Georgia Sample Letter regarding Cancellation of Deed of Trust: A Comprehensive Guide Introduction: A Georgia Sample Letter regarding Cancellation of Deed of Trust is a crucial legal document used to officially notify and request the termination of a Deed of Trust. It is typically sent by the borrower or property owner to the lender or trustee involved in the original Deed of Trust agreement. This letter serves as evidence of the borrower's intent to cancel the Deed of Trust and eliminates any legal obligations or liens on the property. There can be various types of Georgia Sample Letters regarding Cancellation of Deed of Trust, including: 1. Voluntary Cancellation Letter: This type of letter is used when the borrower has successfully paid off the loan and fulfilled all obligations mentioned in the Deed of Trust agreement. It states that the borrower is requesting the cancellation and release of the Deed of Trust due to the loan being fully satisfied. 2. Non-Judicial Foreclosure Cancellation Letter: In cases where foreclosure proceedings were initiated by the lender but later canceled or withdrawn, the borrower may need to send a Non-Judicial Foreclosure Cancellation Letter. This letter requests the removal of the Deed of Trust from the property's title, proving that the foreclosure process has been terminated. 3. Mistaken Deed of Trust Letter: If a Deed of Trust has been mistakenly recorded on a property by either the lender or the trustee, the property owner can use this letter to request the cancellation of the erroneous Deed of Trust. It highlights the error and seeks prompt rectification to avoid any negative implications for the property owner. 4. Satisfaction of Mortgage Letter: Although not strictly a Deed of Trust, a Satisfaction of Mortgage Letter is relevant to debt discharge. It is sent after a mortgage loan is fully paid off, acknowledging that the mortgage lien on the property has been released. While not specifically a Deed of Trust cancellation letter, it serves a similar purpose in providing proof of debt satisfaction. Key Elements of a Georgia Sample Letter regarding Cancellation of Deed of Trust: When drafting a Georgia Sample Letter regarding Cancellation of Deed of Trust, it is important to include specific information to make it effective and legally binding. Here are some essential elements to consider: 1. Contact Information: Include accurate contact details for both the borrower and the lender or trustee. This ensures that communications regarding the cancellation are directed to the correct parties involved. 2. Loan Information: Provide the relevant loan or mortgage account number, original loan amount, date of loan origination, and the property address. These details help identify the specific Deed of Trust associated with the cancellation request. 3. Request for Cancellation and Release: Clearly state the purpose of the letter, expressing the borrower's intent to cancel and release the Deed of Trust from the property's title. Emphasize that all obligations or liens related to the Deed of Trust have been fulfilled. 4. Supporting Documentation: Attach copies of essential documents, such as the original Deed of Trust, loan payoff statement, or any other relevant records that validate the borrower's claim for cancellation. 5. Notary Certification: Consider having the letter notarized to provide additional authenticity and legal weight to the cancellation request. This can vary depending on the specific requirements of Georgia state law. Conclusion: A Georgia Sample Letter regarding Cancellation of Deed of Trust is a vital tool for borrowers seeking to cancel a Deed of Trust. It ensures the elimination of any legal encumbrances on a property and provides proof of the borrower's intent to terminate the loan agreement. Whether it is a voluntary cancellation, foreclosure cancellation, mistaken Deed of Trust, or satisfaction of mortgage, understanding the various types of cancellation letters and including the aforementioned key elements will make the letter effective and legally sound. Seek legal advice if needed, ensuring compliance with Georgia state laws and regulations.

Georgia Sample Letter regarding Cancellation of Deed of Trust

Description

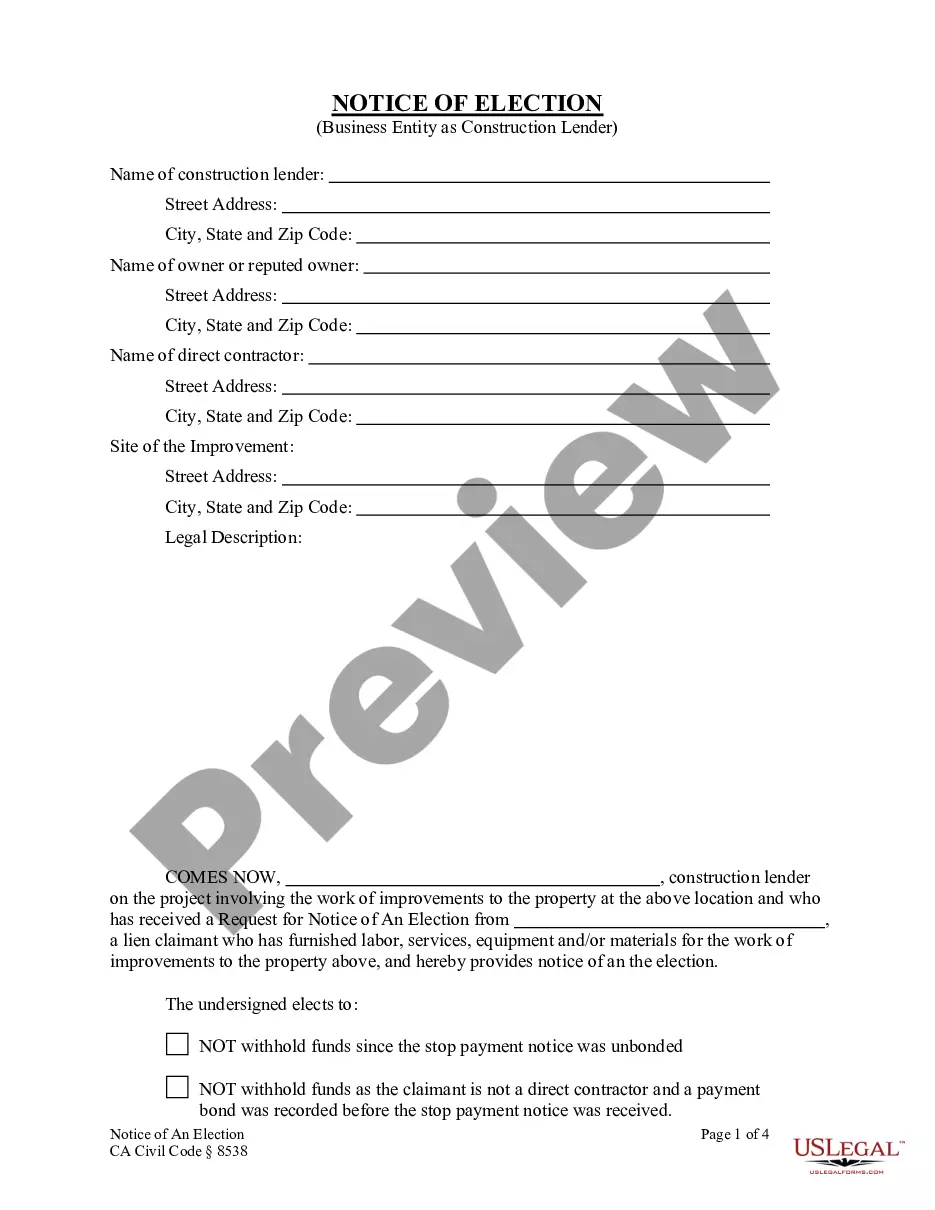

How to fill out Georgia Sample Letter Regarding Cancellation Of Deed Of Trust?

It is possible to spend hrs on the Internet trying to find the legitimate papers design that suits the state and federal specifications you will need. US Legal Forms supplies a huge number of legitimate types that are analyzed by pros. It is possible to acquire or print the Georgia Sample Letter regarding Cancellation of Deed of Trust from our assistance.

If you already have a US Legal Forms accounts, you can log in and click on the Obtain key. Afterward, you can total, change, print, or indication the Georgia Sample Letter regarding Cancellation of Deed of Trust. Every single legitimate papers design you acquire is your own property for a long time. To get an additional version for any bought develop, go to the My Forms tab and click on the related key.

If you work with the US Legal Forms web site for the first time, stick to the easy recommendations below:

- First, make certain you have selected the proper papers design to the state/town of your choosing. Read the develop outline to make sure you have selected the proper develop. If offered, use the Preview key to appear with the papers design too.

- If you want to find an additional version in the develop, use the Look for discipline to get the design that fits your needs and specifications.

- Once you have discovered the design you want, just click Purchase now to carry on.

- Select the prices program you want, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Full the financial transaction. You can utilize your Visa or Mastercard or PayPal accounts to cover the legitimate develop.

- Select the file format in the papers and acquire it to the system.

- Make adjustments to the papers if possible. It is possible to total, change and indication and print Georgia Sample Letter regarding Cancellation of Deed of Trust.

Obtain and print a huge number of papers templates utilizing the US Legal Forms site, which provides the greatest assortment of legitimate types. Use specialist and express-certain templates to tackle your organization or person needs.