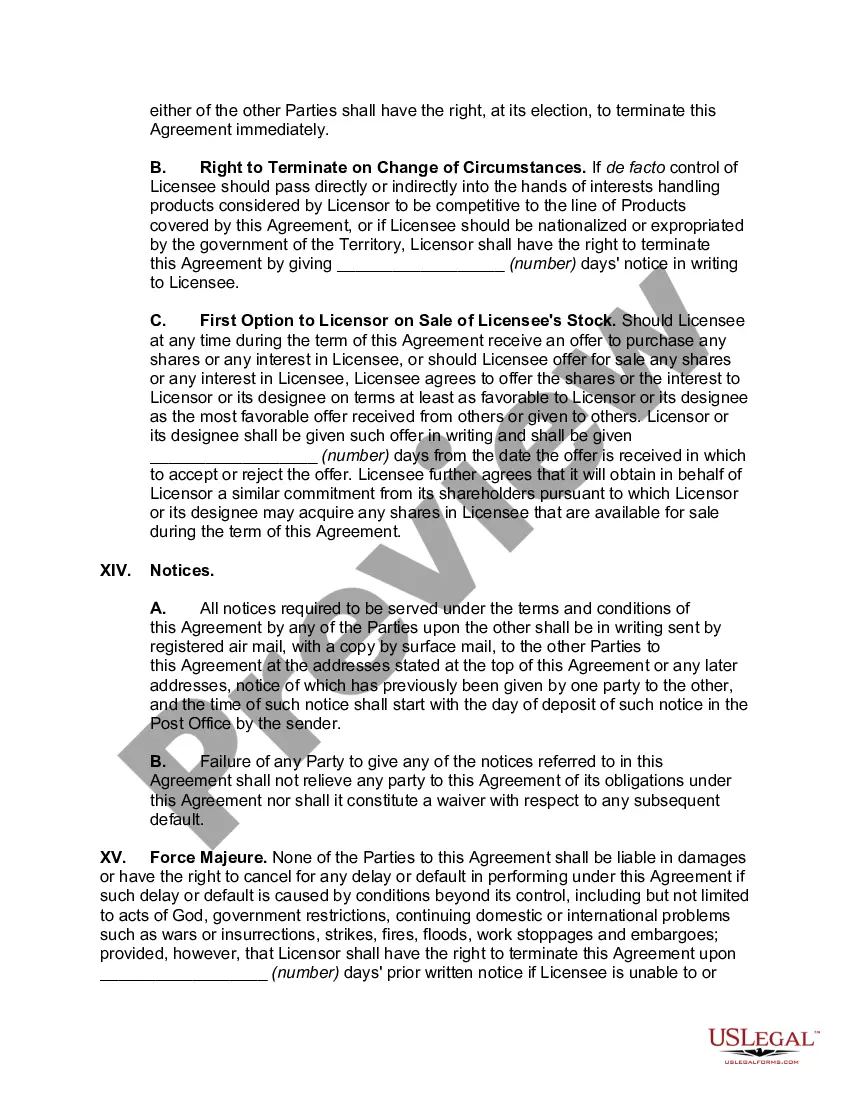

Georgia License Agreement for Manufacture and Sale of Products in Foreign Country is a legal document that outlines the terms and conditions under which a company in Georgia grants another party the license to manufacture and sell its products in a foreign country. This agreement establishes a legal relationship between the licensor (the company in Georgia) and the licensee (the foreign entity). The Georgia License Agreement for Manufacture and Sale of Products in Foreign Country includes several key elements that must be addressed to ensure a transparent and mutually beneficial relationship between the parties involved. These elements may vary depending on the specific type of license agreement, which can be categorized as: 1. Exclusive License Agreement: This type of agreement grants the licensee exclusive rights to manufacture and sell the products in the foreign country, barring any other licenses or agreements with competitors. 2. Non-Exclusive License Agreement: In contrast to the exclusive license agreement, this type allows the licensor to grant licenses to multiple parties in the foreign country simultaneously. The licensee possesses rights to manufacture and sell the products, but the licensor retains the ability to enter into similar agreements with other parties. 3. Territory-Specific License Agreement: This agreement limits the licensee's manufacturing and selling rights to a specific geographical area or territory within the foreign country. This ensures that multiple licensees may exist in different territories. 4. Limited Term License Agreement: This type of license agreement grants the licensee temporary rights to manufacture and sell the products for a specified period, after which the agreement may be terminated or renegotiated. The Georgia License Agreement for Manufacture and Sale of Products in Foreign Country should include detailed provisions related to the following: 1. Intellectual Property: Clearly define the intellectual property rights that are being licensed, such as patents, trademarks, copyrights, and trade secrets. Specify whether the licensee has the right to use the licensor's branding materials and if any royalties or licensing fees are involved. 2. Manufacturing Obligations: Outline the licensee's responsibilities and obligations related to the manufacturing process, including quality control, compliance with relevant regulations, and timely production of goods. 3. Sales and Distribution: Specify the licensee's obligations regarding marketing, sales, and distribution of the products in the foreign country. Detail any minimum sales targets, pricing, and payment terms. 4. Termination and Dispute Resolution: Include provisions for termination of the agreement, specifying grounds for termination and any required notice periods. Also, outline the procedure for resolving disputes between the parties, such as arbitration or mediation. 5. Confidentiality and Non-Disclosure: Clearly state the obligations of both parties to protect any confidential information exchanged during the course of the agreement, including trade secrets, manufacturing processes, and customer data. It is important to consult with legal professionals experienced in international business law to draft a Georgia License Agreement for Manufacture and Sale of Products in Foreign Country that meets the specific requirements and safeguards the interests of both the licensor and the licensee.

Georgia License Agreement for Manufacture and Sale of Products in Foreign Country

Description

How to fill out Georgia License Agreement For Manufacture And Sale Of Products In Foreign Country?

You may commit hours on the Internet searching for the lawful document design which fits the state and federal demands you will need. US Legal Forms gives a huge number of lawful forms which are analyzed by pros. You can easily acquire or print the Georgia License Agreement for Manufacture and Sale of Products in Foreign Country from the assistance.

If you already have a US Legal Forms accounts, you are able to log in and then click the Down load option. Next, you are able to total, change, print, or indication the Georgia License Agreement for Manufacture and Sale of Products in Foreign Country. Every single lawful document design you acquire is yours forever. To acquire another duplicate for any bought develop, visit the My Forms tab and then click the related option.

If you work with the US Legal Forms website the first time, follow the simple instructions beneath:

- Initial, ensure that you have selected the right document design for your area/town of your choosing. See the develop description to ensure you have selected the proper develop. If offered, make use of the Preview option to look through the document design too.

- If you would like find another variation from the develop, make use of the Look for discipline to discover the design that meets your needs and demands.

- After you have discovered the design you desire, click Purchase now to continue.

- Choose the costs strategy you desire, key in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the transaction. You should use your Visa or Mastercard or PayPal accounts to fund the lawful develop.

- Choose the file format from the document and acquire it to the device.

- Make modifications to the document if needed. You may total, change and indication and print Georgia License Agreement for Manufacture and Sale of Products in Foreign Country.

Down load and print a huge number of document layouts using the US Legal Forms Internet site, that offers the biggest collection of lawful forms. Use skilled and status-particular layouts to take on your business or individual requirements.

Form popularity

FAQ

International licensing: International licensing gives a foreign business entity the right to manufacture or use a company's product for its market. While there are many benefits to international licensing for IP owners, there may also be obstacles exclusive to foreign territories, such as quotas or tariffs.

International licensing: International licensing gives a foreign business entity the right to manufacture or use a company's product for its market. While there are many benefits to international licensing for IP owners, there may also be obstacles exclusive to foreign territories, such as quotas or tariffs.

What Is Foreign Licensing? When you have created a product or have the exclusive right to a product, trademark, patent, or copyright, you have the right to grant another person or company in another geographical location, to sell, market, or produce your property.

Practitioners and licensing executives often refer to three basic types of voluntary licenses: non-exclusive, sole, and exclusive. A non-exclusive licence allows the licensor to retain the right to use the licensed property and the right to grant additional licenses to third parties.

An international licensing agreement allows foreign firms, either exclusively or non-exclusively, to manufacture a proprietor's product for a fixed term in a specific market.

A licensing agreement allows one party (the licensee) to use and/or earn revenue from the property of the owner (the licensor). Licensing agreements generate revenues, called royalties, earned by a company for allowing its copyrighted or patented material to be used by another company.

Examples. Suppose Company A, a manufacturer and seller of Baubles, was based in the US and wanted to expand to the Chinese market with an international business license. They can enter the agreement with a Chinese firm, allowing them to use their product patent and giving other resources, in return for a payment.

How can a company use licensing agreements to enter world markets? By licensing, a company can negotiate an agreement that entitles it to produce or market another company's product in return for a royalty or fee.

Licensing is a contractual arrangement whereby the firm, the licensor, offers proprietary assets to a foreign company, the licensee, in exchange for royalty fees. Let's say you are unable to export to an overseas market due to complex rules and regulations or because the transportation cost is prohibitive.

A foreign licensing agreement gives permission to another company or person to market your products while you sit back and collect royalties.