The Georgia Agreement for Sale of Assets of Corporation is a legal document used in the state of Georgia when a corporation intends to sell its assets to another entity. This agreement outlines the terms and conditions of the sale, ensuring that both parties are protected and aware of their rights and responsibilities throughout the transaction. Key elements that are typically covered in a Georgia Agreement for Sale of Assets of Corporation include: 1. Parties Involved: The agreement starts by identifying the parties involved in the transaction, including the seller (corporation) and the buyer (individual or another corporation). 2. Asset Description: A comprehensive list of the assets being sold is provided, including tangible assets such as equipment, inventory, real estate, and intangible assets like patents, trademarks, copyrights, and customer contracts. Each asset is described in detail to avoid any ambiguity. 3. Purchase Price and Payment Terms: The agreement specifies the purchase price for the assets and the method of payment. The payment can be made in a lump sum or through installments, and any applicable taxes or adjustments are also mentioned. 4. Closing Date and Conditions: The agreement establishes the closing date, which is the day the transfer of assets takes place. It may also include certain conditions that need to be fulfilled before the closing, such as obtaining necessary approvals or consents. 5. Representations and Warranties: Both the seller and the buyer make certain representations and warranties to ensure the accuracy of information provided and to minimize any potential liabilities. These may include financial statements, legal compliance, ownership of assets, and any pending litigation. 6. Covenants: The agreement may outline certain ongoing commitments or covenants that the seller is expected to fulfill, post-closing. These can include non-competition agreements, assistance in transitioning customers or suppliers, or handling any outstanding liabilities. 7. Indemnification: To protect the buyer from unforeseen liabilities, the agreement typically includes provisions for indemnification. This ensures that the seller will compensate the buyer for any losses, damages, or legal expenses arising from misrepresentations or breaches of the agreement. 8. Governing Law and Jurisdiction: The agreement specifies that it will be governed by the laws of the state of Georgia, and any disputes will be resolved within the appropriate jurisdiction within the state. Although there may not be specific categories or types of Georgia Agreements for Sale of Assets of Corporation, the content can differ based on the nature of the assets being sold, the complexity of the transaction, and the unique requirements of the parties involved. However, regardless of the specific terms, the agreement is designed to protect the interests of both parties and facilitate a smooth and legally compliant transfer of assets.

Georgia Agreement for Sale of Assets of Corporation

Description

How to fill out Georgia Agreement For Sale Of Assets Of Corporation?

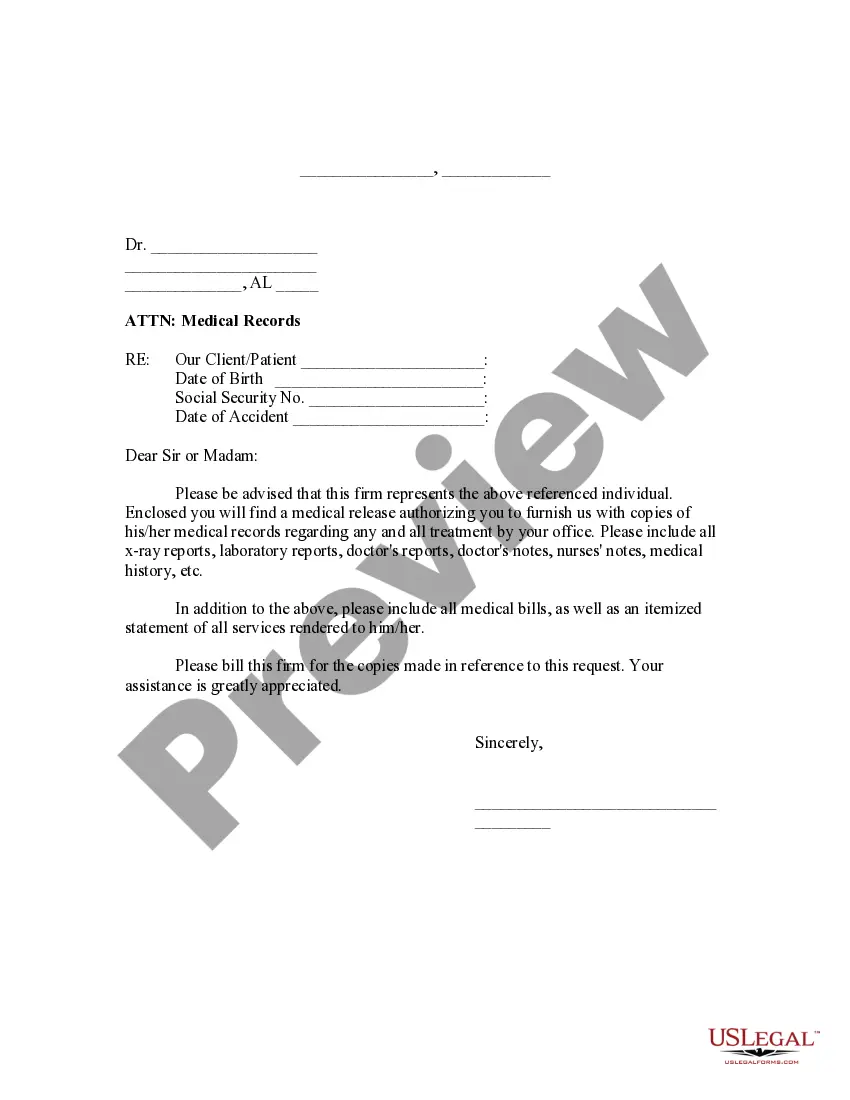

You might spend numerous hours online attempting to discover the legal document template that fulfills the federal and state requirements you desire.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can easily download or print the Georgia Agreement for Sale of Assets of Corporation from our platform.

If available, utilize the Preview button to view the document template simultaneously. If you wish to find another variation of the form, take advantage of the Research section to locate the template that meets your needs and specifications. Once you have identified the template you wish to acquire, click Acquire now to proceed. Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Alter your document if necessary. You can fill out, edit, sign, and print the Georgia Agreement for Sale of Assets of Corporation. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can fill out, edit, print, or sign the Georgia Agreement for Sale of Assets of Corporation.

- Every legal document template you obtain is yours indefinitely.

- To retrieve another copy of any acquired form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/town of choice.

- Refer to the form description to confirm that you have selected the correct form.

Form popularity

FAQ

Yes, you can write your own contract agreement in Georgia, but it requires attention to detail and an understanding of legal principles. A well-drafted contract should clearly articulate the terms and conditions agreed upon by both parties. However, to ensure that your agreement complies with state laws, consider using a template or a service like US Legal Forms. This platform provides resources such as the Georgia Agreement for Sale of Assets of Corporation, which can simplify the drafting process and help you create a legally sound document.

Closing a business in Georgia involves several key steps to ensure compliance with state laws. First, you must settle any outstanding debts and obligations. Next, you should formally dissolve your corporation by filing Articles of Dissolution with the Georgia Secretary of State. It's also important to utilize a Georgia Agreement for Sale of Assets of Corporation, as this document can help manage the sale of company assets and responsibilities during the closure process.

A valid contract typically requires offer, acceptance, consideration, mutual agreement, capacity, lawful purpose, and intention to create legal relations. Each of these requirements ensures that the agreement is enforceable in Georgia. When drafting a Georgia Agreement for Sale of Assets of Corporation, thorough attention to these elements can help prevent misunderstandings and legal conflicts.

The five elements of a legally binding contract are offer, acceptance, consideration, mutuality, and capacity. Understanding these elements can help you craft a sound Georgia Agreement for Sale of Assets of Corporation. By ensuring each element is addressed, you can create a robust agreement that stands the test of time.

The four essential requirements of a legally binding contract include mutual consent, consideration, capacity, and lawful purpose. Each component plays a vital role in the formation of the contract. In context with a Georgia Agreement for Sale of Assets of Corporation, confirming that all parties agree to the terms is key to avoiding disputes in the future.

A contract is legally binding in GA when it meets certain criteria, such as mutual consent, lawful purpose, and consideration. For a Georgia Agreement for Sale of Assets of Corporation, it is important that all essential elements are present and documented properly. This ensures all parties are aware of their rights and responsibilities under the agreement.

In Georgia, a contract becomes legally binding when it includes an offer, acceptance, and consideration. Additionally, both parties must have the legal capacity to enter into a contract. When dealing with a Georgia Agreement for Sale of Assets of Corporation, it is crucial that the terms are clear and that both parties fully understand their obligations.

The taxation of a sale of business assets varies based on the nature of the sale and the type of assets involved. Generally, gains from the sale are subject to capital gains tax. It's important to consult with a tax professional to understand the specific implications in relation to a Georgia Agreement for Sale of Assets of Corporation. This understanding helps in planning the sale strategy effectively for tax benefits.

In a business asset sale, the seller and buyer negotiate the terms, which are then formalized in a Georgia Agreement for Sale of Assets of Corporation. The process generally involves due diligence, where the buyer assesses the value and condition of the assets. Once both parties agree on the terms, they execute the agreement, and the buyer pays for the assets. This smooth transition of assets is crucial for maintaining operational continuity.

The sale of assets can present certain disadvantages. One major drawback is that it may limit the company's ability to carry forward certain tax benefits tied to the business. Additionally, selling assets might lead to operational disruptions, especially if key assets are sold off. Without a Georgia Agreement for Sale of Assets of Corporation, sellers might also face legal risks that could impact the overall sale process.

Interesting Questions

More info

BLUSHING AGREEMENT PURCHASE AGREEMENT This Asset Purchase Agreement made entered into this January between TIMOTHY FLA VIN individual Seller Disappoint COMMUNICATIONS CORPORATION Nevada corporation with corporate address Village Manor Place Suwanee Georgia Buyer RECITALS Seller owner certain assets form computer software computer hardware existing customers base domain names complete description list which attached hereto incorporated herein reference Exhibit Assets Buyer desires purchase acquire from Seller such Assets Seller desires transfer convey same Buyer pursuant to terms and conditions this Agreement Contemporaneously with closing hereinafter defined Buyer Seller will enter into agreement compete form which attached hereto Exhibits EXERCISES of this Agreement of Purchase shall be executed by and between the Parties hereto (including their agents and representatives) on the terms set forth herein, and executed in accordance with, the provisions and provisions set forth in the