The Georgia Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee is a unique insurance arrangement that combines the efforts of both the employer and employee to provide essential coverage. This type of split-dollar insurance is highly popular among businesses and individuals in Georgia, offering numerous benefits. In such an agreement, the employer and employee jointly own a life insurance policy. This policy serves as a contract between the two parties and outlines the terms and conditions for the split-dollar arrangement. The primary purpose of this agreement is to provide life insurance protection to the employee, while also enabling tax advantages for both parties involved. Under the Georgia Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee, there are various types available, depending on the specific needs and preferences of the involved parties. These may include: 1. Traditional Split-Dollar Agreement: This is the most common type, where the employer pays the policy premiums and is entitled to recover the premiums paid upon the death of the insured employee. The employee may also receive some death benefit proceeds. 2. Endorsement Split-Dollar Agreement: In this agreement, the employer pays the policy premiums and is usually the sole recipient of the cash surrender value of the policy. Upon the insured employee's death, the employee's designated beneficiaries receive the death benefit proceeds. 3. Collateral Assignment Split-Dollar Agreement: Here, the employer provides a loan to the employee to cover the payment of the policy premiums. The employer is repaid from the policy's cash surrender value and may also be entitled to a portion of the death benefit proceeds. 4. Equity Split-Dollar Agreement: This type of agreement is designed to allow the employee to build equity in the life insurance policy over time. The employee may receive a portion of the policy's cash surrender value or the death benefit proceeds, depending on the terms specified in the contract. Regardless of the specific type of Georgia Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee, these arrangements offer several advantages. They allow employers to provide key benefits to their employees, such as life insurance protection, while also offering potential tax benefits. The employee benefits from customized insurance coverage, potential access to cash values, and potential tax advantages as well. Before entering into any split-dollar insurance agreement, it is essential for employers and employees in Georgia to seek professional advice from insurance experts or legal advisors. This ensures that the agreement is set up properly, aligns with legal requirements, maximizes tax advantages, and meets the specific needs and objectives of both parties involved.

Georgia Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee

Description

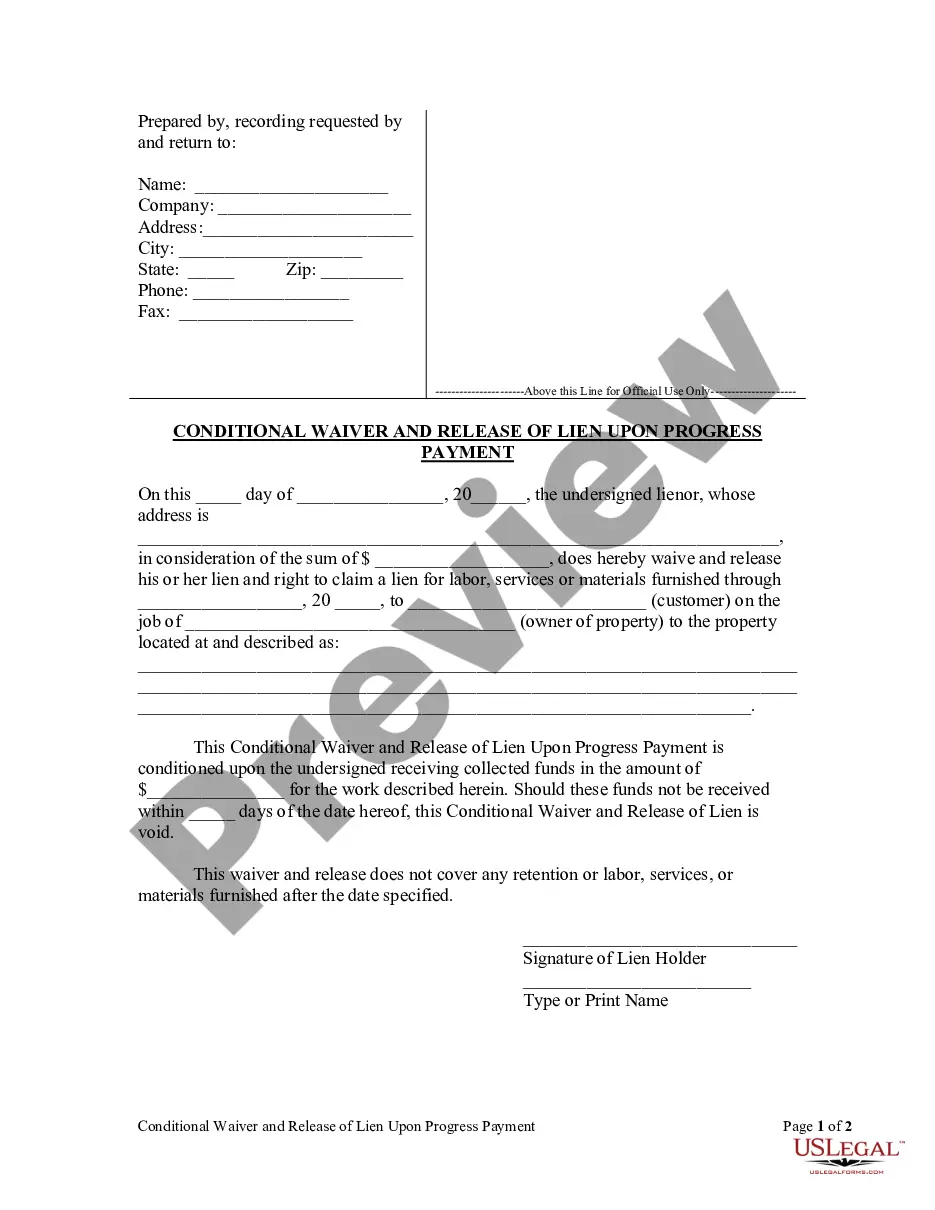

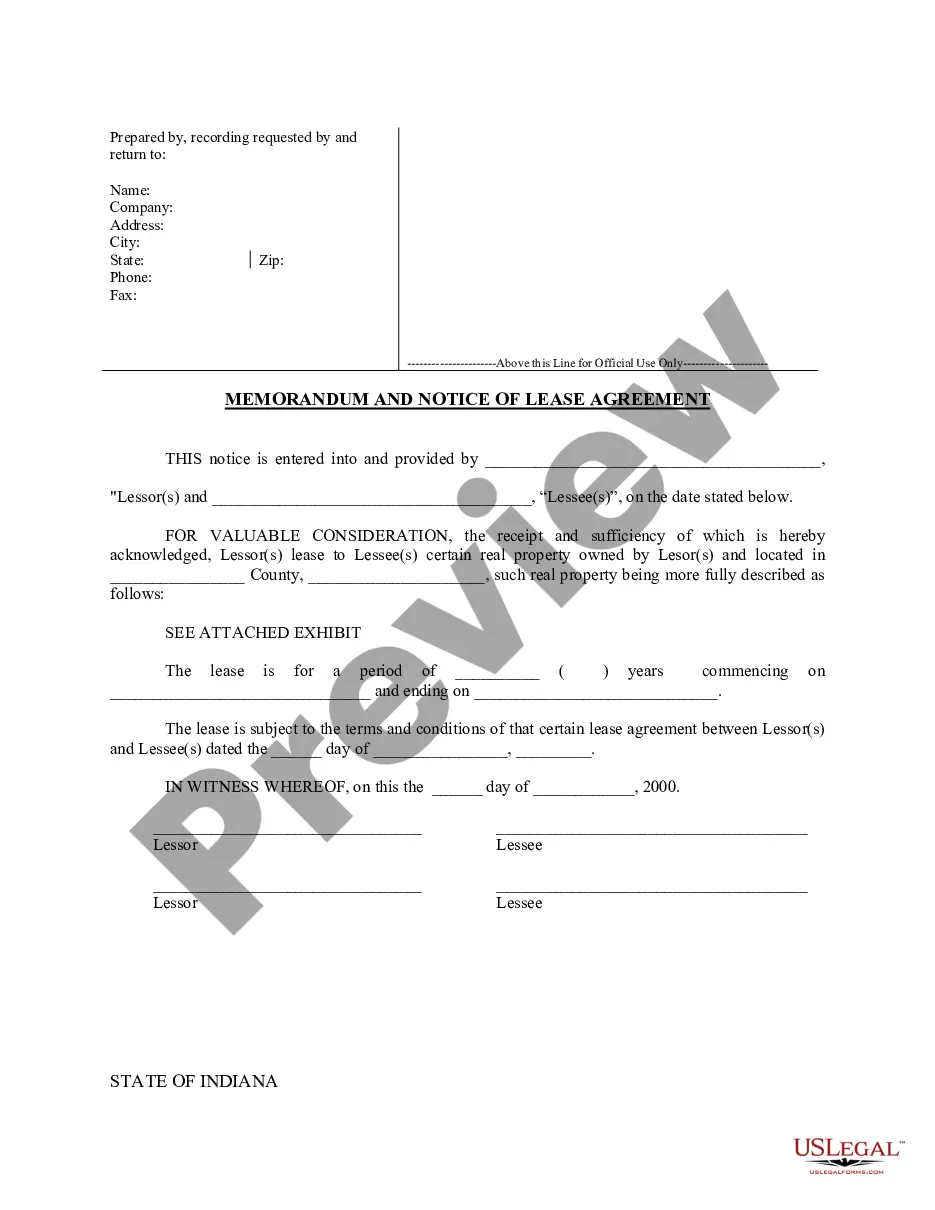

How to fill out Georgia Split-Dollar Insurance Agreement With Policy Owned Jointly By Employer And Employee?

Are you currently within a situation where you require documents for sometimes business or specific reasons nearly every day time? There are a variety of legal record templates available on the net, but locating kinds you can rely is not effortless. US Legal Forms delivers a huge number of form templates, like the Georgia Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee, that are written in order to meet federal and state needs.

When you are previously knowledgeable about US Legal Forms site and also have your account, basically log in. After that, you are able to obtain the Georgia Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee template.

Should you not come with an profile and need to begin to use US Legal Forms, adopt these measures:

- Get the form you will need and make sure it is to the appropriate area/state.

- Take advantage of the Review button to analyze the shape.

- Browse the outline to actually have chosen the proper form.

- In case the form is not what you are seeking, use the Look for area to find the form that suits you and needs.

- Whenever you find the appropriate form, click Get now.

- Opt for the prices prepare you need, submit the necessary info to create your bank account, and pay for your order using your PayPal or Visa or Mastercard.

- Choose a convenient paper structure and obtain your duplicate.

Locate every one of the record templates you might have purchased in the My Forms food selection. You can get a additional duplicate of Georgia Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee at any time, if necessary. Just click on the needed form to obtain or print the record template.

Use US Legal Forms, by far the most comprehensive assortment of legal types, in order to save time as well as steer clear of errors. The services delivers appropriately created legal record templates that you can use for a variety of reasons. Generate your account on US Legal Forms and begin creating your lifestyle easier.

Form popularity

FAQ

Having two or more policies instead of one is called splitting of an insurance policy. If you are very particular about buying split policies, you may buy a normal term cover for 30 years or until retirement and buy another coverage that will cover you for life.

Reverse Split Dollar is an arrangement in which an employee owns a life insurance policy on her own life and endorses death benefit to her employer. How it works during life.

Split-dollar life insurance can be a mutually beneficial arrangement for employers and employees, with each party gaining different advantages. For example, employees receive quality life insurance for little cost and may be able to access tax-efficient income through withdrawals or loans.

Capital Split Dollar is a ?Safe Harbor? tax deductible plan for funding retirement benefits, buyouts and estate liquidity. It uses bank financing to fund a Loan Regime Split Dollar Policy for an S-Corp or LLC.

dollar life insurance agreement (or ?splitdollar plan?) is a strategy generally used as an employer benefit or for estate planning involving life insurance. It's an agreement between two or more parties to share the ownership, costs, and benefits of a permanent life insurance policy, like whole life.

Split-limit car insurance is defined as a policy that divides liability coverage into three separate limits for bodily injury per person, bodily injury per accident, and property damage per accident. Insurance companies often write these limits as three separate numbers.

Split-dollar life insurance is an agreement where two parties ? an employer and an employee ? agree to split the benefits, and sometimes the costs, of a life insurance policy. The employer pays the life insurance premium, in whole or in part, on a cash value life insurance policy purchased on the life of the employee.

Yes, you can designate multiple beneficiaries when you purchase your life insurance policy. When doing so, you will assign each beneficiary a percentage of the death benefit. For example, you could name your two children as equal beneficiaries with 50% allocated to each.