Georgia Provisions for Testamentary Charitable Remainder Unit rust for One Life is a legal instrument that allows individuals in Georgia to support charitable causes while also providing financial benefits to themselves or their loved ones during their lifetime. This type of trust is an effective estate planning tool that can help individuals achieve their philanthropic goals while maximizing their estate tax benefits. Under the Georgia Provisions for Testamentary Charitable Remainder Unit rust for One Life, an individual (known as the donor) can create a trust that will be funded with assets, such as cash, securities, or real estate. The trust will be managed by a trustee, who will oversee the investment and distribution of the trust assets. The primary beneficiary of this trust will be the donor or their designated life beneficiary. During their lifetime, the beneficiary will receive a fixed percentage of the trust assets as income, typically paid annually or semi-annually. This income stream can provide significant financial support to the beneficiary or their loved ones while still allowing them to contribute to charitable causes. Upon the death of the beneficiary, the remaining trust assets will be distributed to one or more qualified charitable organizations that the donor has specified in the trust document. These organizations can include universities, hospitals, religious institutions, or any other 501(c)(3) nonprofit organization. The Georgia Provisions for Testamentary Charitable Remainder Unit rust for One Life offers several advantages. Firstly, it allows individuals to support charitable causes that are important to them, leaving a lasting impact on their community or society at large. Secondly, by creating this trust, individuals can receive immediate income tax deductions for their charitable donation, based on the present value of the charitable remainder interest. Additionally, by removing the assets from the donor's taxable estate, this trust can help reduce potential estate taxes upon the donor's passing. It's important to note that there are different variations of the Georgia Provisions for Testamentary Charitable Remainder Unit rust for One Life, depending on the specific needs and goals of the donor. For example, some individuals may choose a charitable remainder annuity trust, where a fixed dollar amount is paid to the beneficiary each year. Others may opt for a charitable remainder unit rust with a net income limitation, which allows the beneficiary to receive either the fixed percentage or the trust's actual income, whichever is lower. In conclusion, the Georgia Provisions for Testamentary Charitable Remainder Unit rust for One Life provides individuals in Georgia with a flexible and impactful way to support charitable causes while enjoying financial benefits during their lifetime. By carefully considering their philanthropic goals and consulting with legal and financial professionals, individuals can create a charitable trust that aligns with their values and provides a lasting legacy of giving.

Georgia Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

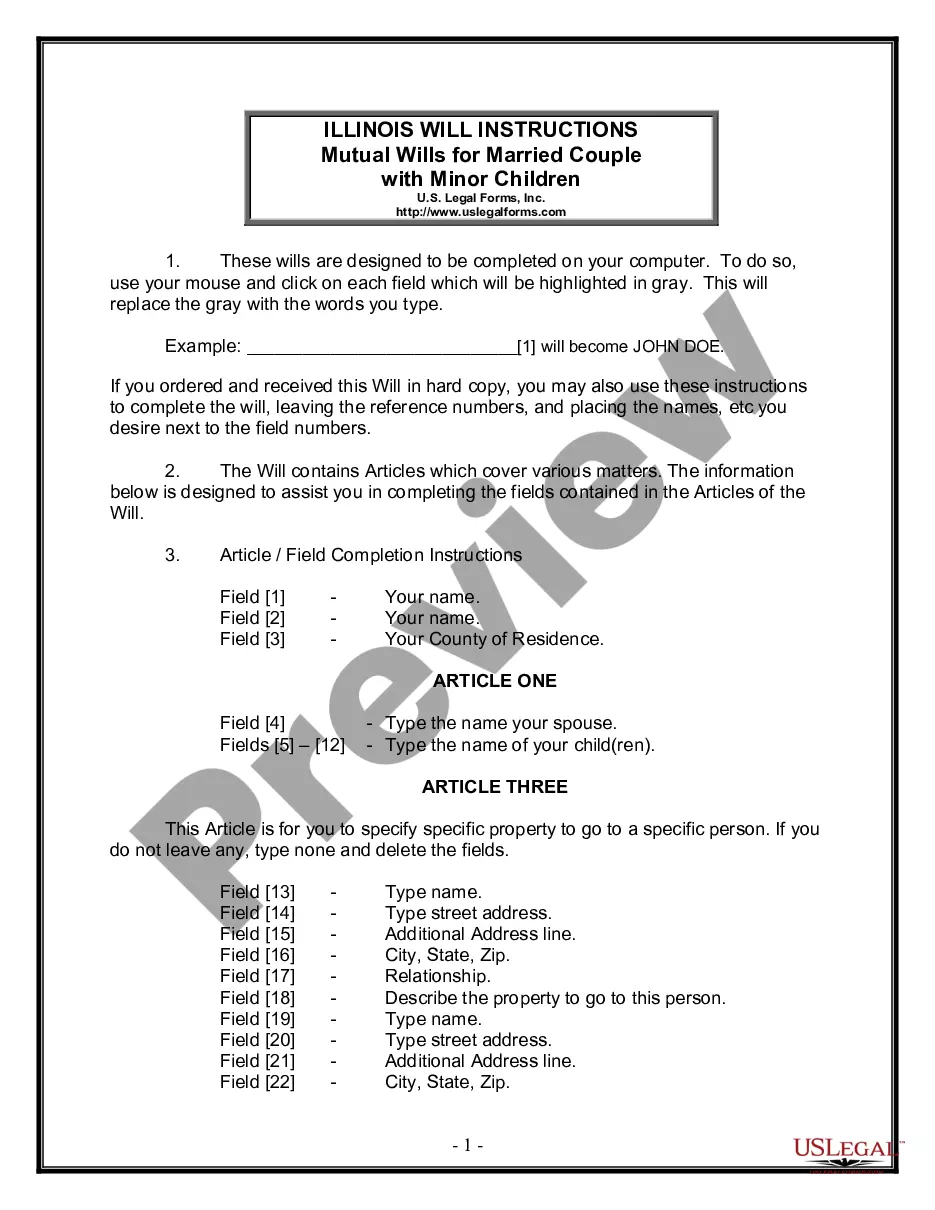

How to fill out Georgia Provisions For Testamentary Charitable Remainder Unitrust For One Life?

Are you currently in a placement the place you will need papers for possibly business or specific functions almost every day? There are tons of legal document themes available online, but finding types you can trust is not straightforward. US Legal Forms provides thousands of form themes, much like the Georgia Provisions for Testamentary Charitable Remainder Unitrust for One Life, which are created to meet federal and state demands.

Should you be presently familiar with US Legal Forms website and also have your account, merely log in. Next, you may acquire the Georgia Provisions for Testamentary Charitable Remainder Unitrust for One Life template.

Unless you offer an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Get the form you want and ensure it is for the correct city/state.

- Take advantage of the Review option to analyze the form.

- Look at the explanation to actually have chosen the right form.

- When the form is not what you`re looking for, take advantage of the Look for area to get the form that suits you and demands.

- When you find the correct form, just click Get now.

- Select the prices program you need, complete the required info to create your money, and purchase the order utilizing your PayPal or charge card.

- Decide on a convenient data file file format and acquire your copy.

Discover each of the document themes you possess purchased in the My Forms food selection. You can get a further copy of Georgia Provisions for Testamentary Charitable Remainder Unitrust for One Life whenever, if necessary. Just click on the essential form to acquire or print the document template.

Use US Legal Forms, one of the most considerable assortment of legal types, to save time and steer clear of faults. The assistance provides skillfully produced legal document themes that you can use for a selection of functions. Generate your account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

1. Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years.

Benefits of CRUTsimmediate income tax deduction for a portion of the contribution to the trust. no upfront capital gains tax on appreciated assets you donate to the trust. steady income stream for life or many years. federal and possible state income tax charitable deduction, and.

A charitable remainder trust is a tax-exempt irrevocable trust designed to reduce the taxable income of individuals. A charitable remainder trust dispenses income to one or more noncharitable beneficiaries for a specified period and then donates the remainder to one or more charitable beneficiaries.

The testamentary charitable remainder unitrust (CRUT) is beneficial in that it allows for an income stream to be paid to selected beneficiaries after the donor's death.

A CRT may last for the Lead Beneficiaries' joint lives or for a term of years (the term may not exceed 20 years).

You can name yourself or someone else to receive a potential income stream for a term of years, no more than 20, or for the life of one or more non-charitable beneficiaries, and then name one or more charities to receive the remainder of the donated assets.

CRUT lie in what the trust pays out on a yearly basis and whether additional contributions are permitted once the trust has been created. With a CRAT, the annuity amount paid each year is fixed. Once you establish a CRAT and make the initial contribution, no further contributions are allowed.

Charitable remainder annuity trusts (CRATs) distribute a fixed annuity amount each year, and additional contributions are not allowed. Charitable remainder unitrusts (CRUTs) distribute a fixed percentage based on the balance of the trust assets (revalued annually), and additional contributions can be made.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.