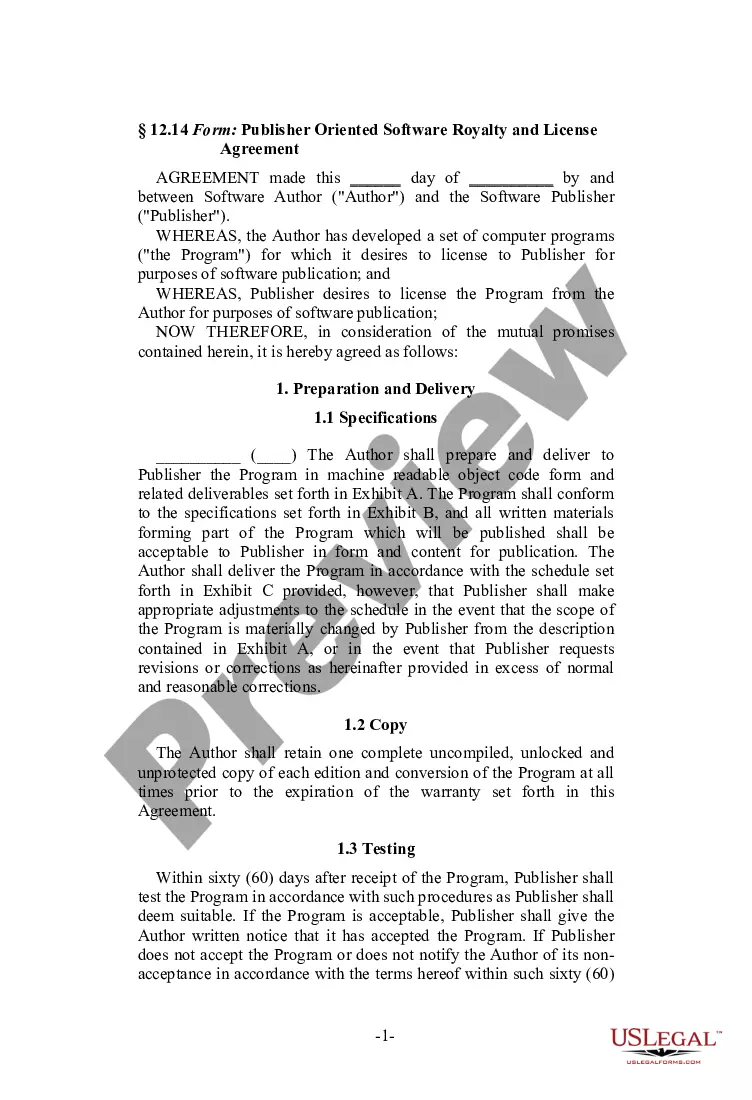

Georgia Author Oriented Software Royalty and License Agreement Regarding a Computer Program for use on Personal Computer

Description

How to fill out Author Oriented Software Royalty And License Agreement Regarding A Computer Program For Use On Personal Computer?

Selecting the appropriate legal document template can be challenging. It goes without saying that there are numerous templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Georgia Author Oriented Software Royalty and License Agreement Regarding a Computer Program for use on Personal Computer, suitable for business and personal purposes.

All the forms are reviewed by experts and comply with federal and state regulations.

Once you are confident that the form is correct, click the Get now button to acquire the form. Choose your desired pricing plan, enter the necessary details, create your account, and complete the payment with your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Georgia Author Oriented Software Royalty and License Agreement Regarding a Computer Program for use on Personal Computer. US Legal Forms is the largest repository of legal forms where you can discover various document templates. Use the service to obtain professionally created documents that adhere to state requirements.

- If you are currently registered, Log In to your account and click on the Download button to obtain the Georgia Author Oriented Software Royalty and License Agreement Regarding a Computer Program for use on Personal Computer.

- Use your account to access the legal forms you have purchased previously.

- Visit the My documents tab of your account to retrieve an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and read the form description to confirm it is suitable for your needs.

- If the form doesn't meet your requirements, use the Search field to find the correct form.

Form popularity

FAQ

Georgia exempts sales and use taxes on a wide range of expenditures made by manufacturers. These include purchases of the following if they are integral to the manufacturing process: Machinery and equipment. Repair and replacement parts.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

The SSUTA defines canned software, whether delivered on a tangible format or electronically, as tangible personal property.

Requirements for prewritten software are still subject to sales and use tax regardless of the method of delivery (whether with a physical medium, downloadable or accessed via the Internet) or if possession or control is given.

Computer software delivered electronically is not a sale of tangible personal property and therefore is not subject to sales and use tax.

According to the Georgia Budget and Policy Institute, sales of items like digital downloads are not taxed because lawmakers have not proactively updated the tax code to include them. H.B. 594 would rectify that if enacted, though whether the measure has the support needed to become law remains to be seen.

Sales of digital products are exempt from the sales tax in Georgia.

Sales of custom software - delivered on tangible media are exempt from the sales tax in Georgia. Sales of custom software - downloaded are exempt from the sales tax in Georgia.

Georgia does not impose sales and use tax on SaaS, cloud-based services or hosting services. Prewritten computer software, delivered either electronically or through load and leave is also not subject to tax in the state, nor are computer related services, including information and data processing services.

While most services are exempt from tax, Georgia does tax the sale of accommodations, in-state transportation of individuals (e.g., taxis, limos), sales of admissions, and charges for participation in games and amusement activities.