Georgia Sample Letter for Payment to Reinstate Account

Description

How to fill out Sample Letter For Payment To Reinstate Account?

Choosing the best lawful file web template can be quite a have difficulties. Naturally, there are plenty of web templates accessible on the Internet, but how do you get the lawful kind you need? Make use of the US Legal Forms website. The assistance offers a large number of web templates, such as the Georgia Sample Letter for Payment to Reinstate Account, which you can use for organization and private requires. All of the kinds are examined by professionals and meet up with federal and state requirements.

When you are previously listed, log in to the profile and then click the Acquire option to get the Georgia Sample Letter for Payment to Reinstate Account. Make use of profile to check with the lawful kinds you possess bought formerly. Visit the My Forms tab of your profile and obtain yet another version of your file you need.

When you are a whole new user of US Legal Forms, listed below are simple guidelines for you to adhere to:

- Initially, make sure you have chosen the appropriate kind to your metropolis/county. You may check out the shape using the Preview option and read the shape description to ensure it is the best for you.

- If the kind does not meet up with your needs, make use of the Seach area to obtain the correct kind.

- Once you are positive that the shape is proper, click the Buy now option to get the kind.

- Pick the prices prepare you desire and enter the essential details. Build your profile and pay money for your order making use of your PayPal profile or Visa or Mastercard.

- Pick the document format and obtain the lawful file web template to the gadget.

- Total, modify and print and indicator the received Georgia Sample Letter for Payment to Reinstate Account.

US Legal Forms may be the greatest local library of lawful kinds in which you can find a variety of file web templates. Make use of the service to obtain appropriately-manufactured paperwork that adhere to state requirements.

Form popularity

FAQ

Write a paragraph or two briefly describing the problems and factors that led to your disqualification. Be honest and accept responsibility. Provide the committee with verification of illness or other circumstances that may have contributed to your academic difficulty.

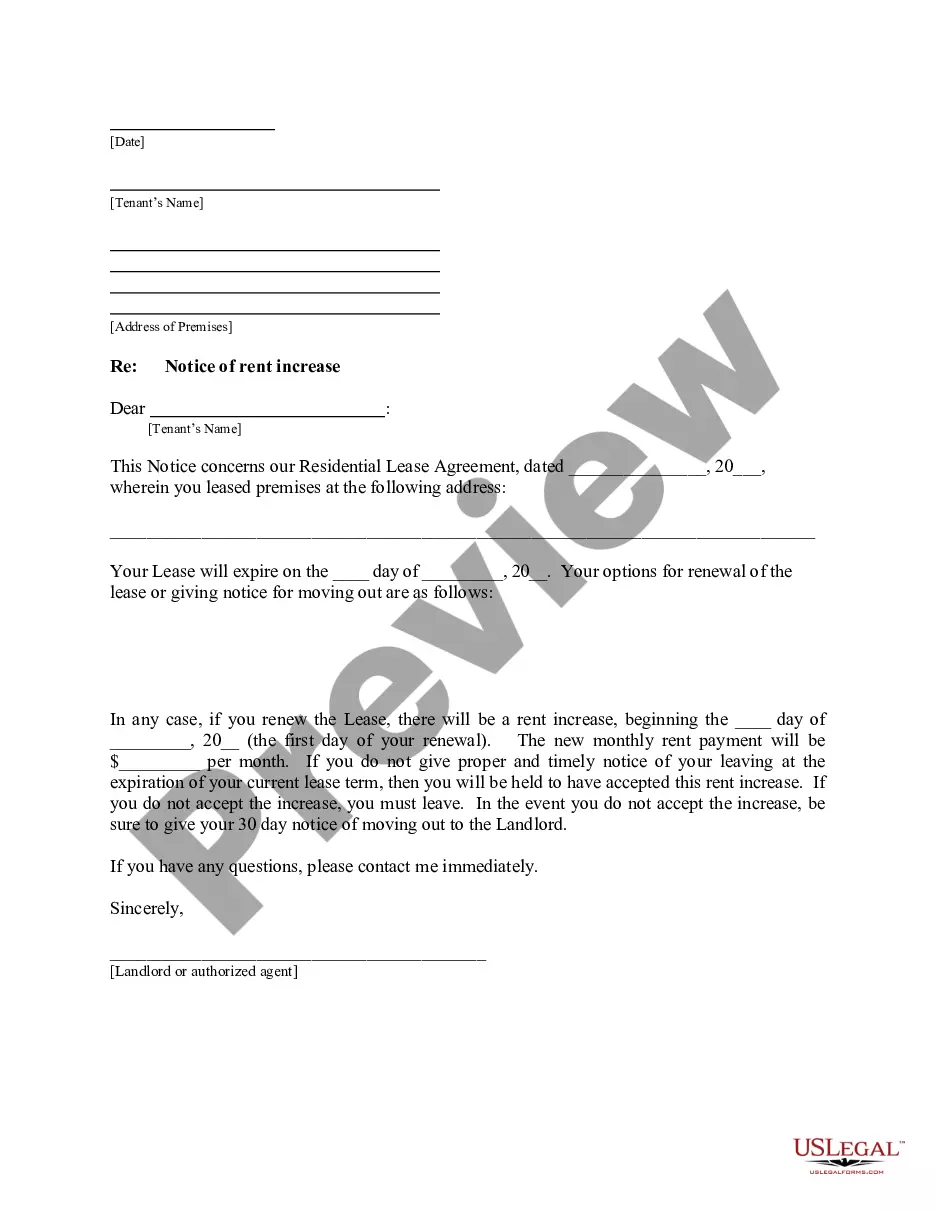

Content and Tone Opening Statement. The first sentence or two should state the purpose of the letter clearly. ... Be Factual. Include factual detail but avoid dramatizing the situation. ... Be Specific. ... Documentation. ... Stick to the Point. ... Do Not Try to Manipulate the Reader. ... How to Talk About Feelings. ... Be Brief.

What to include in an appeal letter Your professional contact information. A summary of the situation you're appealing. An explanation of why you feel the decision was incorrect. A request for the preferred solution you'd like to see enacted. Gratitude for considering your appeal. Supporting documents attached, if relevant.

How to write a reinstatement letter Know who you're writing to. Look at the current job openings. Research job openings at the organization. ... Start with a friendly introduction. State the reason for writing. ... Explain why they should hire you. ... Conclude with a call to action. ... Include your contact information.

How to reinstate registration. You can reinstate your canceled registration by submitting the following to your County Tag Office: Payment of all ad valorem taxes and registration fines. Acceptable proof of Georgia Motor Vehicle Liability Insurance Coverage.

Include a statement of how or why a denial of the reinstatement would cause extreme personal hardship to you. Include a statement about currently pursuing or intending to pursue a full course of study. Include your career and educational plan and goals.

List of Suspension & Fees SuspensionCost by MailCost in PersonNo Proof of Insurance (First Offense)$200.00$210.00No Proof of Insurance (Second/More)$300.00$310.00Points Violation (First Offense)$200.00$210.00Points Violation (Second Offense)$300.00$310.005 more rows

How to write a reinstatement letter Know who you're writing to. Look at the current job openings. Research job openings at the organization. ... Start with a friendly introduction. State the reason for writing. ... Explain why they should hire you. ... Conclude with a call to action. ... Include your contact information.