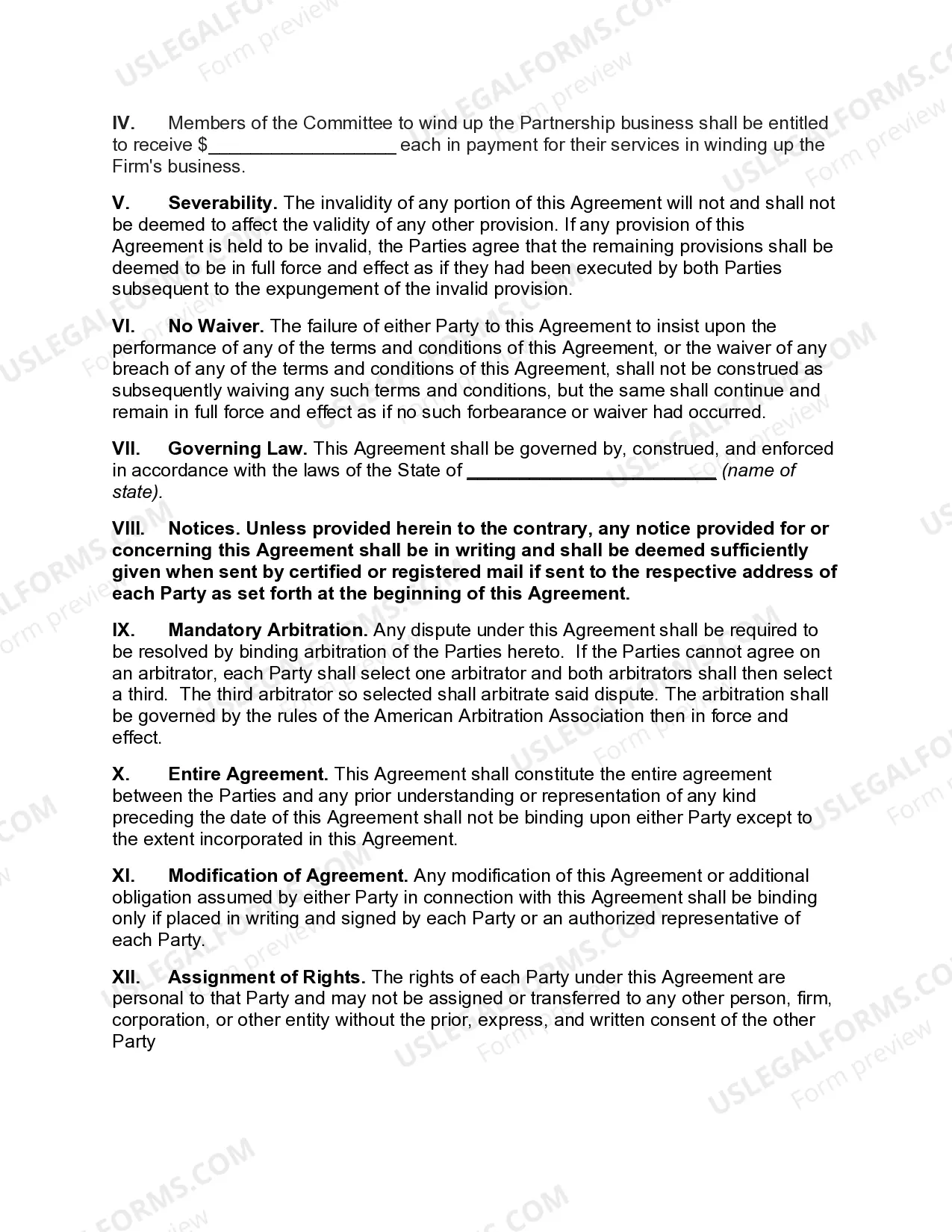

Title: Understanding the Georgia Agreement to Establish Committee to Wind up Partnership Keywords: Georgia Agreement, Establish Committee, Wind up Partnership, Partnership Dissolution, Duties, Decision-Making, Assets, Liabilities, Dispute Resolution, Legal Documentation. Introduction: The Georgia Agreement to Establish Committee to Wind up Partnership is a legal document that outlines the procedures and responsibilities involved in the dissolution and winding up of a partnership. This agreement governs the process of distributing assets, settling liabilities, resolving disputes, and finalizing the partnership's affairs. There may be different types or variations of this agreement depending on the specific partnership arrangement or industry involved. Types of Georgia Agreement to Establish Committee to Wind up Partnership: 1. General Partnership Dissolution Agreement: This type of agreement is used to establish a committee for winding up a general partnership. It specifically applies to partnerships where each partner shares equal rights, responsibilities, and liabilities. 2. Limited Partnership Dissolution Agreement: This agreement is tailored for limited partnerships where there are general partners who manage the partnership and limited partners who have limited liability. The agreement outlines the process of winding up the partnership and ensures the interests of limited partners are protected. 3. Limited Liability Partnership (LLP) Dissolution Agreement: This type of agreement is applicable to partnerships that are formed as Laps, where partners have limited personal liability for the partnership's debts. The agreement establishes the committee responsible for managing the dissolution process and settling all outstanding obligations. Key Elements and Provisions: 1. Purpose and Scope: The agreement states the intention to end the partnership, establish a committee, and delineate its roles and responsibilities during the winding-up process. 2. Committee Formation: Details are provided on the selection and appointment of committee members, specifying their qualifications, roles, decision-making authority, and term of service. 3. Assets and Liabilities: The agreement covers the identification, valuation, and allocation of partnership assets, outlining how they will be distributed or sold to pay off any outstanding partnership liabilities. 4. Debt Settlement: Procedures for settling outstanding debts, including obtaining creditor consent, negotiating payment terms, and ensuring equitable distribution of liabilities among partners, are outlined. 5. Dispute Resolution: In case of disagreements or disputes during the wind-up process, the agreement may include a clause specifying a preferred method for resolving conflicts, such as mediation or arbitration. 6. Tax and Legal Obligations: The agreement addresses compliance with tax regulations, permits, licenses, and any outstanding legal obligations that must be fulfilled before officially dissolving the partnership. 7. Notice and Communication: The agreement establishes protocols for notifying partners, creditors, and other relevant parties about the partnership's dissolution, including the commencement and completion dates of the wind-up process. 8. Execution and Documentation: The agreement requires partners to sign and notarize the document, ensuring its legal validity. Additionally, any supporting documentation, such as financial statements, releases, or assignments, may be attached. Conclusion: The Georgia Agreement to Establish Committee to Wind up Partnership is a crucial legal document that governs the process of dissolving a partnership and ensures a smooth winding up of affairs. By establishing clear guidelines for asset distribution, liability settlement, and decision-making, the agreement minimizes conflicts and provides a structured framework to bring the partnership to a close. Different types of the agreement may exist to suit specific partnership structures or legal requirements.

Georgia Agreement to Establish Committee to Wind up Partnership

Description

How to fill out Georgia Agreement To Establish Committee To Wind Up Partnership?

If you want to total, download, or print legitimate file templates, use US Legal Forms, the largest assortment of legitimate types, which can be found on the Internet. Utilize the site`s simple and easy practical look for to find the papers you want. Different templates for organization and person purposes are categorized by classes and says, or key phrases. Use US Legal Forms to find the Georgia Agreement to Establish Committee to Wind up Partnership in a couple of clicks.

If you are previously a US Legal Forms consumer, log in for your profile and click on the Acquire button to have the Georgia Agreement to Establish Committee to Wind up Partnership. You may also access types you previously downloaded inside the My Forms tab of your profile.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for that proper metropolis/country.

- Step 2. Use the Review option to look over the form`s articles. Never forget to see the outline.

- Step 3. If you are not happy using the kind, make use of the Look for area near the top of the monitor to discover other models of your legitimate kind format.

- Step 4. Once you have identified the shape you want, click on the Purchase now button. Select the costs program you choose and add your qualifications to register for the profile.

- Step 5. Approach the purchase. You may use your charge card or PayPal profile to perform the purchase.

- Step 6. Choose the file format of your legitimate kind and download it on your product.

- Step 7. Full, modify and print or sign the Georgia Agreement to Establish Committee to Wind up Partnership.

Each legitimate file format you acquire is your own property eternally. You may have acces to every kind you downloaded with your acccount. Click the My Forms area and pick a kind to print or download again.

Compete and download, and print the Georgia Agreement to Establish Committee to Wind up Partnership with US Legal Forms. There are many specialist and condition-certain types you may use for your personal organization or person requires.

Form popularity

FAQ

Certificate of TerminationGeorgia does not require you to file this type of final document, instead stating that an LLC "may" file the certificate. However, it is generally advisable to file a certificate of termination. (If you have specific questions about whether to file, you should contact a local attorney.)

All partnerships, corporations, and LLCs that are registering with the Department must register as a new business using the Georgia Tax Center (GTC). Sole Proprietors have a different registration process.

A general partnership has no separate legal existence distinct from the partners. Unlike a private limited company or limited liability partnership, it does not need to be registered at or make regular filings to Companies House, which can help keep things simple.

To dissolve an LLC in Georgia, LLCs have to file an Article of Dissolution. The filing fee is $10.

While there are no formal filing or registration requirements needed to create a partnership, partnerships must comply with registration, filing, and tax requirements applicable to any business.

A general partnership is created any time two or more people agree to go into business together. There's no legal requirement for a contract or written agreement when you enter into a general partnership, but it's best to formalize the details of the arrangement in a written partnership agreement.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.

To dissolve a partnership, four accounting steps must be executed: the sale of noncash assets; allocating profits or losses on the sale; paying off liabilities; distributing remaining cash to partners according to their account balances at the end of the relationship.

To end a Georgia LLC, just file form CD-415, Certificate of Termination, with the Georgia Secretary of State, Corporations Division (SOS). The certificate of termination is available on the Georgia SOS website or your Northwest Registered Agent online account. You are not required to use SOS forms.

General Partnerships (GP) In Georgia, there is no formal filing requirement for general partnerships. All you need is an agreement to run the business with the other partners and you are set.