Georgia Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

How to fill out Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

Have you been in the place that you will need documents for sometimes company or person functions just about every day time? There are plenty of legal file themes available on the net, but getting kinds you can rely is not effortless. US Legal Forms offers 1000s of kind themes, much like the Georgia Liquidation of Partnership with Authority, Rights and Obligations during Liquidation, which can be created to fulfill state and federal needs.

Should you be already informed about US Legal Forms site and possess your account, merely log in. Afterward, it is possible to down load the Georgia Liquidation of Partnership with Authority, Rights and Obligations during Liquidation design.

Should you not come with an profile and would like to begin to use US Legal Forms, follow these steps:

- Discover the kind you want and make sure it is for that right city/region.

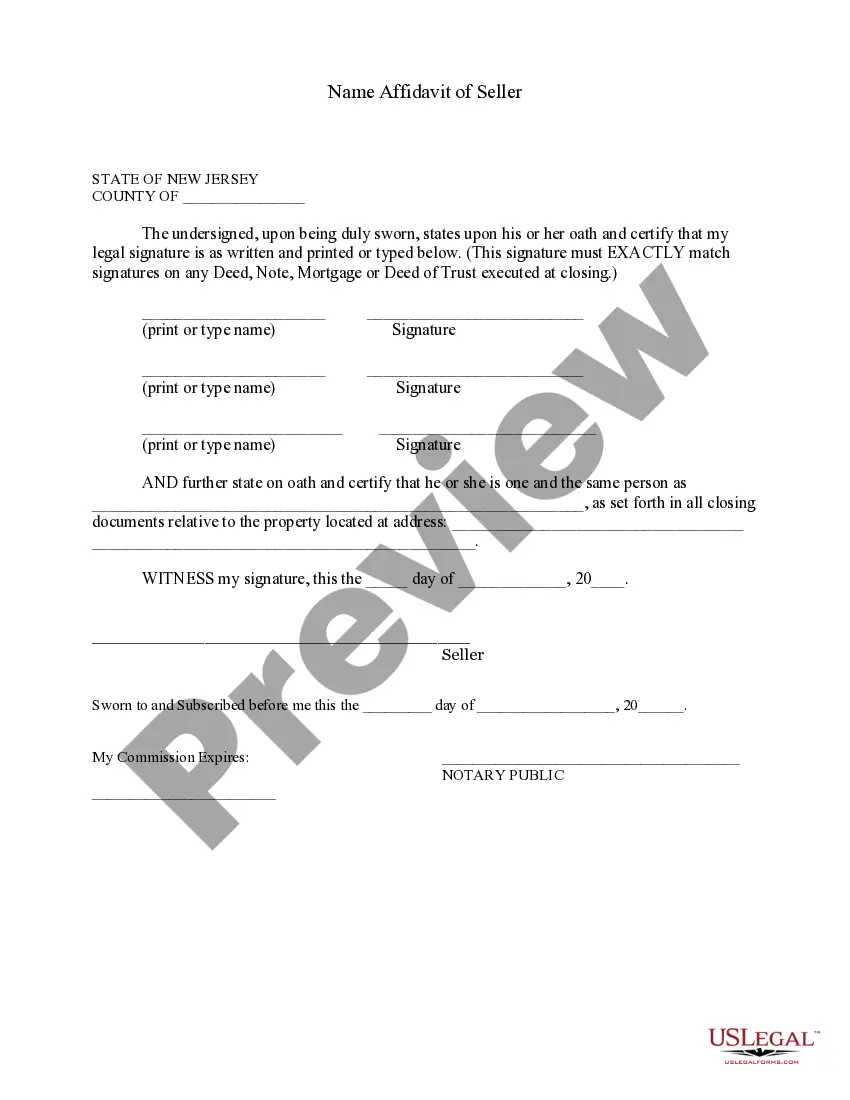

- Take advantage of the Review key to review the form.

- Read the description to ensure that you have chosen the correct kind.

- In case the kind is not what you are trying to find, use the Research area to discover the kind that suits you and needs.

- If you obtain the right kind, simply click Buy now.

- Choose the prices strategy you want, complete the required information to create your bank account, and pay for your order with your PayPal or Visa or Mastercard.

- Decide on a handy data file structure and down load your backup.

Locate every one of the file themes you may have bought in the My Forms food list. You can aquire a extra backup of Georgia Liquidation of Partnership with Authority, Rights and Obligations during Liquidation anytime, if needed. Just select the required kind to down load or produce the file design.

Use US Legal Forms, by far the most extensive collection of legal kinds, to save lots of time and steer clear of errors. The services offers appropriately produced legal file themes that you can use for a selection of functions. Create your account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

Under Chapter 7, the company stops all operations and goes completely out of business. A trustee is appointed to "liquidate" (sell) the company's assets and the money is used to pay off the debt, which may include debts to creditors and investors. The investors who take the least risk are paid first.

Once a company goes into liquidation, creditors holding personal guarantees will pursue the directors to pay the outstanding company debt. The creditors that will almost always have a personal guarantee include, a financing bank, a landlord, and any major suppliers.

If the debtor company is in possession of goods belonging to a creditor, and the creditor can prove ownership, they have the right to make a claim for their return, or reimbursement via the liquidator. Unsecured creditors can claim interest on the debt up to the date of liquidation under certain circumstances.

The court sells the business assets for you, and the proceeds are used to pay off lenders, vendors, and other creditors. Debts, long-term leases and other obligations are erased when the bankruptcy proceeding is closed.

The Insolvent Partnerships Order 1994 operates to apply provisions of the Insolvency Act 1986 and the CDDA 1986, with appropriate amendment set out in the schedules to the Order, to partnerships (including limited partnerships see Part 2).

Generally speaking, insolvency refers to situations where a debtor cannot pay the debts she owes. For instance, a troubled company may become insolvent when it is unable to repay its creditors money owed on time, often leading to a bankruptcy filing.

Creditor's rights can refer to many different aspects of creditor-debtor and creditor-creditor relations including a creditor's rights to place a lien on a debtor's property, garnish a debtor's wages, set aside a fraudulent conveyance, and contact the debtor and relatives.

A balance sheet test is a legal exercise to establish whether your company is in an insolvent state. A court will determine what value to attribute to the prospective and contingent liabilities of a company.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.