Georgia Bond to Secure against Defects in Construction is a type of surety bond required by the state of Georgia to ensure that construction projects are completed without any defects or faults. This bond acts as a form of protection for the property owner or developer, guaranteeing that the contractor will rectify any defects or deficiencies in the construction project. Keywords: Georgia bond, secure against defects, construction, surety bond, protection, property owner, developer, contractor, rectify, deficiencies. There are different types of Georgia Bond to Secure against Defects in Construction, including: 1. Performance Bond: This type of bond guarantees that the contractor will complete the construction project according to the agreed-upon terms, specifications, and timeframe, without any defects or faults. It provides financial compensation to the property owner if the contractor fails to fulfill their obligations. 2. Maintenance Bond: Once the construction project is completed, a maintenance bond may be required to secure against any defects that may arise during the warranty period. It ensures that the contractor will rectify any issues that occur within a specified timeframe after the project's completion. 3. Payment Bond: This bond protects subcontractors, suppliers, and laborers involved in the construction project. It guarantees that they will be paid for their services and materials, even if the contractor fails to make the necessary payments. 4. Subdivision Bond: In the case of large-scale developments or subdivisions, this bond may be required to ensure that the developer complies with all rules and regulations regarding infrastructure, roadways, utilities, and other necessary improvements. It aims to protect the future homeowners and the municipality. 5. Bid Bond: Before commencing a construction project, contractors may be required to submit a bid bond. This bond ensures that the contractor will enter into a contract if their bid is accepted and that they will provide performance and payment bonds if awarded the project. In summary, Georgia Bond to Secure against Defects in Construction ensures that construction projects in Georgia are carried out smoothly and without any defects or faults. These bonds provide protection to property owners, developers, subcontractors, and laborers, guaranteeing that the contractor fulfills their obligations and rectifies any deficiencies. Various types of bonds, including performance bonds, maintenance bonds, payment bonds, subdivision bonds, and bid bonds, cater to different aspects of construction projects to provide comprehensive security and assurance.

Georgia Bond to Secure against Defects in Construction

Description

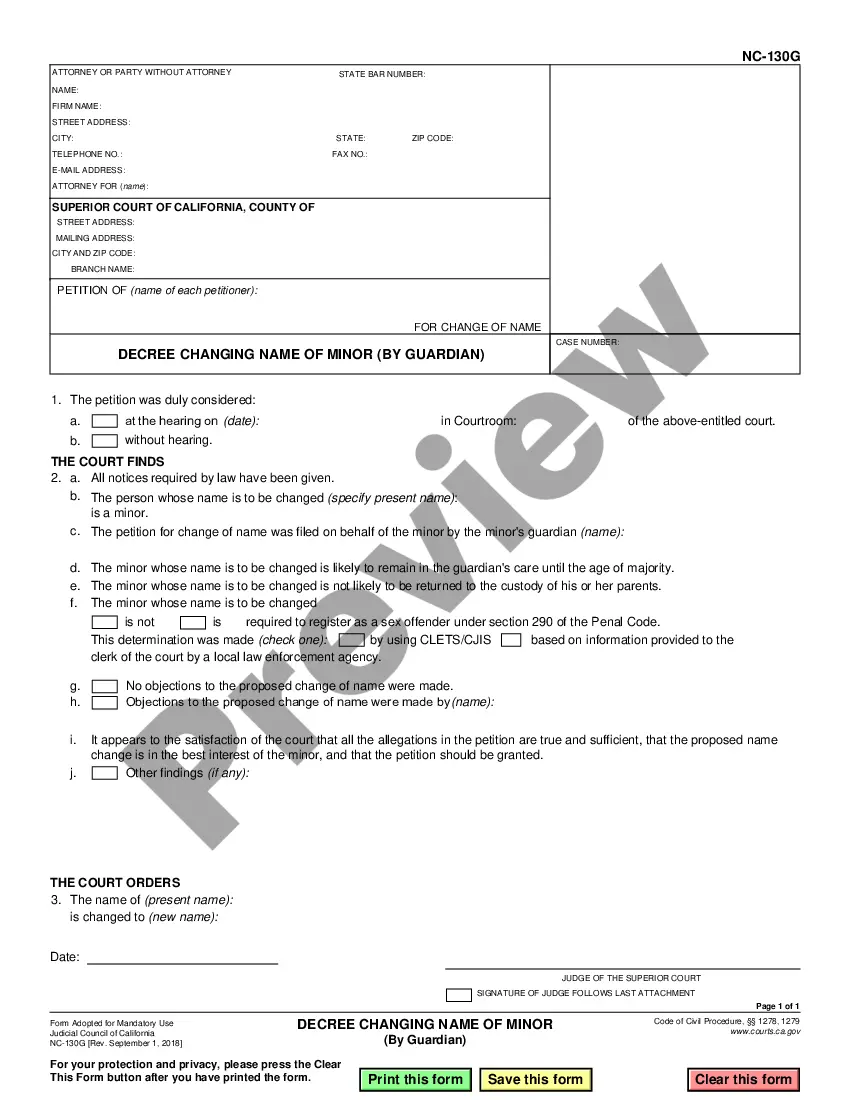

How to fill out Georgia Bond To Secure Against Defects In Construction?

You are able to devote hrs on-line searching for the authorized record format which fits the federal and state demands you need. US Legal Forms provides thousands of authorized kinds that are reviewed by specialists. You can easily down load or print out the Georgia Bond to Secure against Defects in Construction from your support.

If you already possess a US Legal Forms accounts, you may log in and click on the Down load key. After that, you may complete, change, print out, or indicator the Georgia Bond to Secure against Defects in Construction. Each authorized record format you buy is your own property permanently. To get yet another copy associated with a purchased kind, proceed to the My Forms tab and click on the related key.

If you are using the US Legal Forms web site the first time, adhere to the simple recommendations listed below:

- Initial, make certain you have selected the correct record format for the county/town of your choosing. Read the kind information to ensure you have picked out the proper kind. If offered, utilize the Review key to look with the record format too.

- In order to get yet another variation of the kind, utilize the Lookup area to get the format that suits you and demands.

- When you have located the format you need, click on Acquire now to move forward.

- Select the prices prepare you need, type your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal accounts to purchase the authorized kind.

- Select the format of the record and down load it to your system.

- Make alterations to your record if possible. You are able to complete, change and indicator and print out Georgia Bond to Secure against Defects in Construction.

Down load and print out thousands of record web templates while using US Legal Forms site, that offers the greatest variety of authorized kinds. Use specialist and condition-certain web templates to take on your small business or individual requires.

Form popularity

FAQ

A performance bond is a financial guarantee to one party in a contract against the failure of the other party to meet its obligations. It is also referred to as a contract bond. A performance bond is usually provided by a bank or an insurance company to make sure a contractor completes designated projects.

Statute of Repose for Construction Defect Claims in Georgia The statute of repose provides that all construction defect-type claims, however characterized (whether as negligent construction, fraud, breach of fiduciary duty, or indemnity), must be asserted no later than eight years after substantial completion.

Construction bonds, also known as contract bonds, are a type of surety bond that guarantees the payment, performance, or bid of a project. It ensures that the contract will be completed to the standards specified in the initial agreement when the bid is won.

?The main purpose of a construction bond is to provide the security, or guarantee, to the owner that the project he instructs the contractor to build will be completed in the case of failure or bankruptcy of the contractor's company,? says Robbert.

The major types of surety bonds are contractor license bonds, bid bonds, performance or contract bonds, and payment bonds. These bonds provide protection for the project owner and for taxpayers or investors in private projects. Usually, a project requires a trio of bid, performance, and payment bonds.

The most common types of bonds required for federal construction projects are performance bonds, payment bonds, bid bonds, and supply bonds. Performance bonds. ... Payment bonds. ... Bid bonds. ... Supply bonds.

Seven Different Types Of Construction Bonds Bid Bonds. Bid bonds are set in place to ensure that contractors will submit serious bid proposals. ... Payment Bonds. ... Performance Bonds. ... Maintenance Bonds. ... Supply Bonds. ... Site Improvement Bonds. ... Subdivision Bonds.

When a contractor fails to abide by any of the conditions of the contract, the surety and contractor are both held liable. The three main types of construction bonds are bid, performance, and payment.