Title: Georgia Sample Letter for Review of Form 1210: A Comprehensive Guide Introduction: Form 1210 is an important document for Georgia residents, allowing them to request a review of their tax assessment. In this article, we will provide a detailed description of what Form 1210 in Georgia entails and its significance. We will also explore different types of sample letters that can be used when seeking a review of this form, including the various situations when they might be applicable. Content: 1. Understanding Form 1210 in Georgia: — Explanation of For1210s's purpose in the tax assessment process. — Detailed overview of the required information to be provided on the form. — Importance of accurate and complete details on Form 1210. 2. Key Elements of a Georgia Sample Letter for Review of Form 1210: — Addressing the appropriate authority— - Guidance on finding the correct recipient for the letter. — Clear identification of the taxpayer— - Steps to include personal and tax information for proper identification. — Supporting grounds for the review request: — How to build a compelling case by outlining specific reasons for the review. — Relevant documented evidence— - Suggestions on including supporting documents to strengthen the request. — Polite and professional tone— - Tips for maintaining professionalism and courtesy throughout the letter. 3. Sample Letter #1: Request for Review of Form 1210 — Incorrect Assessment— - Description of a scenario where the taxpayer received an inaccurate assessment. — Step-by-step breakdown of the letter's content to address the error. — Sample language to use while requesting a thorough review and correction. 4. Sample Letter #2: Request for Review of Form 1210 Over assessmentnt: - Illustration of a situation where the taxpayer believes they have been overcharged. — Detailed instructions for constructing the letter to challenge the assessment. — Sample wording emphasizing the need for a fair review and appropriate adjustment. 5. Sample Letter #3: Request for Review of Form 1210 — Unjust Penalty— - Explanation of a scenario where the taxpayer disagrees with a penalty imposed. — Suggestions on composing a persuasive letter to contest the penalty. — Sample text emphasizing reasonable cause and requesting penalty removal. Conclusion: With this comprehensive guide, taxpayers in Georgia can better understand the importance of Form 1210 and how to request a review using appropriate sample letters. Whether it's rectifying an incorrect assessment, challenging an over assessment, or contesting an unjust penalty, these sample letters provide a blueprint for effective communication with the tax authorities. Remember to tailor each letter to suit specific circumstances and always maintain a polite and professional tone.

Georgia Sample Letter for Review of Form 1210

Description

How to fill out Georgia Sample Letter For Review Of Form 1210?

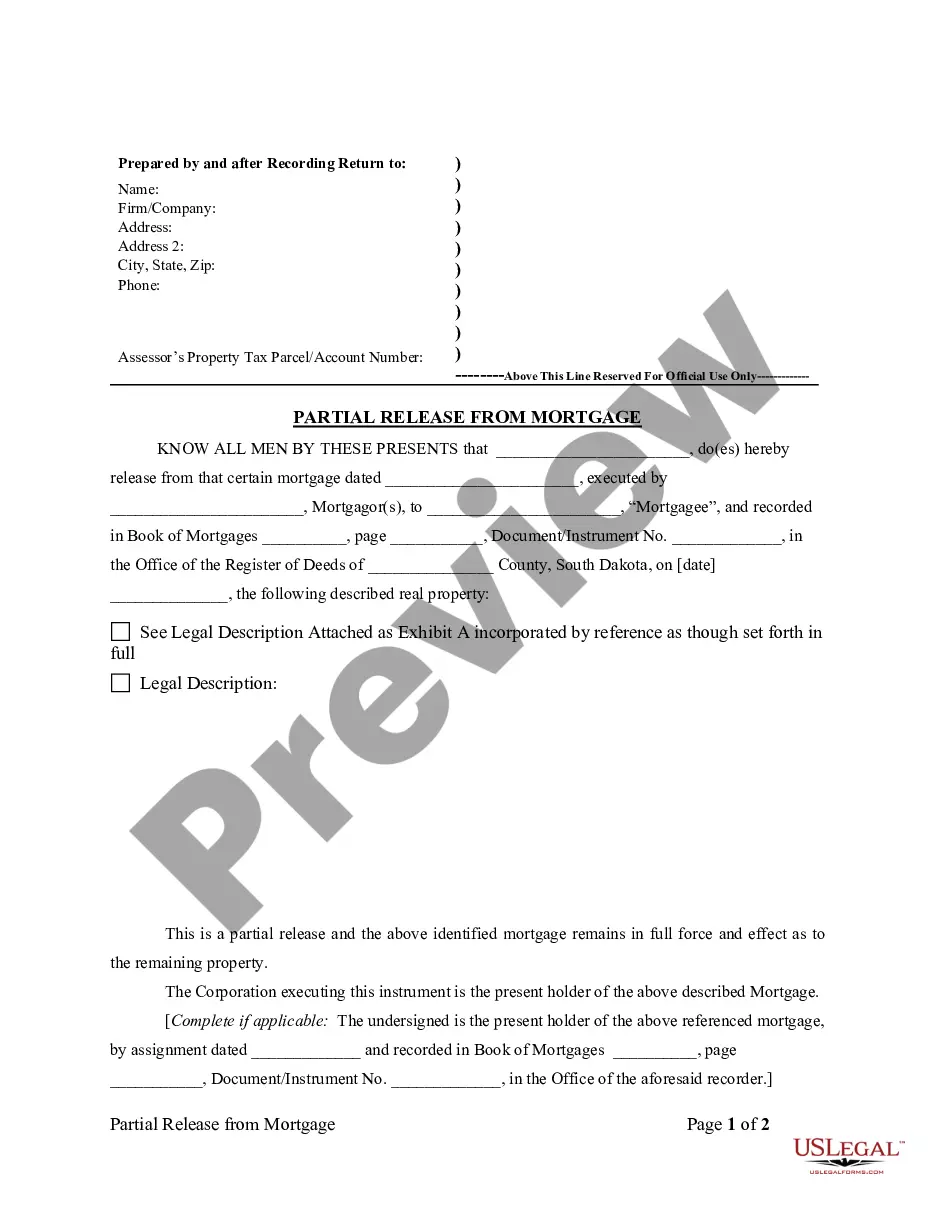

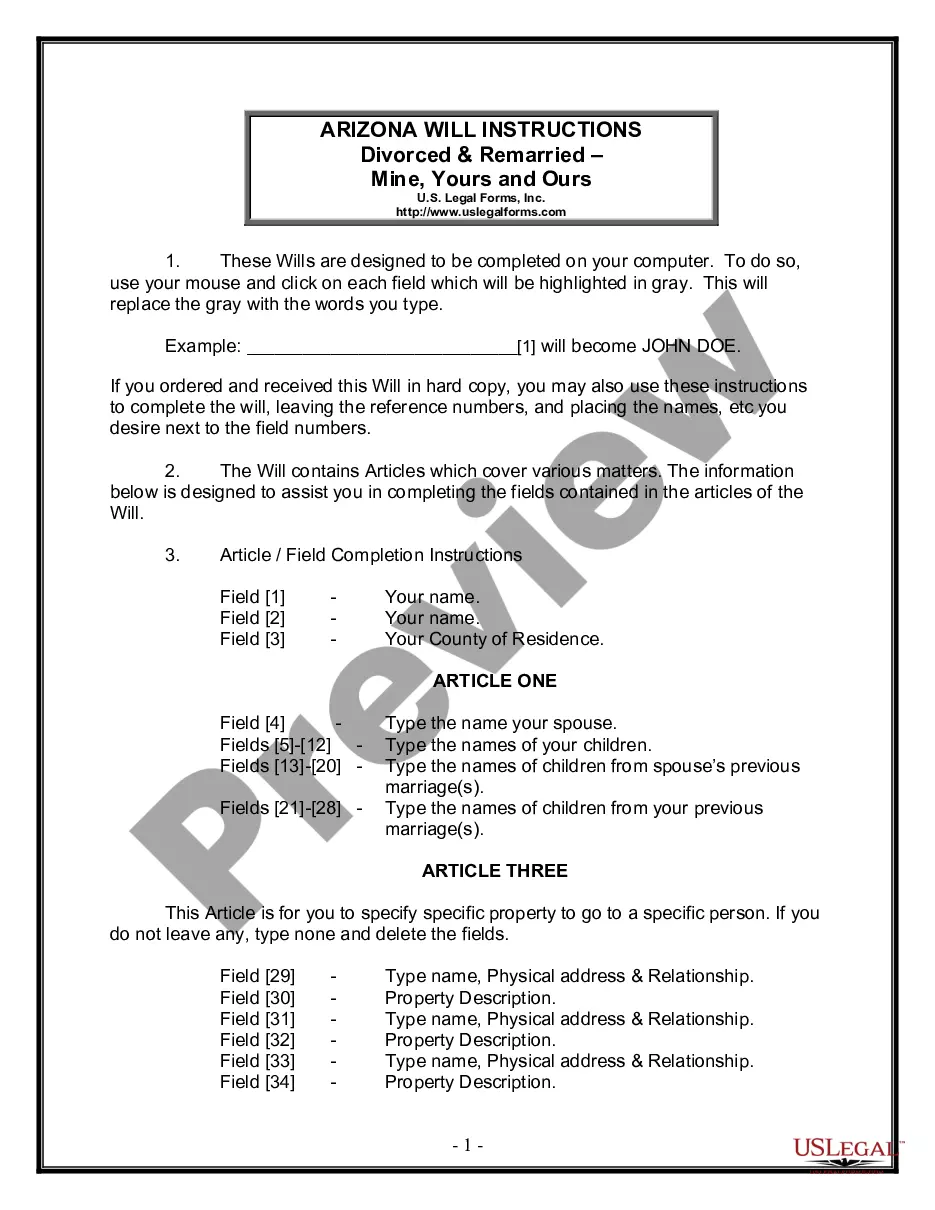

Choosing the right legitimate document template might be a have difficulties. Obviously, there are a variety of templates available on the net, but how do you get the legitimate kind you need? Use the US Legal Forms internet site. The service delivers a huge number of templates, including the Georgia Sample Letter for Review of Form 1210, which you can use for business and private demands. All of the forms are checked by professionals and meet federal and state needs.

Should you be already authorized, log in for your bank account and click the Acquire switch to have the Georgia Sample Letter for Review of Form 1210. Make use of your bank account to appear through the legitimate forms you may have acquired previously. Visit the My Forms tab of your own bank account and acquire another copy of your document you need.

Should you be a fresh user of US Legal Forms, allow me to share basic instructions that you can follow:

- First, make sure you have chosen the proper kind for your metropolis/county. You can check out the form utilizing the Review switch and read the form description to make sure it is the right one for you.

- In case the kind will not meet your requirements, use the Seach field to obtain the right kind.

- Once you are certain that the form would work, click on the Buy now switch to have the kind.

- Select the pricing prepare you need and enter the necessary information and facts. Design your bank account and purchase an order utilizing your PayPal bank account or Visa or Mastercard.

- Pick the document format and down load the legitimate document template for your product.

- Total, change and print out and indication the obtained Georgia Sample Letter for Review of Form 1210.

US Legal Forms is definitely the most significant catalogue of legitimate forms that you can find a variety of document templates. Use the company to down load expertly-manufactured paperwork that follow express needs.