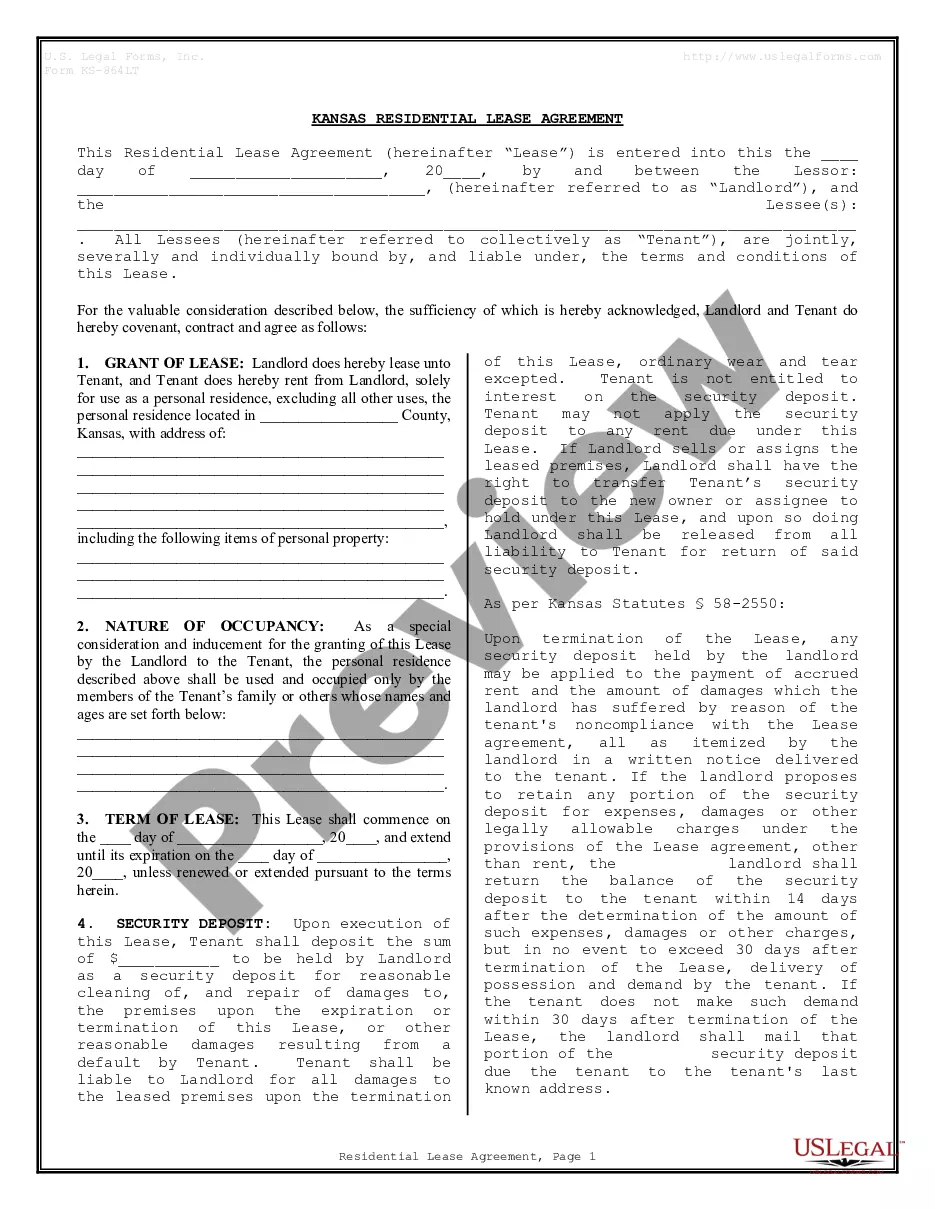

Georgia Affiliate Letter in Rule 145 Transaction is a legal document that plays a crucial role in corporate transactions involving the merger, consolidation, or reclassification of securities in the state of Georgia. This letter is one of the requirements outlined by the Securities and Exchange Commission (SEC) under Rule 145, which provides guidelines for these types of transactions. In a Rule 145 Transaction, a Georgia Affiliate Letter is a written statement provided by a Georgia affiliate of the parent company involved in the merger, consolidation, or reclassification of securities. This letter serves as an acknowledgment and confirmation from the Georgia affiliate that they have received adequate and accurate information regarding the transaction, that they understand the terms and implications, and that they approve of it. The Georgia Affiliate Letter in Rule 145 Transaction is important as it ensures compliance with regulatory requirements and helps protect the interests of shareholders and stakeholders. It provides documentation of the Georgia affiliate's consent and affirmation, establishing the legality and validity of the transaction. There are two types of Georgia Affiliate Letters in Rule 145 Transactions: 1. Affiliate Consent Letter: This letter is provided by the Georgia affiliate to express their consent and approval of the transaction. It confirms that the affiliate has carefully reviewed the transaction details, financial implications, and potential risks associated with the transaction. 2. Disclosure Letter: This type of Georgia Affiliate Letter in Rule 145 Transaction focuses on providing detailed information about the affiliate's relationship with the parent company, any ownership interests, potential conflicts of interest, and other relevant details necessary for compliance with SEC regulations. These types of Georgia Affiliate Letters are specific to Rule 145 Transactions in Georgia and are essential for ensuring transparency, compliance, and legal validity in corporate transactions. They help protect the rights of shareholders, maintain good corporate governance practices, and mitigate any potential risks or disputes that may arise during or after the completion of the transaction.

Georgia Affiliate Letter in Rule 145 Transaction

Description

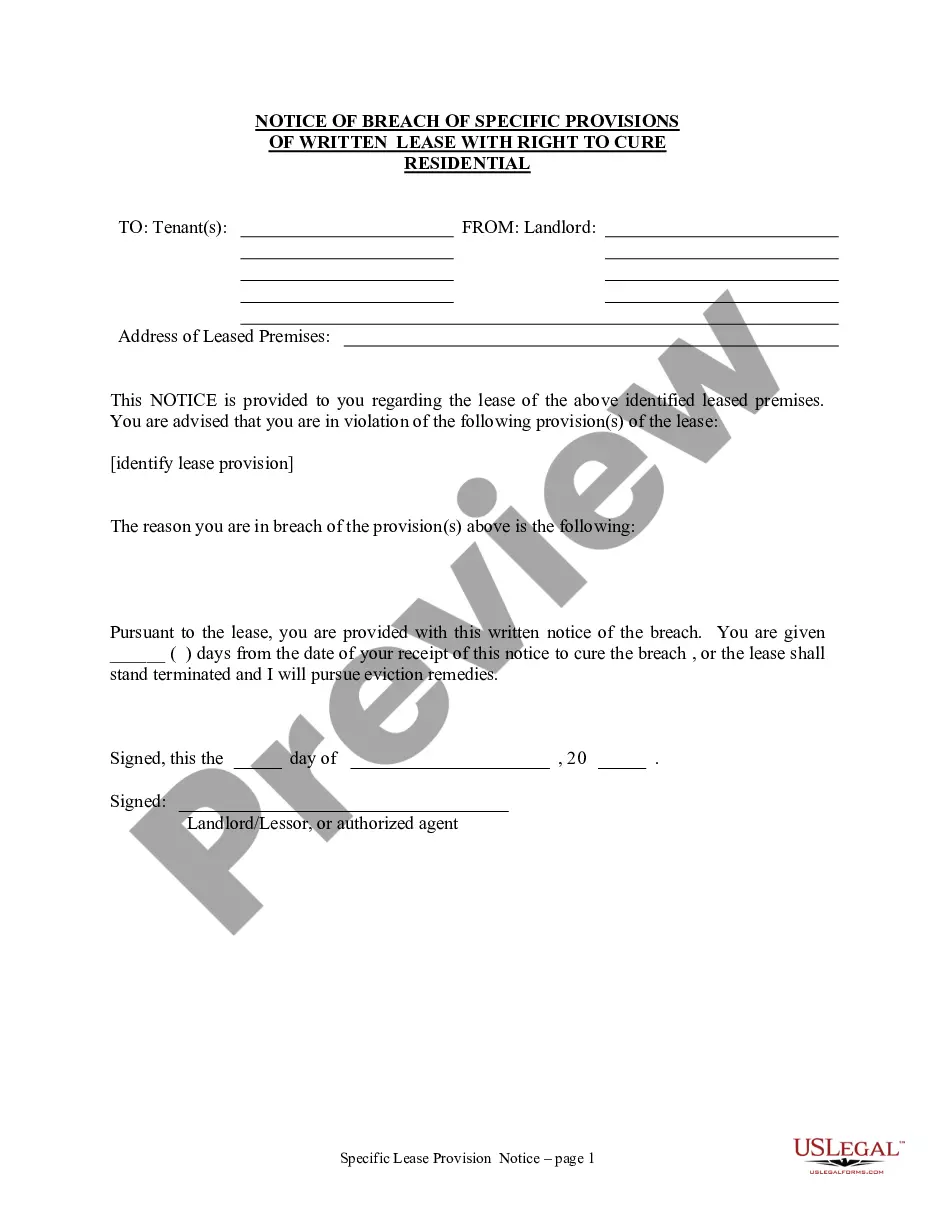

How to fill out Georgia Affiliate Letter In Rule 145 Transaction?

If you wish to total, down load, or printing legal record layouts, use US Legal Forms, the greatest selection of legal kinds, that can be found on the Internet. Utilize the site`s basic and convenient search to get the files you will need. Different layouts for company and personal purposes are sorted by groups and claims, or search phrases. Use US Legal Forms to get the Georgia Affiliate Letter in Rule 145 Transaction in a handful of click throughs.

When you are currently a US Legal Forms buyer, log in to your account and click on the Acquire switch to have the Georgia Affiliate Letter in Rule 145 Transaction. Also you can accessibility kinds you earlier delivered electronically in the My Forms tab of your account.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have selected the shape for your correct area/country.

- Step 2. Make use of the Preview option to look through the form`s content material. Don`t overlook to read the explanation.

- Step 3. When you are not satisfied using the form, take advantage of the Search area on top of the display screen to find other variations in the legal form format.

- Step 4. When you have located the shape you will need, select the Buy now switch. Opt for the pricing program you like and put your accreditations to sign up for the account.

- Step 5. Approach the deal. You can utilize your charge card or PayPal account to perform the deal.

- Step 6. Choose the formatting in the legal form and down load it on your own system.

- Step 7. Comprehensive, edit and printing or indicator the Georgia Affiliate Letter in Rule 145 Transaction.

Each and every legal record format you purchase is the one you have eternally. You might have acces to every form you delivered electronically inside your acccount. Click on the My Forms area and choose a form to printing or down load once more.

Remain competitive and down load, and printing the Georgia Affiliate Letter in Rule 145 Transaction with US Legal Forms. There are millions of specialist and state-particular kinds you can use for the company or personal requirements.

Form popularity

FAQ

The Commission raised the Form 144 filing thresholds so that affiliates must file Form 144 if their proposed sales in reliance on Rule 144 within a three-month period exceed 5,000 shares or $50,000. Non-affiliates no longer need to file Form 144.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.

For purposes of this calculation, the Company does not currently consider any of its shareholders who are not directors or executive officers of the Company, including any such shareholders owning 10% or more of the Company's common stock, to be affiliates of the Company.

Rule 145 is an SEC rule that allows companies to sell certain securities without first having to register the securities with the SEC. This specifically refers to stocks that an investor has received because of a merger, acquisition, or reclassification.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.

An affiliated person is someone in a position to influence the actions of a corporation. This includes directors, officers, and certain shareholders. Depending on the context, an affiliated person might be referred to simply as an "affiliate." Affiliated persons may also be called control persons or insiders.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.