Georgia Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status

Description

How to fill out Independent Sales Representative Agreement With Developer Of Computer Software With Provisions Intended To Satisfy The Internal Revenue Service's 20 Part Test For Determining Independent Contractor Status?

You are able to commit several hours on-line searching for the lawful document template which fits the federal and state needs you want. US Legal Forms provides a large number of lawful forms which can be analyzed by experts. It is simple to acquire or printing the Georgia Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status from my support.

If you already have a US Legal Forms profile, you can log in and then click the Acquire button. Following that, you can comprehensive, edit, printing, or signal the Georgia Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status. Every single lawful document template you get is yours permanently. To obtain yet another duplicate of the acquired develop, check out the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms internet site initially, stick to the basic directions beneath:

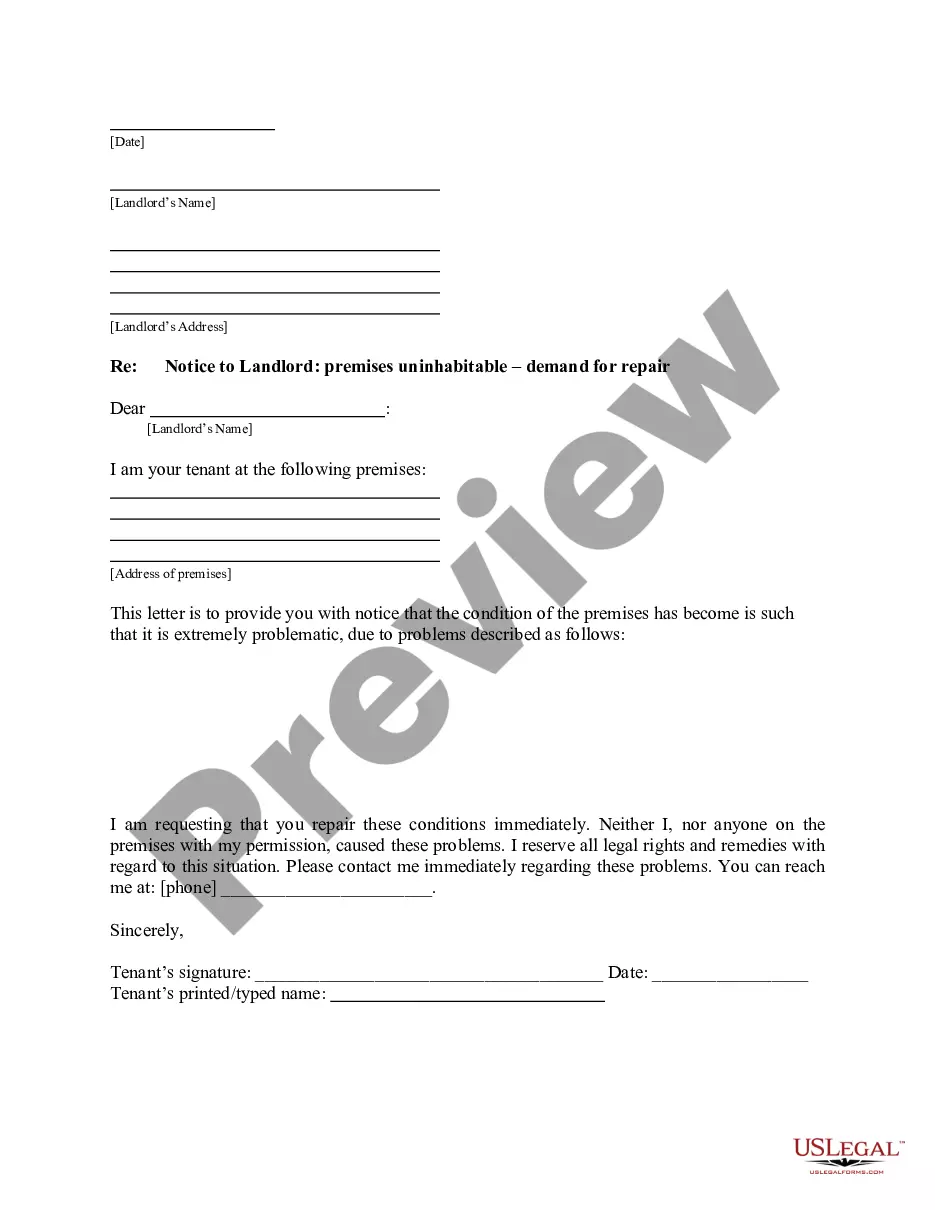

- Initial, ensure that you have chosen the best document template for your county/area of your choice. Read the develop explanation to make sure you have picked out the proper develop. If readily available, use the Preview button to look from the document template also.

- In order to get yet another variation of your develop, use the Research industry to find the template that fits your needs and needs.

- Once you have identified the template you desire, simply click Buy now to move forward.

- Select the costs prepare you desire, type in your references, and sign up for a merchant account on US Legal Forms.

- Full the transaction. You should use your Visa or Mastercard or PayPal profile to pay for the lawful develop.

- Select the file format of your document and acquire it for your product.

- Make modifications for your document if possible. You are able to comprehensive, edit and signal and printing Georgia Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status.

Acquire and printing a large number of document layouts making use of the US Legal Forms website, that offers the biggest selection of lawful forms. Use skilled and state-particular layouts to handle your organization or personal requirements.