A Georgia Sales Consulting Agreement with an Independent Contractor is a legally binding document that outlines the terms and conditions between a company and an independent contractor engaged in providing sales consulting services in the state of Georgia. This agreement serves as a framework that defines the responsibilities, obligations, and expectations of both parties involved in the business relationship. The Georgia Sales Consulting Agreement with an Independent Contractor typically covers key aspects such as compensation, scope of work, intellectual property, confidentiality, termination, and dispute resolution. By clearly defining these elements, the agreement protects the rights and interests of both parties and helps ensure a harmonious and productive business collaboration. There are several types of Georgia Sales Consulting Agreements with Independent Contractors, each designed to cater to specific needs and circumstances. Some common variations include: 1. Commission-based Sales Consulting Agreement: This type of agreement outlines that the independent contractor will receive compensation based on a percentage of sales or revenue generated through their consulting services. The terms and conditions related to commission rates, payment schedules, and performance metrics are clearly specified in this agreement. 2. Hourly or Project-based Sales Consulting Agreement: In this agreement, the independent contractor is paid a fixed rate for their sales consulting services on an hourly basis or for completing specific projects. The contract stipulates the hourly rate, estimated duration of the project, and payment terms. 3. Retainer-based Sales Consulting Agreement: This type of agreement entails the independent contractor receiving a fixed monthly or quarterly retainer fee for providing ongoing sales consulting services to the company. The retainer fee is typically paid in advance and ensures the contractor's availability for a predetermined number of hours or tasks throughout the retainer period. 4. Exclusive Sales Consulting Agreement: This agreement establishes an exclusive contractual relationship between the company and the independent contractor, ensuring that the contractor will only provide sales consulting services to that particular company during the agreement's duration. This type of agreement can include non-compete clauses to prevent the contractor from engaging with competing businesses. It is crucial for both parties to carefully review and negotiate the terms stipulated in the Georgia Sales Consulting Agreement with an Independent Contractor to ensure mutual understanding and satisfaction. Seeking legal advice is recommended to ensure compliance with Georgia state laws and regulations governing independent contractor relationships.

Georgia Sales Consulting Agreement with Independent Contractor

Description

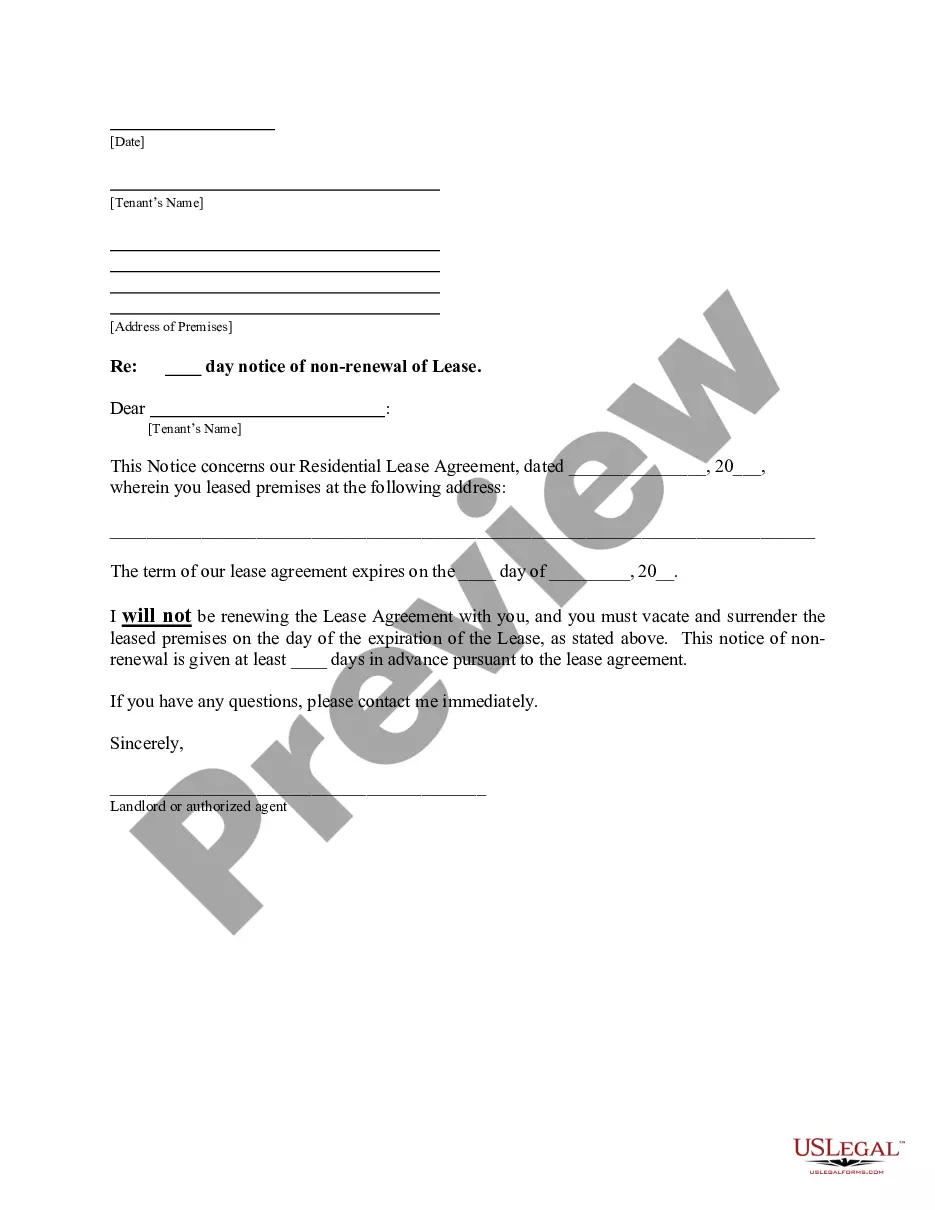

How to fill out Georgia Sales Consulting Agreement With Independent Contractor?

Discovering the right lawful papers format can be a struggle. Naturally, there are a variety of web templates available on the net, but how would you discover the lawful develop you will need? Take advantage of the US Legal Forms site. The service gives thousands of web templates, including the Georgia Sales Consulting Agreement with Independent Contractor, that can be used for company and private demands. Every one of the varieties are checked by professionals and fulfill federal and state demands.

In case you are already listed, log in for your profile and click the Acquire button to get the Georgia Sales Consulting Agreement with Independent Contractor. Make use of your profile to search with the lawful varieties you possess bought formerly. Visit the My Forms tab of your own profile and acquire an additional version in the papers you will need.

In case you are a brand new customer of US Legal Forms, here are straightforward guidelines for you to follow:

- Very first, be sure you have selected the appropriate develop for your metropolis/county. You are able to examine the form while using Review button and read the form explanation to make sure it will be the best for you.

- In case the develop fails to fulfill your expectations, use the Seach industry to obtain the appropriate develop.

- Once you are certain the form is acceptable, click the Purchase now button to get the develop.

- Choose the pricing prepare you need and enter in the necessary information and facts. Create your profile and purchase the transaction using your PayPal profile or bank card.

- Select the submit format and obtain the lawful papers format for your product.

- Full, edit and print out and indication the attained Georgia Sales Consulting Agreement with Independent Contractor.

US Legal Forms is the biggest collection of lawful varieties for which you can discover a variety of papers web templates. Take advantage of the service to obtain professionally-made files that follow status demands.

Form popularity

FAQ

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

The contractor isn't an employee of the company but works independently. The contractor provides services to the client under an Independent Contractor Agreement.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.