Georgia Subrogation Agreement between Insurer and Insured

Description

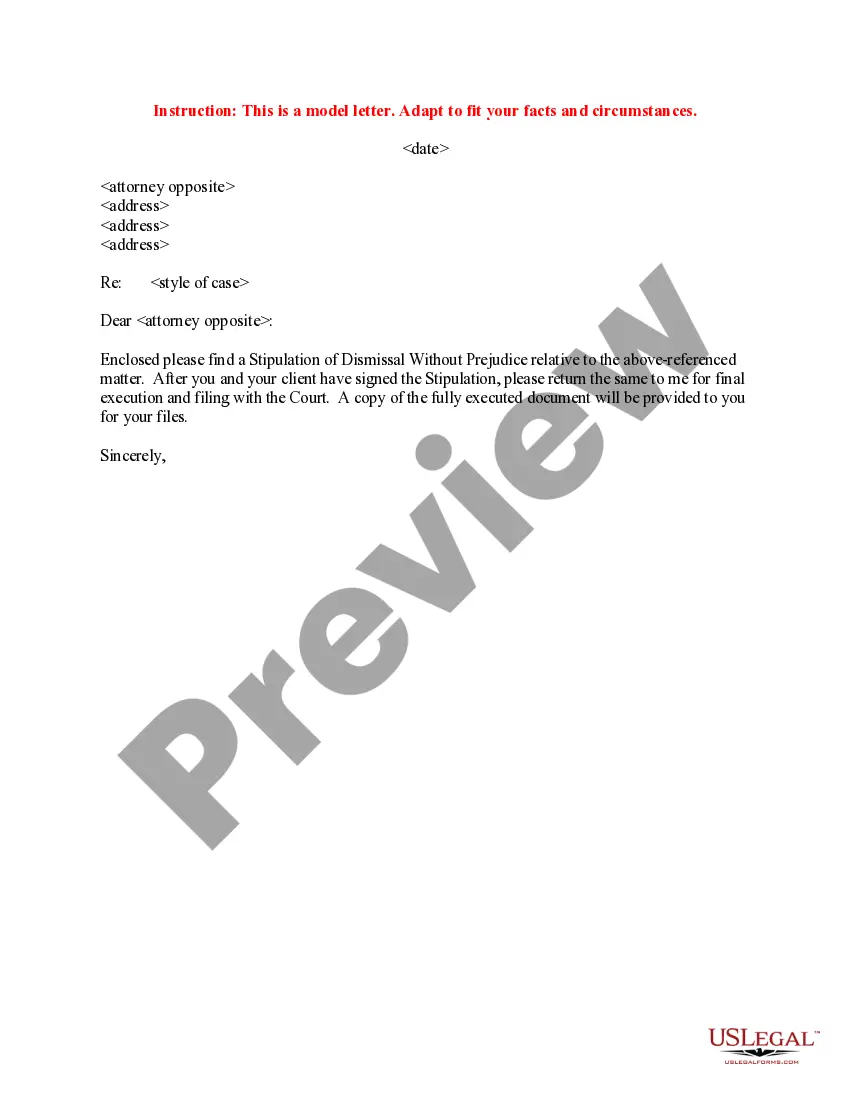

How to fill out Subrogation Agreement Between Insurer And Insured?

If you want to comprehensive, acquire, or produce legal record themes, use US Legal Forms, the biggest collection of legal kinds, that can be found online. Take advantage of the site`s simple and easy practical lookup to get the papers you will need. Various themes for organization and personal functions are categorized by groups and suggests, or keywords. Use US Legal Forms to get the Georgia Subrogation Agreement between Insurer and Insured with a few click throughs.

Should you be currently a US Legal Forms consumer, log in in your accounts and click the Download switch to obtain the Georgia Subrogation Agreement between Insurer and Insured. You may also accessibility kinds you earlier saved in the My Forms tab of your accounts.

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have chosen the form for that appropriate city/nation.

- Step 2. Take advantage of the Preview method to look through the form`s content material. Do not overlook to learn the outline.

- Step 3. Should you be unsatisfied using the kind, utilize the Look for industry on top of the screen to find other models from the legal kind template.

- Step 4. After you have identified the form you will need, click on the Buy now switch. Opt for the prices strategy you like and include your credentials to register to have an accounts.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal accounts to accomplish the financial transaction.

- Step 6. Choose the file format from the legal kind and acquire it on the device.

- Step 7. Comprehensive, revise and produce or indication the Georgia Subrogation Agreement between Insurer and Insured.

Each and every legal record template you acquire is yours forever. You might have acces to each kind you saved with your acccount. Click on the My Forms section and choose a kind to produce or acquire once again.

Be competitive and acquire, and produce the Georgia Subrogation Agreement between Insurer and Insured with US Legal Forms. There are many skilled and state-specific kinds you may use for the organization or personal demands.

Form popularity

FAQ

Subrogation Law and General Insurance Policies Georgia's Made Whole Doctrine states that a benefit provider (health insurance, generally) may only recover from a third-party claim (such as a client's personal injury settlement) if the amount of the recovery exceeds the sum of all economic and non-economic losses.

Generally, in most subrogation cases, an individual's insurance company pays its client's claim for losses directly, then seeks reimbursement from the other party's insurance company. Subrogation is most common in an auto insurance policy but also occurs in property/casualty and healthcare policy claims.

"Subrogation," or "subro" for short, refers to the right your insurance company holds under your policy ? after they've paid a covered claim ? to request reimbursement from the at-fault party. This reimbursement often comes from the at-fault party's insurance company.

When you file a claim, your insurer can try to recover costs from the person responsible for your injury or property damage. This is known as subrogation. For example: Your insurance company pays your doctor for your treatment following an auto accident that someone else caused.

An insurance company may not subrogate against its own insured or a co-insured. However, when a party claiming to be a co-insured is merely a loss payee to which no liability coverage is afforded, subrogation is permissible.

Subrogation refers to the right of an insurance company to recover money it paid to or on behalf of its insureds due to the actions of at-fault third parties.

An insurer may attempt to subrogate against an additional insured for completed operations injuries caused by the insured if the additional insured endorsement provides coverage only for ongoing operations injuries.