Georgia Demand Letter to Partner to Contribute Capital

Description

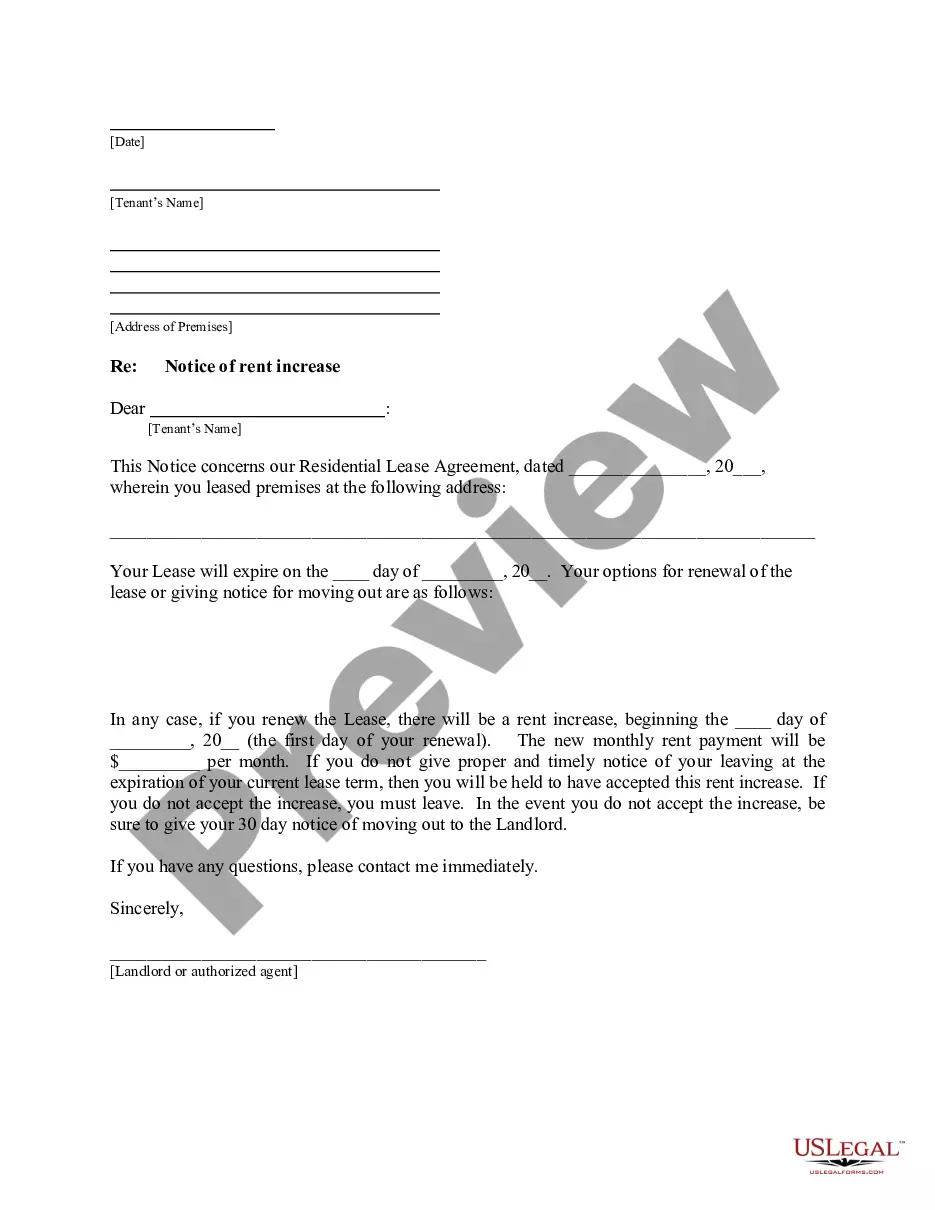

How to fill out Demand Letter To Partner To Contribute Capital?

If you want to be thorough, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site’s straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are unhappy with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your credentials to register for an account.

- Use US Legal Forms to obtain the Georgia Demand Letter to Partner to Contribute Capital in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Obtain button to get the Georgia Demand Letter to Partner to Contribute Capital.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to inspect the form’s content. Be sure to read the summary.

Form popularity

FAQ

What is Contributed Capital?Receive cash for stock. Debit the cash account and credit the contributed capital account.Receive fixed assets for stock. Debit the relevant fixed asset account and credit the contributed capital account.Reduce a liability for stock.

Do Partners Have To Contribute Capital? Upon forming a partnership, all partners will make capital contributions but may make more capital contributions depending on how the partnership operates. Cash and property (vehicles, equipment, computers, etc.) could both be considered capital contributions.

In a typical partnership, each partner has his own capital account. An account has three elements: contributions, allocations and distributions. Contributions represent what the partner has put into the company -- either cash or the value of other assets.

Do partnership distributions have to be equal? Partner equity does not typically equate to equivalent investment contributions from all business partners. Instead, partners can make equal contributions to the company and possess equal ownership rights, but make contributions in a variety of different forms.

There is no necessity or compulsion to contribute a minimum capital for a partner, as per the Limited Liability Partnership Act, 2008 contribution is not a prerequisite for the formation of a limited liability partnership or for a partner to contribute a minimum capital to be a recognized partner in the limited

Capital contributions of the partners at the commencement of the partnership. A method of dividing profits which uses as basis the amount of capital invested and the time during which such capital are actually used by the business. You just studied 15 terms!

Every partner is a debtor of the partnership for whatever he may have promised to contribute thereto. ARTICLE 1788. A partner who has undertaken to contribute a sum of money and fails to do so becomes a debtor for the interest and damages from the time he should have complied with his obligation.

A partnership is a single business in which two or more people share ownership. Each partner contributes to all aspects of the business, including money, property, labor, or skill. In return, each partner shares in the profits and losses of the business.

In business and partnership law, contribution may refer to a capital contribution, which is an amount of money or assets given to a business or partnership by one of the owners or partners. The capital contribution increases the owner or partner's equity interest in the entity.

The Limited Liability Partnership (LLP) is a business entity that provides limited liability to its partners. The partners are allowed to make a capital contribution to the entity, which determines their ownership level in the LLP.