Georgia Breakdown of Savings for Budget and Emergency Fund

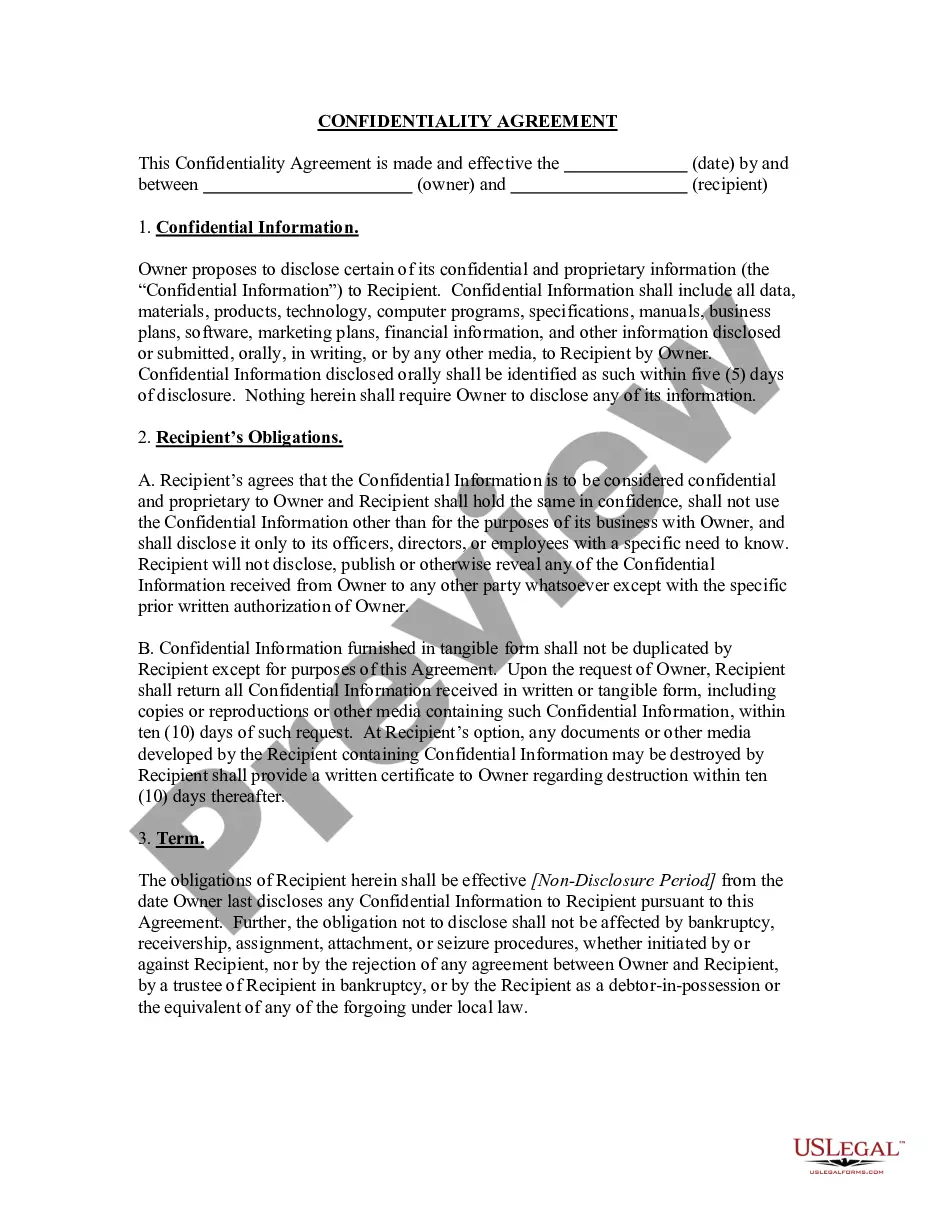

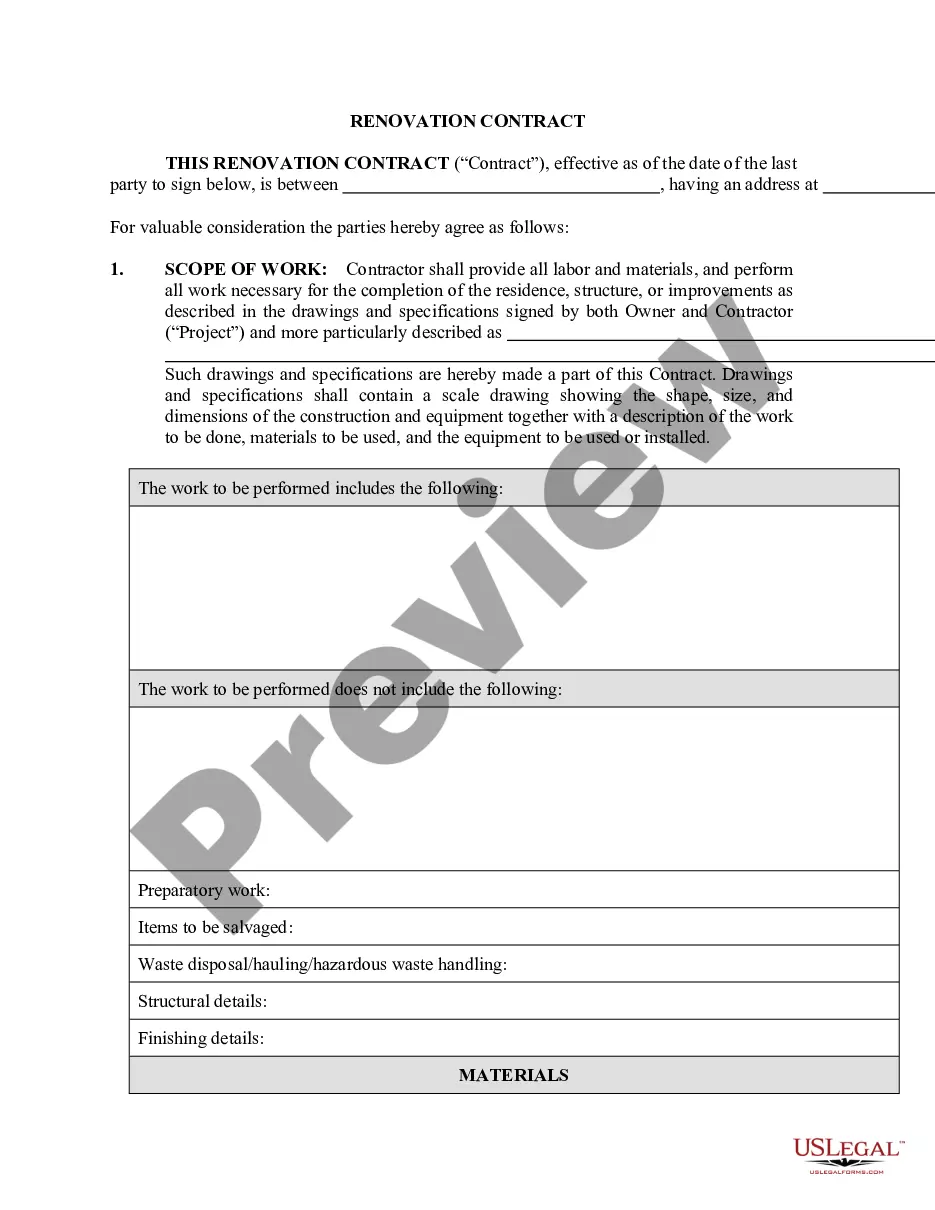

Description

How to fill out Breakdown Of Savings For Budget And Emergency Fund?

Are you currently in a location where you need documentation for either business or specific purposes almost every working day.

There are numerous legitimate document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, such as the Georgia Breakdown of Savings for Budget and Emergency Fund, which are designed to comply with federal and state regulations.

Once you find the right form, click on Purchase now.

Choose the payment plan you prefer, provide the necessary information to set up your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just sign in.

- Then, you can download the Georgia Breakdown of Savings for Budget and Emergency Fund template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for the correct city/county.

- Use the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find a form that meets your needs.

Form popularity

FAQ

A $10,000 emergency fund can be beneficial depending on your personal circumstances and expenses. For many individuals, this amount provides a cushion against unexpected events, but it may not be sufficient for everyone. Assessing your budget and expenses while following the Georgia Breakdown of Savings for Budget and Emergency Fund will guide you in making a more informed decision.

That year, Georgia received approximately $14.3 billion in federal aid, 36.7 percent of the state's general revenues. Taking into consideration the state's 2014 population, this came out to about $1,420 in federal aid per capita. Figures from surrounding states are provided for additional context.

According to current projections, the bill will result in at least $17.4 billion to Georgia, including state and local governments and individual assistance. However, Georgia may receive more or less than the projected amount for any particular program.

Income taxes are the cornerstone of Georgia's revenue system, accounting for half of all state funds.

Every U.S. state other than Vermont has some form of balanced budget provision that applies to its operating budget. The precise form of this provision varies from state to state. Indiana has a state debt prohibition with an exception for "temporary and casual deficits," but no balanced budget requirement.

State and local governments collect tax revenues from three primary sources: income, sales, and property taxes. Income and sales taxes make up the majority of combined state tax revenue, while property taxes are the largest source of tax revenue for local governments, including school districts.

As you know, premium pay is authorized by the American Rescue Plan as a way to reward essential workers with up to $13 per hour in addition to wages or remuneration the worker otherwise receives and in an aggregate amount not to exceed $25,000 per eligible worker. These words are from the Department of the Treasury's

Georgia is statutorily required to set a balanced budget. The state operates in a fiscal year that spans from July 1 to June 30. The state makes changes to the fiscal year budget twice a year. The budget determines the amount of money each state agency may spend by the end of the year.

In particular, funds may be used for payroll and covered benefits expenses for public safety, public health, health care, human services, and similar employees, including first responders, to the extent that the employee's time that is dedicated to responding to the COVID-19 public health emergency.

Balanced Budget Requirements (BBRs) are constitutional or statutory rules that prohibit states from spending more than they collect in revenue. They vary in stringency and design, and some research finds that stricter BBRs can produce tighter state fiscal outcomes, such as reduced spending and smaller deficits.