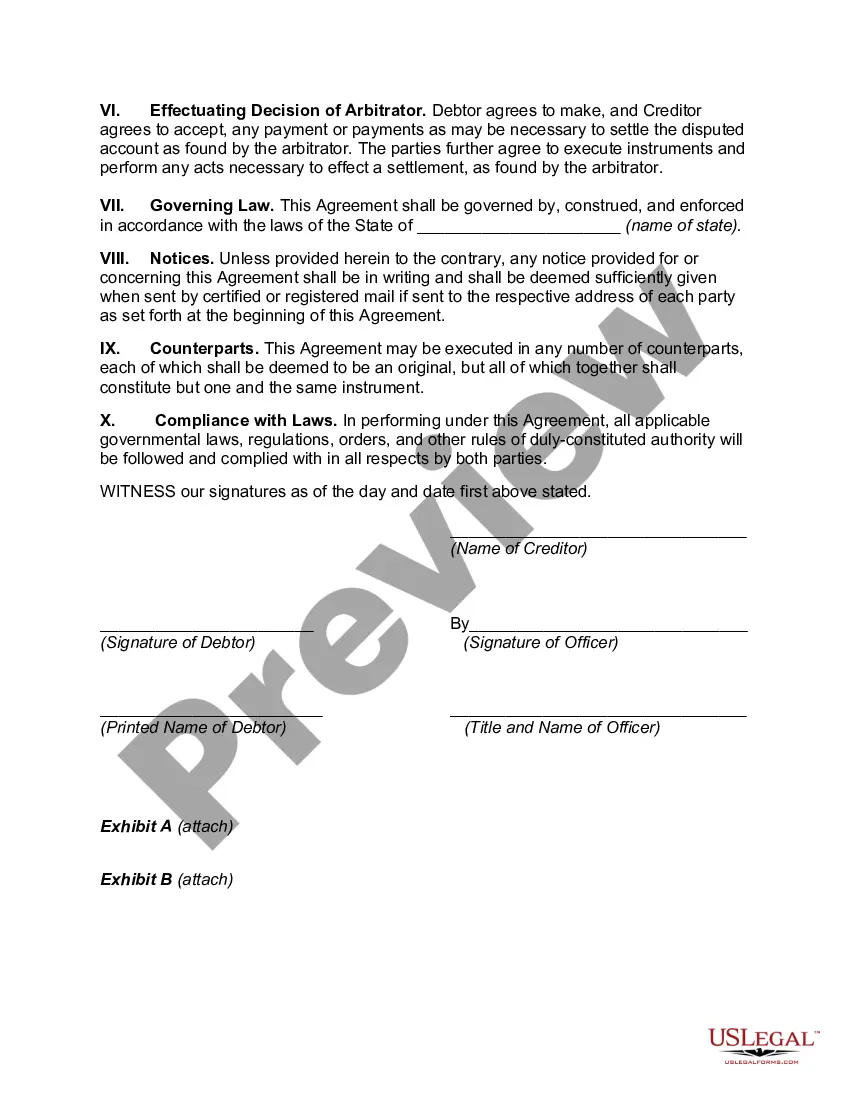

The Georgia Agreement to Arbitrate Disputed Open Account is a legally binding document that outlines the terms and conditions for resolving disputes related to open accounts through arbitration in the state of Georgia. This agreement is designed to provide a fair and efficient method of resolving conflicts between parties involved in open account transactions. Open accounts refer to credit arrangements where one party extends credit to another on a continuing basis, allowing for a flexible and ongoing relationship. These accounts are common in various sectors, such as business-to-business transactions, retail sales, and financial services. The Georgia Agreement to Arbitrate Disputed Open Account typically includes several key elements. Firstly, it outlines the intention of both parties to resolve any disputes arising out of the open account through arbitration rather than going to court. Arbitration is an alternative dispute resolution process that involves the submission of the dispute to one or more neutral arbitrators, whose decision is binding on the parties involved. The agreement specifies the rules and procedures that will govern the arbitration process. It may refer to specific arbitration institutions, such as the American Arbitration Association (AAA) or the International Chamber of Commerce (ICC), which offer standardized rules and guidelines for conducting arbitration. Alternatively, the agreement may establish its own rules and procedures for the arbitration process. Additionally, the Georgia Agreement to Arbitrate Disputed Open Account may include provisions related to the selection of arbitrators. It may specify whether the parties will appoint a single arbitrator or a panel of arbitrators, and outline the qualifications and requirements for the arbitrators. The agreement may also establish a process for appointing arbitrators in case of disagreement or unavailability. Furthermore, the agreement may address the costs of arbitration, including the fees for the arbitrators' services and any administrative expenses. It may allocate these costs between the parties in a fair and reasonable manner, ensuring that both parties contribute proportionally to the arbitration process. In terms of different types of Georgia Agreements to Arbitrate Disputed Open Account, they can vary depending on the specific industry, nature of the business relationship, and parties involved. For example, there might be specific agreements tailored for the construction industry, healthcare sector, or e-commerce businesses. These agreements may incorporate industry-specific terms and conditions while following the general principles of open account arbitration in Georgia. In conclusion, the Georgia Agreement to Arbitrate Disputed Open Account is a critical legal document that facilitates the resolution of disputes related to open account transactions. By voluntarily agreeing to arbitrate rather than litigate, parties can potentially save time, minimize costs, and maintain a more amicable business relationship. However, it is essential for parties to carefully review and understand the terms of the agreement to ensure that their rights and interests are adequately protected throughout the arbitration process.

Georgia Agreement to Arbitrate Disputed Open Account

Description

How to fill out Georgia Agreement To Arbitrate Disputed Open Account?

You can invest time on-line attempting to find the authorized document web template that fits the federal and state requirements you will need. US Legal Forms offers a large number of authorized types that are examined by experts. It is simple to acquire or print the Georgia Agreement to Arbitrate Disputed Open Account from the service.

If you currently have a US Legal Forms accounts, you can log in and click the Download option. After that, you can comprehensive, edit, print, or indication the Georgia Agreement to Arbitrate Disputed Open Account. Each authorized document web template you buy is your own property eternally. To get one more version of any obtained form, check out the My Forms tab and click the related option.

If you are using the US Legal Forms internet site for the first time, keep to the easy instructions beneath:

- Initially, make certain you have selected the correct document web template for the region/city of your liking. Read the form information to ensure you have selected the proper form. If available, take advantage of the Review option to appear with the document web template at the same time.

- If you would like get one more version in the form, take advantage of the Lookup field to find the web template that meets your requirements and requirements.

- Once you have located the web template you need, click on Buy now to carry on.

- Find the prices plan you need, type your references, and register for an account on US Legal Forms.

- Complete the deal. You can use your charge card or PayPal accounts to pay for the authorized form.

- Find the file format in the document and acquire it for your device.

- Make modifications for your document if possible. You can comprehensive, edit and indication and print Georgia Agreement to Arbitrate Disputed Open Account.

Download and print a large number of document templates using the US Legal Forms Internet site, which offers the greatest selection of authorized types. Use specialist and condition-distinct templates to tackle your business or specific demands.

Form popularity

FAQ

A mandatory arbitration agreement should identify the rules, procedures, and evidentiary guidelines to be applied. Many agreements opt for a particular forum's rules and procedures. If there are any rules that the parties want to opt out of (e.g., a limitation on discovery), state as much in the arbitration agreement.

The agreement must fulfil all the essentials of a valid contract as provided under section 10 of the Indian Contract Act, 1872. The parties must be major, of sound mind, not disqualified by law, with free consent, and for lawful object and consideration.

As to the requirements, an arbitration agreement must:sufficiently specify the parties (they must at least be. determinable);sufficiently specify the subject matter of the dispute in.sufficiently specify the parties' intent to have the.be contained either in a written document signed by the.

Arbitrationan introduction to the key features of arbitrationParty autonomy and procedural flexibility.Choice of seat or forum.Choice of decision makersthe arbitral tribunal.Privity and joinder.Separability of the arbitration agreement.Confidentiality and privacy in arbitration.More items...

10 essential elements for effective arbitration agreementsGoverning Law of the Arbitration Agreement.Existence of a Contract.Consideration.Mutuality.Class-Action Waiver.Opt-out Provision.Employees' Rights Under the Law.Waiver of Jury Trial.More items...?

The parties may also wish to stipulate in the arbitration clause:the law governing the contract;the number of arbitrators;the place of arbitration; and/or.the language of the arbitration.

"Arbitration agreement" is an agreement by the parties to submit to arbitration all or certain disputes which have arisen or which may arise between them in respect of a defined legal relationship, whether contractual or not.

Arbitration agreements under the Federal Arbitration Act need to be written, but not necessarily signed.

First, any valid arbitration agreement must reflect the conscious, mutual and free will of the parties to resort to arbitration and not to other means of dispute resolution, including State courts. The consent of both parties to submit their dispute to arbitration is the cornerstone of arbitration.

Top 10 tips for drafting arbitration agreementsIntroduction.Scope of the arbitration agreement.Seat of the arbitration.Governing law of the arbitration agreement.Choice of rules.Language.Number and appointment of arbitrators.Specifying arbitrator characteristics.More items...