Subject: Dissolution Finalized for Our Georgia Clients: Important Information Inside! Dear [Client's Name], We hope this letter finds you well. We are writing to inform you that the dissolution process for your business in the state of Georgia has been successfully completed, bringing the closure of your company to its final stage. We understand the significance of this milestone and acknowledge your dedication and commitment throughout this journey. The dissolution of a business entity involves numerous legal and administrative steps, including the formal termination of the company's operations, tax filings, and the settlement of any remaining business matters. Our team has diligently worked to expedite this process and ensure compliance with all necessary regulations. Throughout this journey, we have strived to provide you with exceptional guidance and support, minimizing the burden and complexities associated with dissolving a business. We thank you for entrusting us with this crucial task and appreciate your cooperation, as it significantly contributed to the smooth transition towards a finalized dissolution. To ensure you are well-informed and prepared for what lies ahead, we would like to provide you with vital information and next steps: 1. Official Closure: The dissolution process has officially concluded, signifying the legal termination of your business in the state of Georgia. 2. Legal Documentation: We will be sending you the finalized dissolution documents, including the Certificate of Dissolution, which will serve as evidence of the successful completion of the dissolution process. 3. Tax Obligations: It's important to note that the state of Georgia may still require you to fulfill certain tax obligations, including filing your final tax returns and settling any outstanding taxes owed. We highly recommend consulting with a tax professional to ensure compliance with these obligations. 4. Business Assets and Liabilities: We advise you to review your business assets and liabilities, ensuring a smooth transfer or liquidation of any remaining assets. Our team is here to offer guidance and can provide referrals to reputable professionals for this purpose, if needed. 5. Informing Stakeholders: It is vital to inform stakeholders such as clients, employees, suppliers, and creditors about the dissolution of your business. Our team can assist you in drafting a formal notification letter, if required. Please keep in mind that this letter serves as a general overview of the post-dissolution process, and your specific circumstances may warrant additional actions or considerations. Our team remains committed to providing ongoing support and guidance as you navigate the aftermath of this dissolution. If you have any questions or require further assistance, please do not hesitate to reach out to our dedicated team of experts. We are here to ensure a seamless transition and to address any concerns you may have. Once again, we extend our heartfelt gratitude for choosing our services, and we wish you the best in your future endeavors. Rest assured, our team remains at your disposal should you require any further assistance or guidance. Warm regards, [Your Name] [Your Title] [Company Name]

Georgia Sample Letter to Client regarding Dissolution Finalized

Description

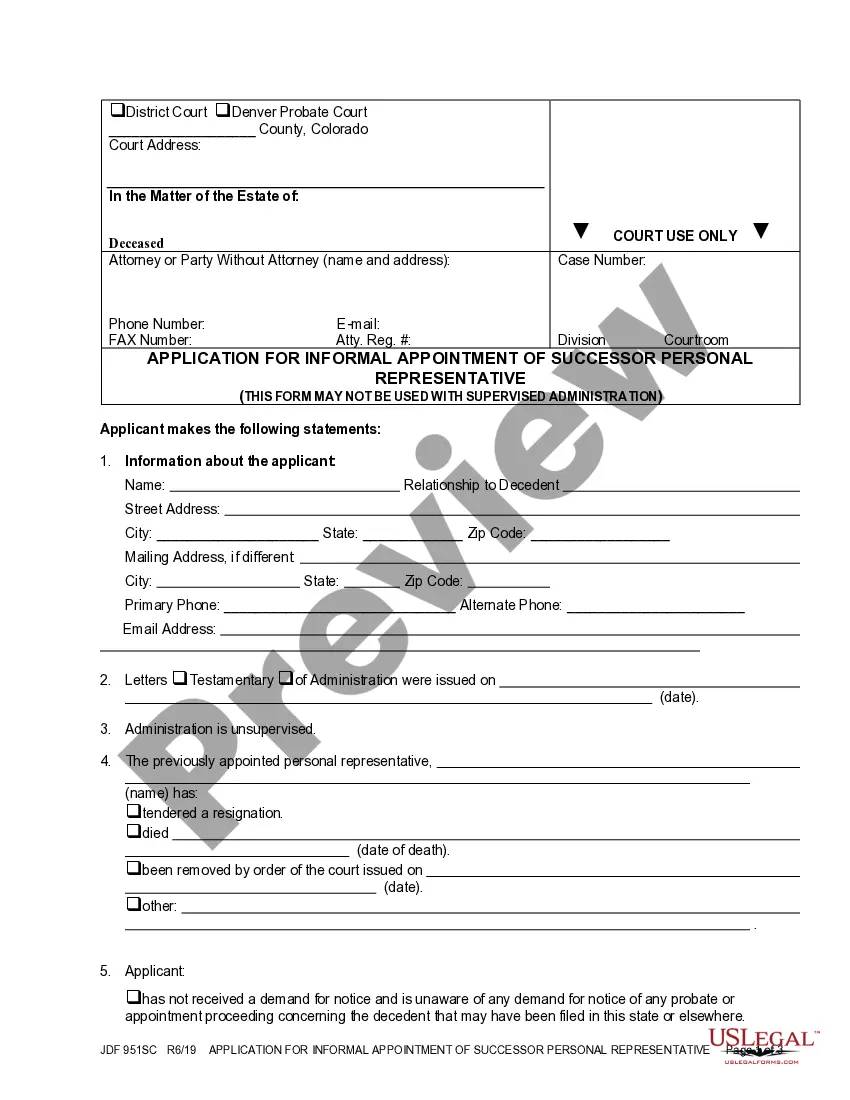

How to fill out Georgia Sample Letter To Client Regarding Dissolution Finalized?

If you need to complete, down load, or produce lawful document templates, use US Legal Forms, the most important selection of lawful forms, which can be found on the web. Utilize the site`s basic and convenient search to find the paperwork you need. Different templates for organization and personal functions are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to find the Georgia Sample Letter to Client regarding Dissolution Finalized with a couple of click throughs.

If you are presently a US Legal Forms customer, log in in your profile and click the Obtain switch to find the Georgia Sample Letter to Client regarding Dissolution Finalized. Also you can gain access to forms you formerly downloaded in the My Forms tab of your profile.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape to the correct metropolis/land.

- Step 2. Make use of the Review method to look through the form`s content material. Do not overlook to read the information.

- Step 3. If you are unhappy with the kind, use the Look for field towards the top of the display screen to find other versions of your lawful kind design.

- Step 4. After you have identified the shape you need, click on the Buy now switch. Pick the prices plan you like and include your accreditations to register for an profile.

- Step 5. Method the financial transaction. You should use your bank card or PayPal profile to complete the financial transaction.

- Step 6. Select the formatting of your lawful kind and down load it in your device.

- Step 7. Complete, modify and produce or signal the Georgia Sample Letter to Client regarding Dissolution Finalized.

Every single lawful document design you acquire is your own permanently. You have acces to each kind you downloaded within your acccount. Go through the My Forms portion and decide on a kind to produce or down load yet again.

Be competitive and down load, and produce the Georgia Sample Letter to Client regarding Dissolution Finalized with US Legal Forms. There are millions of skilled and state-specific forms you can utilize for your organization or personal demands.

Form popularity

FAQ

Although the content will vary, certain elements should be included in every letter of dissolution. These include: The name of the recipient and the name of the person sending the letter. The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.

This intent to dissolve should include the following information: A detailed description of the claim. Information regarding the claim, the amount of the claim, and whether it is admitted to or not. A mailing address where any claims can be sent. A deadline: This must be at least 120 days after the written notice date.

Please be advised that the [corporation] [the partnership between (insert partner names)] [limited liability company between (insert member names)] known as (insert name of business), doing business at (insert address) will be dissolved by [shareholder and director resolution] [mutual consent of the partners] [[mutual ...

The letter should include the date of termination, the reason for termination (if applicable), any remaining obligations that either party may have, and an acknowledgement of contributions made by the employee during their time with the company.

First, you need to be sure to include the legal name of your company. Second, your articles of dissolution should state the date when your company will be dissolved. Finally, there should be a statement that your corporation's board of directors or your LLC's members approved the dissolution.

engagement letter informs prospective clients that the attorney will not be representing them. Lawyers prepare this type of correspondence to clarify and document the status of the relationship.

Firstly, start by addressing the recipient in a professional manner using their full name or company name. Be clear and concise about your intentions for writing the letter, stating that you intend to dissolve the partnership. Next, provide context for why you've made this decision.