Georgia Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Description

How to fill out Revenue Sharing Agreement To Income From The Licensing And Custom Modification Of The Software?

You might spend time online trying to discover the appropriate legal document format that meets the state and federal requirements you need.

US Legal Forms provides a vast collection of legal documents that have been reviewed by specialists.

You can download or print the Georgia Revenue Sharing Agreement for Income from the Licensing and Custom Modification of the Software from my service.

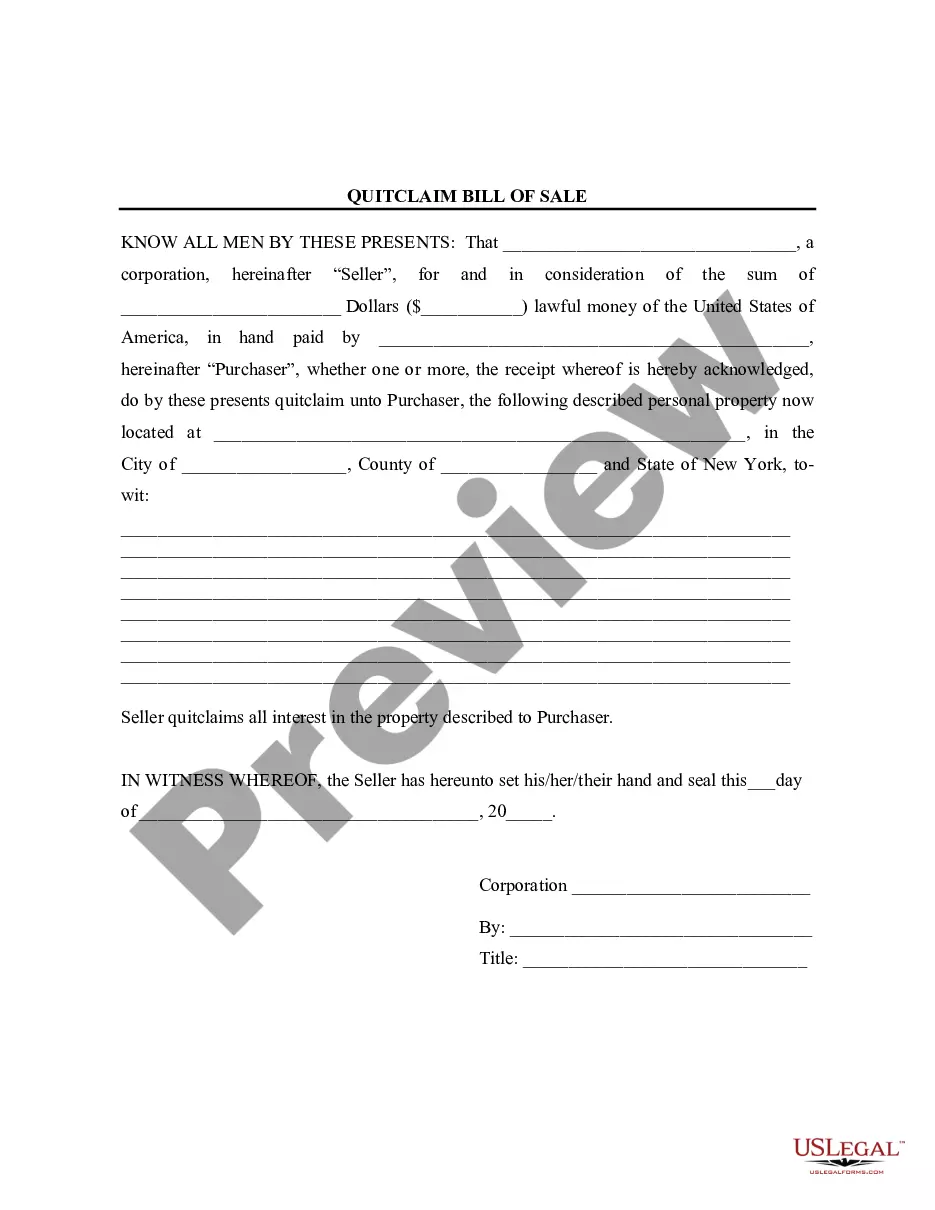

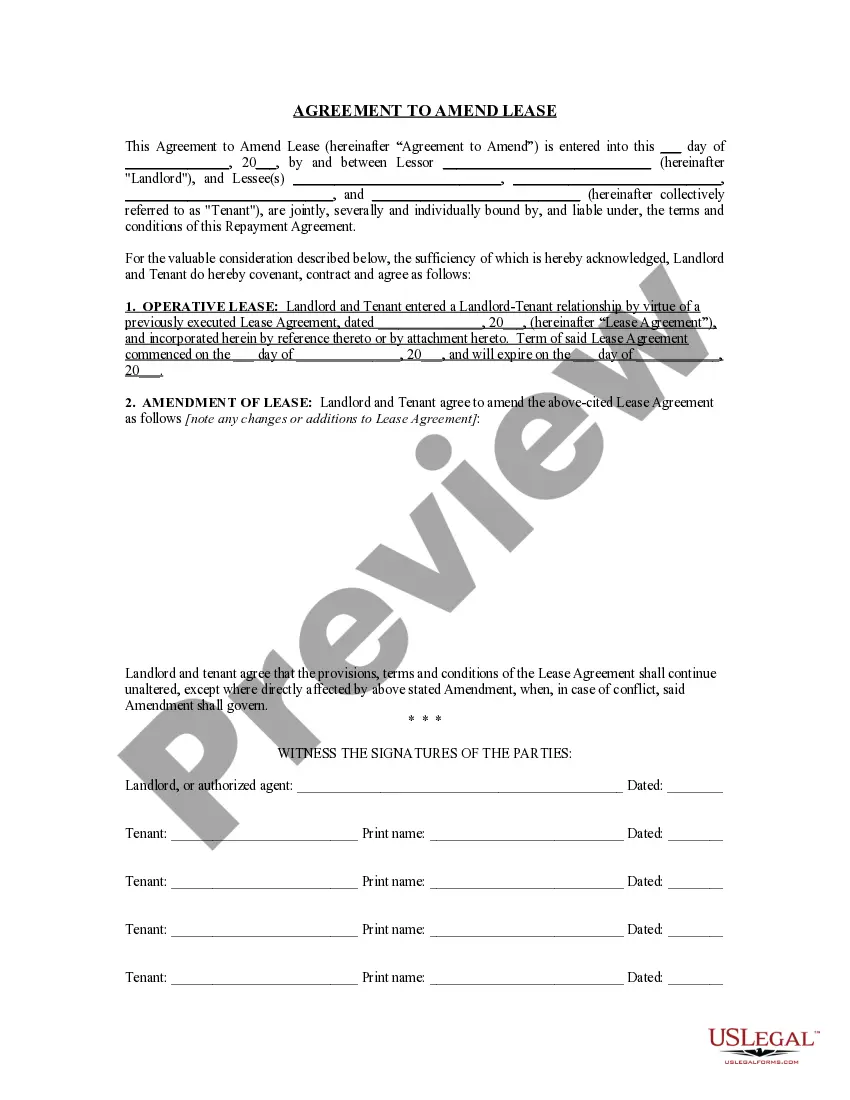

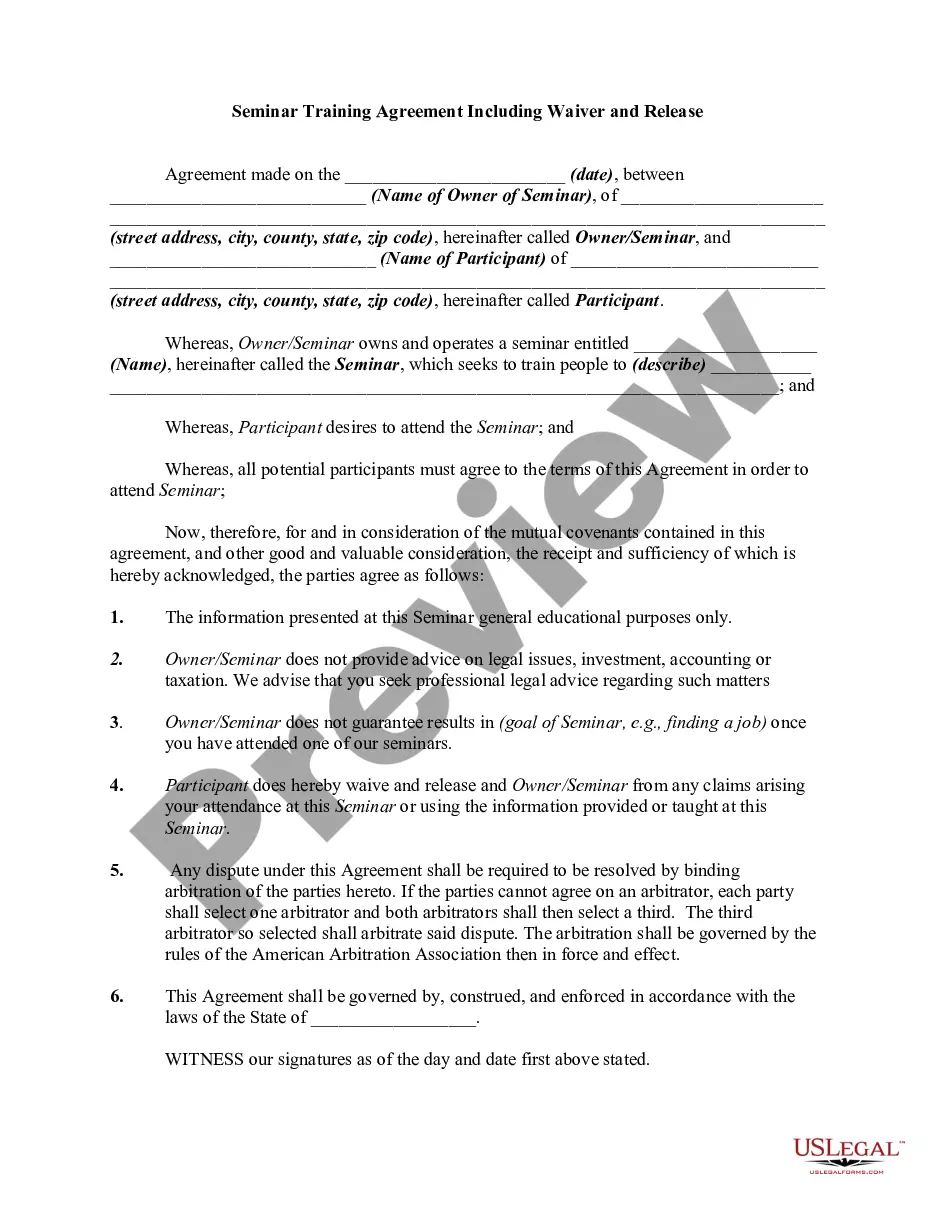

If available, utilize the Preview option to view the document format as well.

- If you already have a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can complete, modify, print, or sign the Georgia Revenue Sharing Agreement for Income from the Licensing and Custom Modification of the Software.

- Every legal document format you purchase belongs to you indefinitely.

- To obtain another copy of any purchased form, go to the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for your chosen state/city.

- Review the form description to make sure you have selected the right document.

Form popularity

FAQ

A revenue sharing agreement is a legal document between two parties where one party has to pay a percentage of profits or revenues received to the other for the rights to use something.

Separately stated charges for software maintenance agreements, when such agreements include prewritten software updates, upgrades, or enhancements delivered in a tangible medium and include support services, are deemed to be taxable at 50 percent of the software maintenance agreement's total stated sales price.

The sale, lease, rental, license, or use of prewritten computer software is subject to sales and use tax when sold in a tangible medium. Prewritten computer software, even though modified or enhanced to the specifications of a purchaser, remains prewritten computer software.

Computer software delivered electronically is not a sale of tangible personal property and therefore is not subject to sales and use tax.

In addition, licenses for the use of software accessed electronically are not considered sales of tangible personal property, and therefore are not subject to state sales tax, as long as no transfer of tangible personal property occurs as a part of the transaction.

Sales of custom software - delivered on tangible media are exempt from the sales tax in Georgia. Sales of custom software - downloaded are exempt from the sales tax in Georgia.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Any custom software that is delivered through electronic means or via the load and leave method is not considered tangible personal property nor subject to sales tax. However, it is only tax-exempt if separately stated on the invoice from charges for manuals, disks, CDs or other tangible property, which is taxable.

Separately stated charges for software maintenance agreements, when such agreements include prewritten software updates, upgrades, or enhancements delivered in a tangible medium and include support services, are deemed to be taxable at 50 percent of the software maintenance agreement's total stated sales price.

California: SaaS is not a taxable service. However, software or information that is delivered electronically is exempt. The ability to access software from a remote network or location is exempt. Under California sales and use tax law, there must be a transfer of TPP, in order to have a taxable event.