Georgia Joint Trust with Income Payable to Trustors During Joint Lives

Description

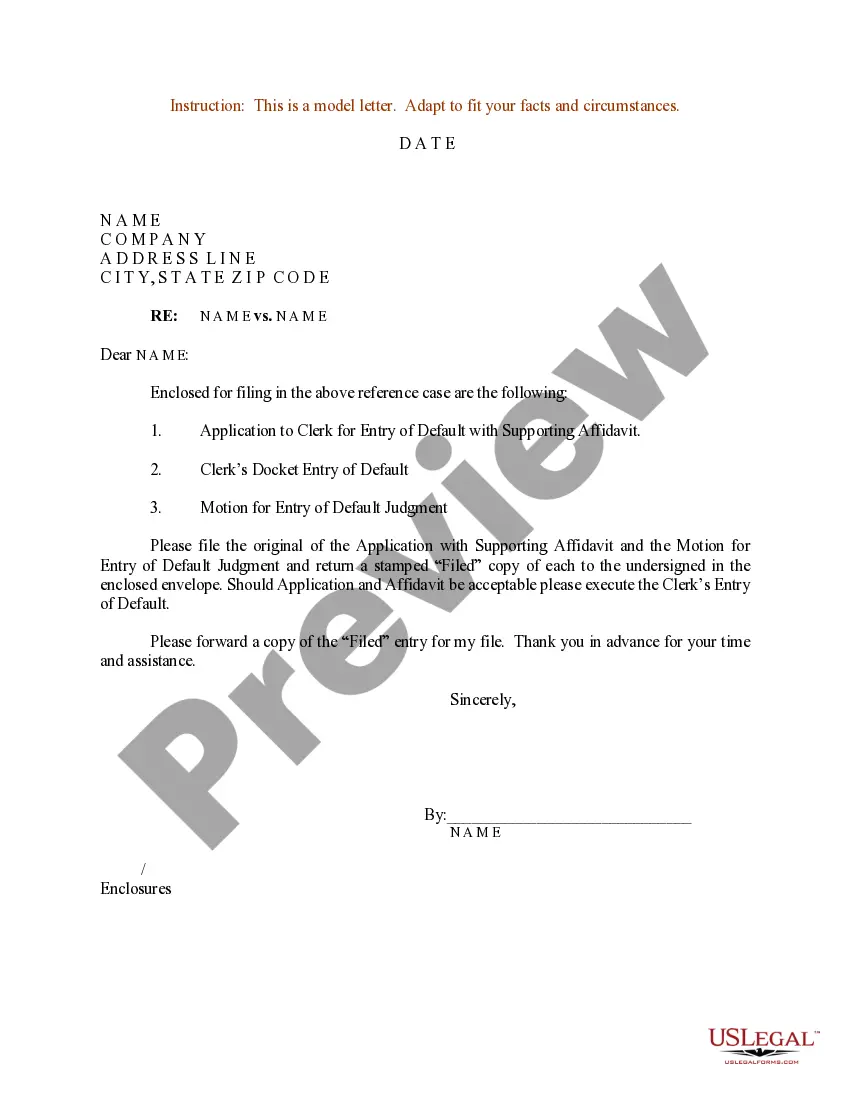

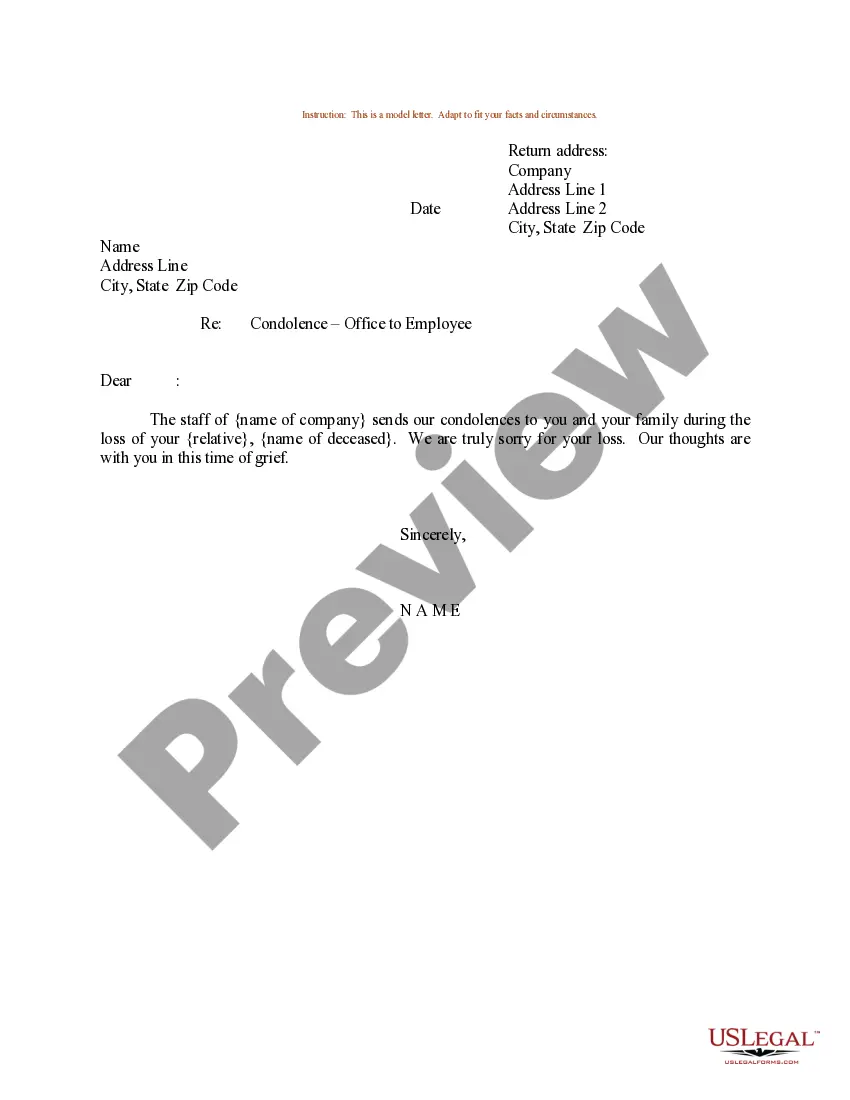

How to fill out Joint Trust With Income Payable To Trustors During Joint Lives?

It is feasible to allocate time online trying to locate the sanctioned document template that fulfills the state and federal criteria you need.

US Legal Forms offers numerous legal documents which can be examined by experts.

You can download or print the Georgia Joint Trust with Income Payable to Trustors During Joint Lives from my services.

To find an additional version of your form, utilize the Search field to locate the template that corresponds to your needs and specifications.

- If you maintain a US Legal Forms account, you can Log In and click the Acquire button.

- Subsequently, you can complete, amend, print, or sign the Georgia Joint Trust with Income Payable to Trustors During Joint Lives.

- Every legal document template you obtain is yours permanently.

- To obtain another copy of any purchased form, access the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your state/region of choice.

- Review the form description to confirm you have chosen the accurate form.

Form popularity

FAQ

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

The trust remains revocable while both spouses are alive. The couple may withdraw assets or cancel the trust completely before one spouse dies. When the first spouse dies, the trust becomes irrevocable and splits into two parts: the A trust and the B trust.

No Asset Protection A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

When a trust is a grantor trust for income tax purposes, either the grantor or a beneficiary is deemed the owner of the income and losses of the trust for income tax purposes and must include such income and losses on his or her personal tax return.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

Joint trusts are also revocable living trusts, set up to hold all of the assets of a married couple and to provide access to the trust assets for both. Typically, at the first death, half of the assets receive a step-up in basis, but all of the assets stay in the trust.

Some of your financial assets need to be owned by your trust and others need to name your trust as the beneficiary. With your day-to-day checking and savings accounts, I always recommend that you own those accounts in the name of your trust.