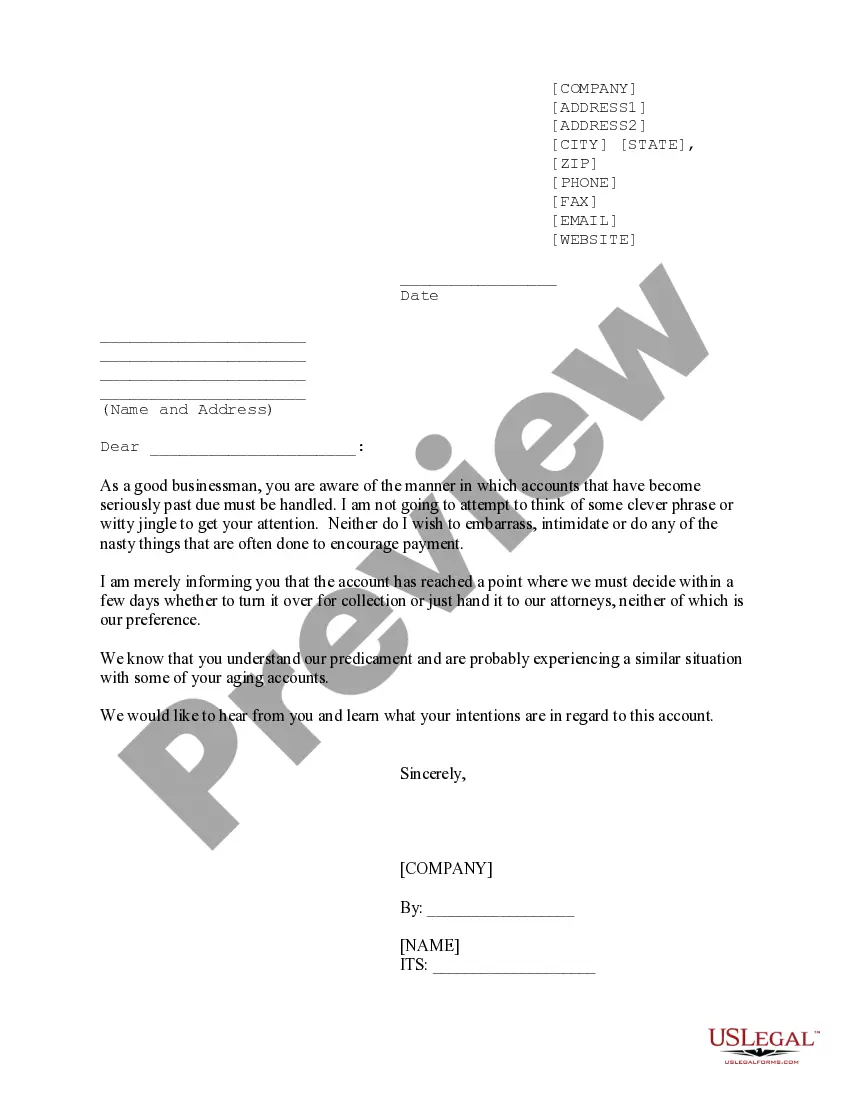

An effective collection letter should be clear, concise, and professional. Start by addressing the debtor directly, reiterating the details of the debt, and including a clear demand for payment. Make sure to display a genuine intent to resolve the issue, while referencing a Georgia Sample of a Collection Letter to Small Business in Advance for reference. A well-structured letter that communicates urgency and clarity can significantly increase the chances of timely payment.

Writing a letter for debt collection involves stating the debt details in a respectful yet assertive manner. Begin with your business information and address the recipient directly. In the letter, mention the amount owed, the original due date, and any previous communication related to the debt. Utilizing a Georgia Sample of a Collection Letter to Small Business in Advance can provide you with a strong template to work from, helping you achieve an effective message that drives results.

A good debt settlement letter should clearly explain your intention to settle the debt for less than the full amount. Start by detailing your financial situation to help the creditor understand your position. If you can, include a proposed payment plan or a lump sum offer referencing a Georgia Sample of a Collection Letter to Small Business in Advance for structure. This approach shows your willingness to resolve the matter amicably and encourages a positive response from the creditor.

To write a letter of debt collection, you should start by clearly stating your business name and contact information. Next, include the recipient’s name and address, followed by a polite yet firm explanation of the debt owed, referencing a Georgia Sample of a Collection Letter to Small Business in Advance for guidance. It is important to outline the amount due, any associated fees, and a deadline for payment to encourage prompt action.

To send a bill to a collection agency, gather all relevant documents related to the debt, including your Georgia Sample of a Collection Letter to Small Business in Advance. After compiling the necessary information, reach out to a reputable collection agency and provide them with the documentation. They will guide you through their process to start the collection efforts effectively.

The 7 7 7 rule refers to contacting the debtor seven times within seven days, followed by sending a formal notice after that period. This approach shows persistent efforts to collect the debt. You can incorporate a Georgia Sample of a Collection Letter to Small Business in Advance as part of your strategy during the initial outreach.

To send someone to collections, you need clear documentation of the debt. This includes invoices, contracts, and any correspondence related to the outstanding balance. Utilizing a Georgia Sample of a Collection Letter to Small Business in Advance ensures that you present your case clearly and correctly to the collection agency.

A collection notice typically includes details like the debtor's name, outstanding balance, account number, and a deadline for payment. An effective example can be found in a Georgia Sample of a Collection Letter to Small Business in Advance, helping you communicate the urgency of the matter while remaining professional.

The language in a debt collection letter must be straightforward and direct. It should clearly articulate the debt amount, the nature of the debt, and any applicable terms or consequences of non-payment. A Georgia Sample of a Collection Letter to Small Business in Advance can provide the necessary framework for your letter.

Debt collectors must inform you that they are attempting to collect a debt and any information obtained will be used for that purpose. They must also disclose the amount owed, the original creditor, and your right to dispute the debt. Using a Georgia Sample of a Collection Letter to Small Business in Advance can ensure compliance with these requirements.